Hi KRV! -I'm sorry but what is CSP?

-What strategy have you implement on SPCE? personally I cannot "see" the business modal for now, I am a bit reluctant to go deeper there (but for fun with 3DTE maybe yes

), I assume SpaceX is there competitor?

-I'm waiting for TSLA to pullback aswell, specifically covered calls as I don't think I want to bet against Elon.

Cheers,

Hi Investor12, -Yes premium comes with volatility, I think you're having the right approach of not jumping into the wagon without prior understanding. What stock are you holding?

Hi Lamode,-Never heard of that ticker, certainly it's not widely discussed on the average investing forum, do you work in that industry?

Hi yggdrasil,-thanks buddy.

How do I tag people's username on a reply?

Anyway,

Some article I wrote earlier for another forum right after I executed my trade plan, I copy paste here. You'll get the idea of cost-reduction of share in return your shares will be locked up for a certain period to cover the option contract, and also potential to have a capped gain if your options sold got exercised buy the buyer.

Google theta - option, to see the idea of selling "time" as a premium.

*************************************************************************************************************************************

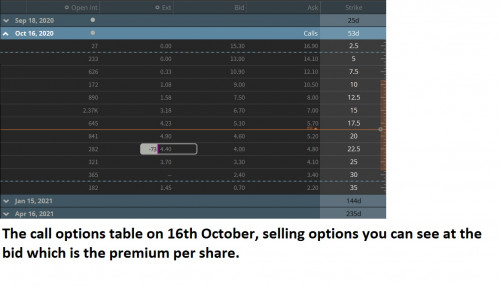

My long term view on MESO is bullish, but I don’t expect logically that the share price will hit sky high in a few months, it might fluctuate up and down, and go higher with de-risking, but I don’t think it will hit 30, 40, 50 USD by fortnight.

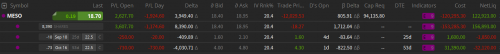

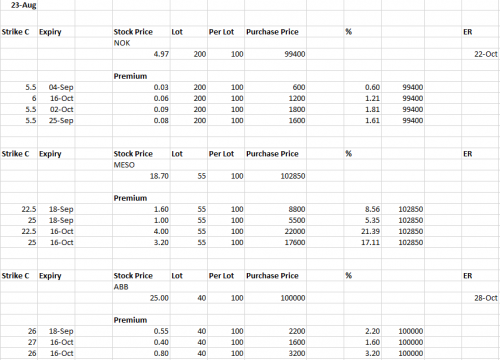

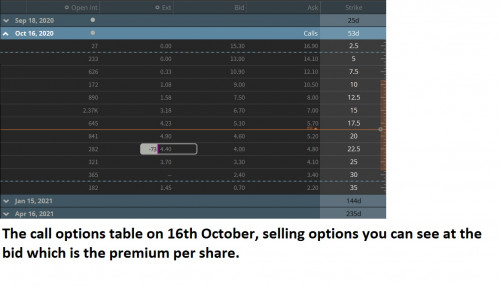

To make the most of time invested, I will write call options, for now. The call options for 25 USD @ 16-Oct is 3.3 dollars per share. So let say your purchase price for one share is 18 USD, and you sell a call option for 25 USD expiring at 16-Oct for 3.3 dollars per share, your breakeven price will be 14.7 USD. You pocket the 3.3 dollars on the spot. But for me, I am super bullish but also believe that prices won’t go above 25 USD before 16-Oct, so the 3.3 dollars are piled up with the rest of my capital to purchase more MESO shares.

This is how I compound the invested time on this stock, to buying more shares.

At worst scenario, if prices shoot up to 40 before 16-oct, and it is close to the option expiry date. I have to trade off my share as I am obliged to fulfill the option contract, so, it will be profit, but capped, that is the downside, so howmuch will I make then? 25-18+3.3 = 10.3 per share.

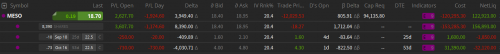

Below is my current portfolio, I took a bit more risk by selling at 22.5 Oct 16 (53 days to expiry), due to the fat premiums. I also incurred good gains which I took to buy more shares. But as other long term investors, they have their choice to sell at different strikes according to the options tables.

*************************************************************************************************************************************

Okay cheers guys, I hope to see other DDs aswell. I won't be active for now, until my contract is close to expiry.

Aug 23 2020, 06:27 PM, updated 6y ago

Aug 23 2020, 06:27 PM, updated 6y ago

Quote

Quote

0.0218sec

0.0218sec

0.76

0.76

5 queries

5 queries

GZIP Disabled

GZIP Disabled