Anyway, is there a secondary market?

This post has been edited by TOS: Aug 18 2020, 12:08 PM

Sukuk Prihatin

|

|

Aug 18 2020, 12:06 PM Aug 18 2020, 12:06 PM

Return to original view | IPv6 | Post

#1

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

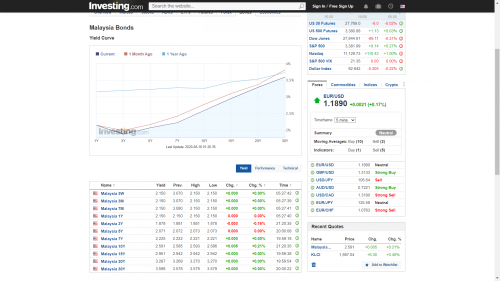

2% only... It's indeed priced correctly between the current 1-year and 3-years MGS yield. https://www.investing.com/markets/malaysia

Anyway, is there a secondary market? This post has been edited by TOS: Aug 18 2020, 12:08 PM |

|

|

Aug 18 2020, 09:22 PM Aug 18 2020, 09:22 PM

Return to original view | IPv6 | Post

#2

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

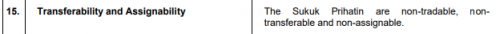

QUOTE(Eurobeater @ Aug 18 2020, 08:23 PM) Assuming the bonds are issued at par, then the yield is actually not bad and is even slightly better then existing sukuk of the same tenure too I see. Thanks. Checked out the FAQ sheet as well.  These bonds are non-trad-able, so no secondary markets unfortunately  The non-tradable provision is very disturbing. What happens if interest rate rises above 2% 1-2 years later? If bonds can be traded, market can price in accordingly (by selling the bond in secondary market until yield goes up to market-clearing level), but with non-tradable provision, you are stuck with low rate. Can't even sell back to government before maturity. A 2% return for such an illiquid asset is not really enticing to me. |

|

|

Sep 20 2020, 09:12 PM Sep 20 2020, 09:12 PM

Return to original view | IPv6 | Post

#3

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

| Change to: |  0.0257sec 0.0257sec

0.73 0.73

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 19th December 2025 - 12:58 AM |