QUOTE(lowyatjobseeking @ Jun 16 2020, 07:09 PM)

I opened an E toro account just to play around with the virtual account for now. Seems like we can't trade ETF's but normal stocks can be bought. Is that correct?

QUOTE(kucingfight @ Jun 16 2020, 12:37 PM)

by default, Msia acc will be uder ASIC (aus).

So far, 'cheapest' way is by BigPay. u can apply online, basically is a debit card.

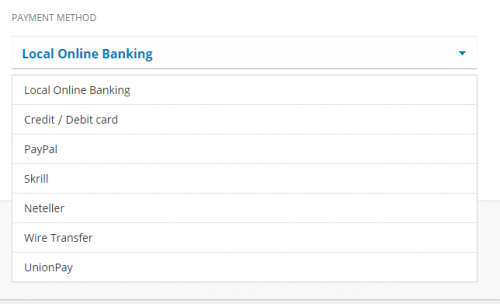

Another way is by online local banking

Just to give u comparison rate i went through:

actual XE: 0.2341

BigPay: 0.2343

M2U: 0.2334

if not mistaken rm800. (oh they have changed it to USD50 ~ rm215)

$200 initial, $50 subsequent. Bigpay is probably the best way to get instant funds and cash out with its highly competitive rates. It's pretty fast too, faster than SA's withdrawal. Biggest thing that sucks about it is the $5 fee which T212 doesn't have iirc.

QUOTE(z21j @ Jun 16 2020, 02:52 PM)

etoro is actually like "forex". "No commission" is a gimmick, it has been "included" when you buy sell - i think 0.09% mark up from market price.

"x1" is also a trick. No such thing call "fractional shares" in the US market as minimum unit for US stock per regulation is 1. In any event, it's still a CFD, but "low risk CFD" in my opinion.

That's some good weed you're smoking. You went from "are fractional shares worth it" to "fractional shares (that literally every broker offers) are a scam in your double posts

It's not really a new thing (even IKBR started offering it last year) and pretty much everyone has picked it up. It's not a CFD either. It's the actual share but obviously you can't transfer or move it to other platforms because of its nature.

QUOTE(lowyatjobseeking @ Jun 16 2020, 07:09 PM)

I opened an E toro account just to play around with the virtual account for now. Seems like we can't trade ETF's but normal stocks can be bought. Is that correct?

QUOTE(kucingfight @ Jun 16 2020, 07:23 PM)

ETF can, eg SPY . min trade USD500 . not all all ETFs are listed.

$200 minimum for ETFs. $50 for shares and $25 for commodities. Not really worth it on here with that large an amount with regards to ETFs but none of the "easy brokers" offer it. You'd have to go the TD Ameritrade or IKBR route to get better access but you'll also get slapped with fees per transaction which sucks for smaller DCAs. Stashaway was nice because you could invest in a wide selection of US ETFs without having to lump sum. Now that they removed the good ETFs, they're not as useful in my opinion. If you want just pure US shares for cheap (but no US ETFs) then Trading 212 is a better option.

QUOTE(doomx @ Jun 16 2020, 02:57 PM)

i think with the recent surge in US stocks market alot of ppl find avenue to enter the to invest. That being said, etoro provide a lower barrier for entry and if u have etoro, it really do feel like social trading app, people in there giving their opinion, mind you these ppl are all non-pro but they do their study of TA and whatever other bullshit, the initial idea is to get ppl to copy their trade so can get more money out of it, like commision based.

Good broker like IBKR, or TSG requires very high initial deposit which limits as a barrier of entry. Etoro 200 USD vs TSG 1000 USD makes alot of differences, but that being said, like many other sifu here say, u collect till u got 1k USD and then invest in a proper broker which is the wise decision.

I also interested in US market, but with my limited funds, i will stick to KLSE.

Like I said before, IKBR or TD Ameritrade are way more solid options for long term investing if you're the type to just invest and forget. If you're just looking to play around and make some money on the side while not getting too serious, Etoro is probably your thing. I've listed a lot of their shortcomings in my previous posts in this thread because I've been using them since they were a purely forex broker instead of hearsay from 3rd parties talking out of their ass

Jun 14 2020, 09:04 PM

Jun 14 2020, 09:04 PM

Quote

Quote

0.0219sec

0.0219sec

1.01

1.01

5 queries

5 queries

GZIP Disabled

GZIP Disabled