QUOTE(GrumpyNooby @ Aug 14 2020, 06:28 PM)

Simple™ competitor?

Versa Collaborates With Affin Hwang To Launch New Digital Cash Management Solution

Versa Asia has collaborated with Affin Hwang Asset Management to launch a new cash management mobile app that allows Malaysians to earn returns similar to fixed deposit rates on their invested money through money market funds. It also offers them the flexibility of being able to access their funds at any time, with no lock-ins and hidden terms.

Versa works like a savings account, but with returns on par with FD interest rates – and without the need to visit a bank. Once you’ve registered an account with Versa, you can then deposit an amount of money into it, which will be invested into Affin Hwang’s Enhanced Deposit Fund. Returns will then be re-deposited into your account and re-invested until you decide to withdraw them.

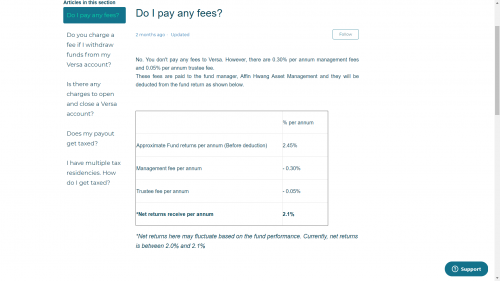

Versa allows you to start saving at a minimum of RM100, and it charges no hidden fees, including management, transfer, and exit fees. You can also withdraw your money anytime without penalty, with income distribution calculated up to the day of withdrawal.

Article link: https://ringgitplus.com/en/blog/investment/...abYeXgKSc5RxZKA

Versa link: https://versa.asia/

Versa Collaborates With Affin Hwang To Launch New Digital Cash Management Solution

Versa Asia has collaborated with Affin Hwang Asset Management to launch a new cash management mobile app that allows Malaysians to earn returns similar to fixed deposit rates on their invested money through money market funds. It also offers them the flexibility of being able to access their funds at any time, with no lock-ins and hidden terms.

Versa works like a savings account, but with returns on par with FD interest rates – and without the need to visit a bank. Once you’ve registered an account with Versa, you can then deposit an amount of money into it, which will be invested into Affin Hwang’s Enhanced Deposit Fund. Returns will then be re-deposited into your account and re-invested until you decide to withdraw them.

Versa allows you to start saving at a minimum of RM100, and it charges no hidden fees, including management, transfer, and exit fees. You can also withdraw your money anytime without penalty, with income distribution calculated up to the day of withdrawal.

Article link: https://ringgitplus.com/en/blog/investment/...abYeXgKSc5RxZKA

Versa link: https://versa.asia/

QUOTE(vanitas @ Aug 14 2020, 08:28 PM)

Add on:

Meanwhile, Versa and Affin Hwang AM have secured a Memorandum of Understanding with a leading global payment network with over 50 million global touchpoints to work towards a real-time balance card linked to Affin Hwang AM’s money market funds.

Article link: https://www.malaymail.com/news/money/2020/0...lutions/1893813

Looks interesting, New stuff to try out.Meanwhile, Versa and Affin Hwang AM have secured a Memorandum of Understanding with a leading global payment network with over 50 million global touchpoints to work towards a real-time balance card linked to Affin Hwang AM’s money market funds.

Article link: https://www.malaymail.com/news/money/2020/0...lutions/1893813

Aug 14 2020, 08:46 PM

Aug 14 2020, 08:46 PM

Quote

Quote

0.0474sec

0.0474sec

0.70

0.70

7 queries

7 queries

GZIP Disabled

GZIP Disabled