Outline ·

[ Standard ] ·

Linear+

Money market fund

|

Hoshiyuu

|

Feb 21 2021, 03:30 AM Feb 21 2021, 03:30 AM

|

|

I don't really understand how does payout work, I assume that since we are earning interest daily (and it seems to reflect on the lifetime gains), but those gains are not used to buy units until "payout" day? But then payout would sound a little misleading.

Are we suppose to get a bonus on payout day or something?

|

|

|

|

|

|

Hoshiyuu

|

Mar 17 2021, 10:15 PM Mar 17 2021, 10:15 PM

|

|

Not bad. Tested full withdrawal on about RM2k - request initiated on 16th morning, withdrawal booked at 1pm, received funds on 17th around 4pm. Pretty smooth. I posted a withdrawal request at the same time on SA Simple, curious to see how they compare.

|

|

|

|

|

|

Hoshiyuu

|

Mar 19 2021, 11:28 AM Mar 19 2021, 11:28 AM

|

|

QUOTE(Hoshiyuu @ Mar 17 2021, 10:15 PM) Not bad. Tested full withdrawal on about RM2k - request initiated on 16th morning, withdrawal booked at 1pm, received funds on 17th around 4pm. Pretty smooth. I posted a withdrawal request at the same time on SA Simple, curious to see how they compare. Update again, Stashaway Simple withdrawal complete, arrived into bank on march 19th, 11:30am. So T+1 vs T+3. |

|

|

|

|

|

Hoshiyuu

|

Mar 24 2021, 09:23 AM Mar 24 2021, 09:23 AM

|

|

The king of cashback has graced us with his presence  |

|

|

|

|

|

Hoshiyuu

|

Mar 24 2021, 09:55 AM Mar 24 2021, 09:55 AM

|

|

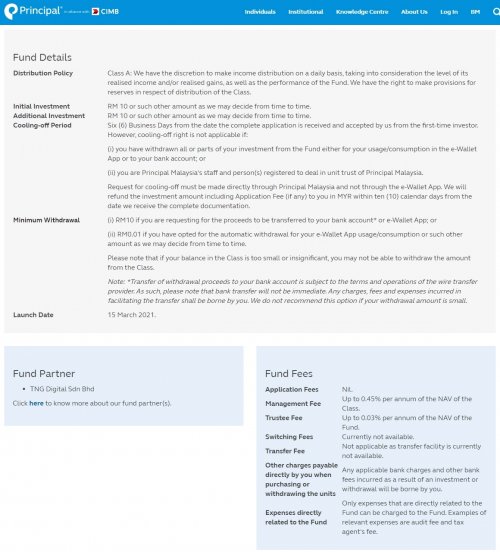

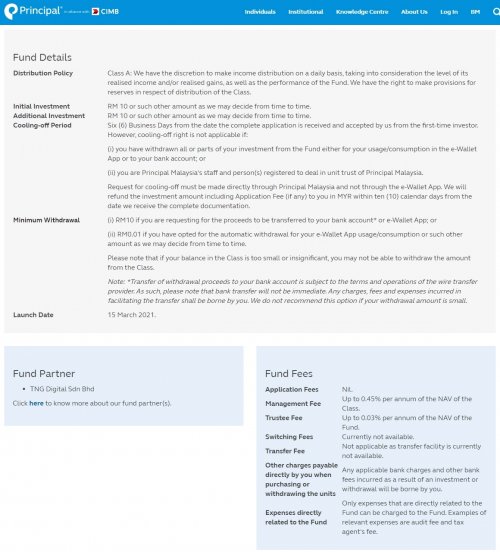

QUOTE(Ramjade @ Mar 24 2021, 09:48 AM)  🤔 automatic withdrawal to e-wallet balance down to the cent anytime though considering both versa and SA Simple's "real return" now is around ~1.2% anyway, it might still justify dropping them in favor of TnG Go+? This post has been edited by Hoshiyuu: Mar 24 2021, 09:56 AM |

|

|

|

|

|

Hoshiyuu

|

Mar 24 2021, 10:21 AM Mar 24 2021, 10:21 AM

|

|

QUOTE(Ramjade @ Mar 24 2021, 10:09 AM) Where do you get 1.2% for versa? Just napkin math, I've put in ~2k in both Versa and SA Simple on the same day, and withdrawn after 1 month, and removing overnight interest due to delay in deposit, my returns were roughly 1.2~1.4% p.a. , not to mention the sentiment I've seen is that it'll drop further. (Monthly gain were in the ballpark of RM2.3~2.5) This post has been edited by Hoshiyuu: Mar 24 2021, 10:22 AM |

|

|

|

|

|

Hoshiyuu

|

Mar 24 2021, 10:43 AM Mar 24 2021, 10:43 AM

|

|

QUOTE(Ramjade @ Mar 24 2021, 10:34 AM) Alright. I thiugh was still in 2.x% range. That's what I thought too, I was told its in the low 2.Xs but when I checked the underlying funds, it's been sad for a while now, and then I saw some rumors of SA Simple is covering the missing projected gain out of their pockets, which made no sense. So after testing it and double checking with other user's replies, I am pretty confident both of them are returning no more than 1.5% at absolute best.... But I am happy to be corrected! |

|

|

|

|

|

Hoshiyuu

|

Mar 24 2021, 11:41 AM Mar 24 2021, 11:41 AM

|

|

QUOTE(Stashaway @ Mar 24 2021, 11:36 AM) I'm happy to clarify it for you! The Dividend Entitlements for Simple are your dividends earned for your funds invested. Dividend payouts happen at the beginning of every other month. The dividends are declared and paid out on a monthly basis, thereafter, the funds received are then automatically reinvested into your Simple portfolio. https://www.bloomberg.com/quote/PRUISIN:MK?sref=g4LS3DvTThis is expected to happen every month. The rinse and repeat cycle plus the rebates we issue every quarter will help you to reach the projected rate of 2.4% p.a. Assuming that you withdraw before the dividend payout date (ex-div date), you will not be entitled to the dividend payout. Having said that, you will be selling at a "high" as the fund value increases until the ex-div date. Seems periodical rebates is needed to achieve 2.4% p.a. Also, given their explanation, seems like I don't need to concern myself too much with deposit date and withdrawal date missing dividend date as it would be reflected in unit price. |

|

|

|

|

|

Hoshiyuu

|

Mar 25 2021, 10:37 AM Mar 25 2021, 10:37 AM

|

|

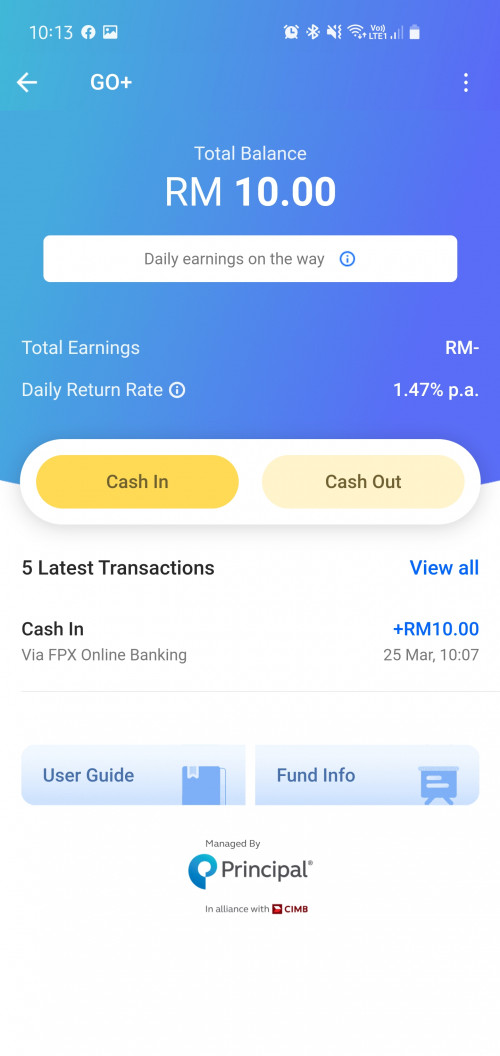

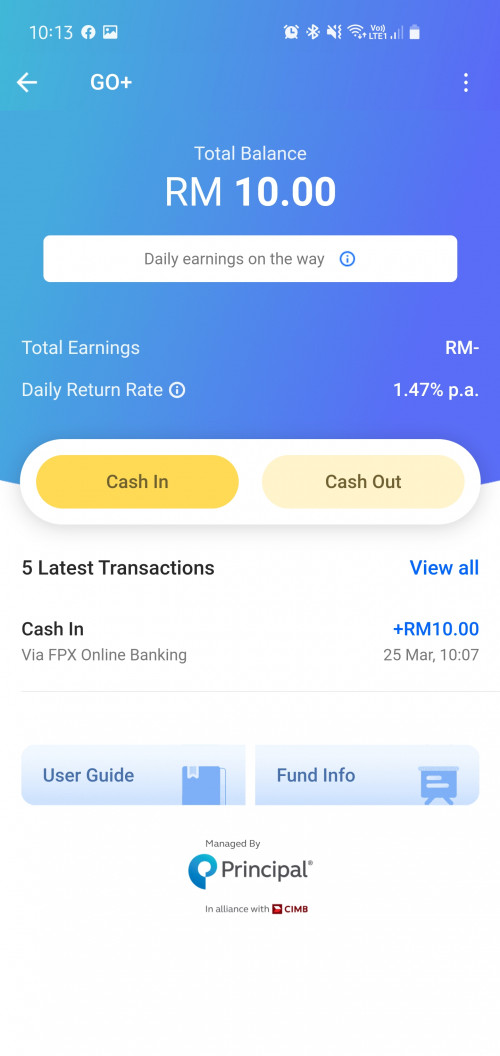

QUOTE(cr7jyej @ Mar 25 2021, 10:18 AM) Put in rm10 for fun   Wow already? How to get access? I am on android and I don't see any update or buttons to use it. |

|

|

|

|

|

Hoshiyuu

|

Mar 25 2021, 02:03 PM Mar 25 2021, 02:03 PM

|

|

Yes finally arrived for me  |

|

|

|

|

|

Hoshiyuu

|

Mar 26 2021, 08:26 AM Mar 26 2021, 08:26 AM

|

|

QUOTE(blackchides @ Mar 26 2021, 07:46 AM) GO+ is automatically registered as your quick balance anyway, as long its the highest in the list, it should be fine. (i.e. having RM50 on wallet, RM50 in GO+, but you buy something worth RM100 should work) |

|

|

|

|

|

Hoshiyuu

|

Mar 26 2021, 09:04 AM Mar 26 2021, 09:04 AM

|

|

QUOTE(CSW1990 @ Mar 26 2021, 08:32 AM) In this case should all put in GO+ already , why still need left balance in eWallet... Haha yeah, that's what I plan to do. But you cannot reload directly to GO+ with CC  Have to go through eWallet Its just an optional architecture... |

|

|

|

|

|

Hoshiyuu

|

Mar 26 2021, 12:53 PM Mar 26 2021, 12:53 PM

|

|

QUOTE(ericlaiys @ Mar 26 2021, 12:27 PM) how come , yours so fast can see earning? It's reported on mine too, its quite quick. |

|

|

|

|

|

Hoshiyuu

|

Mar 26 2021, 04:00 PM Mar 26 2021, 04:00 PM

|

|

QUOTE(rexus @ Mar 26 2021, 03:58 PM) In a wave of GO+ comments, just wanted to say its versa payout day again No profit this time  all withdrawn as bullet for the dip |

|

|

|

|

|

Hoshiyuu

|

Apr 12 2021, 10:04 PM Apr 12 2021, 10:04 PM

|

|

QUOTE(cklimm @ Apr 12 2021, 08:45 PM) I have received multiple spam messages in whatsapp, following registering for Versa via RPlus, has anyone else receives similar spams? Can chime in, no problem with Versa. BigPay, on the other hand... |

|

|

|

|

|

Hoshiyuu

|

Feb 15 2022, 09:33 PM Feb 15 2022, 09:33 PM

|

|

QUOTE(cklimm @ Feb 15 2022, 06:51 PM) Maybe we will see it in details once account has been activated 3.0% vs 2.46%? In before 3% - 0.7% fee = 2.3% real return  |

|

|

|

|

|

Hoshiyuu

|

Feb 15 2022, 09:58 PM Feb 15 2022, 09:58 PM

|

|

QUOTE(tadashi987 @ Feb 15 2022, 09:50 PM) yep management fee only applies on KDI INVEST but not KDI SAVE Ah, same structure as Stashaway Simple then, I thought the 3% was a T&C gotcha from them. Interesting. |

|

|

|

|

Feb 21 2021, 03:30 AM

Feb 21 2021, 03:30 AM

Quote

Quote

0.0530sec

0.0530sec

0.49

0.49

7 queries

7 queries

GZIP Disabled

GZIP Disabled