Outline ·

[ Standard ] ·

Linear+

Banking BNM announced 5 digital bank licences

|

SUSxander83

|

Jun 17 2021, 04:04 AM Jun 17 2021, 04:04 AM

|

|

QUOTE(TOS @ Jun 16 2021, 08:28 PM) Foresee gonna be with either with Alliance Bank or OCBC or UOB as their partner Seems like most banks are gonna partner instead taking the direct route with 5 licenses for sure 3 is confirmed taken with 2 still up for grabs from over 40 bidders |

|

|

|

|

|

SUSTOS

|

Jun 17 2021, 10:08 AM Jun 17 2021, 10:08 AM

|

|

QUOTE(xander83 @ Jun 17 2021, 04:04 AM) Foresee gonna be with either with Alliance Bank or OCBC or UOB as their partner Seems like most banks are gonna partner instead taking the direct route with 5 licenses for sure 3 is confirmed taken with 2 still up for grabs from over 40 bidders Which 3 are "confirmed"? Mind sharing your thoughts? |

|

|

|

|

|

SUSTOS

|

Jun 17 2021, 03:02 PM Jun 17 2021, 03:02 PM

|

|

|

|

|

|

|

|

Nom-el

|

Jun 17 2021, 04:21 PM Jun 17 2021, 04:21 PM

|

|

QUOTE(xander83 @ Feb 26 2021, 03:59 AM) No need to tell will be with CIMB for sure QUOTE(TOS @ Jun 17 2021, 10:08 AM) Which 3 are "confirmed"? Mind sharing your thoughts? He is merely speculating. He was saying that Boost would be partnering with CIMB for sure earlier which is ridiculous considering TNGD (joint venture between TNG (subsidiary of CIMB) and AliPay) is a competitor to Boost. As we all know now, Boost is partnering with RHB. |

|

|

|

|

|

TSKadaj

|

Jun 17 2021, 06:51 PM Jun 17 2021, 06:51 PM

|

|

QUOTE During a Fintech Fireside Asia chat session organised by Fintech News Malaysia today, Suhaimi Ali, Director of Innovation and Development at Bank Negara Malaysia (BNM) tells digital bank applicants to respect the process. He highlighted that they are seeing a number of parties using their political connections to lobby and get a head start in the digital banking license process.In the session, he made clear that BNM’s main consideration remains on the applicants who are able to deliver value proposition and that the central bank prioritise outcomes. Some groups have also been seen making media statements urging the government to “provide at least one digital bank license to enable establishing a digital waqf bank owned by any national wakaf institutions.” Earlier this month, Axiata and RHB announced their joint bid for a digital banking license which sparked concerns among other players that the licenses will end up mostly in the hands of bank-led consortiums. BNM Tells Lobby Groups to Respect the Digital Bank Licensing ProcessI hope those parties won't get the license.  |

|

|

|

|

|

greyPJ

|

Jun 18 2021, 03:08 PM Jun 18 2021, 03:08 PM

|

|

KUALA LUMPUR/SINGAPORE (June 17): Sea Ltd and national oil company Petroliam Nasional Bhd (Petronas) are among companies planning to bid for a digital banking licence in Malaysia, according to people familiar with the matter, as the country prepares to open up its financial industry.

Local conglomerates Genting Bhd and YTL Corp Bhd and the Sarawak government are also considering a bid, the people said, asking not to be identified because the information is private. Some of the firms, such as Sea and YTL Corp, have joined forces and plan to bid as a consortium, they said. They join ride-hailing and payment firm Grab Holdings Inc, Sunway Bhd and others, which have also expressed interest.

|

|

|

|

|

|

SUSxander83

|

Jun 18 2021, 05:19 PM Jun 18 2021, 05:19 PM

|

|

QUOTE(TOS @ Jun 17 2021, 10:08 AM) Which 3 are "confirmed"? Mind sharing your thoughts? 3 major banks as I am sure you will know which ones The question lies who are their partnership with The ones with current banking license will be easy to approved due to BNM regulations and risk mitigation factors while those struggling and will have to setup consortium in order to get share of the pie |

|

|

|

|

|

cybpsych

|

Jun 29 2021, 09:04 PM Jun 29 2021, 09:04 PM

|

|

|

|

|

|

|

|

nicemamak

|

Jun 29 2021, 10:18 PM Jun 29 2021, 10:18 PM

|

Getting Started

|

QUOTE(cybpsych @ Jun 29 2021, 09:04 PM) Is Grabpay and Touch n Go belong to Maybank? |

|

|

|

|

|

MUM

|

Jun 29 2021, 11:41 PM Jun 29 2021, 11:41 PM

|

|

QUOTE(nicemamak @ Jun 29 2021, 10:18 PM) Is Grabpay and Touch n Go belong to Maybank? maybe the answers can be found here? https://www.theedgemarkets.com/article/news...digital-bankingMalayan Banking Bhd (Maybank) has an indirect 30% stake in the company that operates GrabPay https://www.thestar.com.my/business/busines...raise-rm6045milCIMB and its unit Touch ‘n Go Sdn Bhd, read for details? |

|

|

|

|

|

SUSxander83

|

Jun 30 2021, 04:31 AM Jun 30 2021, 04:31 AM

|

|

QUOTE(nicemamak @ Jun 29 2021, 10:18 PM) Is Grabpay and Touch n Go belong to Maybank? Maybank has a strategically stake their shares with Grab in exchange for a stake in Grab Touch n Go majority shareholder one of them is CIMB with Ant Financial |

|

|

|

|

|

cybpsych

|

Jun 30 2021, 09:20 AM Jun 30 2021, 09:20 AM

|

|

Green Packet-led consortium to apply for Islamic digital bank licence | The StarKUALA LUMPUR (Bernama) -- A consortium led by Green Packet Bhd, ZICO Holdings Inc (ZHI) and M24 Tawreeq Sdn Bhd has been formed to apply for one of five digital banking licences to be issued by Bank Negara. In a joint statement today, the consortium said the application is aimed to establish an Islamic digital bank with several other strategic collaborators that would further complement the products and value-added services to be offered by the group. The consortium said the decision to apply for an Islamic digital banking licence was founded on the desire to elevate the livelihoods of the unserved and underserved Malaysians, as espoused in the Shared Prosperity Vision 2030.

|

|

|

|

|

|

SUSTOS

|

Jun 30 2021, 05:44 PM Jun 30 2021, 05:44 PM

|

|

More details on iFAST's consortium. They partner with Koperasi Angkatan Tentera and others. https://links.sgx.com/FileOpen/iFAST_MY%20D...t&FileID=673073 |

|

|

|

|

|

SUSxander83

|

Jun 30 2021, 06:36 PM Jun 30 2021, 06:36 PM

|

|

QUOTE(TOS @ Jun 30 2021, 05:44 PM) More details on iFAST's consortium. They partner with Koperasi Angkatan Tentera and others. https://links.sgx.com/FileOpen/iFAST_MY%20D...t&FileID=673073Looks promising on paper but execution is key Most likely Affin will join as the financial partner later as current banking license doesn’t need to apply the new digital banking license as they can migrate easily from it if they want to with BNM blessings |

|

|

|

|

|

SUSTOS

|

Jun 30 2021, 08:14 PM Jun 30 2021, 08:14 PM

|

|

|

|

|

|

|

|

jorgsacul

|

Jun 30 2021, 09:51 PM Jun 30 2021, 09:51 PM

|

|

BigEarPay coming to town soon

|

|

|

|

|

|

SUSxander83

|

Jul 1 2021, 04:11 AM Jul 1 2021, 04:11 AM

|

|

QUOTE(jorgsacul @ Jun 30 2021, 09:51 PM) BigEarPay coming to town soon BigPay should have MMF after that to secure more deposits for their digital bank  |

|

|

|

|

|

cybpsych

|

Jul 2 2021, 05:23 PM Jul 2 2021, 05:23 PM

|

|

Latest update: Touch ‘n Go Group and MyMy confirm that they did not submit for a digital banking bid. The two parties are now no longer part of the bidding war |

|

|

|

|

|

T231H

|

Jul 4 2021, 11:54 AM Jul 4 2021, 11:54 AM

|

|

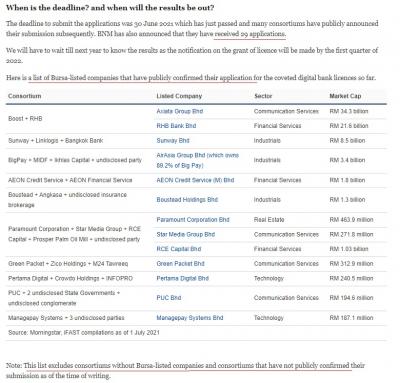

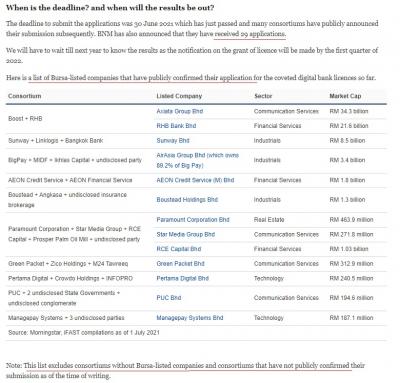

13 Bursa-listed companies in the Digital Bank race https://www.fsmone.com.my/funds/research/ar...-race?src=funds Attached thumbnail(s)

|

|

|

|

|

|

contestchris

|

Jul 4 2021, 11:57 AM Jul 4 2021, 11:57 AM

|

|

Banks shouldn’t be allowed to compete as they already have a full banking license. Only non banking entities should be allowed to compete, except for existing banking associates such as TNGD.

|

|

|

|

|

Jun 17 2021, 04:04 AM

Jun 17 2021, 04:04 AM

Quote

Quote

0.0396sec

0.0396sec

1.22

1.22

6 queries

6 queries

GZIP Disabled

GZIP Disabled