QUOTE(Davidtcf @ Jan 22 2022, 11:41 AM)

Anyone got transfer to wrong bank before? Did u manage to get back the money?

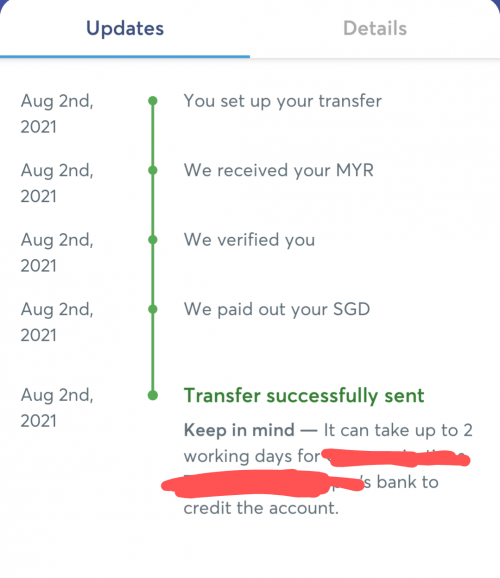

I was suppose to transfer to my SG CIMB but instead transferred to MY CIMB. It is my first time doing this transfer. I inserted my own name and SG CIMB bank account number. Funds still went through as Wise do not do any account number checking on their end.

Really frustrated now as wise don’t work on Saturday and Sunday. Haih all due to my stupidity didn’t check properly did the transfer too fast now regret. Should have checked YouTube properly on how to transfer from Local bank to Wise, then to SG CIMB before assuming.😢

Their multi currency feature confused me I went to put money in SGD wallet then thought money going out there will be to Singapore. Name of bank is CIMB Bernard but I still didn’t catch that mistake zzz.

Already called CIMB and logged ticket to Wise.

CIMB say bank should auto reject for this.. but I’m not sure now as they also told me there are CIMB bank loan accounts starting with number 1 (Singapore account number starts with 1). I wanted to ask them check if this account number exists in CIMB Malaysia but they tell me cannot.. due to customer privacy. F**k.🤬 now can only depend on Wise to help as I had attached transfer receipt.. And really hope CIMB MY there reject the transfer and bounce back to Wise.

Don’t be like me guys. Always double or triple check especially if first time transferring.😭

Could you clarify if you transfer out SGD or MYR? If you transfer SGD, automatically, you could only select Singapore’s banks.

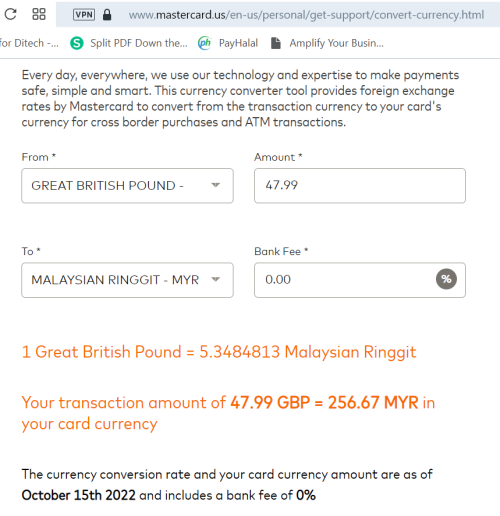

Or did you transfer MYR to CIMB Malaysia, but you inserted CIMB SG account number? If this is the case, you could just do instant transfer (say RM1, from any of your existing Malaysian bank) to this account number to see if the same number, exist in CIMB Malaysia.

If the account number existed, it is probably owned by someone else, but you will know the account holder name, and proceed to report this to cimb to get your money back.

if the account number didnt exist, by right, the transaction should be reversed and you should get your money back.

I have a suspicion that your SG account number, the same number also exist in Malaysia. Hence that is why the transaction was successful in wise.

As mentioned by other forumers, CIMB registered name in Singapore is CIMB Bank Berhad.

Could you show the screenshot showing the transfer is successful?

This post has been edited by Mr Gray: Jan 27 2022, 09:31 AM

Dec 10 2021, 01:51 AM

Dec 10 2021, 01:51 AM

Quote

Quote

0.0833sec

0.0833sec

0.21

0.21

7 queries

7 queries

GZIP Disabled

GZIP Disabled