our Malaysia wise card pin ok in Istanbul... wave not working...

Wise (Transferwise) Malaysia Discussion, v1.0

Wise (Transferwise) Malaysia Discussion, v1.0

|

|

May 31 2022, 06:18 PM May 31 2022, 06:18 PM

Return to original view | Post

#61

|

Senior Member

6,230 posts Joined: Jun 2006 |

our Malaysia wise card pin ok in Istanbul... wave not working...

|

|

|

|

|

|

Jun 18 2022, 11:45 PM Jun 18 2022, 11:45 PM

Return to original view | Post

#62

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(tadashi987 @ Jun 18 2022, 11:24 PM) get both tadashi987 liked this post

|

|

|

Jun 20 2022, 06:51 AM Jun 20 2022, 06:51 AM

Return to original view | Post

#63

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(w1z4rd @ Jun 20 2022, 02:13 AM) not just malaysia, same thing in singapore, especially the contactless. pin workscontactless gets rejected 50% of the time, even in singapore. But when i wave with bigpay or any other malaysian credit card, it works everytime. what about those that are using it in europe /uk / australia etc... does paywave works everytime like it should? what's the point of a multi currency card when it doesnt work overseas. |

|

|

Jun 20 2022, 09:55 PM Jun 20 2022, 09:55 PM

Return to original view | Post

#64

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(w1z4rd @ Jun 20 2022, 09:39 PM) do what you must lor...anyways confirm pin working in France n Turkey... someone say UK... I also say get bigpay... no harm get more backup... This post has been edited by dwRK: Jun 20 2022, 09:57 PM |

|

|

Aug 18 2022, 05:02 PM Aug 18 2022, 05:02 PM

Return to original view | Post

#65

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(lillingling @ Aug 18 2022, 10:48 AM) Is it still recommended to use wise for travel purposes? i prefer not to carry too much cash for safety... will always just get enough for incidentals...im looking into euro and saw that ppl reco midvalley got better rate than wise. and also, seems like its very hard to get in contact with their customer service. can i get some advises from sifus here? would probably just exchange for like 1k euro 🤔 peace of mind > a few euro savings... my kid and friends went to France recently... the friend lost her wallet and all monies... TOS liked this post

|

|

|

Sep 11 2022, 02:57 PM Sep 11 2022, 02:57 PM

Return to original view | Post

#66

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(acbc @ Sep 11 2022, 09:56 AM) Means cannot use Wise to receive anything larger than RM 30K. Looks like need to use the money runners. They charged slightly more but can receive hard cash. I didn't want SWIFT because the bank rates were horrible. QUOTE(ziling60 @ Sep 11 2022, 12:16 PM) Oh no no ... i am not wanting to keep money in the Wise account. It is purely a bank A in overseas to bank B in malaysia transfer using Wise thats all. Will that be any issue? guys... you do not need to use Wise's MCA to hold money where the max limit kicks in... just set it up as normal transfer directly to any local banks... Wise will function like it's original remittance/exchange services... TOS liked this post

|

|

|

|

|

|

Sep 18 2022, 11:18 AM Sep 18 2022, 11:18 AM

Return to original view | Post

#67

|

Senior Member

6,230 posts Joined: Jun 2006 |

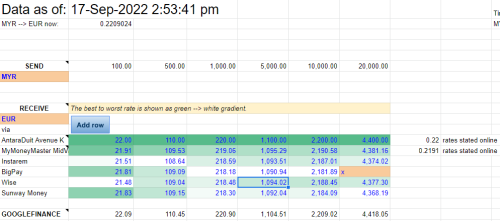

QUOTE(Takudan @ Sep 17 2022, 05:46 PM) I have a business trip to Europe soon, so I've just gotten my Wise card, paid RM13.70 and looks like it will be delivered to me in 10 working days. business trip means company pays for everything... including exchange rate fees and losses when exchange back to myr... yes? then find the most expensive money changer to exchange a small amount and use that rate as record for your claims lor... and find the cheapest for your actual spend... hahaha... personally i don't do this... just put everything on company card and enjoy... small incidental i don't even claim... ...but I'm still trying to understand how the borderless account works... Now I also compared several rates, and to my surprise, the cash option is way cheaper, assuming the advertised rates on their websites are true and without surcharge:  Another point to note is that Wise has the shittiest rate if it's a small amount (100 or below). So here are my questions, assuming the same rate holds: 1. What if I deposit into my EUR account at one go, and then I swipe Wise card when in Europe? Please confirm my example: - load 218 EUR (pay slightly less than RM1000) - swiped 10 transactions with Wise card, each at 21.48 EUR > my EUR account is now left with 3.2 EUR 2. What if I deposit into my MYR account, and do the same? Please confirm example: - load RM 1000 - swiped 10 transactions with Wise card, each at 21.48 EUR > my MYR account is deducted RM 100 each, resulting in 0 money left. If my examples are correct, then I'm planning to load my EUR account before travelling, then I have the freedom to either swipe my card directly, or just ATM to get some cash if I don't have enough. Now another follow up question: suppose I have excess EUR after the trip - will I be allowed to deposit to my IBKR broker via this EUR account? Note: I also see that it is possible to get IBAN/SWIFT code or something if I deposited some money first... does that give me a proper "bank account number" that the IBKR can flag as an account I own, rather than 3rd party? as for option 1 or 2... if myr is strengthening then option 2 may end up better... personally i would just load some eur for draw down and not worry about rates... btw wise website (without logging in) shows option 2 to be better... 0.55% fee vs 0.58% fee... so better check properly after login... (avernue k is 0.5537%) yes you'll get a proper iban account number once you create the eur account... i have received eur from ibkr... ts has send eur to ibkr... This post has been edited by dwRK: Sep 18 2022, 11:34 AM |

|

|

Sep 18 2022, 01:33 PM Sep 18 2022, 01:33 PM

Return to original view | Post

#68

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Takudan @ Sep 18 2022, 12:40 PM) Thanks both for the mid valley tips. I'm not going to stay in the city centre and my colleague who's a local remarked that it's still kinda 50/50 with regards to card vs cash... That's why I'm looking into getting some cash too. It's going to be a big group of us so might be able to share the opportunity cost.. let's see! always carry some cash lah for convenience... and a few debit and credit cards... travelling in a group at least not so bad got backup... You're right about changing rates, hence my decision to get Wise card to open up more options. My bigpay physical so ngam is expiring next year after all Actually the examples were meant to compare EUR and MYR accounts directly and confirm my understanding of which rates would be used, wasn't meant to be realistic haha... 80% correct... I'm extending my stay on weekends for personal travel also, which will not be covered. I am indeed going with convenience for the ones I know my company's paying... E.g. my hotel stay, just gonna swipe CC I don't think I can cheat my company audit your way... As our claims are itemised, I'm afraid will kena reject if they see the receipt I'm only getting a small amount at that rate, but claim so much more. » Click to show Spoiler - click again to hide... « Last 2 questions about account opening: 1. It requires me to deposit like RM 101 -- is that a permanent amount to park there, just like how we need to park a minimal amount in our bank accounts to prevent closure? 2. It warned that any amount entering the EUR account needs to be of my own name, to prevent money laundering yadayada, kinda like IBKR. Have you tried using different fintech to transfer into Wise account? (Relevant if Wise offers worse rate) Thank you all for very detailed answers. I am inclined to proceed with EUR account on Wise as I like that I can channel the excess into IBKR as investment, without another round of forex loss. as for audit... you didn't falsify anything so its not cheating lah... can have many reasons why only exchange 100 but spend 500... myself i always have some leftover notes laying around... so for any new trip i exchange a bit more to top up and take the leftovers as well... sometimes family got leftovers i sapu theirs also... lol... got money changer receipt that is good enough for audit... i will never teach ppl to cheat...don't lose your job over a few cents... 101 is to make sure you are serious... you can spend it all after you get your card... which i did... but i also did top up a few times for testing... and also top up with eur and usd... ps... where yall going? kepoh a bit... lol This post has been edited by dwRK: Sep 18 2022, 01:36 PM |

|

|

Sep 19 2022, 02:36 PM Sep 19 2022, 02:36 PM

Return to original view | Post

#69

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Takudan @ Sep 19 2022, 12:15 PM) Niceee.. borderless account sounds really convenient, also a good way to force users to use Wise transfer (but it's a win win nonetheless if Wise is the best one at the time of transfer). first time in amsterdam, i was alone walking around the red light district enjoying the sights... not sure how but i was suddenly aware someone following me... as i turned around the guy closed the gap fast and i thought i was gonna be robbed... luckily he just wanna sell me some cocaine and heroin... lol... very fond memories of the place... but has lost quite a lot of its charm... hahahaXD good point about the old notes, thanks I'm going Netherlands, unfortunately not likely to travel other countries due to time constraint... I also paiseh to extend my stay too long, long story short, don't want to set bad first impression 😅 Fortunately, again thanks to group travel, other colleagues have been here so we have a long list of known good foods/places to go lol. i do miss their stroopwafel though... |

|

|

Sep 28 2022, 06:26 PM Sep 28 2022, 06:26 PM

Return to original view | Post

#70

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(TOS @ Sep 28 2022, 09:08 AM) Let me teach you another pyschology trick. If you are afraid the transaction can't go through even after submitting the documents, you can mention at the end of your email to them that after submitting all these documents and if Wise/Instarem still can't approve, ask them to refund you the money and you shall use another service provider. lol...Add pressure to the compliance team. That can help a lot since you have the pricing power with so many fintech service providers out there. they just kuli follow sop... won't entertain you lah... hahaha banks have been known to cancel ppl accounts without notice... If I management... make you come hq to claim refund... hahaha |

|

|

Oct 1 2022, 09:20 AM Oct 1 2022, 09:20 AM

Return to original view | Post

#71

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 1 2022, 09:24 AM Oct 1 2022, 09:24 AM

Return to original view | Post

#72

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(Takudan @ Sep 30 2022, 06:18 PM) This feels a bit strange to me as I never used overseas ATM before.... Same... fees using other banks atm... but if premium banking is waived...So in Malaysia, we get additional charges if you use different bank ATM. E.g. I have CIMB card and use on Maybank ATM, there's a RM 1 fee. Does this kind of fee exist in other countries in similar format? (That Wise doesn't mention since it's not them who charges it) |

|

|

Oct 1 2022, 09:49 AM Oct 1 2022, 09:49 AM

Return to original view | Post

#73

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

|

|

|

Oct 6 2022, 08:35 AM Oct 6 2022, 08:35 AM

Return to original view | Post

#74

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Oct 6 2022, 08:39 AM Oct 6 2022, 08:39 AM

Return to original view | Post

#75

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(ChipZ @ Oct 6 2022, 01:10 AM) I always purchase stuff from Ebay and am using PayPal (which charges quite a bit). Will using Wise help on this? probably yes... as local cc usually got markup...Another question, I have some $ on Etrade (company stock). Can I transfer those to my Wise account? yes... use ach xfer to Wise usd account... if use wire you pay a small fee |

|

|

Oct 7 2022, 12:26 PM Oct 7 2022, 12:26 PM

Return to original view | Post

#76

|

Senior Member

6,230 posts Joined: Jun 2006 |

|

|

|

Mar 8 2023, 09:54 AM Mar 8 2023, 09:54 AM

Return to original view | Post

#77

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(leo2010 @ Mar 8 2023, 09:36 AM) It depends on what currency you want to convert. A snapshot for your reference (~ 9:30am) wise more expensive... lolRHB MCA : MYR4525 --> USD1000 (all inclusive) Forex rate gets refreshed every 5-10min There is a RM20 annual fee for the debit card $$ in your call account gets to earn daily interest, accrued by end of the month. https://www.rhbgroup.com/treasury-rates/mul...osit/index.html https://www.rhbgroup.com/treasury-rates/mul...card/index.html (indicative) Wise : MYR4534.66 --> USD1000 (all inclusive) |

|

|

Mar 8 2023, 08:58 PM Mar 8 2023, 08:58 PM

Return to original view | Post

#78

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(ragk @ Mar 8 2023, 03:15 PM) #2. If i wanted to spend on NZD, so I top up NZD currency first, thn if i withdraw at NZ it will reduce from my NZD acc? Would it work if i only top up MYR? Yes.Yes... but will incure 1% fee on transaction... ragk liked this post

|

|

|

Mar 9 2023, 09:54 AM Mar 9 2023, 09:54 AM

Return to original view | Post

#79

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(CommodoreAmiga @ Mar 8 2023, 10:23 PM) I would still use WISE over RHB. So far my Wise support is very good. This is more important. Whatever the small exchange rates is negligible. I don't trust RHB and has little faith in Bigpay(which I also have). no need to be exclusive WISE for me. QUOTE(MystiqueLife @ Mar 8 2023, 11:45 PM) IINM, another forumer shared outbound TT is flat USD 10 and must be done OTC, so definitely Wise is the better one. not entirely true... rhb is cheaper if you are sending big amount... and wise cannot send >RM 30k per day.... money park in rhb got interest... wise no interest... rhb paywave works properly... yada yada... lol... Super2047 liked this post

|

|

|

Mar 9 2023, 12:21 PM Mar 9 2023, 12:21 PM

Return to original view | Post

#80

|

Senior Member

6,230 posts Joined: Jun 2006 |

QUOTE(CommodoreAmiga @ Mar 9 2023, 11:43 AM) It's not about exclusive. When you are overseas, you want the most reliable card that works and customer service that's response to you. Interest in debit card doesn't interests me...Its not like I will put 100k inside. What for? I will only put in enough for my use and ensure I can top up reliably online if needed when I am overseas. my dotter had problems using wave/pin in france last year... half a day cannot use... but i dunno the actual problem so won't say much more... other than take more cards for backup especially going overseas... Paywave is not a big issue. As long as PIN works, it doesn't bother me at all. |

| Change to: |  0.0383sec 0.0383sec

0.70 0.70

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 10th December 2025 - 04:40 AM |