QUOTE(kbandito @ Jan 25 2023, 10:06 AM)

I linked the virtual card to ApplePay with heavy usage. But contactless with physical card always work for me too.

Your wise account is MY, SG or other countries?Wise (Transferwise) Malaysia Discussion, v1.0

|

|

Jan 25 2023, 04:31 PM Jan 25 2023, 04:31 PM

Return to original view | Post

#21

|

Senior Member

924 posts Joined: Aug 2013 |

|

|

|

|

|

|

Feb 1 2023, 10:56 PM Feb 1 2023, 10:56 PM

Return to original view | Post

#22

|

Senior Member

924 posts Joined: Aug 2013 |

|

|

|

Feb 18 2023, 08:33 AM Feb 18 2023, 08:33 AM

Return to original view | Post

#23

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(xander2k8 @ Feb 18 2023, 06:13 AM) Obviously the 1st 🤦♀️ because 2nd method will have FX spread will be more as decided Bank the receiving the money You can't read or what? 🤦♀️ 🤦♀️🤦♀️1st method you can control the rate itself Why you so scared when Wise is regulated by BNM rules 🤦♀️ Both method utilise wise to convert. 🤦♀️🤦♀️🤦♀️ Both method will have very little fx spread by wise🤦♀️🤦♀️🤦♀️ He was just asking which one of the two options is better. 🤦♀️🤦♀️🤦♀️ Where got bank decide the FX spread. Go read it again. 🤦♀️🤦♀️🤦♀️ |

|

|

Mar 8 2023, 06:54 AM Mar 8 2023, 06:54 AM

Return to original view | Post

#24

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(nanan75 @ Mar 7 2023, 09:01 PM) Managed to activate my card via pin (4 digits). Just try your wave at several shops in Malaysia first. Experience for many people, so many terminal cannot wave.Subsequently able to paywave. Hope can use paywave in uk (tube) and europe few months from now. Please update if it is no longer the case |

|

|

Mar 19 2023, 12:02 AM Mar 19 2023, 12:02 AM

Return to original view | Post

#25

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(Agent001 @ Mar 18 2023, 11:36 PM) Think it’s got something to do with being verified. I suppose if you have verified your address with Wise before, you can’t change the country yourself. I guess so. My account also verified and cannot change the address both in app/website.Same thing happened to mine. Such a shame. Hope Wise gets accepted into Apple Pay soon in Malaysia. Quite cumbersome when their contactless just doesn’t seem to work overseas. The address setting is greyed out |

|

|

Mar 24 2023, 09:17 PM Mar 24 2023, 09:17 PM

Return to original view | Post

#26

|

Senior Member

924 posts Joined: Aug 2013 |

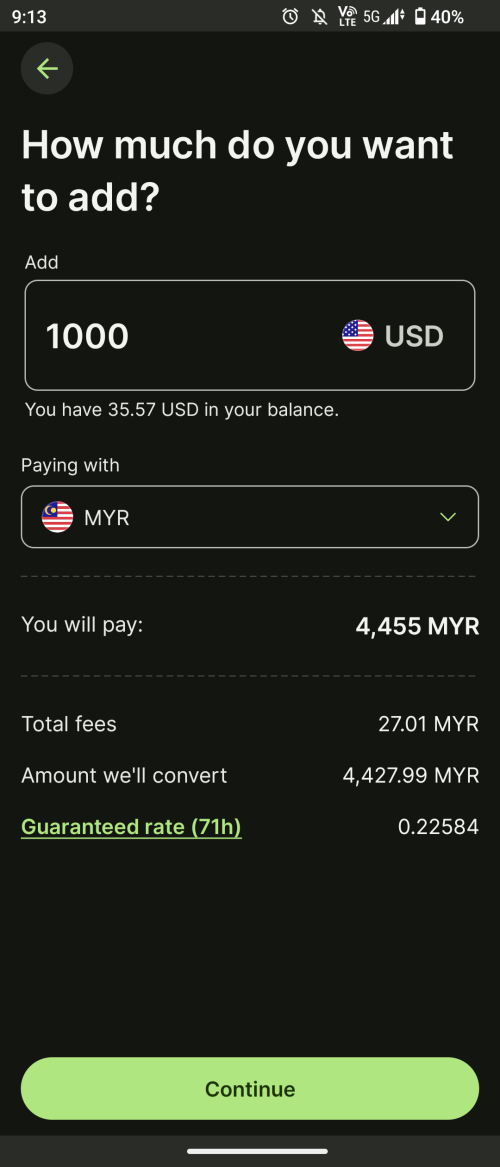

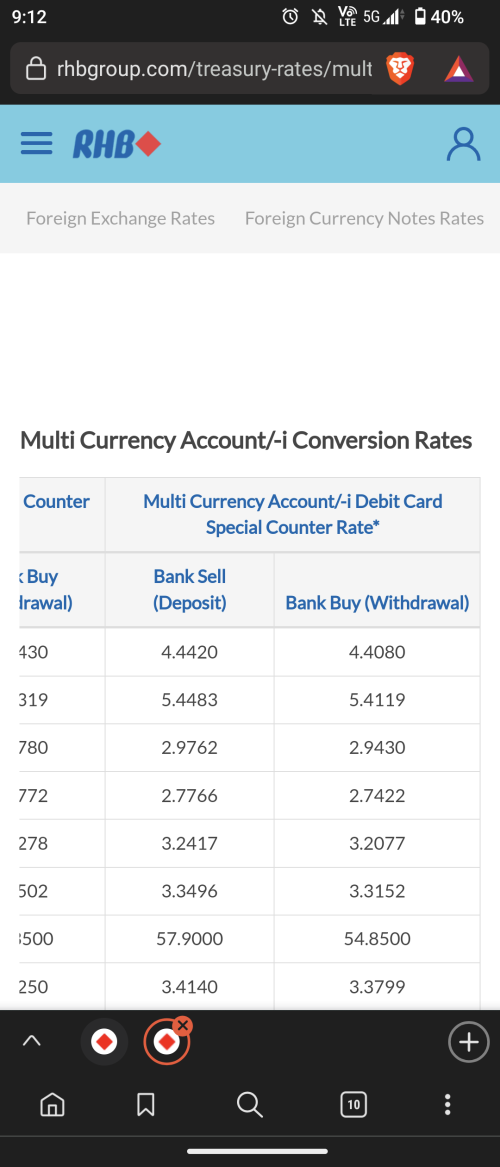

QUOTE(ideaplus @ Mar 24 2023, 06:06 PM) HLB: RM1000 can get THB7674.80 despite rate is 7.6748 RHB gives the best rate, better than even Wise and HLB to convert to USD.WISE: RM1000 can get THB7,654.20 despite rate is 7.70699 I know the rate is better in wise, but i get less amount when converting in wise at the end. We should focus on what we get at the end, right? PS: RM1 is just for demonstration MYR to 1000USD RHB MCA: RM4442.00 HLB Wallet: RM4464.30 Wise: RM4455    |

|

|

|

|

|

Mar 25 2023, 12:31 PM Mar 25 2023, 12:31 PM

Return to original view | Post

#27

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(dwRK @ Mar 25 2023, 12:13 PM) lol... I am just annoyed at his know-it-all and condescending attitude.free forum mah... he is free to reply to anyone... and you 'join' his thb discussion with the other chap... with USD info... lol... can blame him for replying you... hahaha Every single post, must have that stupid face palm emoticon, and arrogant reply. |

|

|

Mar 25 2023, 12:46 PM Mar 25 2023, 12:46 PM

Return to original view | Post

#28

|

Senior Member

924 posts Joined: Aug 2013 |

|

|

|

Apr 5 2023, 06:38 AM Apr 5 2023, 06:38 AM

Return to original view | Post

#29

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(bowranger @ Apr 4 2023, 01:23 PM) Inward transfer through duitnow on Wise JP Morgan account details took 2-3 days, the last time I did it.Don't worry, your money is not lost. Money credited to the JP Morgan account is instant, however Wise took several days to reflect that in your Wise account. |

|

|

Apr 16 2023, 04:18 PM Apr 16 2023, 04:18 PM

Return to original view | Post

#30

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(Garysydney @ Apr 16 2023, 02:16 PM) Ditto, RHB MCA seems more competitive than Wise for inward TT.Outward TT, depends on value, looks like wise better most of the time. gooroojee liked this post

|

|

|

Apr 16 2023, 04:19 PM Apr 16 2023, 04:19 PM

Return to original view | Post

#31

|

Senior Member

924 posts Joined: Aug 2013 |

|

|

|

Apr 16 2023, 06:06 PM Apr 16 2023, 06:06 PM

Return to original view | Post

#32

|

Senior Member

924 posts Joined: Aug 2013 |

|

|

|

May 26 2023, 07:56 PM May 26 2023, 07:56 PM

Return to original view | Post

#33

|

Senior Member

924 posts Joined: Aug 2013 |

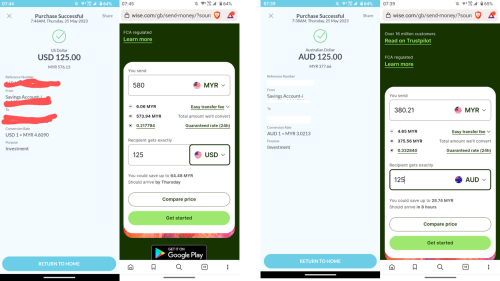

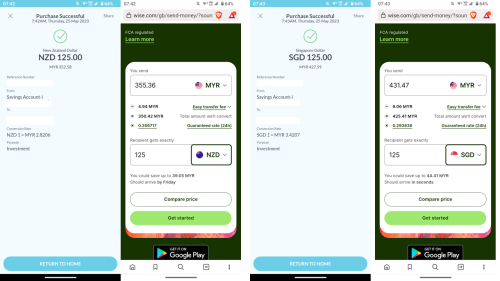

QUOTE(silverhawk @ May 26 2023, 11:30 AM) Hmm really? I just checked the rates RHB MCA rate is always more competitive than Wise. Wise has additional fees, so total cost of conversion from Ringgit to foreign currencies, RHB wins hands down. See pictures of my real transaction yesterday on RHB MCA, as compared to WiseWise: 4.63850 RHB: 4.5060 or 4.6200 (special counter rate) Small difference, likely save money after apply wise's conversion fee (expensive now) Are the special rates a promotional thing? would it go away after a while? Pros of RHB MCA 1. Possibly the best rate in the market, it's even better than Wise for sure. 2. All balances receive very competitive interest, calculated daily, credited monthly. (no lock-up period, but rate is lower than FD). 3. Insured by PIDM up to RM250k. Cons of RHB MCA 1. Only useful for keeping foreign currencies in your own RHB account 2. Outward TT will incur fees, inward TT is free though. So conversion from different currencies between different bank accounts across countries, Wise would be better. 3. Limited to 24 currencies, Wise have more currencies. 4. Each conversion must involve Ringgit. IE say to convert between USD and EUR, U need to convert USD to MYR first, then MYR to EUR, so you lose on the double spread. Wise is better for direct conversion between any pair of currencies not involving ringgit. That special rate is valid for all RHB MCA accountholders with debit card. MCA debit card is a must condition. It has been there since always, so don't think it's promotional. Call rate as of today: AUD (3.25%), CAD (4%), GBP (4.1%), NZD (4.5%), SGD (3.4%), USD (4.95%). Comparison of rates between RHB and Wise as at 25 May 2023 morning, of conversion from Ringgit into the respective currencies. Rate from Wise website is taken at the same time I did conversion from Ringgit. USD125: RHB (RM576.13), Wise (RM580) AUD125: RHB (RM377.66), Wise (RM380.21) GBP125: RHB (RM712.16), Wise (RM716.59) CAD125: RHB (RM424.40), Wise (RM427.94) NZD125: RHB (RM352.58), Wise (RM355.36) SGD125: RHB (RM427.59), Wise (RM431.47)    This post has been edited by Mr Gray: May 26 2023, 07:56 PM |

|

|

|

|

|

May 27 2023, 06:30 AM May 27 2023, 06:30 AM

Return to original view | Post

#34

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(silverhawk @ May 26 2023, 11:18 PM) From what I'm seeing it seems like wise still gives better rates, but due to the conversion fee it effectively becomes more expensive. Wise better rate is misleading. If you click convert currency inside wise website, they will only show the rate, and didn't show the additional fees.Sadly the fees for TT and double spread when converting currencies would negate alot of this benefit for me. Need to click "send money", then only they show the full fees But in actuality, they do charge conversion fee. So apple to apple comparison would be to compare total cost of converting the same amount of currency. As rhb doesn't have any other fees. This post has been edited by Mr Gray: May 27 2023, 06:40 AM Steve78 liked this post

|

|

|

May 27 2023, 06:35 AM May 27 2023, 06:35 AM

Return to original view | Post

#35

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(TOS @ May 26 2023, 11:50 PM) So, RHB MCA is only good if you wish to bring back USD/SGD etc. but not willing/planning to immediately convert to MYR. (E.g., nearing retirement age/early years of retirement). For sure wise and RHB are useful for different types of users.The outward TT fee is a big problem for investors who wish to use RHB MCA to park their monies temporarily while waiting for market to collapse/go south... lol PIDM 250k. Malaysia can't print USD, SGD, EUR, CHF... that's always something to bear in mind ya. Of course la Malaysia can't print foreign currencies, I also didn't tell that. but still it's an deposit insurance. Compared to wise, no insurance at all. |

|

|

May 27 2023, 11:40 PM May 27 2023, 11:40 PM

Return to original view | Post

#36

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(TOS @ May 27 2023, 10:45 AM) It does not make sense for PIDM to compensate your lost SGD, USD, CHF with MYR. The chance of a bank run on RHB being backed by its biggest shareholder (EPF) with around RM1 trillion asset? Meh, I feel a lot safer with RHB than Wise. In a crisis, chances are MYR will depreciate sharply against those currencies, pay you 229,850 MYR now, the next moment, 229,850 may buy much less than 50k USD. Moreover, in a crisis like a bank run, there will be a huge USD shortage in the market. Buying USD isn't as easy as you may think. In the end, PIDM can always guarantee MYR, because BNM prints MYR. You can never guarantee a currency you don't print. The best PIDM can do is, as you say, pay you "at prevalent rates" the equivalent of your currency foreign currencies in MYR. But it begs to ask who will want MYR at that point? (Banks failing... Economy go south... 1998 Asian Financial Crisis repeats...) » Click to show Spoiler - click again to hide... « For some people, it defeats the purpose of placing USD/SGD etc. FD in the first place, should they know they get paid in MYR in the end. But ok lah, that's just me. If you are happy with PIDM paying your foreign currency FD in MYR in the event of a bank run/crisis, that's perfectly fine. Despite being a famous company, Wise total equity is just a puny 400 million pound = RM2.27 billion, and total asset of GBP7.5 billion. And it's still just a remittance company, it's not regulated like a normal bank. Banks have to adhere to much stricter capital adequacy requirements, Basel etc, you won't be seeing a ratio of only 5.3% equity/asset like what Wise balance sheet shows now This post has been edited by Mr Gray: May 27 2023, 11:54 PM |

|

|

Jul 1 2023, 07:20 AM Jul 1 2023, 07:20 AM

Return to original view | Post

#37

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(dwRK @ Jun 29 2023, 08:19 PM) Standard Chartered Jumpstart is a better card than Wise. Free overseas withdrawal tooAnd RHB MCA account is also better than Wise, but limited to 16 currencies only Both cards give better conversion rates than Wise. This post has been edited by Mr Gray: Jul 1 2023, 07:23 AM |

|

|

Jul 9 2023, 07:02 AM Jul 9 2023, 07:02 AM

Return to original view | Post

#38

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(glc200 @ Jul 6 2023, 01:10 PM) Hi sifus, No online banking? Then how are you supposed to add money to wise/bigpay/rhb mca. All required transactions to be done on phone app.I'll be going to Switzerland this october. I plan to use a Debit card there. I could make up my mind either to get : - wise -big pay - enrcih money - rhb mca. I came across a fb for the 'wise scam' where people got 'scam' by the wise management where their acct suddenly being locked or terminated. made me scared. Also my problem is I've no online banking . Can I deposit the money into those cards using the teller only? I appreciate your feedback and advice. Thanks At this age still no online banking. How old are u uncle?. |

|

|

Sep 1 2023, 09:04 PM Sep 1 2023, 09:04 PM

Return to original view | Post

#39

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(nampaknyahebat @ Sep 1 2023, 08:53 PM) Hi guys, so I’m about to go overseas for the first time and I’m bringing my wise card too. My concern is can I add money to Wise from Maybank if let I'm running out of money at that time, as maybank now approve transaction through MAE instead of sending TAC and I will change my sim card too. As long as you are connected to Internet, mae notification will come through |

|

|

Sep 30 2023, 02:12 PM Sep 30 2023, 02:12 PM

Return to original view | Post

#40

|

Senior Member

924 posts Joined: Aug 2013 |

QUOTE(elea88 @ Sep 30 2023, 12:59 PM) coz i already hv wise earlier then only found out about RHB. Yes RHB conversion better than Wise. Plus RHB gives you very decent interest on your balance eg more than 5% on USDi store japan yen when dip. then decided not to go japan. then also bought some pound. but not going London end up now changing euro to go Netherlands direct. and not via LONDON so the pound will not be used. plans do have a way of changing.. so to avoid the auto conversion. i now park the yen and the pound in jar i was always wondering whats the difference between JAR and the wallet.. now i know. is RHB MCA conversion better than wise in rates? Both rates are generated inside RHB app and Wise app. https://pasteboard.co/jJue7wbKTfe5.png https://pasteboard.co/MeqVltqktR8W.png |

| Change to: |  0.0862sec 0.0862sec

0.24 0.24

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 4th December 2025 - 06:49 AM |