QUOTE(Maiiyowei @ Jan 22 2021, 10:56 AM)

houzkey many hidden charges, if can get conventional loan approval, why choose houzkey, right? pay now or later, u still need to pay for proggresive interest, and spa and loan legal fee, even mot buyer need to pay when convert the unit after one year from rent

QUOTE(Erictan1981 @ Jan 22 2021, 12:17 PM)

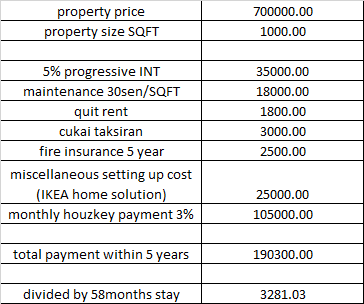

Strongly agree there are many hidden charge.

Some agent just confuse buyer said low installment commitment & no progressive interest.

Some agent will misleading you can have probation period or test staying period within 5 years & return to bank if you dun like the place.

In fact, they just delay the installment and paid later if you interest to buy.

The moment you decide really go for unit, then you still have to paid MOT, legal free, stamp duty, progress interest.

No more free legal fee, MOT or stamp duty from developer.

The good thing is you can lock property price if you not ready for down payment or commitment now.

Dun forgot you have to paid all house expense including monthly maintenance, Indah water, electricity, water, quit rent & assessment.

Why not direct own the unit if you are looking for own stay.

I have to first be clear and say that I'm neither an agent or a banker.

Don't trust entirely what the people at the sales gallery tell you, because they themselves are sometimes not knowledgeable about this scheme as well. For me, I asked thoroughly through emails and Houzkey's online chat, and they have been very good at responding. You can also ask a Maybank mortgage consultant instead.

What both of you said is completely true, and has been laid on in the product disclosure sheet of Houzkey as well as the lease agreement after application. To me, there is nothing hidden, if unsure, just have to ask. Maybank is not trying to hide anything.

I'll simply list down the pros and cons of Houzkey.

PROS1. Lock down SPA price for future purchase.

2. Exit

after 5 years, at least (because minimum lease tenure is 5 years). Also do note you get your security deposit back.

3. If you choose to buy

only after 1 year get keys, you get green lane loan application, don't have to provide any additional documents to build up your credibility. Your credibility is based on your monthly "rental" that you have paid.

4. No progressive interest to pay during construction,

but if you choose to but within the 5 years, this progressive interest you need to pay.5. Extra cashflow for you to save up, in the future if that property you think is still too expensive for you to bear when converting to conventional mortgage, can walk away after 5 years, or try to sell it off, and you keep the profits subjected to RPGT.

CONS1. In the event you want to sell after 1 year, you have to find your own buyer.

2. Long term, you're paying more to own said property. This is because your monthly "rental" is calculated based on interest. Basically the amount you're paying monthly is more or less like the interest part of a convntional loan.

3. Fire insurance, maintenance fees, cukai pintu & tanah are all borne by you.

4.

Currently, you will lose HOC exemptions, because you are not the one who signed the SPA. But for first property, stamp duty exemptions for both loan and MOT (first 500k) was recently announced in Budget 2021, effective till 2025.

5.

All legal and any disbursement fees are borne by you in the future, if you choose to buy it in the future.

6. All the fees and stamp duty etc everything you have to pay when you own can be included into your financing, but obviously this would mean you'll have to borrow more from bank, along with the interests.

7.

Personal Opinion: Houzkey projects are usually on the pricier side, so be prepared for the installments to go up, as the base lending rate will go up as well, all the marketed low monthly installments through Houzkey are calculated based on the BLR now, which is at it's all time low.

NET NET: Houzkey is a financing scheme which allows you to have more flexibility and cashflow in the near future, but you have to pay more for it in the long run,

And your first year of commitment does not contribute to anything, and will be treated as rental and is basically just burnt off.

Apr 28 2020, 10:39 PM, updated 6y ago

Apr 28 2020, 10:39 PM, updated 6y ago

Quote

Quote

0.0734sec

0.0734sec

1.09

1.09

6 queries

6 queries

GZIP Disabled

GZIP Disabled