QUOTE(klcc99 @ Apr 9 2022, 05:10 PM)

under maybank Houzkey, who will sign SPA with developer ? buyer or Maybank will sign?

Upon completion of the property, title issue who will pay the MOT buyer or Maybank ?

QUOTE(klcc99 @ Apr 9 2022, 05:10 PM)

under maybank Houzkey, who will sign SPA with developer ? buyer or Maybank will sign?

Upon completion of the property, title issue who will pay the MOT buyer or Maybank ?

Under Maybank Houzkey, buyer still signs SPA with the developer. MOT is borne by the buyer, never by the bank. The Houzkey programme was working alongside HOC before this. But it was never paid by the bank. So for current situation, it will depend on whether the developer continue to help buyer to waive or subsidise on MOT all these.

Actually, for this programme, it is designed to help new homebuyer to secure a roof over the top. But investors who looking for lower cost and calculated risk, you can always find out more to add Houzkey unit into your investment assets. Obviously, if you have cash on hand, why do you even want to pay more to the bank in the first place?

For under con project, with or without Houzkey, definitely you would look at the profile of the developer and their track records. Houzkey is an alternative option financing package that you can consider.

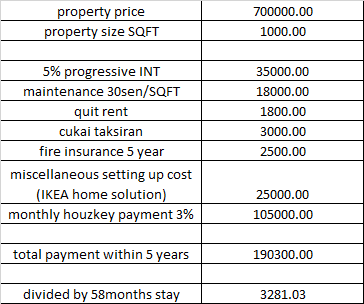

So what is in for the buyer to take into consideration? First, 5 years, or as mentioned by the PDS, initial tenure, you invest at a lower instalment. The lower instalment is calculated based on the SPA amount, to the current lowest campaign rate, 2.88% annually. Then you will add in the progressive interest to the SPA amount, to lock in for the mortgage amount in continuous tenure, which is the remaining part of the tenure that you signed up in Houzkey. To sign the Houzkey agreement, you will need to standby 3 months of that instalment.

So what are the implications that come together? In the PDS, it's summarised to three categories. First, if you want to continue staying, you will have to start paying for the mortgage in the continuos tenure. You will have to inform Maybank at 4.5 years after VP, and pay a conversion rate of the mortgage amount. Normal, because this is the 2nd agreement that you are going to sign and you need the lawyer to execute this.

Secondly, buyer can sell their unit, well SPA is under your name, why not? However, you may want to make sure you are selling at higher than the mortgage amount (locked in before), else you would have to pay the balance, which works similarly to normal mortgage loan. And plus point, you enjoy 100% of the gain, after RPGT, if applicable. Remember, you can only do this after minimum payment of 13 month of instalment payment.

Last, walk away. This is the part where usually everybody get confused. Now, walk away is different from normal mortgage loan. Because you will get noticed if you do that with normal mortgage loan. For Houzkey, you WILL NEED TO pay the progressive interest back to the bank, after calculated by the bank. Well, like it or not, the bank did borrow you the money early and allow you to 'moratorium' for the period until you get your keys. It's only fair if they request it back. So this is the CALCULATED RISK that you must take into consideration.

So, 5 years initial tenure, you just need to make sure the first 13 months until 4.5 years, this is where you make all your consideration, stay close with your agent for the most updated news, and then make your judgement from there. Agents advise but you will be the one making the decision. For investors, take this time also to make the profit from doing rental, your initial tenure cost is already kept low. Do day rental, learn marketing, and brush up

Aug 28 2021, 11:25 AM

Aug 28 2021, 11:25 AM

Quote

Quote

0.0291sec

0.0291sec

0.39

0.39

6 queries

6 queries

GZIP Disabled

GZIP Disabled