Outline ·

[ Standard ] ·

Linear+

LHDN e-filling with spouse joint assessment

|

TShuntbazz P

|

Apr 22 2020, 11:15 PM, updated 6y ago Apr 22 2020, 11:15 PM, updated 6y ago

|

New Member

|

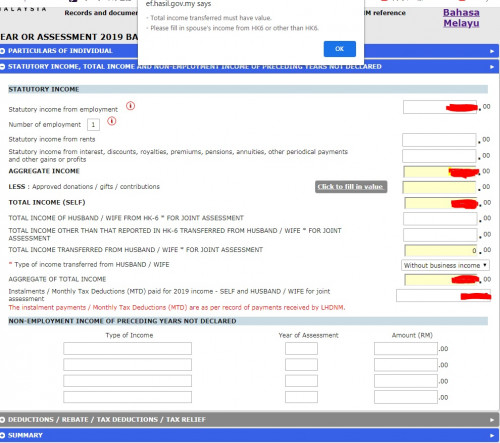

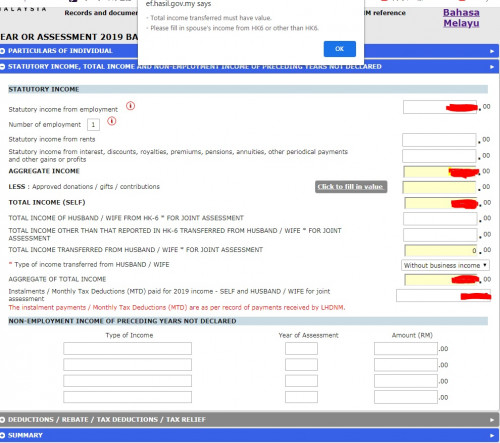

Hi guys, I am normal employee e-BE and decided to join assessment together with the wife for first time under my name, wife no source income, so I think I should put 0 in the column : TOTAL INCOME OF HUSBAND / WIFE FROM HK-6 * FOR JOINT ASSESSMENT however error message as in the screenshot below avoid me to proceed further, anyone can advise how should I fill ? TQVM  |

|

|

|

|

|

romuluz777

|

Apr 23 2020, 08:28 AM Apr 23 2020, 08:28 AM

|

|

Make sure that on Page 1, you select this from the drop down menu under Jenis Taksiran :-

DIRI SENDIRI DI MANA SUAMI/ISTERI TIADA PUNCA PENDAPATAN

You might have inadvertently selected the option where the Isteri also has income and you both are declaring jointly, either under your name or Isteri's.

This post has been edited by romuluz777: Apr 23 2020, 08:30 AM

|

|

|

|

|

|

TShuntbazz P

|

Apr 23 2020, 08:54 PM Apr 23 2020, 08:54 PM

|

New Member

|

QUOTE(romuluz777 @ Apr 23 2020, 08:28 AM) Make sure that on Page 1, you select this from the drop down menu under Jenis Taksiran :- DIRI SENDIRI DI MANA SUAMI/ISTERI TIADA PUNCA PENDAPATAN You might have inadvertently selected the option where the Isteri also has income and you both are declaring jointly, either under your name or Isteri's. Thank you so much, this is the cause ! |

|

|

|

|

|

loui

|

Apr 23 2020, 10:07 PM Apr 23 2020, 10:07 PM

|

|

Any benefit of declare together?

|

|

|

|

|

|

candidman78

|

Apr 24 2020, 08:10 AM Apr 24 2020, 08:10 AM

|

Getting Started

|

QUOTE(loui @ Apr 23 2020, 10:07 PM) Any benefit of declare together? If both are working (with declared income) If not mistaken perlepasan is not worth it. I don't see benefit hehe |

|

|

|

|

|

candidman78

|

Apr 24 2020, 08:12 AM Apr 24 2020, 08:12 AM

|

Getting Started

|

QUOTE(loui @ Apr 23 2020, 10:07 PM) Any benefit of declare together? If both are working (with declared income) If not mistaken perlepasan is not worth it. I don't see benefit hehe The fastest way to know and more direct. Key in everything DON'T submit. The calculator will tell u how much tax u need to pay. Compare both with and without joint. |

|

|

|

|

|

WaCKy-Angel

|

Apr 24 2020, 08:22 AM Apr 24 2020, 08:22 AM

|

|

QUOTE(loui @ Apr 23 2020, 10:07 PM) Any benefit of declare together? only worth it if 1 side does not have income or very low income, so that the claims can be "transferred" to the spouse for lowering the tax. |

|

|

|

|

|

MGM

|

Apr 25 2020, 07:31 AM Apr 25 2020, 07:31 AM

|

|

Tumpang Tanya, has e-BE dateline been extended?

|

|

|

|

|

|

akhito

|

Apr 25 2020, 08:37 AM Apr 25 2020, 08:37 AM

|

|

QUOTE(MGM @ Apr 25 2020, 07:31 AM) Tumpang Tanya, has e-BE dateline been extended? Yes it was extended. QUOTE It also extended the deadline for individuals filing their tax returns online to June 30. Source: https://www.thestar.com.my/news/nation/2020...r-some-services |

|

|

|

|

|

MGM

|

Apr 25 2020, 09:44 AM Apr 25 2020, 09:44 AM

|

|

QUOTE(akhito @ Apr 25 2020, 08:37 AM) Thanks |

|

|

|

|

Apr 22 2020, 11:15 PM, updated 6y ago

Apr 22 2020, 11:15 PM, updated 6y ago

Quote

Quote

0.0157sec

0.0157sec

0.70

0.70

5 queries

5 queries

GZIP Disabled

GZIP Disabled