» Click to show Spoiler - click again to hide... «

QUOTE(Angelic Layer @ Mar 10 2021, 08:40 AM)

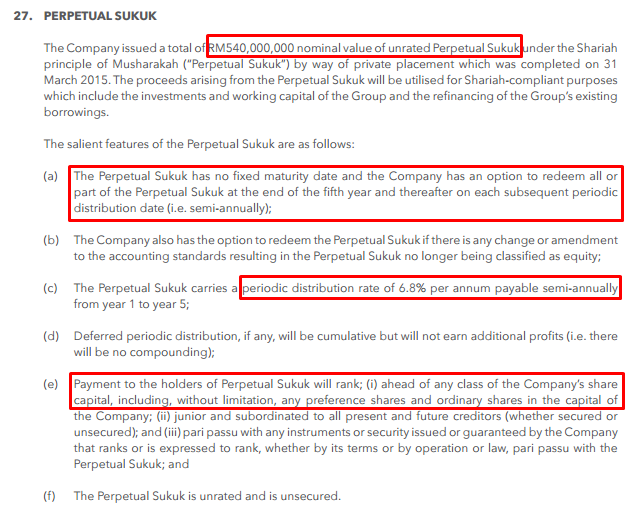

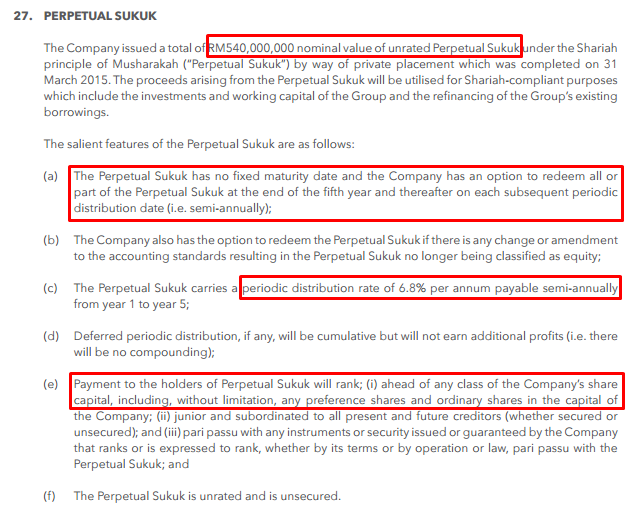

Sukuk is classified as "equity" instead of borrowing, it doesn't show up as debt or in EBITDA.

For example Mahsing "borrowed" 540 million via sukuk in 2017 (no fixed maturity):

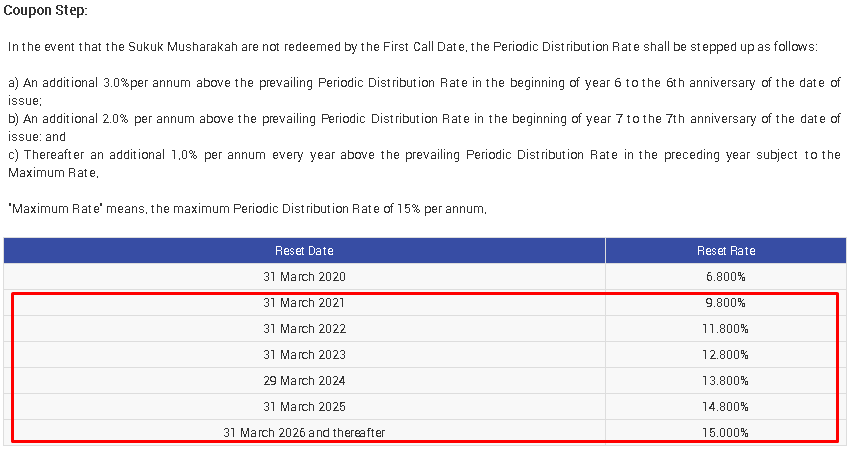

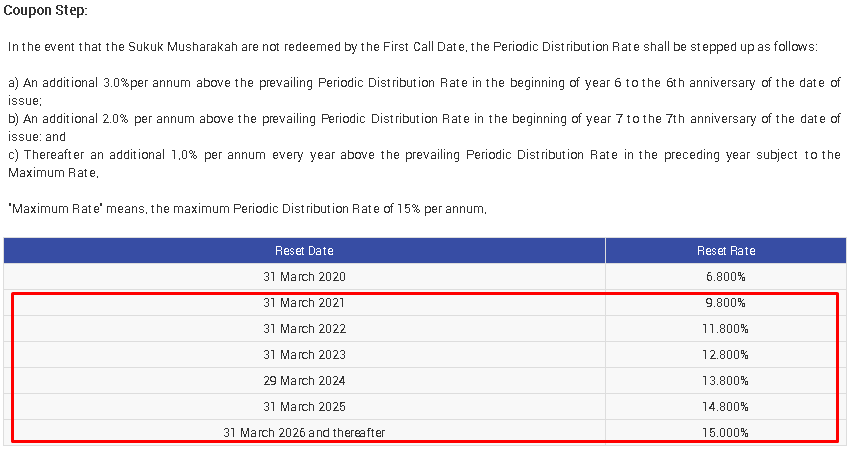

It has to repay 9.8% rate per year if they didn't buy back at the end of this month:

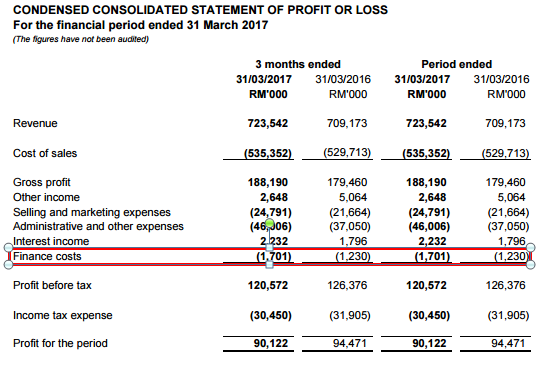

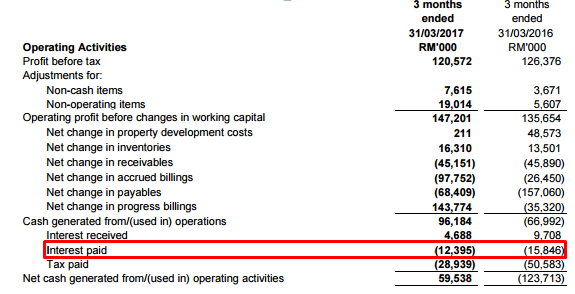

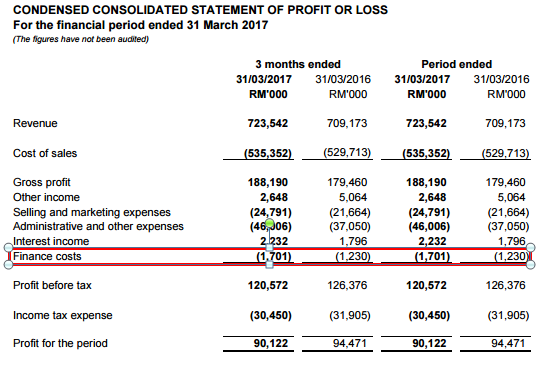

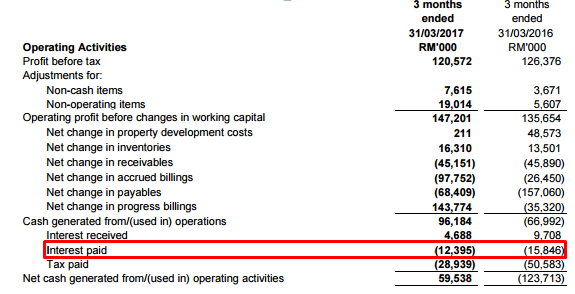

They don't classify as "interest" but instead as "distribution"

Source

And this is not the only Sukuk they issued, last year they issued 100 million via sukuk.

Just managed to read this: https://islamicmarkets.com/publications/mah...tion-memorandum

They want to issue 1 billion some more.

How can they redeem it?

By borrowing money to pay back old debt, do you think it will work?

For example Mahsing "borrowed" 540 million via sukuk in 2017 (no fixed maturity):

It has to repay 9.8% rate per year if they didn't buy back at the end of this month:

They don't classify as "interest" but instead as "distribution"

Source

And this is not the only Sukuk they issued, last year they issued 100 million via sukuk.

Just managed to read this: https://islamicmarkets.com/publications/mah...tion-memorandum

They want to issue 1 billion some more.

How can they redeem it?

By borrowing money to pay back old debt, do you think it will work?

this guy homeworks

Mar 10 2021, 08:52 AM

Mar 10 2021, 08:52 AM

Quote

Quote 0.0233sec

0.0233sec

0.58

0.58

6 queries

6 queries

GZIP Disabled

GZIP Disabled