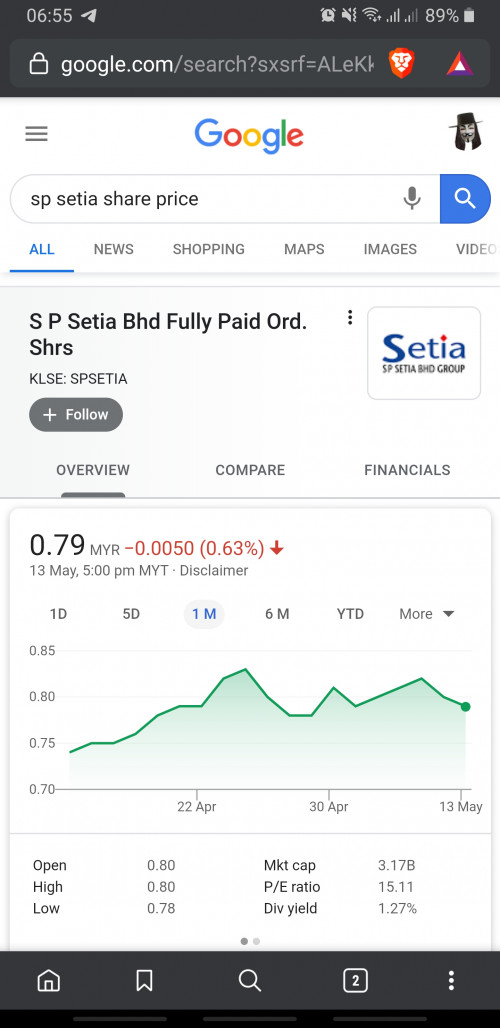

1) SP Setia Bhd

( S P Setia to take over

I&P Group Sdn Bhd

for RM3.65b

June 22, 2017 )

land banks = 9,417 acres

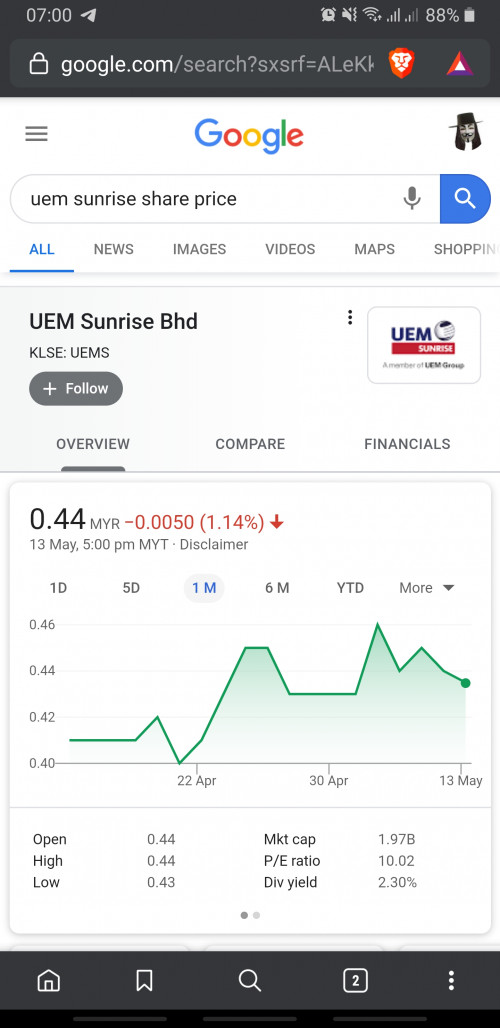

2) UEMS (5148)

UEM SUNRISE BHD

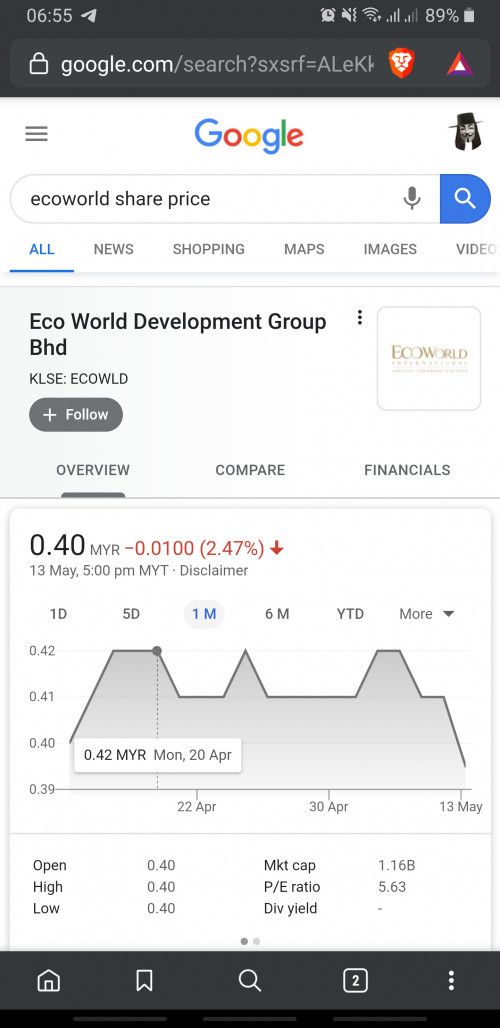

3) Eco World Development Group Berhad

8206

4) SUNWAY BERHAD (5211)

In 2013, Sunway Property further expanded its portfolio by purchasing

691 acres

of land in Medini Iskandar

and

1,109 acres in Pendas

TOTAL 1800 ACRES!!!!

located in the southern

Peninsular Malaysia in the state of Johor.

The development of its largest

sustainable township in Sunway Iskandar will embody a world-class architecture

and nature’s design.

5)

MAHSING (8583)

MAH SING GROUP BHD

6)

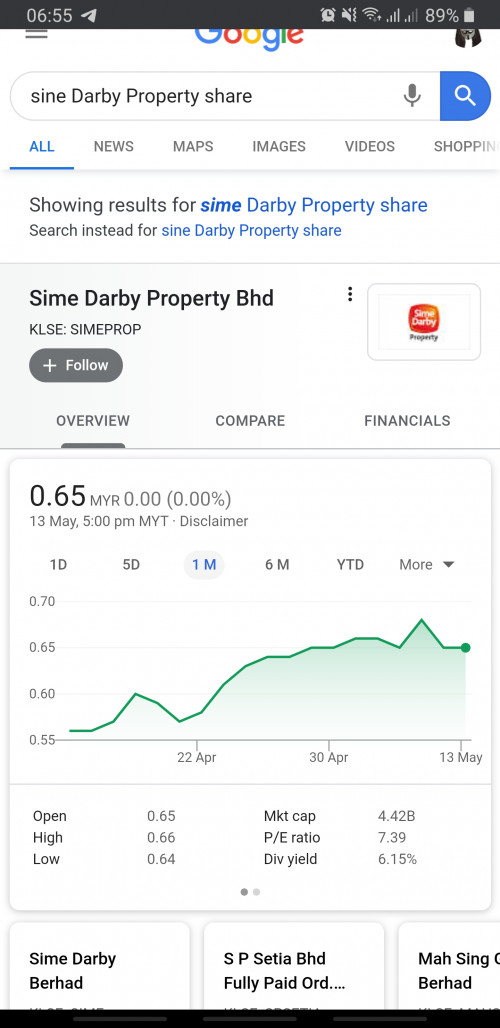

SIMEPROP (5288)

SIME DARBY PROPERTY BERHAD

7) Tropicana Corporation Berhad

8)

IOIPG (5249)

IOI PROPERTIES GROUP BHD

9)

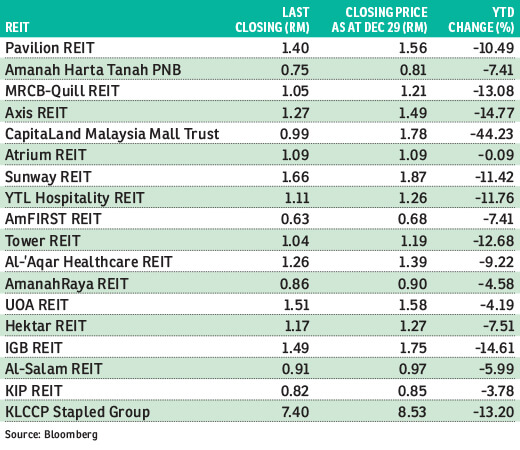

IGBB (5606)

IGB BHD

10)

UOADEV (5200)

UOA DEVELOPMENT BHD

IBHD (4251)

I-BERHAD

OSK (5053)

OSK HOLDINGS BHD

Our Johor office was opened in 1996 and became part of the Savills Group in 2015.

Our Johor office is located near the main central business district. Johor Bahru is a rapidly growing city comprising multi-storey office towers/buildings, shopping complexes, hotels and multi-storey terraced shophouses, which are scattered all around the main CBD.

Unit 16.01,

Level 16,

Menara Landmark,

12, Jalan Ngee Heng,

80000 johor bahru.

OFFICE OPENING HOURS

Mon - Fri: 9:00am - 6:00pm

‐------------------------------------------------------------@@@@@@@@###@######

Rahim & Co International Sdn Bhd(1126597 – X)

Unit 19A,

Level 19,

Metropolis Tower,

Jalan Dato' Abdullah Tahir,

80300 Johor Bahru,

Johor, Malaysia.

T +(60 7) 333 7166

---------------------------------------------@@@@@@@@###@#---------------------------------------------@@@@@@@@###@#

Knight Frank Offices

Address:

Suite 3A-01,

Level 3A ,

Bangunan Pelangi:

Jalan Biru,

Taman Pelangi,

80400 Johor Bahru ,

Malaysia.

+607 338 2888

--------------------------------------@@@@@@@@###@#---------------------------------------------@@@@@@@@###@#

WTW Property Services Sdn. Bhd.

Menara Ansar,

Suite 15B, Level, 15,

Jalan Trus,

80000 Johor Bahru,

Johor.

------------------------------------------@@@@@@@@###@#---------------------------------------------@@@@@@@@###@#

C H Williams & Co was established in Kuala Lumpur in 1960. Talhar & Co was founded in Johor Bahru in 1972. C H Williams Talhar & Wong was formed in 1974 as a result of the merger of the practices of C H Williams & Co and Talhar & Co. The operating offices throughout Peninsular Malaysia were complemented further by associated offices in Sarawak (1975) and Sabah (1977).

In 2016, CBRE Group, Inc. entered into an agreement to acquire a significant interest in the operatinf companies of the 13 Peninsular Malaysia offices rebranding the company as

CBRE | WTW

-----------------------------------------@@@@@@@@###@#---------------------------------------------@@@@@@@@###@#

JLL Property Services (Malaysia) Sdn Bhd

Unit 7.2, Level 7,

Menara 1 Sentrum,

201, Jalan Tun Sambanthan,

50470 Kuala Lumpur

Malaysia

Tel : +603-22 600 700

-----------------------------------------@@@@@@@@###@#---------------------------------------------@@@@@@@@###@#

SP Setia

8664

RM0.78

-IOI Properties Group Bhd

KLSE: IOIPG

1.06 MYR

5249

SIMEPROP

(5288)

SIME DARBY PROPERTY BERHAD

RM 0.66

IJM Land berhad

UEM Sunrise Bhd

(5148)

KLSE: UEMS

RM 0.42

------------------------------------------------------------------------------------------------------------------------------------------------------------

EcoWorld

8206

RMM0.39

SUNWAY BHD

5211

RM1.39

[img]https://themalaysianrese

Eastern & Oriental Berhad

KLSE: E&O

E&O (3417)

0.40 MYR 0.00 (0.00%)

OSK (5053)

OSK HOLDINGS BHD

MAHSING

(8583)

MAH SING GROUP BHD

RM0.56

Sunsuria Bhd

(3743)

KLSE: SUNSURIA

0.46 MYR

TROP (5401)

TROPICANA CORP BHD

IJM LAND BERHAD belongs to

IJM (3336)

IJM CORP BHD

Scientex is also on the top tier of property developers in Malaysia with integrated property projects spread over 1,935 acres of land in the southern states of Johor and Melaka

Scientex Berhad

(KLSE:SCIENTX)

4731

RM9.22

UOA Development Bhd

UOADEV (5200)

1.76 MYR

Few more are in the smaller development companies league and they probably have almost the same pricing power.

Top Glove founder emerges as substantial shareholder of LBS Bina

March 24, 2020

KUALA LUMPUR (March 24): Tan Sri Dr Lim Wee Chai, founder and executive chairman of Top Glove Corp Bhd, has emerged as a substantial shareholder in LBS Bina Group Bhd after purchasing 103.13 million shares or a 6.81% stake in the property developer.

In a filing with Bursa Malaysia today, LBS Bina said Wee Chai bought the shares via direct business transactions between March 19 and 24 at 32 sen apiece or RM33 million.

Separate filings show that Wee Chai bought the shares in several blocks from LBS Bina's single largest shareholder Gaterich Sdn Bhd, which is the private investment vehicle of LBS Bina founder Datuk Seri Lim Bok Seng and his family. Post-disposal, Gaterich has a 35.88% stake in LBS Bina.

At the closing today, shares in LBS Bina were up one sen or 2.94% at 35 sen with a market capitalisation of RM530.18 million. Year-to-date, LBS Bina's share price has fallen 30%.

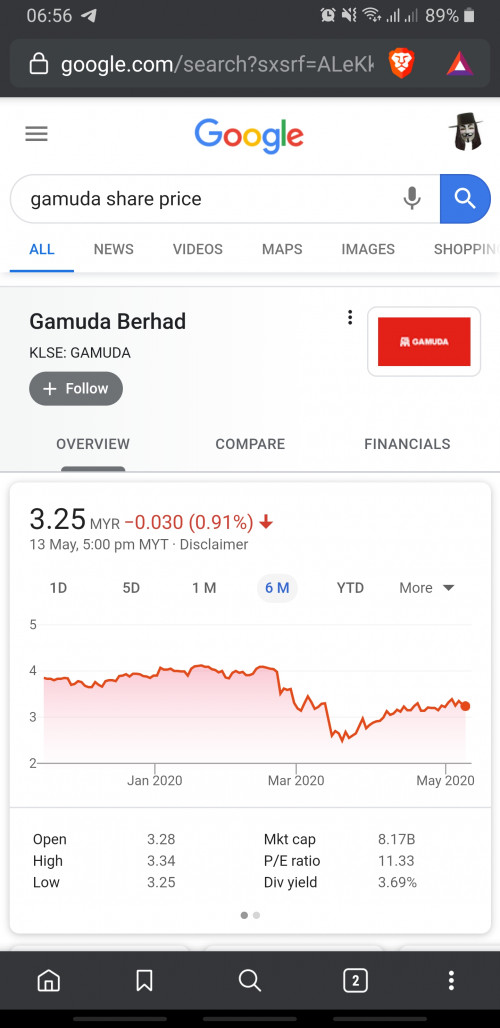

wct berhad

These are

Gamuda (due to lack of available GDV),

TTDI,

Paramount,

OSK Properties,

Malton,

DRB-Hicom,

Hong Leong Properties and several others.

This post has been edited by plouffle0789: Jan 24 2022, 10:36 PM

Apr 20 2020, 02:32 PM, updated 4y ago

Apr 20 2020, 02:32 PM, updated 4y ago

Quote

Quote

-19May2014.jpg)

0.0773sec

0.0773sec

0.28

0.28

5 queries

5 queries

GZIP Disabled

GZIP Disabled