Anyone follow dividend magic facebook or instagram?

Mine sharing how he calculate his quarterly dividend yield or gross investment etc?

I tried to calculate but does not get the number he got.

**New to stock market

Dividend magic

Dividend magic

|

|

Apr 7 2020, 08:52 PM, updated 6y ago Apr 7 2020, 08:52 PM, updated 6y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

436 posts Joined: Jun 2019 |

Anyone follow dividend magic facebook or instagram?

Mine sharing how he calculate his quarterly dividend yield or gross investment etc? I tried to calculate but does not get the number he got. **New to stock market |

|

|

|

|

|

Apr 7 2020, 10:08 PM Apr 7 2020, 10:08 PM

Show posts by this member only | Post

#2

|

Senior Member

1,917 posts Joined: Sep 2012 |

why call it magic when it's just maths and finance....?

not on Facebook. If you take some screenshots and post it here, maybe we can help you. |

|

|

Apr 8 2020, 08:45 AM Apr 8 2020, 08:45 AM

Show posts by this member only | Post

#3

|

Junior Member

436 posts Joined: Jun 2019 |

|

|

|

Apr 8 2020, 08:48 AM Apr 8 2020, 08:48 AM

Show posts by this member only | Post

#4

|

Junior Member

436 posts Joined: Jun 2019 |

|

|

|

Apr 8 2020, 09:15 AM Apr 8 2020, 09:15 AM

Show posts by this member only | IPv6 | Post

#5

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 08:48 AM)  So i use the share price on the date entitle for dividend to calculate the market value and dividend yield but i don't get the numbers he get Don't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! This post has been edited by Boon3: Apr 8 2020, 09:16 AM |

|

|

Apr 8 2020, 10:12 AM Apr 8 2020, 10:12 AM

Show posts by this member only | Post

#6

|

Junior Member

169 posts Joined: Jan 2011 |

QUOTE(Boon3 @ Apr 8 2020, 09:15 AM) Your calculation was right for that ONE dividend. However SunR paid out 4 sets of dividend for the year 2019. You need to add all 4 then divide by your cost if investment. I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. MadnessDon't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! |

|

|

|

|

|

Apr 8 2020, 10:14 AM Apr 8 2020, 10:14 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Boon3 @ Apr 8 2020, 10:15 AM) Your calculation was right for that ONE dividend. However SunR paid out 4 sets of dividend for the year 2019. You need to add all 4 then divide by your cost if investment. So could i understand it as Don't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term |

|

|

Apr 8 2020, 10:15 AM Apr 8 2020, 10:15 AM

Show posts by this member only | Post

#8

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Salvador_Dali @ Apr 8 2020, 11:42 AM) I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. Madness And Now make PRs news that they must be bailed out |

|

|

Apr 8 2020, 10:18 AM Apr 8 2020, 10:18 AM

Show posts by this member only | Post

#9

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Seth Ho @ Apr 8 2020, 11:44 AM) So could i understand it as Dividend is worth when there is MOAT. solid MOAT. example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term That kind is very rare. Most people who got the stocks way earlier when all are running naked. And they know realistic expectation. Not dividend expectation. |

|

|

Apr 8 2020, 10:51 AM Apr 8 2020, 10:51 AM

Show posts by this member only | IPv6 | Post

#10

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 10:14 AM) So could i understand it as Did you understand what happened in your SunR example? example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term One of common mistake is to buy a stock JUST because it has a yield of say 7%. I am sure you heard such statements in reports, papers, forums etc etc... 1. First thing, you need to look the dividend paid out history for the past 5 years (at least). A brief look see and you will be able to tell if the dividends paid out is increasing or not. Got to be honest here with yourself. If the numbers are increasing, it is increasing. If it is ding dong up or down, - it simply means erratic. Yes, call the cat White if it is white. 2. When was the last dividend paid? Take your SunR example. The current div per year (dps) is 9. 59 sen. Yield is over 6% based on current price. Now this stat is correct but it has one big assumption, which is you received the full 4 set of dividends paid for 2019. Now if you invest in Aug 2019, you've missed the first 2 dividends. Hence the yield would be different? Get what I am saying here. 3. After a stock gives out dividend, the stock price is readjusted to reflect the dividend paid. Do not forget this simple issue.... Anyway I am merely highlighting the risk if one focus solely on dividends. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? |

|

|

Apr 8 2020, 11:04 AM Apr 8 2020, 11:04 AM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Salvador_Dali @ Apr 8 2020, 10:12 AM) I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. Madness Actually, it is much more than what you can see on the papers. You don't know what's in his mind, you don't know what is his intention and what plans he has for the company, afterall, by paying huge diviends, who benefits the most? When the valuation is undervalued or deemed to be undervalued, what do you do as the owner? Sorry, can't divulge much, i don't wanna go to the jail. So sometimes it is essential to put on the controlling shareholder thinking cap (despite we won't have the capability in one way or another, especially financially). Think like a business owner, follow their footsteps to play this kind of game and potentially can make money. Don't think like a typical MI. |

|

|

Apr 8 2020, 03:12 PM Apr 8 2020, 03:12 PM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Boon3 @ Apr 8 2020, 11:51 AM) Did you understand what happened in your SunR example? Thank you for the details explanation i get what you mean but i have a few curios question.One of common mistake is to buy a stock JUST because it has a yield of say 7%. I am sure you heard such statements in reports, papers, forums etc etc... 1. First thing, you need to look the dividend paid out history for the past 5 years (at least). A brief look see and you will be able to tell if the dividends paid out is increasing or not. Got to be honest here with yourself. If the numbers are increasing, it is increasing. If it is ding dong up or down, - it simply means erratic. Yes, call the cat White if it is white. 2. When was the last dividend paid? Take your SunR example. The current div per year (dps) is 9. 59 sen. Yield is over 6% based on current price. Now this stat is correct but it has one big assumption, which is you received the full 4 set of dividends paid for 2019. Now if you invest in Aug 2019, you've missed the first 2 dividends. Hence the yield would be different? Get what I am saying here. 3. After a stock gives out dividend, the stock price is readjusted to reflect the dividend paid. Do not forget this simple issue.... Anyway I am merely highlighting the risk if one focus solely on dividends. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? Let's say i don't focus on dividend too much but on the value of the stock let's say the stock price is rm 1 this year, 3 years later rm 7, but on the 4th years due to some circumstances is drop back to rm 4. (Let's say yearly DY 3.5%) for this example if i want to sell on the 4th year actually my investment stock price have just increase by rm3? Thank you for all the Sifu Sifu here that share their opinion. |

|

|

Apr 8 2020, 03:19 PM Apr 8 2020, 03:19 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Syie9^_^ @ Apr 8 2020, 11:18 AM) Dividend is worth when there is MOAT. solid MOAT. So i guess for fresh grad or someone new to stock market should invest more in future stocks?That kind is very rare. Most people who got the stocks way earlier when all are running naked. And they know realistic expectation. Not dividend expectation. Ex: AI company, industrial 4.0, Fintech, Data mining etc ?? Or actually focus on blue chip stock like glove company? banks? REIT? |

|

|

|

|

|

Apr 8 2020, 03:24 PM Apr 8 2020, 03:24 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Seth Ho @ Apr 8 2020, 04:49 PM) So i guess for fresh grad or someone new to stock market should invest more in future stocks? there`s always a stock. Be it Dividend Aristocrat; Dividend Growth and so on~Ex: AI company, industrial 4.0, Fintech, Data mining etc ?? Or actually focus on blue chip stock like glove company? banks? REIT? Invest what you believe will have future. you dont want another bear stearns OLD blue chip; got tore apart last GFC |

|

|

Apr 8 2020, 04:09 PM Apr 8 2020, 04:09 PM

|

Junior Member

247 posts Joined: Aug 2018 From: Bukit Bintang, Kuala Lumpur |

If you want to invest in increasing dividend yield that increase year after year, then go for KLCC, not SunR or others

|

|

|

Apr 9 2020, 10:36 AM Apr 9 2020, 10:36 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 03:12 PM) Thank you for the details explanation i get what you mean but i have a few curios question. Well yes. Let's say i don't focus on dividend too much but on the value of the stock let's say the stock price is rm 1 this year, 3 years later rm 7, but on the 4th years due to some circumstances is drop back to rm 4. (Let's say yearly DY 3.5%) for this example if i want to sell on the 4th year actually my investment stock price have just increase by rm3? Thank you for all the Sifu Sifu here that share their opinion. Your profit = Cost of sale of share - cost of purchase. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? This one... Sometimes talk is cheap! LOL! It's harsh talk but that's the fact of life. Instead of talking so much, this was a realtime example done last year on a high yielding REIT stock, AMfirst, which was paying a yield of more than 6% during that time of writing in 2019. post #4619 QUOTE(Boon3 @ Sep 11 2019, 04:09 PM) I just looked at my set of data for Amfirst. I opened my chart, set it to weekly time frame and I disabled all dividend + capital changes... ie disabled everything. So if one bought in 2012, at a price of 1.05 the so called dividend collected was 37.1 sen. Good dividend yield rightrNow I drew a horizontal line on July 2012. This date would be important cos AmFirst had a 3 for 5 rights issue. ( But the greater reason is ...aiyoh 3 for 5 rights issue, adds so much more calculations lo... [attachmentid=10313487] So assuming one bought AmFirst on Jul 2012 and assuming the price of around 1.05. The following year, AmFirst paid 6.81 sen for dividends, so the yield there would make 'sort' of a case' to buy this bugger. right? So dividends paid, received, secured by this reit investor since then.... 6.81 sen + 7.35 + 5.53 + 5.1 + 4.06 + 4.2 + 4 (data taken from mstock.biz) which sums up to 37.1 sen. Cost of reit 1.05. Total dividends 37.1 sen. Years holding this reit = 7 years! Current price of Amfirst = 51 sen. Rugi big big lo. Would I dare say one can lose money in reit as per the example of AmFirst? * I know, some would bring out the argument lo, hold the stock longer and hope that the investment could 'break even' ..... Yeah, technically, it could happen. One could use the erroneous theory that as long as not yet sold is considered not yet lose... but how long should one hold? Another 7 year could see the reits dividend total maybe 74 sen ( i did the lazy annualising lor based on 37.1 sen) or better still another 7 years, one could receive a total of 1.05 sen in reits dividends from this reit. Which means a total of 21 years....... and of course whatever price the reit is trading in the market is considered profit. Well? For me, I would ask myself, if such an investment would remotely make any sense......... However, unfortunately price for Amfirst reit in Sep 2019 was only 51 sen! Basically one got an insane dividend yield but with the cost of Amfirst plunging to a mere 51 sen, this investment is yielding losses for a holding period of 7 years!!!! And Amfirst today is trading at only 42 sen !!! A clear cut example that shows that there exist stocks where can lose money despite getting great dividends. Now if this is the case, how could one mislead others by declaring that dividends is magic? |

|

|

Apr 9 2020, 11:32 AM Apr 9 2020, 11:32 AM

Show posts by this member only | IPv6 | Post

#17

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Apr 9 2020, 10:36 AM) Well yes. Gotta find out how they were getting the cash to pay the dividends. Your profit = Cost of sale of share - cost of purchase. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? This one... Sometimes talk is cheap! LOL! It's harsh talk but that's the fact of life. Instead of talking so much, this was a realtime example done last year on a high yielding REIT stock, AMfirst, which was paying a yield of more than 6% during that time of writing in 2019. post #4619 So if one bought in 2012, at a price of 1.05 the so called dividend collected was 37.1 sen. Good dividend yield rightr However, unfortunately price for Amfirst reit in Sep 2019 was only 51 sen! Basically one got an insane dividend yield but with the cost of Amfirst plunging to a mere 51 sen, this investment is yielding losses for a holding period of 7 years!!!! And Amfirst today is trading at only 42 sen !!! A clear cut example that shows that there exist stocks where can lose money despite getting great dividends. Now if this is the case, how could one mislead others by declaring that dividends is magic? Not sure about AMfirst. BUT if you bought Panamy in 2010 at Rm12.50 you would have received total dividends of Rm10.44 to 2016 and sold at Rm40 per share. 0r if you held to date , total dividends is RM16.35 with present price of Rm27 Not all dividend stocks are bad provided they are not out to scam you! |

|

|

Apr 9 2020, 11:45 AM Apr 9 2020, 11:45 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(prophetjul @ Apr 9 2020, 11:32 AM) Gotta find out how they were getting the cash to pay the dividends. Well I did not state that all is bad either. Not sure about AMfirst. BUT if you bought Panamy in 2010 at Rm12.50 you would have received total dividends of Rm10.44 to 2016 and sold at Rm40 per share. 0r if you held to date , total dividends is RM16.35 with present price of Rm27 Not all dividend stocks are bad provided they are not out to scam you! Look, many of us are aware of this dividend magic or dividend warrior nonsense. Spam everywhere with his meaningless gloating. If it's magic, why are they so many bad apples examples, such as Amfirst reit (do suggest you read about Amfirst reit. With declining dps, the stock has but only one way but down) exist? If such bad examples exist, then the term dividend magic certainly ain't applicable! |

|

|

Apr 9 2020, 12:20 PM Apr 9 2020, 12:20 PM

|

Junior Member

169 posts Joined: Jan 2011 |

QUOTE(Boon3 @ Apr 9 2020, 11:45 AM) Well I did not state that all is bad either. That is why it is called magic, to trick you.Look, many of us are aware of this dividend magic or dividend warrior nonsense. Spam everywhere with his meaningless gloating. If it's magic, why are they so many bad apples examples, such as Amfirst reit (do suggest you read about Amfirst reit. With declining dps, the stock has but only one way but down) exist? If such bad examples exist, then the term dividend magic certainly ain't applicable! Like AirAsia and AmReit's dividend |

|

|

Apr 9 2020, 12:49 PM Apr 9 2020, 12:49 PM

Show posts by this member only | IPv6 | Post

#20

|

Senior Member

2,210 posts Joined: Jan 2018 |

If DPS>EPS, this means dividend is unsustainable and they are paying out from reserves. Share price will eventually fall. Avoid at all costs

|

|

|

Apr 9 2020, 02:06 PM Apr 9 2020, 02:06 PM

Show posts by this member only | IPv6 | Post

#21

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Salvador_Dali @ Apr 9 2020, 12:20 PM) AirAsia dividends were different. They were special dividend which raised from their disposal of planes which came about during its sale and leaseback. Such dividends were clearly not sustainable. |

|

|

Apr 9 2020, 02:36 PM Apr 9 2020, 02:36 PM

|

Junior Member

169 posts Joined: Jan 2011 |

QUOTE(Boon3 @ Apr 9 2020, 02:06 PM) AirAsia dividends were different. They were special dividend which raised from their disposal of planes which came about during its sale and leaseback. Such dividends were clearly not sustainable. Exactly, that is why buying AA stock for their dividend is not a good advice.It is like selling our property and then lease it back to sublet it. Eventually, we'll run out of property to sell. |

|

|

Apr 9 2020, 03:10 PM Apr 9 2020, 03:10 PM

Show posts by this member only | IPv6 | Post

#23

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Boon3 @ Apr 9 2020, 11:36 AM) Well yes. Thank you for this great example so by all means eveytime i need to calculate total returns to clearly know how much have i earn by investing in a certain stockYour profit = Cost of sale of share - cost of purchase. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? This one... Sometimes talk is cheap! LOL! It's harsh talk but that's the fact of life. Instead of talking so much, this was a realtime example done last year on a high yielding REIT stock, AMfirst, which was paying a yield of more than 6% during that time of writing in 2019. post #4619 So if one bought in 2012, at a price of 1.05 the so called dividend collected was 37.1 sen. Good dividend yield rightr However, unfortunately price for Amfirst reit in Sep 2019 was only 51 sen! Basically one got an insane dividend yield but with the cost of Amfirst plunging to a mere 51 sen, this investment is yielding losses for a holding period of 7 years!!!! And Amfirst today is trading at only 42 sen !!! A clear cut example that shows that there exist stocks where can lose money despite getting great dividends. Now if this is the case, how could one mislead others by declaring that dividends is magic? |

|

|

Apr 9 2020, 03:37 PM Apr 9 2020, 03:37 PM

Show posts by this member only | IPv6 | Post

#24

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Salvador_Dali @ Apr 9 2020, 03:36 PM) Exactly, that is why buying AA stock for their dividend is not a good advice. Let's say if today Tony Fernandes is not the biggest shareholders i guess the share still got chance to rebound since he will not be the biggest winner??It is like selling our property and then lease it back to sublet it. Eventually, we'll run out of property to sell. furthermore, currently AA focus on logistics and bigpay this will change their company profit profile right? I did not buy AA stock just a thought of mind |

|

|

Apr 9 2020, 03:55 PM Apr 9 2020, 03:55 PM

|

Junior Member

911 posts Joined: Jan 2019 |

QUOTE(Seth Ho @ Apr 9 2020, 03:37 PM) Let's say if today Tony Fernandes is not the biggest shareholders i guess the share still got chance to rebound since he will not be the biggest winner?? Does dividend investing reap the benefit during crisis?furthermore, currently AA focus on logistics and bigpay this will change their company profit profile right? I did not buy AA stock just a thought of mind |

|

|

Apr 9 2020, 03:59 PM Apr 9 2020, 03:59 PM

Show posts by this member only | IPv6 | Post

#26

|

Senior Member

1,061 posts Joined: Feb 2008 |

QUOTE(Yggdrasil @ Apr 9 2020, 12:49 PM) If DPS>EPS, this means dividend is unsustainable and they are paying out from reserves. Share price will eventually fall. Avoid at all costs Errr yes & no. The ability for a stock to pay consistent dividends is to have strong free cash flow. Sometime the EPS can hit by high depreciation, but the cash flow still remain strong, hence they are still able to pay dividend even they have this DPS > EPS situation. P&L can be financially engineered, but cash flow statement is hard to fake. |

|

|

Apr 9 2020, 04:11 PM Apr 9 2020, 04:11 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Smurfs @ Apr 9 2020, 03:59 PM) Errr yes & no. No. You cannot pay out dividends if you have no profit.The ability for a stock to pay consistent dividends is to have strong free cash flow. Sometime the EPS can hit by high depreciation, but the cash flow still remain strong, hence they are still able to pay dividend even they have this DPS > EPS situation. P&L can be financially engineered, but cash flow statement is hard to fake. Dividends can only be paid out if the company is making losses by paying from their distributable reserves. Profits increase distributable reserves not EBITDA. If a company has EBITDA of RM100k but net profit of RM0, it still cannot pay a dividend (again unless they pay from the distributable reserve). Hence, EPS is more important before cash flows. Even if you have "good" cash flow but unprofitable (this alone is highly unlikely because unprofitable companies tend to have bad cash flows), the company by law is not allowed to pay dividends except from retained earnings. If you don't believe me, you can see for yourself the share price of companies that pay out DPS>EPS. |

|

|

Apr 9 2020, 04:21 PM Apr 9 2020, 04:21 PM

Show posts by this member only | IPv6 | Post

#28

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Yggdrasil @ Apr 9 2020, 04:11 PM) No. You cannot pay out dividends if you have no profit. Dividends can only be paid out if the company is making losses by paying from their distributable reserves. Profits increase distributable reserves not EBITDA. If a company has EBITDA of RM100k but net profit of RM0, it still cannot pay a dividend (again unless they pay from the distributable reserve). Hence, EPS is more important before cash flows. Even if you have "good" cash flow but unprofitable (this alone is highly unlikely because unprofitable companies tend to have bad cash flows), the company by law is not allowed to pay dividends except from retained earnings. If you don't believe me, you can see for yourself the share price of companies that pay out DPS>EPS. |

|

|

Apr 9 2020, 04:44 PM Apr 9 2020, 04:44 PM

Show posts by this member only | IPv6 | Post

#29

|

Senior Member

1,042 posts Joined: Jan 2003 |

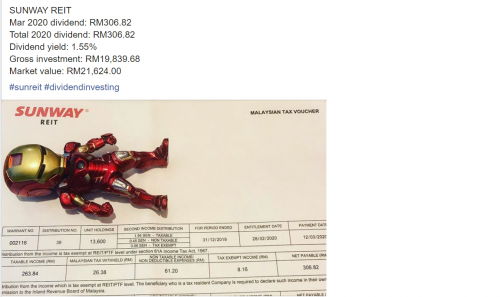

Basically the way he presents it is:

Gross investment: Cost of him purchasing the shares (inclusive of brokerage, stamp fee, clearance fee, etc charges I assume) Market value: Number of shares x latest price Dividend yield: Total dividend received for calendar year/Gross investment |

|

|

Apr 9 2020, 04:51 PM Apr 9 2020, 04:51 PM

Show posts by this member only | IPv6 | Post

#30

|

Senior Member

1,061 posts Joined: Feb 2008 |

QUOTE(Yggdrasil @ Apr 9 2020, 04:11 PM) If you don't believe me, you can see for yourself the share price of companies that pay out DPS>EPS. I found 1 company that pays out DPS > EPS. But the share price is still quite high.  I'm not a finance graduates, I just know for a company to be able to pay sustainable dividend, you need strong free cash flow. Cash flow statement stated the actual inflow / outflow of business activities. Profit number alone is not representing the actual cash that you have got at the end of the quarter. Hence you can see there will be some adjustment for depreciation, amortisation,impairment of goodwill, changes in fair values of properties etc. Profit on the other hand, is a product of accounting rules. And accounting profit is based on accrual concept, and not cash concept. I think this you are more well-versed than me. |

|

|

Apr 9 2020, 05:17 PM Apr 9 2020, 05:17 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(Smurfs @ Apr 9 2020, 04:51 PM) I found 1 company that pays out DPS > EPS. But the share price is still quite high. Look at a few companies before arriving to conclusion. I'm not a finance graduates, I just know for a company to be able to pay sustainable dividend, you need strong free cash flow. Cash flow statement stated the actual inflow / outflow of business activities. Profit number alone is not representing the actual cash that you have got at the end of the quarter. Hence you can see there will be some adjustment for depreciation, amortisation,impairment of goodwill, changes in fair values of properties etc. Profit on the other hand, is a product of accounting rules. And accounting profit is based on accrual concept, and not cash concept. I think this you are more well-versed than me. HEIM's EPS>DPS. DPS is usually calculated last year while EPS is calculated this year.  From your screenshot, the DPS in my picture is summation of 54 sens and 40 sens. Hence, HEIM's EPS>DPS. The moment a stocks EPS falls below last year's DPS, shareholders know that the company will likely cut dividends. This is why share price falls. |

|

|

Apr 9 2020, 05:46 PM Apr 9 2020, 05:46 PM

Show posts by this member only | IPv6 | Post

#32

|

Senior Member

1,061 posts Joined: Feb 2008 |

QUOTE(Yggdrasil @ Apr 9 2020, 05:17 PM) Look at a few companies before arriving to conclusion. Well if you insist, i rest my case.HEIM's EPS>DPS. DPS is usually calculated last year while EPS is calculated this year.  From your screenshot, the DPS in my picture is summation of 54 sens and 40 sens. Hence, HEIM's EPS>DPS. The moment a stocks EPS falls below last year's DPS, shareholders know that the company will likely cut dividends. This is why share price falls. Good luck and stay safe. |

|

|

Apr 13 2020, 10:56 AM Apr 13 2020, 10:56 AM

|

Senior Member

709 posts Joined: Oct 2013 From: Midgar |

Chasing dividends is only good if you pick the right stocks.

AA is not a dividend stocks imo. Never buy a stocks that have fluctuations in dividends rate throughout the years. This post has been edited by ywliang96: Apr 13 2020, 10:57 AM |

|

|

Apr 13 2020, 12:04 PM Apr 13 2020, 12:04 PM

Show posts by this member only | IPv6 | Post

#34

|

Junior Member

372 posts Joined: Dec 2016 |

i thot dicidend from profit is a law requirement while cash flow is a mgt consideration n decision?

|

|

|

Apr 14 2020, 06:04 PM Apr 14 2020, 06:04 PM

Show posts by this member only | IPv6 | Post

#35

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(ywliang96 @ Apr 13 2020, 10:56 AM) Chasing dividends is only good if you pick the right stocks. I tend to disagree part of this pointAA is not a dividend stocks imo. Never buy a stocks that have fluctuations in dividends rate throughout the years. If a company has set a dividend policy, i don't find it why the dividends will not fluctuate |

|

|

Apr 14 2020, 06:08 PM Apr 14 2020, 06:08 PM

Show posts by this member only | IPv6 | Post

#36

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Yggdrasil @ Apr 9 2020, 04:11 PM) No. You cannot pay out dividends if you have no profit. look at oriental and gentingDividends can only be paid out if the company is making losses by paying from their distributable reserves. Profits increase distributable reserves not EBITDA. If a company has EBITDA of RM100k but net profit of RM0, it still cannot pay a dividend (again unless they pay from the distributable reserve). Hence, EPS is more important before cash flows. Even if you have "good" cash flow but unprofitable (this alone is highly unlikely because unprofitable companies tend to have bad cash flows), the company by law is not allowed to pay dividends except from retained earnings. If you don't believe me, you can see for yourself the share price of companies that pay out DPS>EPS. they can pay out huge dividend even they are making loss their cash in bank are sufficient to even easily declare 50% of their share price as dividend and that will not even hurt their operating expenses |

|

|

Apr 14 2020, 06:57 PM Apr 14 2020, 06:57 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(squarepilot @ Apr 14 2020, 06:08 PM) look at oriental and genting It's paid out of Retained Earnings from past profits. Nothing new.they can pay out huge dividend even they are making loss their cash in bank are sufficient to even easily declare 50% of their share price as dividend and that will not even hurt their operating expenses Obviously they cannot declare 50% of share price as dividend because they have expenses to pay. They can't simply close shop overnight. Even firing people and liquidating assets costs money. There is 1 legit company listed in Malaysia that is currently trading below cash value. With that logic of yours, this will be a better buy than Genting. |

|

|

Apr 14 2020, 07:05 PM Apr 14 2020, 07:05 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(squarepilot @ Apr 14 2020, 06:04 PM) I tend to disagree part of this point Dividend policy is just a guide. Doesn't mean the management have to stick to it.If a company has set a dividend policy, i don't find it why the dividends will not fluctuate Dividend policy is meant for institutional investors or substantial shareholders who rely on dividends to finance their day-to-day activities. Extract from BPLANT's 2017 financial statement:  Look at share price and dividends today. |

|

|

Apr 14 2020, 08:00 PM Apr 14 2020, 08:00 PM

|

Senior Member

709 posts Joined: Oct 2013 From: Midgar |

QUOTE(squarepilot @ Apr 14 2020, 06:04 PM) I tend to disagree part of this point I think I didnt explain clearly, but I took AA as an example. 2019 they gave out a 0.9 cents special dividends to investors. What I mean't is newbies shouldn't invest into something like this to chase the 0.9 cents gains.If a company has set a dividend policy, i don't find it why the dividends will not fluctuate |

|

|

Apr 15 2020, 09:43 AM Apr 15 2020, 09:43 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Yggdrasil @ Apr 14 2020, 07:05 PM) Dividend policy is just a guide. Doesn't mean the management have to stick to it. i think you should not set bplant as an example, this company is mismanaged from top to bottom all the way, including its major shareholder too.Dividend policy is meant for institutional investors or substantial shareholders who rely on dividends to finance their day-to-day activities. Extract from BPLANT's 2017 financial statement:  Look at share price and dividends today. its major shareholder can even distribute dividends when it has accumulated losses in its books. what do you expect from such organisation and subsidiaries which they have major controlling stake? i am sure there are plenty of other company who pay consistent dividends. |

|

|

Apr 15 2020, 09:44 AM Apr 15 2020, 09:44 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(ywliang96 @ Apr 14 2020, 08:00 PM) I think I didnt explain clearly, but I took AA as an example. 2019 they gave out a 0.9 cents special dividends to investors. What I mean't is newbies shouldn't invest into something like this to chase the 0.9 cents gains. investor should only look at normalised income/profit.even SC will disregard your extraordinary income in the event of evaluating any proposal. these are non-recurrent events, it's certainly not a benchmark/precedent. |

|

|

Apr 15 2020, 09:58 AM Apr 15 2020, 09:58 AM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(tehoice @ Apr 15 2020, 09:43 AM) i think you should not set bplant as an example, this company is mismanaged from top to bottom all the way, including its major shareholder too. I was talking about 2016-2018 period.its major shareholder can even distribute dividends when it has accumulated losses in its books. what do you expect from such organisation and subsidiaries which they have major controlling stake? i am sure there are plenty of other company who pay consistent dividends. Bplant sold some land for a big profit. So they issued a one off special dividend. The losses only came later. You're misreading the accounts. Bplant still has RM1b of retained earnings. Of course, they can still give dividend (with a cut). |

|

|

Apr 15 2020, 10:47 AM Apr 15 2020, 10:47 AM

Show posts by this member only | IPv6 | Post

#43

|

Senior Member

2,649 posts Joined: Nov 2010 |

Tbh, I don't think msia suitable for dividend investing

Have not done extensive research, so afaik there's basically no listed company in msia that have consistent dividend growth rate Please share if there's is. |

|

|

Apr 15 2020, 11:12 AM Apr 15 2020, 11:12 AM

Show posts by this member only | IPv6 | Post

#44

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(xcxa23 @ Apr 15 2020, 11:47 AM) Tbh, I don't think msia suitable for dividend investing I have discuss with many finance friends they said malaysia more suitable for dividend investment because the growth are affected by US stock market so the growth are not independent.Have not done extensive research, so afaik there's basically no listed company in msia that have consistent dividend growth rate Please share if there's is. But stock giving consistent dividend growth rate is really not many company |

|

|

Apr 15 2020, 11:41 AM Apr 15 2020, 11:41 AM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Yggdrasil @ Apr 15 2020, 09:58 AM) I was talking about 2016-2018 period. ohhh okok.Bplant sold some land for a big profit. So they issued a one off special dividend. The losses only came later. You're misreading the accounts. Bplant still has RM1b of retained earnings. Of course, they can still give dividend (with a cut). but you misunderstand my 2nd part. what i mean is their shareholder. LTAT. |

|

|

Apr 15 2020, 11:57 AM Apr 15 2020, 11:57 AM

Show posts by this member only | IPv6 | Post

#46

|

Senior Member

2,649 posts Joined: Nov 2010 |

QUOTE(Seth Ho @ Apr 15 2020, 11:12 AM) I have discuss with many finance friends they said malaysia more suitable for dividend investment because the growth are affected by US stock market so the growth are not independent. may i know which company/stock they recommend?But stock giving consistent dividend growth rate is really not many company afaik, there's no company listed in malaysia that does not have consistency/steady dividend pay not many means you found company that have consistent dividend growth rate? mind sharing? |

|

|

Apr 15 2020, 11:58 AM Apr 15 2020, 11:58 AM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(tehoice @ Apr 15 2020, 11:41 AM) Bplant was allowed to give special dividend because the cash from the land sale is better given back to shareholders.LTAT doesn't need money badly during that time. In fact LTAT is one of the best performing funds, even better than EPF. Too bad most of their investments all tanked. |

|

|

Apr 15 2020, 12:09 PM Apr 15 2020, 12:09 PM

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Yggdrasil @ Apr 15 2020, 11:58 AM) Bplant was allowed to give special dividend because the cash from the land sale is better given back to shareholders. but if you also realise, LTAT managed companies are all in bad shape, it simply shows mismanagement from top to toe at all levels within the boustead group.LTAT doesn't need money badly during that time. In fact LTAT is one of the best performing funds, even better than EPF. Too bad most of their investments all tanked. |

|

|

Apr 15 2020, 12:21 PM Apr 15 2020, 12:21 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(tehoice @ Apr 15 2020, 12:09 PM) but if you also realise, LTAT managed companies are all in bad shape, it simply shows mismanagement from top to toe at all levels within the boustead group. LTAT is a fund manager. They don't directly manage companies but decides the directors who run the company.Boustead has always been terribly managed. Probably hire directors based on race not merit. |

|

|

Apr 15 2020, 01:29 PM Apr 15 2020, 01:29 PM

Show posts by this member only | IPv6 | Post

#50

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Yggdrasil @ Apr 14 2020, 06:57 PM) It's paid out of Retained Earnings from past profits. Nothing new. The example i quoted is based on their cash in banks (after minus borrowing) and not from retained earnings. i think we shouldn't look at retained earnings as it will serve as a misleading guide.Obviously they cannot declare 50% of share price as dividend because they have expenses to pay. They can't simply close shop overnight. Even firing people and liquidating assets costs money. There is 1 legit company listed in Malaysia that is currently trading below cash value. With that logic of yours, this will be a better buy than Genting. And when we find company to invest, we need to look at their past - current performance and tally with their dividend policy for planning, and not to look at constant dividend history Alone. Like Bplant that you mentioned, they are giving dividend while making loss? just to make us shareholder happy? No. should have stop giving and focus on financial restructuring. No dividend? sell? Hold? That's depends on whether you are a trader or investor. QUOTE(ywliang96 @ Apr 14 2020, 08:00 PM) I think I didnt explain clearly, but I took AA as an example. 2019 they gave out a 0.9 cents special dividends to investors. What I mean't is newbies shouldn't invest into something like this to chase the 0.9 cents gains. yes. correctI'll usually set my investment criteria as follow:- 1. Must have growth from past 3 years (looking and Qtr-Qtr and Y on Y), If it's not, have to check it's justification in it's financial statement 2. Preferable to have dividend policy or constant dividend payout based on it's profit 3. Must be in relevant and sustainable industry It took me many painful years for me to learn this simple rule Don't go waste it This post has been edited by squarepilot: Apr 15 2020, 01:32 PM |

|

|

Apr 15 2020, 01:55 PM Apr 15 2020, 01:55 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(squarepilot @ Apr 15 2020, 01:29 PM) The example i quoted is based on their cash in banks (after minus borrowing) and not from retained earnings. i think we shouldn't look at retained earnings as it will serve as a misleading guide. If you have cash in bank but no retained earnings, you can't pay a dividend by law.And when we find company to invest, we need to look at their past - current performance and tally with their dividend policy for planning, and not to look at constant dividend history Alone. Like Bplant that you mentioned, they are giving dividend while making loss? just to make us shareholder happy? No. should have stop giving and focus on financial restructuring. QUOTE(squarepilot @ Apr 15 2020, 01:29 PM) Like Bplant that you mentioned, they are giving dividend while making loss? just to make us shareholder happy? No. should have stop giving and focus on financial restructuring. Err did you even read the reason why I quoted BPLANT?I used BPLANT to refute dividend policies. I just wanted to point out that a company can still pay dividends even if the current year is making a loss if it has retained earnings. |

|

|

Apr 15 2020, 02:58 PM Apr 15 2020, 02:58 PM

Show posts by this member only | IPv6 | Post

#52

|

Senior Member

1,075 posts Joined: Apr 2010 |

QUOTE(Yggdrasil @ Apr 15 2020, 01:55 PM) If you have cash in bank but no retained earnings, you can't pay a dividend by law. Ok. my mistake for overlook at BPLANTErr did you even read the reason why I quoted BPLANT? I used BPLANT to refute dividend policies. I just wanted to point out that a company can still pay dividends even if the current year is making a loss if it has retained earnings. First and foremost, if a company don't have retain earning, it probably don't have cash too. i'm not saying that retain earning is not important, i'm saying that there are more numbers and figures to look into besides retain earnings and NTA look at all these solid account books, those are so called huge retain earning, but are they sustainable? one is not, another is doing just fine and another are great. and again, i'm nit talking about overall, i'm just focusing on the importance of having cash in account rather than importance of retain earning when comes into consideration of paying dividend The ok one

the steady one

the shittiest one

This post has been edited by squarepilot: Apr 15 2020, 03:01 PM Attached thumbnail(s)

|

|

|

Apr 15 2020, 03:04 PM Apr 15 2020, 03:04 PM

|

Senior Member

2,210 posts Joined: Jan 2018 |

QUOTE(squarepilot @ Apr 15 2020, 02:58 PM) Ok. my mistake for overlook at BPLANT This is partly true for loss making companies which are making losses for over a period of time.First and foremost, if a company don't have retain earning, it probably don't have cash too. i'm not saying that retain earning is not important, i'm saying that there are more numbers and figures to look into besides retain earnings and NTA There are companies with plenty of cash but little retained earnings. Can you think of one? Answer: » Click to show Spoiler - click again to hide... « |

|

|

Apr 15 2020, 04:00 PM Apr 15 2020, 04:00 PM

|

|

Staff

25,802 posts Joined: Jan 2003 From: Penang |

In simple fact, on accounting basis.

There are 2 criteria needs to be satisfied in order to give dividend. 1. There is retained profit 2. Cash. Whenever there is dividend given out, on the balance sheet, it will reduce the retained profit. While if the company is giving out dividend less than profit this year, then you will not see reduce retained profit. While if the company is giving out more dividend than profit this year, then you will see the reduce retained profit. Balance sheet is simple, It consist of Share capital + retained profit (sometimes perpetual securities, we omit this first to make it simple for other to understand) = Total equity of the company. If company is giving out more cash dividend than its profit, it reduces the retained profit. In the balance sheet, the reduce cash in hand is matched by reduce in retained earning, we call it balance sheet has its reason. Once it gives it out all retained profit, it no longer can give anymore. If really want to give further, then it needs to be in formed of capital. Set aside the cash issue, so the max how much company can give dividend for a particular financial year is depended how much current profit + retained profit. Retained profit is not necessary come from operation, it can be via revaluation of asset as well. Loss making company can still give dividend mainly because it still has retained profit in their balance sheet. But once loss eat into the retained profit in the future which resulted retained profit become negative, then the company has no ability to give dividend anymore. It really want to give further, then only way is via capital, which is more much complicated process. There is accounting standard needs to be followed, not simply have cash, then already can distribute simply. While for IPO cash money raised, company needs to follow strictly SC rules, normally in the prospectus, there is mentioned where the IPO money will be used for, company cannot simply divert to give dividend or other thing else without SC approval. |

|

|

Apr 18 2020, 12:54 AM Apr 18 2020, 12:54 AM

|

Newbie

17 posts Joined: Apr 2018 |

Guys I got one noob question.

Why ar.. Everytime declare deviden.. After the ex date the dividend amount will be deducted from share price? Example ar.. Share AAA price at RM1. dividend RM0.02. After ex date the share price become 0.98. Altho u get dividend bank in to ur account but your share drop 0.02 cent. What's the point la like that? Anyone can give Pencerahan or not? |

|

|

May 19 2020, 09:12 PM May 19 2020, 09:12 PM

|

Junior Member

32 posts Joined: Apr 2017 |

Got new https://dividends.my. macam ok. everyone using?

|

|

|

May 20 2020, 08:37 AM May 20 2020, 08:37 AM

Show posts by this member only | IPv6 | Post

#57

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(peoplemoney @ May 19 2020, 09:12 PM) does not work |

|

|

May 20 2020, 12:20 PM May 20 2020, 12:20 PM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

The way I look at dividend investing is simple. It has definitely made me a calmer investor during this pandemic crisis than I was before I stumbled upon Dividend Magic blog. It does give me the comfort that:

1. I am still receiving above average yield from my portfolio even when the prices fell. 2. While waiting for the market to recover, I was able to average down some of my stocks with the dividends received during the crisis. 3. I improved my stock selection techniques a lot. So now all I have to do is wait out this storm and then see my stocks recover back to their pre-covid levels, and then continue to receive dividends while I sleep. |

|

|

May 20 2020, 01:11 PM May 20 2020, 01:11 PM

|

Junior Member

32 posts Joined: Apr 2017 |

|

|

|

May 20 2020, 01:15 PM May 20 2020, 01:15 PM

|

Senior Member

879 posts Joined: Oct 2008 |

Why dividens magix venture into etoro and cfd

Haiz |

|

|

May 20 2020, 01:33 PM May 20 2020, 01:33 PM

Show posts by this member only | IPv6 | Post

#61

|

Senior Member

3,482 posts Joined: Sep 2007 |

|

|

|

May 20 2020, 01:52 PM May 20 2020, 01:52 PM

Show posts by this member only | IPv6 | Post

#62

|

All Stars

12,287 posts Joined: Oct 2010 |

|

|

|

May 20 2020, 04:01 PM May 20 2020, 04:01 PM

|

Junior Member

32 posts Joined: Apr 2017 |

|

|

|

May 21 2020, 12:10 AM May 21 2020, 12:10 AM

|

Senior Member

4,061 posts Joined: Jan 2003 From: Melaka |

QUOTE(kvvk @ Apr 18 2020, 12:54 AM) Guys I got one noob question. Please read how dividends work. Why ar.. Everytime declare deviden.. After the ex date the dividend amount will be deducted from share price? Example ar.. Share AAA price at RM1. dividend RM0.02. After ex date the share price become 0.98. Altho u get dividend bank in to ur account but your share drop 0.02 cent. What's the point la like that? Anyone can give Pencerahan or not? A dividend is not free money. The money has to come from somewhere. If dividend works the way you thought it did, everyone can become super rich by borrowing RM1 million to buy all the shares they can right before ex-date, then pocket the free dividend money, sell back all the stocks to return the money borrowed. Also I would not recommend people to treat dividend magic like gospel. Understand that it really matters when you buy into a stock and don't just blindly follow the guy's portfolio. It's definitely not worth buying some of the stocks he's holding anymore, the ship has sailed a long time ago. Like Nestle. The guy bought Nestle stocks when it was at RM66.88. |

|

|

May 21 2020, 09:57 AM May 21 2020, 09:57 AM

|

|

Elite

5,626 posts Joined: Nov 2004 From: Klang, Selangor |

QUOTE(infested_ysy @ May 21 2020, 12:10 AM) Please read how dividends work. Rule #1 - Do NOT buy a stock just for its dividends, unless the stock has proven track record of its management abilities and a track record of maintaining a sustainable growth in profit. Buying stocks just before ex-date is beyond stupid like you said. Dividend Magic also does not condone that kind of practice.A dividend is not free money. The money has to come from somewhere. If dividend works the way you thought it did, everyone can become super rich by borrowing RM1 million to buy all the shares they can right before ex-date, then pocket the free dividend money, sell back all the stocks to return the money borrowed. Also I would not recommend people to treat dividend magic like gospel. Understand that it really matters when you buy into a stock and don't just blindly follow the guy's portfolio. It's definitely not worth buying some of the stocks he's holding anymore, the ship has sailed a long time ago. Like Nestle. The guy bought Nestle stocks when it was at RM66.88. Rule #2 - I agree with you. Do NOT blindly follow someone else's portfolio when you don't even understand the how the company works. Nestle is definitely NOT a buy anymore, it is a hold at best, or he could've sold it off for a neat profit if he chooses to as his profit already flipped. So everyone else is quite late to the party now. Note: Remember that everyone was lamenting that the price of Nestle was too high when it was around RM60, and that they missed the boat. It just depends on one's perspectives. Rule #3 - To borrow a line from WB, do NOT forget rule #1 and rule #2. lola88 liked this post

|

|

|

May 21 2020, 12:37 PM May 21 2020, 12:37 PM

|

Senior Member

520 posts Joined: Jul 2015 |

QUOTE(Jordy @ May 21 2020, 09:57 AM) Rule #1 - Do NOT buy a stock just for its dividends, unless the stock has proven track record of its management abilities and a track record of maintaining a sustainable growth in profit. Buying stocks just before ex-date is beyond stupid like you said. Dividend Magic also does not condone that kind of practice. Rule #2 - I agree with you. Do NOT blindly follow someone else's portfolio when you don't even understand the how the company works. Nestle is definitely NOT a buy anymore, it is a hold at best, or he could've sold it off for a neat profit if he chooses to as his profit already flipped. So everyone else is quite late to the party now. Note: Remember that everyone was lamenting that the price of Nestle was too high when it was around RM60, and that they missed the boat. It just depends on one's perspectives. Rule #3 - To borrow a line from WB, do NOT forget rule #1 and rule #2. |

|

|

May 23 2020, 01:44 AM May 23 2020, 01:44 AM

|

Senior Member

879 posts Joined: Oct 2008 |

QUOTE(infested_ysy @ May 21 2020, 12:10 AM) Please read how dividends work. I admire people actually invest in those penny stocks with no proven track record... Those are heroes with brave souls....A dividend is not free money. The money has to come from somewhere. If dividend works the way you thought it did, everyone can become super rich by borrowing RM1 million to buy all the shares they can right before ex-date, then pocket the free dividend money, sell back all the stocks to return the money borrowed. Also I would not recommend people to treat dividend magic like gospel. Understand that it really matters when you buy into a stock and don't just blindly follow the guy's portfolio. It's definitely not worth buying some of the stocks he's holding anymore, the ship has sailed a long time ago. Like Nestle. The guy bought Nestle stocks when it was at RM66.88. |

|

|

May 23 2020, 11:02 AM May 23 2020, 11:02 AM

|

Senior Member

4,821 posts Joined: Mar 2009 |

always ask yourself why the company kept paying dividend if they could use cash for business expansion?

|

|

|

May 23 2020, 01:09 PM May 23 2020, 01:09 PM

|

Senior Member

1,917 posts Joined: Sep 2012 |

QUOTE(Seth Ho @ Apr 15 2020, 11:12 AM) I have discuss with many finance friends they said malaysia more suitable for dividend investment because the growth are affected by US stock market so the growth are not independent. I hope you don't think "finance background = great investors."But stock giving consistent dividend growth rate is really not many company there are many finance graduates every year, but I'm not sure if 50% of them are good / great investors. |

|

|

May 23 2020, 01:40 PM May 23 2020, 01:40 PM

|

Senior Member

3,076 posts Joined: Jan 2008 |

|

|

|

May 23 2020, 05:20 PM May 23 2020, 05:20 PM

|

Newbie

44 posts Joined: Sep 2018 |

Financial bloggers such as dividendmagic generally make money from sponsored posts and affiliate links. Financial bloggers are generally marketers of financial products. They might give you some basic advice here and there but that's about it. The recent Etoro endorsement was just a way for the writer to gain more commissions. Etoro is not regulated in Malaysia. If suddenly Bank Negara blocks fund transfers from Malaysian accounts to Etoro, investors will be massively screwed. The same thing happened with Luno for bitcoin in Malaysia previously. Etoro is also providing CFD (option on the stock) vs normal share purchase. Big big difference. Nowadays financial bloggers also showcase their entire portfolio. They do this so that more readers will purchase the same stocks as them and prop up their portfolio values. The universal rule here still applies- "those who can't do, teach". If you read the blog post on 16 March 2020, it was mentioned that "my return right now is at a measly 0.91%. Since inception." If you look back at the posting dates of the freedom fund, the first post is December 2015. If you had put your money in a risk-free FD account for the past 4 years, you would have outperform this portfolio without the need to do any single research. On a separate note, if you're into stocks, dividend yield is just a distraction for me personally. A company with high yield is not necessarily a good buy. A company can take on debt to pay dividends even if it's making losses. Share price will always move upwards in the long term if and only if revenue and net profit grows. In the short term, glove counters such as Top Glove are trading way ahead of their fundamentals due to FOMO and pure speculation. So do expect a sudden drop in share price of these counters when a vaccine is found. This post has been edited by johnsonlim777: May 23 2020, 05:22 PM lola88 liked this post

|

|

|

May 23 2020, 09:02 PM May 23 2020, 09:02 PM

|

All Stars

11,954 posts Joined: May 2007 |

Why divide magic is not responding to this post?

|

|

|

May 24 2020, 12:59 AM May 24 2020, 12:59 AM

|

Senior Member

4,061 posts Joined: Jan 2003 From: Melaka |

QUOTE(johnsonlim777 @ May 23 2020, 05:20 PM) Nowadays financial bloggers also showcase their entire portfolio. They do this so that more readers will purchase the same stocks as them and prop up their portfolio values. Additional note: The universal rule here still applies- "those who can't do, teach". If you read the blog post on 16 March 2020, it was mentioned that "my return right now is at a measly 0.91%. Since inception." If you look back at the posting dates of the freedom fund, the first post is December 2015. If you had put your money in a risk-free FD account for the past 4 years, you would have outperform this portfolio without the need to do any single research. On a separate note, if you're into stocks, dividend yield is just a distraction for me personally. A company with high yield is not necessarily a good buy. A company can take on debt to pay dividends even if it's making losses. Share price will always move upwards in the long term if and only if revenue and net profit grows. In the short term, glove counters such as Top Glove are trading way ahead of their fundamentals due to FOMO and pure speculation. So do expect a sudden drop in share price of these counters when a vaccine is found. Don't ever trust financial gurus who claim they found a method to always win at trades and are trying to sell you their course, but never once do they show you their portfolio. Even those who show you their portfolio can be suspect because of reasons above. Easiest and safest way to make dividend is to just put money into buying blue chips like public bank, maybank, tenaga. |

|

|

May 26 2020, 11:29 AM May 26 2020, 11:29 AM

|

Junior Member

472 posts Joined: Dec 2013 |

|

|

|

May 26 2020, 11:46 AM May 26 2020, 11:46 AM

Show posts by this member only | IPv6 | Post

#75

|

All Stars

14,906 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(johnsonlim777 @ May 23 2020, 05:20 PM) The recent Etoro endorsement was just a way for the writer to gain more commissions. Etoro is not regulated in Malaysia. If suddenly Bank Negara blocks fund transfers from Malaysian accounts to Etoro, investors will be massively screwed. The same thing happened with Luno for bitcoin in Malaysia previously. Etoro is also providing CFD (option on the stock) vs normal share purchase. Big big difference. So which broker is regulated in SC that's offering zero commission for international stocks?And what about eToro FCA/ASIC regulation vs SC? If regulated in SC, what are the available remedies to compensate investors in case broker defaults? |

|

|

May 26 2020, 12:17 PM May 26 2020, 12:17 PM

Show posts by this member only | IPv6 | Post

#76

|

Senior Member

4,504 posts Joined: Mar 2014 |

QUOTE(Icehart @ May 26 2020, 11:46 AM) So which broker is regulated in SC that's offering zero commission for international stocks? If licensed in Malaysia you can make clams in Malaysia. At very least, you are protected for RM100k under the Capital Markets Compensation Fund.And what about eToro FCA/ASIC regulation vs SC? If regulated in SC, what are the available remedies to compensate investors in case broker defaults? |

|

|

May 26 2020, 02:48 PM May 26 2020, 02:48 PM

|

Senior Member

1,595 posts Joined: Feb 2006 |

QUOTE(johnsonlim777 @ May 23 2020, 05:20 PM) Financial bloggers such as dividendmagic generally make money from sponsored posts and affiliate links. Financial bloggers are generally marketers of financial products. They might give you some basic advice here and there but that's about it. There's still so many alternative payment methods like Paypal, Neteller, Skrill and so on that would bypass any such restrictions. eToro is one of the easiest to fund and withdraw from, it's no wonder that so many Malaysians use it. Personally I only follow DM to see what he's up to and see if I can get any useful information from it. I don't follow any of his suggestions for the most part because the window has long closed.The recent Etoro endorsement was just a way for the writer to gain more commissions. Etoro is not regulated in Malaysia. If suddenly Bank Negara blocks fund transfers from Malaysian accounts to Etoro, investors will be massively screwed. The same thing happened with Luno for bitcoin in Malaysia previously. Etoro is also providing CFD (option on the stock) vs normal share purchase. Big big difference. QUOTE(Cubalagi @ May 26 2020, 12:17 PM) If licensed in Malaysia you can make clams in Malaysia. At very least, you are protected for RM100k under the Capital Markets Compensation Fund. None of the foreign brokers are licensed in Malaysia. In the end it doesn't matter. If you want to make money, you have to grow some balls. If you need tongkat for every investment you make, might as well dump all your spare cash into EPF and just wait for retirement. |

|

|

May 26 2020, 02:51 PM May 26 2020, 02:51 PM

Show posts by this member only | IPv6 | Post

#78

|

Senior Member

1,793 posts Joined: Oct 2008 From: UC Berkeley |

QUOTE(Salvador_Dali @ Apr 8 2020, 10:12 AM) I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. Madness yeah that's fcked up. why do they do that rather than investing back to their core biz? |

|

|

May 26 2020, 02:52 PM May 26 2020, 02:52 PM

|

Junior Member

36 posts Joined: Dec 2019 |

You know what's an influencer?

Even rakuten trade keep promoting him. LOL. |

|

|

May 26 2020, 03:40 PM May 26 2020, 03:40 PM

Show posts by this member only | IPv6 | Post

#80

|

All Stars

14,906 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(red streak @ May 26 2020, 02:48 PM) There's still so many alternative payment methods like Paypal, Neteller, Skrill and so on that would bypass any such restrictions. eToro is one of the easiest to fund and withdraw from, it's no wonder that so many Malaysians use it. Personally I only follow DM to see what he's up to and see if I can get any useful information from it. I don't follow any of his suggestions for the most part because the window has long closed. I personally use eToro for two reasons:None of the foreign brokers are licensed in Malaysia. In the end it doesn't matter. If you want to make money, you have to grow some balls. If you need tongkat for every investment you make, might as well dump all your spare cash into EPF and just wait for retirement. 1. Instant funding with BigPay card at favourable exchange rate. I can fund my account in 2 mins max. 2. Regulated in FCA and ASIC, two of the well-known regulators. I personally have my account under FCA. |

|

|

May 27 2020, 10:46 AM May 27 2020, 10:46 AM

Show posts by this member only | IPv6 | Post

#81

|

Senior Member

2,802 posts Joined: Dec 2006 |

QUOTE(Icehart @ May 26 2020, 03:40 PM) I personally use eToro for two reasons: what are u collecting over there? I wonder if u have any dividen stocks there and how does the dividen paid? Any extra charges?1. Instant funding with BigPay card at favourable exchange rate. I can fund my account in 2 mins max. 2. Regulated in FCA and ASIC, two of the well-known regulators. I personally have my account under FCA. Aside from that, i just realise that ETF is consider as CFD sadly but good thing can buy individual stock there. |

|

|

May 27 2020, 10:51 AM May 27 2020, 10:51 AM

Show posts by this member only | IPv6 | Post

#82

|

Junior Member

376 posts Joined: Feb 2015 |

QUOTE(k8zw3ll @ May 26 2020, 11:29 AM) Hi, wow. this turned into a bash and thrash post real quick. QUOTE(johnsonlim777 @ May 23 2020, 05:20 PM) Financial bloggers such as dividendmagic generally make money from sponsored posts and affiliate links. Financial bloggers are generally marketers of financial products. They might give you some basic advice here and there but that's about it. Let me first respond to this.The recent Etoro endorsement was just a way for the writer to gain more commissions. Etoro is not regulated in Malaysia. If suddenly Bank Negara blocks fund transfers from Malaysian accounts to Etoro, investors will be massively screwed. The same thing happened with Luno for bitcoin in Malaysia previously. Etoro is also providing CFD (option on the stock) vs normal share purchase. Big big difference. Nowadays financial bloggers also showcase their entire portfolio. They do this so that more readers will purchase the same stocks as them and prop up their portfolio values. The universal rule here still applies- "those who can't do, teach". If you read the blog post on 16 March 2020, it was mentioned that "my return right now is at a measly 0.91%. Since inception." If you look back at the posting dates of the freedom fund, the first post is December 2015. If you had put your money in a risk-free FD account for the past 4 years, you would have outperform this portfolio without the need to do any single research. On a separate note, if you're into stocks, dividend yield is just a distraction for me personally. A company with high yield is not necessarily a good buy. A company can take on debt to pay dividends even if it's making losses. Share price will always move upwards in the long term if and only if revenue and net profit grows. In the short term, glove counters such as Top Glove are trading way ahead of their fundamentals due to FOMO and pure speculation. So do expect a sudden drop in share price of these counters when a vaccine is found. To clarify, the 0.91% return I'm talking about is just my capital gain. Does not include dividends. I apologise if this caused some confusion. The sharp drop was due to covid crisis that spark general panic sell, margin call and also bad investment sentiment. As a long term investor, I don't believe in following the flow and selling off majority / all of my stake in the stock market. I believe anyone who hold long term position will incur losses in this period of time too. With that clarification, FD did not outperform my portfolio at all. Now that the general investment sentiment is better.. My portfolio is back up and running. Q2's update should be significantly higher. I don't mean to single you out but how did your portfolio do during the covid crisis? @johnsonlim777 Also, I've never ever given financial advise to anyone or told anyone to invest in the stocks i invest in. In fact, I always make it a point to remind readers to DO YOUR OWN DUE DILIGENCE when investing in any stocks. The main reason I posted up my portfolio is to keep myself accountable. If I lose money, I post it, if I make money, I post it. Regarding affiliation with other companies, I actually use these guys for my own investments. Lol I can't believe I kena bash by being honest about my portfolio and investing. I call myself dividend magic also wrong. I've never said dividend investing is for everyone and I've never said it's magic.. Investing - be it in stocks or other assets is the best way for Malaysians to achieve some form of financial freedom. It so happens that I found my investment to be in stocks, and my style to be in dividends. If you have your own, that is perfectly fine. I don't call you out in the middle of a financial crisis and use your own name against you. |

|

|

May 27 2020, 11:05 AM May 27 2020, 11:05 AM

Show posts by this member only | IPv6 | Post

#83

|

Junior Member

376 posts Joined: Feb 2015 |

QUOTE(Seth Ho @ Apr 7 2020, 08:52 PM) Anyone follow dividend magic facebook or instagram? Also, I guess I should answer this.Mine sharing how he calculate his quarterly dividend yield or gross investment etc? I tried to calculate but does not get the number he got. **New to stock market I think this is my first dividend from SunREIT. And they pay out 4x a year. So the yield you are seeing is: RM306.82 / RM19,839.68 = 1.55% When SunREIT pays out again in June, it'll be: (RM306.82 + Dividend No.2) / RM19,839.68 = 3.xx% |

|

|

May 27 2020, 12:32 PM May 27 2020, 12:32 PM

Show posts by this member only | IPv6 | Post

#84

|

All Stars

14,906 posts Joined: Apr 2005 From: Kuala Lumpur & Selangor |

QUOTE(doomx @ May 27 2020, 10:46 AM) what are u collecting over there? I wonder if u have any dividen stocks there and how does the dividen paid? Any extra charges? https://forum.lowyat.net/topic/4964732Aside from that, i just realise that ETF is consider as CFD sadly but good thing can buy individual stock there. https://www.etoro.com/customer-service/help...-pay-dividends/ |

|

|

May 27 2020, 01:08 PM May 27 2020, 01:08 PM

|

Junior Member

213 posts Joined: Feb 2008 |

QUOTE(Dividend Magic @ May 27 2020, 11:05 AM) Also, I guess I should answer this. Skimmed through your portfolio once, not a bad one actually, with IIRC, concentrations on MBB, TNB, REITS (Sunway?) n other steady-as-she goes companies.I think this is my first dividend from SunREIT. And they pay out 4x a year. So the yield you are seeing is: RM306.82 / RM19,839.68 = 1.55% When SunREIT pays out again in June, it'll be: (RM306.82 + Dividend No.2) / RM19,839.68 = 3.xx% Just relax from the bashing here, i doubt many readers here have your kind of portfolio with investment amount of close to half a mil?? All the best n enjoy ur dividends! |

|

|

May 27 2020, 05:24 PM May 27 2020, 05:24 PM

Show posts by this member only | IPv6 | Post

#86

|

Senior Member

1,099 posts Joined: Aug 2005 |

QUOTE(Dividend Magic @ May 27 2020, 10:51 AM) Hi, wow. this turned into a bash and thrash post real quick. keep hustlin cuz, there is always two sides for everything, apple vs android, pay cash vs credit cardLet me first respond to this. To clarify, the 0.91% return I'm talking about is just my capital gain. Does not include dividends. I apologise if this caused some confusion. The sharp drop was due to covid crisis that spark general panic sell, margin call and also bad investment sentiment. As a long term investor, I don't believe in following the flow and selling off majority / all of my stake in the stock market. I believe anyone who hold long term position will incur losses in this period of time too. With that clarification, FD did not outperform my portfolio at all. Now that the general investment sentiment is better.. My portfolio is back up and running. Q2's update should be significantly higher. I don't mean to single you out but how did your portfolio do during the covid crisis? @johnsonlim777 Also, I've never ever given financial advise to anyone or told anyone to invest in the stocks i invest in. In fact, I always make it a point to remind readers to DO YOUR OWN DUE DILIGENCE when investing in any stocks. The main reason I posted up my portfolio is to keep myself accountable. If I lose money, I post it, if I make money, I post it. Regarding affiliation with other companies, I actually use these guys for my own investments. Lol I can't believe I kena bash by being honest about my portfolio and investing. I call myself dividend magic also wrong. I've never said dividend investing is for everyone and I've never said it's magic.. Investing - be it in stocks or other assets is the best way for Malaysians to achieve some form of financial freedom. It so happens that I found my investment to be in stocks, and my style to be in dividends. If you have your own, that is perfectly fine. I don't call you out in the middle of a financial crisis and use your own name against you. im also a believer of dividends and it has rewarded me very well in the last 4-5 years (mbb, reits etc.) but i also balance them with other stocks with capital gain in mind basically theres no right way or one way of doing things as long as you know what ur end goal is |

| Change to: |  0.0425sec 0.0425sec

1.07 1.07

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 11:19 PM |