Anyone follow dividend magic facebook or instagram?

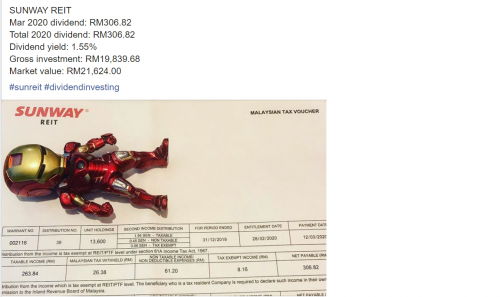

Mine sharing how he calculate his quarterly dividend yield or gross investment etc?

I tried to calculate but does not get the number he got.

**New to stock market

Dividend magic

Dividend magic

|

|

Apr 7 2020, 08:52 PM, updated 6y ago Apr 7 2020, 08:52 PM, updated 6y ago

Show posts by this member only | IPv6 | Post

#1

|

Junior Member

436 posts Joined: Jun 2019 |

Anyone follow dividend magic facebook or instagram?

Mine sharing how he calculate his quarterly dividend yield or gross investment etc? I tried to calculate but does not get the number he got. **New to stock market |

|

|

|

|

|

Apr 7 2020, 10:08 PM Apr 7 2020, 10:08 PM

Show posts by this member only | Post

#2

|

Senior Member

1,917 posts Joined: Sep 2012 |

why call it magic when it's just maths and finance....?

not on Facebook. If you take some screenshots and post it here, maybe we can help you. |

|

|

Apr 8 2020, 08:45 AM Apr 8 2020, 08:45 AM

Show posts by this member only | Post

#3

|

Junior Member

436 posts Joined: Jun 2019 |

|

|

|

Apr 8 2020, 08:48 AM Apr 8 2020, 08:48 AM

Show posts by this member only | Post

#4

|

Junior Member

436 posts Joined: Jun 2019 |

|

|

|

Apr 8 2020, 09:15 AM Apr 8 2020, 09:15 AM

Show posts by this member only | IPv6 | Post

#5

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 08:48 AM)  So i use the share price on the date entitle for dividend to calculate the market value and dividend yield but i don't get the numbers he get Don't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! This post has been edited by Boon3: Apr 8 2020, 09:16 AM |

|

|

Apr 8 2020, 10:12 AM Apr 8 2020, 10:12 AM

Show posts by this member only | Post

#6

|

Junior Member

169 posts Joined: Jan 2011 |

QUOTE(Boon3 @ Apr 8 2020, 09:15 AM) Your calculation was right for that ONE dividend. However SunR paid out 4 sets of dividend for the year 2019. You need to add all 4 then divide by your cost if investment. I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. MadnessDon't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! |

|

|

|

|

|

Apr 8 2020, 10:14 AM Apr 8 2020, 10:14 AM

Show posts by this member only | IPv6 | Post

#7

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Boon3 @ Apr 8 2020, 10:15 AM) Your calculation was right for that ONE dividend. However SunR paid out 4 sets of dividend for the year 2019. You need to add all 4 then divide by your cost if investment. So could i understand it as Don't trust what you read esp that website. A wrong, high dividend yield can still lose money for the investor if that stock profits keep falling. If No profits or declining profits, how can the said stick continue paying the same dividend. A declining dividend per year could also cause the investor to lose money. Dividend is like the chicken and the egg. The egg cannot be valued more than chicken cos no chicken, means no egg. Hence, dividends MUST always be treated as a bonus and not the ultimate gold. Buy the stock because the company is gonna make more money makes more sense than chasing the dividend. Dividend investing has just as much risk as a normal stock. Dividend is not magic! Do not be fooled! example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term |

|

|

Apr 8 2020, 10:15 AM Apr 8 2020, 10:15 AM

Show posts by this member only | Post

#8

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Salvador_Dali @ Apr 8 2020, 11:42 AM) I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. Madness And Now make PRs news that they must be bailed out |

|

|

Apr 8 2020, 10:18 AM Apr 8 2020, 10:18 AM

Show posts by this member only | Post

#9

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Seth Ho @ Apr 8 2020, 11:44 AM) So could i understand it as Dividend is worth when there is MOAT. solid MOAT. example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term That kind is very rare. Most people who got the stocks way earlier when all are running naked. And they know realistic expectation. Not dividend expectation. |

|

|

Apr 8 2020, 10:51 AM Apr 8 2020, 10:51 AM

Show posts by this member only | IPv6 | Post

#10

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 10:14 AM) So could i understand it as Did you understand what happened in your SunR example? example Public bank is better than Maybank?although public bank giving lower dividend than maybank but their stock growth are much higher than the maybank? any tips on what should we focus when we buy stock? value investing? to check on the potential future growth? longterm investing? **So many people sharing actually getting dividend for long term investing are better than short term One of common mistake is to buy a stock JUST because it has a yield of say 7%. I am sure you heard such statements in reports, papers, forums etc etc... 1. First thing, you need to look the dividend paid out history for the past 5 years (at least). A brief look see and you will be able to tell if the dividends paid out is increasing or not. Got to be honest here with yourself. If the numbers are increasing, it is increasing. If it is ding dong up or down, - it simply means erratic. Yes, call the cat White if it is white. 2. When was the last dividend paid? Take your SunR example. The current div per year (dps) is 9. 59 sen. Yield is over 6% based on current price. Now this stat is correct but it has one big assumption, which is you received the full 4 set of dividends paid for 2019. Now if you invest in Aug 2019, you've missed the first 2 dividends. Hence the yield would be different? Get what I am saying here. 3. After a stock gives out dividend, the stock price is readjusted to reflect the dividend paid. Do not forget this simple issue.... Anyway I am merely highlighting the risk if one focus solely on dividends. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? |

|

|

Apr 8 2020, 11:04 AM Apr 8 2020, 11:04 AM

Show posts by this member only | IPv6 | Post

#11

|

Senior Member

5,529 posts Joined: Oct 2007 |

QUOTE(Salvador_Dali @ Apr 8 2020, 10:12 AM) I agree, a good example is AirAsia. Good dividend but was stripped naked by Tony and gang for years, even before coronavirus. RM10-12 billion debt, sold off most of their airplanes and take profit and give out as dividend. Madness Actually, it is much more than what you can see on the papers. You don't know what's in his mind, you don't know what is his intention and what plans he has for the company, afterall, by paying huge diviends, who benefits the most? When the valuation is undervalued or deemed to be undervalued, what do you do as the owner? Sorry, can't divulge much, i don't wanna go to the jail. So sometimes it is essential to put on the controlling shareholder thinking cap (despite we won't have the capability in one way or another, especially financially). Think like a business owner, follow their footsteps to play this kind of game and potentially can make money. Don't think like a typical MI. |

|

|

Apr 8 2020, 03:12 PM Apr 8 2020, 03:12 PM

Show posts by this member only | IPv6 | Post

#12

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Boon3 @ Apr 8 2020, 11:51 AM) Did you understand what happened in your SunR example? Thank you for the details explanation i get what you mean but i have a few curios question.One of common mistake is to buy a stock JUST because it has a yield of say 7%. I am sure you heard such statements in reports, papers, forums etc etc... 1. First thing, you need to look the dividend paid out history for the past 5 years (at least). A brief look see and you will be able to tell if the dividends paid out is increasing or not. Got to be honest here with yourself. If the numbers are increasing, it is increasing. If it is ding dong up or down, - it simply means erratic. Yes, call the cat White if it is white. 2. When was the last dividend paid? Take your SunR example. The current div per year (dps) is 9. 59 sen. Yield is over 6% based on current price. Now this stat is correct but it has one big assumption, which is you received the full 4 set of dividends paid for 2019. Now if you invest in Aug 2019, you've missed the first 2 dividends. Hence the yield would be different? Get what I am saying here. 3. After a stock gives out dividend, the stock price is readjusted to reflect the dividend paid. Do not forget this simple issue.... Anyway I am merely highlighting the risk if one focus solely on dividends. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? Let's say i don't focus on dividend too much but on the value of the stock let's say the stock price is rm 1 this year, 3 years later rm 7, but on the 4th years due to some circumstances is drop back to rm 4. (Let's say yearly DY 3.5%) for this example if i want to sell on the 4th year actually my investment stock price have just increase by rm3? Thank you for all the Sifu Sifu here that share their opinion. |

|

|

Apr 8 2020, 03:19 PM Apr 8 2020, 03:19 PM

Show posts by this member only | IPv6 | Post

#13

|

Junior Member

436 posts Joined: Jun 2019 |

QUOTE(Syie9^_^ @ Apr 8 2020, 11:18 AM) Dividend is worth when there is MOAT. solid MOAT. So i guess for fresh grad or someone new to stock market should invest more in future stocks?That kind is very rare. Most people who got the stocks way earlier when all are running naked. And they know realistic expectation. Not dividend expectation. Ex: AI company, industrial 4.0, Fintech, Data mining etc ?? Or actually focus on blue chip stock like glove company? banks? REIT? |

|

|

|

|

|

Apr 8 2020, 03:24 PM Apr 8 2020, 03:24 PM

|

Senior Member

1,072 posts Joined: Jun 2018 |

QUOTE(Seth Ho @ Apr 8 2020, 04:49 PM) So i guess for fresh grad or someone new to stock market should invest more in future stocks? there`s always a stock. Be it Dividend Aristocrat; Dividend Growth and so on~Ex: AI company, industrial 4.0, Fintech, Data mining etc ?? Or actually focus on blue chip stock like glove company? banks? REIT? Invest what you believe will have future. you dont want another bear stearns OLD blue chip; got tore apart last GFC |

|

|

Apr 8 2020, 04:09 PM Apr 8 2020, 04:09 PM

|

Junior Member

247 posts Joined: Aug 2018 From: Bukit Bintang, Kuala Lumpur |

If you want to invest in increasing dividend yield that increase year after year, then go for KLCC, not SunR or others

|

|

|

Apr 9 2020, 10:36 AM Apr 9 2020, 10:36 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(Seth Ho @ Apr 8 2020, 03:12 PM) Thank you for the details explanation i get what you mean but i have a few curios question. Well yes. Let's say i don't focus on dividend too much but on the value of the stock let's say the stock price is rm 1 this year, 3 years later rm 7, but on the 4th years due to some circumstances is drop back to rm 4. (Let's say yearly DY 3.5%) for this example if i want to sell on the 4th year actually my investment stock price have just increase by rm3? Thank you for all the Sifu Sifu here that share their opinion. Your profit = Cost of sale of share - cost of purchase. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? This one... Sometimes talk is cheap! LOL! It's harsh talk but that's the fact of life. Instead of talking so much, this was a realtime example done last year on a high yielding REIT stock, AMfirst, which was paying a yield of more than 6% during that time of writing in 2019. post #4619 QUOTE(Boon3 @ Sep 11 2019, 04:09 PM) I just looked at my set of data for Amfirst. I opened my chart, set it to weekly time frame and I disabled all dividend + capital changes... ie disabled everything. So if one bought in 2012, at a price of 1.05 the so called dividend collected was 37.1 sen. Good dividend yield rightrNow I drew a horizontal line on July 2012. This date would be important cos AmFirst had a 3 for 5 rights issue. ( But the greater reason is ...aiyoh 3 for 5 rights issue, adds so much more calculations lo... [attachmentid=10313487] So assuming one bought AmFirst on Jul 2012 and assuming the price of around 1.05. The following year, AmFirst paid 6.81 sen for dividends, so the yield there would make 'sort' of a case' to buy this bugger. right? So dividends paid, received, secured by this reit investor since then.... 6.81 sen + 7.35 + 5.53 + 5.1 + 4.06 + 4.2 + 4 (data taken from mstock.biz) which sums up to 37.1 sen. Cost of reit 1.05. Total dividends 37.1 sen. Years holding this reit = 7 years! Current price of Amfirst = 51 sen. Rugi big big lo. Would I dare say one can lose money in reit as per the example of AmFirst? * I know, some would bring out the argument lo, hold the stock longer and hope that the investment could 'break even' ..... Yeah, technically, it could happen. One could use the erroneous theory that as long as not yet sold is considered not yet lose... but how long should one hold? Another 7 year could see the reits dividend total maybe 74 sen ( i did the lazy annualising lor based on 37.1 sen) or better still another 7 years, one could receive a total of 1.05 sen in reits dividends from this reit. Which means a total of 21 years....... and of course whatever price the reit is trading in the market is considered profit. Well? For me, I would ask myself, if such an investment would remotely make any sense......... However, unfortunately price for Amfirst reit in Sep 2019 was only 51 sen! Basically one got an insane dividend yield but with the cost of Amfirst plunging to a mere 51 sen, this investment is yielding losses for a holding period of 7 years!!!! And Amfirst today is trading at only 42 sen !!! A clear cut example that shows that there exist stocks where can lose money despite getting great dividends. Now if this is the case, how could one mislead others by declaring that dividends is magic? |

|

|

Apr 9 2020, 11:32 AM Apr 9 2020, 11:32 AM

Show posts by this member only | IPv6 | Post

#17

|

All Stars

12,287 posts Joined: Oct 2010 |

QUOTE(Boon3 @ Apr 9 2020, 10:36 AM) Well yes. Gotta find out how they were getting the cash to pay the dividends. Your profit = Cost of sale of share - cost of purchase. So a simple question. Can a dividend paying stock of over 6% causes an investor to lose money in a 5 year span? This one... Sometimes talk is cheap! LOL! It's harsh talk but that's the fact of life. Instead of talking so much, this was a realtime example done last year on a high yielding REIT stock, AMfirst, which was paying a yield of more than 6% during that time of writing in 2019. post #4619 So if one bought in 2012, at a price of 1.05 the so called dividend collected was 37.1 sen. Good dividend yield rightr However, unfortunately price for Amfirst reit in Sep 2019 was only 51 sen! Basically one got an insane dividend yield but with the cost of Amfirst plunging to a mere 51 sen, this investment is yielding losses for a holding period of 7 years!!!! And Amfirst today is trading at only 42 sen !!! A clear cut example that shows that there exist stocks where can lose money despite getting great dividends. Now if this is the case, how could one mislead others by declaring that dividends is magic? Not sure about AMfirst. BUT if you bought Panamy in 2010 at Rm12.50 you would have received total dividends of Rm10.44 to 2016 and sold at Rm40 per share. 0r if you held to date , total dividends is RM16.35 with present price of Rm27 Not all dividend stocks are bad provided they are not out to scam you! |

|

|

Apr 9 2020, 11:45 AM Apr 9 2020, 11:45 AM

|

All Stars

15,942 posts Joined: Jun 2008 |

QUOTE(prophetjul @ Apr 9 2020, 11:32 AM) Gotta find out how they were getting the cash to pay the dividends. Well I did not state that all is bad either. Not sure about AMfirst. BUT if you bought Panamy in 2010 at Rm12.50 you would have received total dividends of Rm10.44 to 2016 and sold at Rm40 per share. 0r if you held to date , total dividends is RM16.35 with present price of Rm27 Not all dividend stocks are bad provided they are not out to scam you! Look, many of us are aware of this dividend magic or dividend warrior nonsense. Spam everywhere with his meaningless gloating. If it's magic, why are they so many bad apples examples, such as Amfirst reit (do suggest you read about Amfirst reit. With declining dps, the stock has but only one way but down) exist? If such bad examples exist, then the term dividend magic certainly ain't applicable! |

|

|

Apr 9 2020, 12:20 PM Apr 9 2020, 12:20 PM

|

Junior Member

169 posts Joined: Jan 2011 |

QUOTE(Boon3 @ Apr 9 2020, 11:45 AM) Well I did not state that all is bad either. That is why it is called magic, to trick you.Look, many of us are aware of this dividend magic or dividend warrior nonsense. Spam everywhere with his meaningless gloating. If it's magic, why are they so many bad apples examples, such as Amfirst reit (do suggest you read about Amfirst reit. With declining dps, the stock has but only one way but down) exist? If such bad examples exist, then the term dividend magic certainly ain't applicable! Like AirAsia and AmReit's dividend |

|

|

Apr 9 2020, 12:49 PM Apr 9 2020, 12:49 PM

Show posts by this member only | IPv6 | Post

#20

|

Senior Member

2,210 posts Joined: Jan 2018 |

If DPS>EPS, this means dividend is unsustainable and they are paying out from reserves. Share price will eventually fall. Avoid at all costs

|

| Change to: |  0.0248sec 0.0248sec

1.46 1.46

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 24th December 2025 - 05:17 PM |