https://www.bnm.gov.my/index.php?ch=en_pres...ac=5018&lang=en

Bank Negara Malaysia (the Bank) today announces a number of regulatory and supervisory measures in support of efforts by banking institutions to assist individuals, small and medium-sized enterprises (SMEs) and corporations to manage the impact of the Covid-19 outbreak. These measures allow banking institutions to remain focused on supporting the economy during these exceptional and unprecedented circumstances, by providing flexibilities for banking institutions to respond swiftly to the needs of their customers. Banking institutions are well-positioned to do so, given the large financial buffers that have been built up over the years.

Deferment and Restructuring of Loans/Financing Facilities

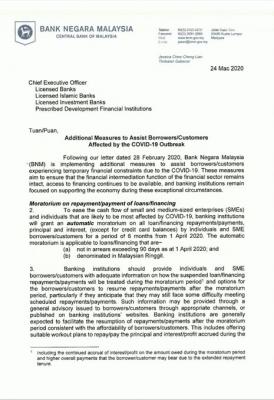

QUOTE

Loans/financing to individuals and SMEs

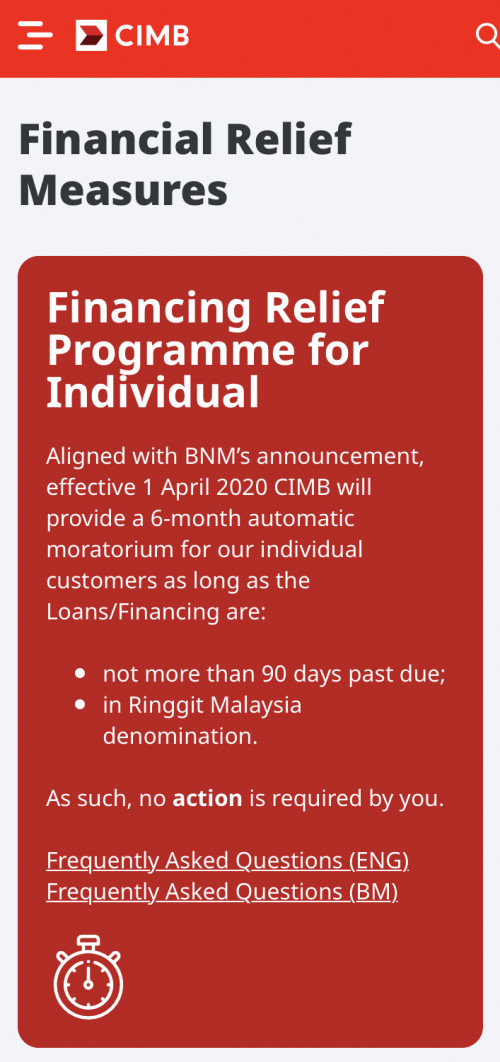

To ease the cash flow of individuals and SMEs that are likely to be the most affected by Covid-19, banking institutions will offer a deferment of all loan/financing repayments for a period of 6 months, with effect from 1 April 2020. This offer is applicable to performing loans, denominated in Malaysian Ringgit, that have not been in arrears for more than 90 days as at 1 April 2020. For credit card facilities, banking institutions will offer to convert the outstanding balances into a 3-year term loan with reduced interest rates to help borrowers better manage their debt.

It is important to note that the interest/profit will continue to accrue on loan/financing repayments that are deferred and borrowers will need to honour the deferred repayments in the future. Borrowers should therefore ensure that they understand and discuss with their banking institutions on the options available to resume their scheduled repayments after the deferment period.

Individuals and SMEs that do not wish or need to avail of these flexibilities can continue with their current repayment structures.

To ease the cash flow of individuals and SMEs that are likely to be the most affected by Covid-19, banking institutions will offer a deferment of all loan/financing repayments for a period of 6 months, with effect from 1 April 2020. This offer is applicable to performing loans, denominated in Malaysian Ringgit, that have not been in arrears for more than 90 days as at 1 April 2020. For credit card facilities, banking institutions will offer to convert the outstanding balances into a 3-year term loan with reduced interest rates to help borrowers better manage their debt.

It is important to note that the interest/profit will continue to accrue on loan/financing repayments that are deferred and borrowers will need to honour the deferred repayments in the future. Borrowers should therefore ensure that they understand and discuss with their banking institutions on the options available to resume their scheduled repayments after the deferment period.

Individuals and SMEs that do not wish or need to avail of these flexibilities can continue with their current repayment structures.

QUOTE

Loans/financing to corporations

Banking institutions will also facilitate requests by corporations to defer or restructure their loans/financing repayments in a way that will enable viable corporations to preserve jobs and swiftly resume economic activities when conditions improve. Corporations should approach their banking institutions to discuss their repayment plans and the restructuring of credit facilities.

The Bank has provided appropriate time-bound flexibilities for banking institutions to report deferred/restructured facilities in the Central Credit Reference Information System (CCRIS), taking into account the temporary nature of disruptions faced by borrowers/customers.

Comprehensive FAQBanking institutions will also facilitate requests by corporations to defer or restructure their loans/financing repayments in a way that will enable viable corporations to preserve jobs and swiftly resume economic activities when conditions improve. Corporations should approach their banking institutions to discuss their repayment plans and the restructuring of credit facilities.

The Bank has provided appropriate time-bound flexibilities for banking institutions to report deferred/restructured facilities in the Central Credit Reference Information System (CCRIS), taking into account the temporary nature of disruptions faced by borrowers/customers.

https://t.co/m57LsxkYMq?amp=1

QUOTE

Do I need to apply?

-No. All individual and SME loans/financing(excluding credit cards) that meet the criteria will automatically qualify for the deferment.

If I opt for the deferment, will my CCRIS records be adversely affected?

-No. However, interest/profit will continue to accrue on loan/financing repayments that are deferredand borrowers/customers will need to honour the deferred repayments in the future. Customers are advised to contact their banking institutions to discuss on the options available to resume repayments after the deferment period.

Will I be charged additional interest on the repayment amount that is deferred by 6 months during the period?

-For conventional loans, interest will continue to be charged on the outstanding balance comprising of both principal and interest portion (i.e. compounded) during the moratorium period.For Islamic financing, profit will continue to accrue on the outstanding principal amount. Such profit however will not be compounded in line with Shariah principles. Banks are however not allowed to impose late penalty charges on the deferred amount.In other words, the loan/financing repayment is just deferred by 6 months.

-No. All individual and SME loans/financing(excluding credit cards) that meet the criteria will automatically qualify for the deferment.

If I opt for the deferment, will my CCRIS records be adversely affected?

-No. However, interest/profit will continue to accrue on loan/financing repayments that are deferredand borrowers/customers will need to honour the deferred repayments in the future. Customers are advised to contact their banking institutions to discuss on the options available to resume repayments after the deferment period.

Will I be charged additional interest on the repayment amount that is deferred by 6 months during the period?

-For conventional loans, interest will continue to be charged on the outstanding balance comprising of both principal and interest portion (i.e. compounded) during the moratorium period.For Islamic financing, profit will continue to accrue on the outstanding principal amount. Such profit however will not be compounded in line with Shariah principles. Banks are however not allowed to impose late penalty charges on the deferred amount.In other words, the loan/financing repayment is just deferred by 6 months.

Bank Announcement

1) PBB - https://www.pbebank.com/Announcements.aspx?qid=2924#q2924

2) HLB - https://www.hlb.com.my/en/personal-banking/...wide-heretohelp

3) CIMB - https://www.cimb.com.my/en/personal/help-su...19-support.html

4) MBB - https://www.maybank2u.com.my/maybank2u/mala...ief_scheme.page

5) UOB - https://www.uob.com.my/default/financial-re...f-measures.page

6) Affin - https://www.affinbank.com.my/NewsDetails.aspx?id=965

7) AmBank - https://www.ambank.com.my/eng/covid-19

8) MBSB - https://www.mbsbbank.com/storage/misc/moratorium_FAQ.pdf

9) OCBC - https://www.ocbc.com.my/assets/pdf/Media/20...um%20period.pdf

10) Agro Bank - https://www.agrobank.com.my/announcements/n...aan-moratorium/

11) BSN - https://www.mybsn.com.my/formdownload?formDownloadId=2212

12) Bank Islam - https://www.bankislam.com/wp-content/uploads/QA.pdf

13) RHB - https://www.rhbgroup.com/covid-19/index.html

14) Standard Charted Bank - https://av.sc.com/my/content/docs/relief-measures.pdf

15) Bank Rakyat - https://www.bankrakyat.com.my/repository/15...HAN%20Final.pdf

16) Bank Muamalat - https://www.muamalat.com.my/announcement/announcement-2/

17) Al-Rajhi - https://www.alrajhibank.com.my/post/importa...inancial-relief

18) HSBC - https://www.hsbc.com.my/content/dam/hsbc/my...ent-measure.pdf

This post has been edited by Emily Ratajkowski: Mar 27 2020, 06:07 PM

Mar 24 2020, 09:45 PM, updated 6y ago

Mar 24 2020, 09:45 PM, updated 6y ago

Quote

Quote

0.1300sec

0.1300sec

0.37

0.37

6 queries

6 queries

GZIP Disabled

GZIP Disabled