https://ringgitplus.com/en/blog/bank-news/m...oronavirus.html

MORATORIUM PEMBIAYAAN BANK SEMPENA WABAK COVID

|

|

Mar 20 2020, 08:04 PM Mar 20 2020, 08:04 PM

Return to original view | Post

#1

|

All Stars

65,367 posts Joined: Jan 2003 |

|

|

|

|

|

|

Mar 26 2020, 11:55 AM Mar 26 2020, 11:55 AM

Return to original view | Post

#2

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(aeiou228 @ Mar 26 2020, 10:56 AM) [attachmentid=10457766] Let's discuss faq#15. BNM didn't state clearly that the accrued interest will be added (or rather compounded) to the outstanding loan balance on the monthly basis during the 6 moths moratorium period OR added after the 6 mths moratorium period. I guess it all depend on the respective bank. I read somewhere that HSBC will not do the monthly compounding on the accrued interest. Please report what's your bank policy on the treatment of the 6 months moratorium accrued interest. QUOTE(netcrawler @ Mar 26 2020, 11:06 AM) I also get the info that HSBC will not compound the interest during moratorium. Guess it's subject to the individual bank if they will compound the good move by hsbc -- both the interest for conventional loans as well as profit on Islamic financing will not be compounded during the moratorium periodinterest. |

|

|

Mar 27 2020, 06:51 AM Mar 27 2020, 06:51 AM

Return to original view | Post

#3

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(Wenxuan2 @ Mar 26 2020, 09:32 PM) Hi all, maybank islamic mentioned that profit will still be charged but not compounded. Can someone what does this mean? Does it mean that it will not on to my current interest and only prolong my tenure? Thanks would appreciate the help! in simplest term, "not compounded" = the accumulated profit wont be counted in future profit calculation. only the principal will be used for profit calculation.QUOTE(Canfloat @ Mar 26 2020, 10:57 PM) Even if the 6 months interest is not compounded during the moratorium period, if I cannot afford to pay one lump sum to settle 6 months on month #7, after the entire loan is paid off, will I have paid more than originally planned? yep. that's why only go for this moritorium if you have severe cash flow. else, those with fixed income (hopefully!) and still able to continue serving the instalments, then just optout/continue the repayment.If I'm not mistaken I'm losing money overall, because daily/monthly rest is calculated on the capital owing, and I owe more than originally planned out in the schedule. this is just a short-term relief ("bandage"), but definitely not a fix/waiver, and ultimately not a loss to the bank i just felt that this moritorium will just keep digging deeper debt hole for us. imagine i'm losing my job now and still couldnt recover from month #7 onwards (slow economic growth, business recovery to hire me, etc etc) |

|

|

Mar 27 2020, 12:26 PM Mar 27 2020, 12:26 PM

Return to original view | Post

#4

|

All Stars

65,367 posts Joined: Jan 2003 |

|

|

|

Mar 27 2020, 12:32 PM Mar 27 2020, 12:32 PM

Return to original view | Post

#5

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(Lynixx @ Mar 27 2020, 12:31 PM) Hi All, sorry if this question has been asked as i unable to get through PPB customer serivce. read >> https://www.pbebank.com/Announcements.aspx?qid=2924#q2924i wanna ask 1)if Hire-Purchase(car loan) will automatic get 6 months moratorium for PBB? 2)is application form required 3)interest will included during 6 months moratorium? Thanks for reply and sorry for asking this question again. PBB optout form >> https://www.pbebank.com/srf/optout This post has been edited by cybpsych: Mar 27 2020, 12:33 PM |

|

|

Mar 27 2020, 12:43 PM Mar 27 2020, 12:43 PM

Return to original view | Post

#6

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(Lynixx @ Mar 27 2020, 12:40 PM) hp interest has been discussed for the n-th times here.... if still not satisfied...Kindly contact the Public Bank Helpdesk at: 03 - 2176 6408 or 03 – 2177 3066 (for Housing Loan/Term Loan/Fixed Loan/Overdraft/Bills Facilities) 03 - 2176 7466 or 03 – 2176 7689 (for Hire Purchase) 03 - 2176 8222 (for Credit Card) covid19moratorium@publicbank.com.my |

|

|

|

|

|

Mar 27 2020, 03:37 PM Mar 27 2020, 03:37 PM

Return to original view | Post

#7

|

All Stars

65,367 posts Joined: Jan 2003 |

|

|

|

Mar 28 2020, 06:34 AM Mar 28 2020, 06:34 AM

Return to original view | Post

#8

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(cylee32 @ Mar 28 2020, 12:42 AM) Hi, I'm taking OCBC housing loan. May i know the housing loan entitles non-compounding interest too? As i understand OCBC i only offer non-compounding interest for Businesses and SME customer only. should be same across all banks.their choice of words is kinda confusing to readers on their covid19 info page >> https://www.ocbc.com.my/business-banking/lo...elief-measures/ faq >> https://www.ocbc.com.my/assets/pdf/Loans/FA..._Moratorium.pdf |

|

|

Mar 28 2020, 04:25 PM Mar 28 2020, 04:25 PM

Return to original view | Post

#9

|

All Stars

65,367 posts Joined: Jan 2003 |

|

|

|

Mar 28 2020, 04:28 PM Mar 28 2020, 04:28 PM

Return to original view | Post

#10

|

All Stars

65,367 posts Joined: Jan 2003 |

Got a question on the 6-month Automatic Moratorium programme? We are here to address some commonly asked questions.

For the full set of frequently asked questions and answers, please visit our moratorium FAQ page where we answer questions like: What is a moratorium? What if I have a standing instruction on my loan? Will there be compounding interest on my loan interest? www.alliancebank.com.my/moratorium-faqs.aspx    |

|

|

Mar 28 2020, 09:34 PM Mar 28 2020, 09:34 PM

Return to original view | Post

#11

|

All Stars

65,367 posts Joined: Jan 2003 |

|

|

|

Mar 28 2020, 10:03 PM Mar 28 2020, 10:03 PM

Return to original view | Post

#12

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Mar 27 2020, 03:37 PM) MAYBANK >> If you do not wish to be auto-enrolled into this moratorium, here are two ways you can opt out:Reply the SMS we will be sending to you. Fill in and submit the form(s) below: Opt Out Request Form for my Hire Purchase/Auto Loan/Financing Opt Out Request Form for my Mortgage, Personal, ASB & Education Loan/Financing Opt Out Request Form for my SME Loan/Financing If you would like to convert your outstanding credit card balances into a term loan/financing, kindly submit the Credit Card Relief Assistance Form so we can assist you further. Not sure if the moratorium is right for you? Here are some considerations that could be useful to help you decide: Do you have a stable and consistent income stream? If you do, this moratorium might not be a critical consideration for you. Do you foresee the potential of having high cash outflow in the next 6 months? If you do, this moratorium could help to ease your monthly financial burden. Do you foresee a huge impact on your business or investment due to the recent events? If you do, this moratorium could help to ease your financial burden. Are you aware of and agreeable to the accrued interest and higher repayment amount or longer tenure after the moratorium? If you are not comfortable with this term, the option to opt out is available to you. You also have the freedom to select which loan/financing to opt out of, while keeping others enrolled into the program. |

|

|

Mar 31 2020, 10:12 AM Mar 31 2020, 10:12 AM

Return to original view | Post

#13

|

All Stars

65,367 posts Joined: Jan 2003 |

finally, CIMB's FAQs are up

COVID-19 RELIEF MEASURES AND SUPPORT FAQ (ENG) Updated 10 Apr 2020 | FAQ (BM) Updated 10 Apr 2020 T&C (ENG) Updated 3 Apr 2020 | T&C (BM) Updated 3 Apr 2020 Aligned with BNM’s announcement, effective 1st April 2020 CIMB will provide a 6-month automatic moratorium for our individual customers on all types of financing payment except for credit cards as long as the Loan/Financings are: - Not more than 90 days past due as at 1st April 2020 - In Ringgit Malaysia denomination Important note: To Opt Out from this programme, send an SMS request to 62666 by 7 April 2020 11.59PM as per below, for each of your loans/financing accounts: OPTOUT<space>Last 4 Digits NRIC/Passport number<space>Loan/Financing Account Number Reply: RM0.00 CIMB: TQ, we are processing your opt-out reply & will update you soon. Don't forget to send SMS request to opt-out for other financing accts Results: RM0.00 CIMB: Your account ending xxxx has been opted out from the moratorium programme. Please continue to make payment by your monthly due date. Thank you This post has been edited by cybpsych: Apr 13 2020, 08:39 PM |

|

|

|

|

|

Apr 1 2020, 06:30 PM Apr 1 2020, 06:30 PM

Return to original view | Post

#14

|

All Stars

65,367 posts Joined: Jan 2003 |

Public Bank - COVID-19 Moratorium: E-SI for PBB Loan/Financing

- 31 March 2020 Dear Valued Customers, With reference to the recent announcement on the automatic 6-month moratorium for loans/financing effective 1 April 2020, kindly check if you have any existing E-Standing Instructions (E-SI) scheduled for your PBB Loan / Financing payment. Please take note that the moratorium will not automatically cancel your scheduled E-SI payments to PBB Loan/Financing. If you wish to stop your scheduled E-SI payments, please log in to PBe / PB enterprise and manually delete your E-SI. Please follow these simple steps on how to delete an E-SI: For PBe: Log in to PBe After login, select ‘Account’ Click on ‘E-Standing Instruction (E-SI)’ Click on ‘Manage E-SI’ Select the E-SI you want to manage and click on ‘View Details’ Check the checkbox on which transactions you wish to delete Click on ‘Delete’ to complete the process For PB enterprise: Log in to PB enterprise After login, select ‘PB Loan/Financing Account' Click on ‘Manage E-Standing Instruction (E-SI)’ Check the checkbox on which transactions you wish to delete Click on ‘Cancel E-SI’ Enter a valid cancellation reason Click 'OK' to submit for Authorizer to approve |

|

|

Apr 6 2020, 08:35 PM Apr 6 2020, 08:35 PM

Return to original view | Post

#15

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(cybpsych @ Mar 31 2020, 10:12 AM) finally, CIMB's FAQs are up COVID-19 RELIEF MEASURES AND SUPPORT FAQ (ENG) Updated 1 Apr 2020 | FAQ (BM) Updated 1 Apr 2020 T&C (ENG) Updated 3 Apr 2020 | T&C (BM) Updated 3 Apr 2020 Aligned with BNM’s announcement, effective 1st April 2020 CIMB will provide a 6-month automatic moratorium for our individual customers on all types of financing payment except for credit cards as long as the Loan/Financings are: - Not more than 90 days past due as at 1st April 2020 - In Ringgit Malaysia denomination Important note: To Opt Out from this programme, send an SMS request to 62666 by 7 April 2020 11.59PM as per below, for each of your loans/financing accounts: OPTOUT<space>Last 4 Digits NRIC/Passport number<space>Loan/Financing Account Number 1st response: RM0.00 CIMB: TQ, we are processing your opt-out reply & will update you soon. Don't forget to send SMS request to opt-out for other financing accts [Updated] 1 Apr 2020 » Click to show Spoiler - click again to hide... « QUOTE(kennykck @ Apr 6 2020, 06:34 PM) I’m currently using Cimb bank. Base on my understanding, if I opt in the moratorium, bank will charge the 6 month interest and put into principal. At the same time, the tenure will increase by additional 6 months. how and where did you get that idea?So not only my principal is higher, but the additional 6 months tenure will results in rm10k+ loss to interest. Am I correct? try read the FAQs and T&Cs from CIMB. else, call bank and ask. |

|

|

Apr 6 2020, 10:05 PM Apr 6 2020, 10:05 PM

Return to original view | Post

#16

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(kennykck @ Apr 6 2020, 09:37 PM) If you read the terms and condition document, it stated housing loan will add 6 months tenure, and cannot bullet payment. // Starting 1 October 2020, your monthly instalment will be allocated to clear the accrued 6-month moratorium interest/profit.As for the acrued 6 month interest during moratorium, it should be park under principal. Else where can it park at? Once the accrued interest/profit rate is cleared, your monthly instalment will revert to paying principal and interest/profit. // still, get CIMB to clarify your question. |

|

|

Apr 7 2020, 08:41 AM Apr 7 2020, 08:41 AM

Return to original view | Post

#17

|

All Stars

65,367 posts Joined: Jan 2003 |

QUOTE(kennykck @ Apr 6 2020, 10:20 PM) Attached is the link for your reference. i'm aware of the faq and t&c from cimb, which i already quoted above.https://www.cimb.com.my/content/dam/cimb/pe...cts-tnc-eng.pdf Under item no 22, clearly stated extension of 6 months tenure. For other local bank also same except for Maybank, where it allows you to increase the monthly installment amount or extend loan tenure. there are 2 elements you were asking: extension of loan period i.e. 6 months and the treatment of interest/profit. you answered the extension portion, which is extended to 6 months. that's given. how does the treatment of interest/profit works from 1 Oct onwards? from t&c, it stated "monthly installment may change". my interpretation is amount will be revised upward to cover monthly installment + monthly interest + accrued interest (maybe spread across x % or y RM) --- my guess is cimb will elaborate further when nearing the end of moratorium. they'll take these few months to work out the calculation (eg. impact to the bank, impact to your loan, etc) from faq, "monthly instalment will be allocated to clear the accrued 6-month moratorium interest/profit." my interpretation is coincide with the T&C clause 22 above. and then from faq, "Once the accrued interest/profit rate is cleared, your monthly instalment will revert to paying principal and interest/profit.", my interpretation is the same as above. once your accrued interest/profit is cleared, installment amount is revised back to pre-moratorium amount (assuming no change to blr/br/etc). why are you comparing with other banks and ringgitplus? each bank operates/manage differently. just because you like/understand how the other bank works, doesnt mean it can apply to your cimb loan. the only proper answer anyone can give you is CIMB themselves. also, do you really really need to takeup the moratorium? else, just opt-up and continue serving the loan. no headache or whatsoever. if really need to take this, then CALL CIMB for explanation. |

|

|

May 3 2020, 08:14 AM May 3 2020, 08:14 AM

Return to original view | Post

#18

|

All Stars

65,367 posts Joined: Jan 2003 |

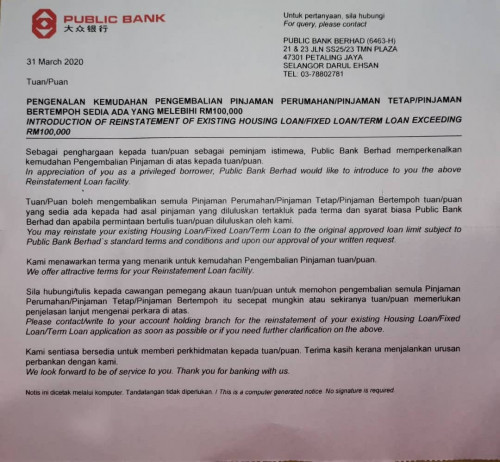

QUOTE(NoFrill @ Apr 25 2020, 01:01 AM)  I am actually opt-in for loan moratorium. Today received this letter dated 31 Mar which before moratorium officially start. Anybody received such letter from PBB? I don't understand what the reinstatement is about. QUOTE(romuluz777 @ May 3 2020, 03:58 AM) I received a letter from PBB offering a Reinstatement Loan Facility at attractive terms. same as above?Any bros here familiar with what this is ? Is it a top-up loan based on the house loan ? |

|

|

May 6 2020, 08:30 PM May 6 2020, 08:30 PM

Return to original view | Post

#19

|

All Stars

65,367 posts Joined: Jan 2003 |

cimb already removed the "extra interest" clause this afternoon

|

|

|

May 12 2020, 08:02 PM May 12 2020, 08:02 PM

Return to original view | Post

#20

|

All Stars

65,367 posts Joined: Jan 2003 |

Following Bank Negara Malaysia’s announcement on 30 April 2020, customers who wish to participate in the 6-month moratorium/repayment deferment from April to September 2020 for Hire Purchase financing are required to provide their official confirmation.

We know that you have been very patient as we prepared our systems and processes to enable you to provide your confirmation in a hassle-free manner, and we thank you for that. Here is some information to help you understand the Hire Purchase moratorium better and what you need to do. For further details, please read the FAQ: https://mybk.co/3fEKCFb  |

| Change to: |  0.0407sec 0.0407sec

1.09 1.09

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 23rd December 2025 - 07:29 AM |