Outline ·

[ Standard ] ·

Linear+

MORATORIUM PEMBIAYAAN BANK SEMPENA WABAK COVID

|

ben3003

|

May 8 2020, 05:29 PM May 8 2020, 05:29 PM

|

|

just talked to SC bank live agent. for personal loan such CashOne, the tenure will be extended and the monthly installment remain the same.

example the moratorium start apr 2020, then i defer until sep 2020, and only resume paying on oct2020, and the tenure extend for 6 months, and the installment amount is the same.

to me it looks like no extra interest charged right

|

|

|

|

|

|

ben3003

|

May 8 2020, 07:46 PM May 8 2020, 07:46 PM

|

|

QUOTE(MNF0 @ May 8 2020, 06:29 PM) How about those on variable rate hire purchase? need to ask live chat urself, apparently i only check the loan i have with SC. |

|

|

|

|

|

ben3003

|

May 10 2020, 04:24 PM May 10 2020, 04:24 PM

|

|

I wanna check with u guys, for the housing loan, if opt in moratorium, they will recalculate the monthly installment again? I have housing loan with both cimb and rhb bank..

|

|

|

|

|

|

ben3003

|

May 10 2020, 04:46 PM May 10 2020, 04:46 PM

|

|

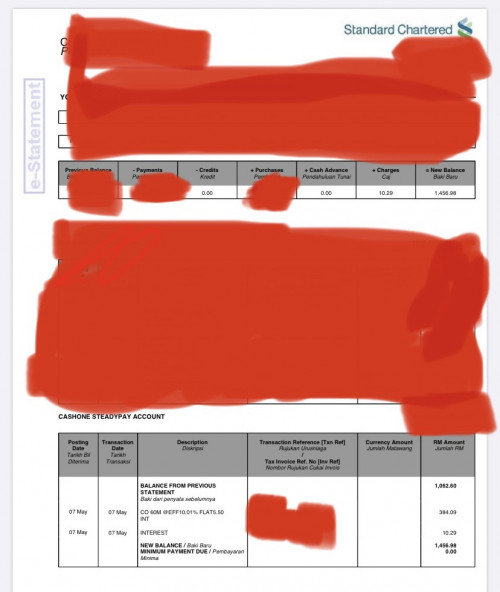

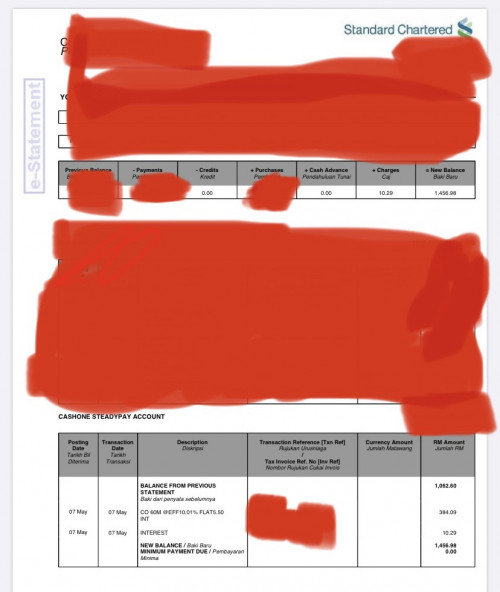

QUOTE(MNF0 @ May 10 2020, 04:26 PM) Okok but i see my standard chartered personal loan they still accumulate my interest, wat the fuk..  I tried email them see what they say |

|

|

|

|

|

ben3003

|

May 10 2020, 06:14 PM May 10 2020, 06:14 PM

|

|

QUOTE(MNF0 @ May 10 2020, 06:09 PM) Of course they will. Interestt will continue to accrue on the outstanding principal amount but it will not be compounded. (Updated 30/4/2020, 8pm) BNM and ABM’s announcement today covers only hire purchase agreements as well as fixed-rate Islamic financing. There is no mention of additional interest charges for conventional loans, so for now, it is safe to say that conventional personal loans will have no additional interest charged. this is what ringgitplus charged. |

|

|

|

|

|

ben3003

|

May 10 2020, 06:25 PM May 10 2020, 06:25 PM

|

|

QUOTE(MNF0 @ May 10 2020, 06:09 PM) Of course they will. Interestt will continue to accrue on the outstanding principal amount but it will not be compounded. but the SC live chat say i will pay the same installment amount the tenure only extend? My understanding this is delay without additional charges? (Updated 30/4/2020, 8pm) BNM and ABM’s announcement today covers only hire purchase agreements as well as fixed-rate Islamic financing. There is no mention of additional interest charges for conventional loans, so for now, it is safe to say that conventional personal loans will have no additional interest charged. |

|

|

|

|

|

ben3003

|

May 11 2020, 07:04 AM May 11 2020, 07:04 AM

|

|

QUOTE(MNF0 @ May 10 2020, 10:07 PM) The latest U-Turn was for the HP and fixed-rate Islamic financing. For everything else, it's as what i have said in my previous post. Last time oledi say fixed interest all no additional charges, then HP and fixed rate islamic u-turn become got interest, then only S turn balik become no interest la my fren |

|

|

|

|

|

ben3003

|

May 11 2020, 06:28 PM May 11 2020, 06:28 PM

|

|

QUOTE(ronnie @ May 11 2020, 06:18 PM) Just follow the latest MoF statement... no interest on Hire Purchase(HP) moratorium, just delay payment for 6 months. which add 6 month payment to your existing HP loan feel like u will pay more later. cos let say the tenure is 60 months, then now paused at 50months, then 66 months later add 6 months to ur tenure, become 56, then u total pay will start from 50 to 66 |

|

|

|

|

|

ben3003

|

May 17 2020, 08:46 AM May 17 2020, 08:46 AM

|

|

if u guys realize, the term they extend from like 60 to 66 months, then u realize actually u need to pay 6 months extra of same monthly installment. so if now ur term is 30/60 it will become 30/66, then now u paying rm600 per month, later 6 month later ur term still 30/66, but u now need to pay extra 6months at the end, which is 6 times 600 is rm3600 extra. I ask SC bank they also sohai cannot advise me on the actual installment i need to pay.

unless the term if u no pay the term will still gerak la. so the best way is to take time can go to bank to ask the bank officer directly.

This post has been edited by ben3003: May 17 2020, 08:47 AM

|

|

|

|

|

|

ben3003

|

May 17 2020, 05:56 PM May 17 2020, 05:56 PM

|

|

QUOTE(victorian @ May 17 2020, 09:02 AM) Wut are you even saying? You are not paying extra, your 6 months deferment is just deferred to the additional 6 months at the end. err cos ur term will extenf 6 months. u understand what im saying? cos loan punya term is like 5years is 60months. so u start pay 1st term 2nd term 3rd term until 60th term. now u stop at 50th term. According to the statement here is tat term will be extended for 6 months, so become 50/66. But after u paused at 50th term, u no pay 51st until 56th term, it will still jalan itself? if it still same 50/66, then ur leftover term is 16 term, if previously before u extend is 10term only. so u need pay extra 6 term. |

|

|

|

|

|

ben3003

|

May 18 2020, 07:14 AM May 18 2020, 07:14 AM

|

|

QUOTE(ronnie @ May 18 2020, 12:10 AM) What do you expect ??? free 6-months loan ?   but u all sohai say is like free 6 months loan. u cannot understand what im saying. can read properly? if ur loan is 50/60 then extend to 50/66, 1 is u pay 10months left, 1 is u pay 16months left. this can understand? This post has been edited by ben3003: May 18 2020, 07:15 AM |

|

|

|

|

|

ben3003

|

Sep 7 2020, 05:54 PM Sep 7 2020, 05:54 PM

|

|

why moratorium end 30/9, but ambank start ask me pay already tis month? got sohai ma?

|

|

|

|

|

|

ben3003

|

Oct 5 2020, 11:12 AM Oct 5 2020, 11:12 AM

|

|

only hire purchase no interest, thats y i cancel my moratorium for personal loan

|

|

|

|

|

|

ben3003

|

Jul 6 2021, 11:15 PM Jul 6 2021, 11:15 PM

|

|

QUOTE(cockerish @ Jul 6 2021, 10:13 PM) How to opt out ? I bank in my installment every 20 of the month so now how ? Now is opt-in, no apply just normal only. The auto mentioned by FM is auto approve, only if u apply. No apply nothing to approve wat |

|

|

|

|

|

ben3003

|

Jul 7 2021, 10:04 AM Jul 7 2021, 10:04 AM

|

|

QUOTE(raptar_eric @ Jul 7 2021, 10:02 AM) i just checked back my previous moratorium application for HP. there is indeed interest, just non compounding. no matter what, bank still wins #bankerjagabanker last i ask ambank they say no charge leh? they say the monthly repayment same, then only extend 6 month. |

|

|

|

|

|

ben3003

|

Jul 7 2021, 01:13 PM Jul 7 2021, 01:13 PM

|

|

No ppl go luan MoF? Should go kecih MoF becos tis time is diff from last year, bank start to cut throat people.

|

|

|

|

|

|

ben3003

|

Jul 8 2021, 04:56 PM Jul 8 2021, 04:56 PM

|

|

Dont need think too much, take and put inside epf, ur future will thank you. Now fund risky, put epf at least 5-6%.

|

|

|

|

|

|

ben3003

|

Jul 9 2021, 10:24 AM Jul 9 2021, 10:24 AM

|

|

already checked with ambank, this round even hire purchase also will have interest accrued.

|

|

|

|

|

May 8 2020, 05:29 PM

May 8 2020, 05:29 PM

Quote

Quote

0.0481sec

0.0481sec

0.83

0.83

7 queries

7 queries

GZIP Disabled

GZIP Disabled