Thanks for your offer but let me illustrate further.

Assume, you take RM 100k at 2.88% per year interest.

The interest for one year is RM 2,880. Add it to the principal of RM 100k and the total payable is RM 102,880. Monthly installment will be RM 8573.33 (Total payable divided by 12).

Take the RM 100k and invest in a FD at 4.3% and at the end of one year, you will get RM 4,300 (assume bullet payment at the end of the tenure - if monthly interest payment, the amount will be higher if you reinvest the interest into FD). The amount will add up to RM 104,300.

It does not matter what the effective interest rate is. The most important is - do you make more money or not from the investment amount compared to the payable amount?

In this case, the delta is RM 1,420 or 1.42%. (RM 104,300-RM 102,880) Precisely why I took up this offer.

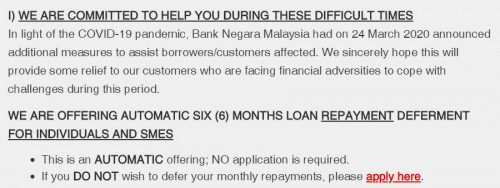

Just to update anyone who may have also taken this type of loans, I called HSBC and they confirmed that:-

1. There is no moratorium

2. There is no advantage in early settlement as it is fixed interest for the tenure

But...HSBC asked to check back on Apr 1 - perhaps there will some relief? If yes, it's a bonus, the repayment amount take to reinvest into another FD (virtually risk free) for 6 months (tenure of moratorium) and make more money.

Mar 28 2020, 09:55 PM

Mar 28 2020, 09:55 PM

Quote

Quote

0.0220sec

0.0220sec

0.65

0.65

7 queries

7 queries

GZIP Disabled

GZIP Disabled