Outline ·

[ Standard ] ·

Linear+

Insurance Talk V6!, Everything about Insurance

|

starvinder

|

Jul 20 2020, 12:42 PM Jul 20 2020, 12:42 PM

|

New Member

|

Hi Guys, need your advice if i'm overpaying for my insurance premium. I got AIA insurance 6 months ago from a fairly young agent. I was told to get ILP to keep yearly premium low. Im 28 this year.

Yearly premium : RM 3072

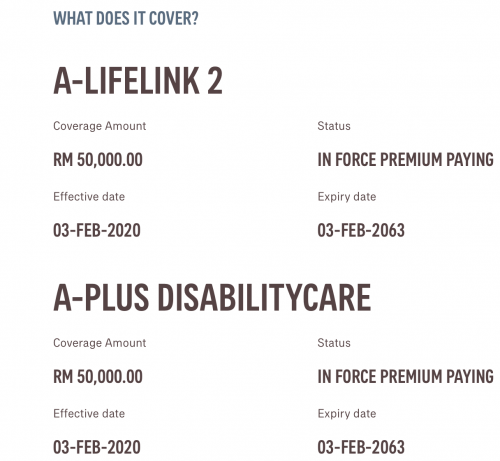

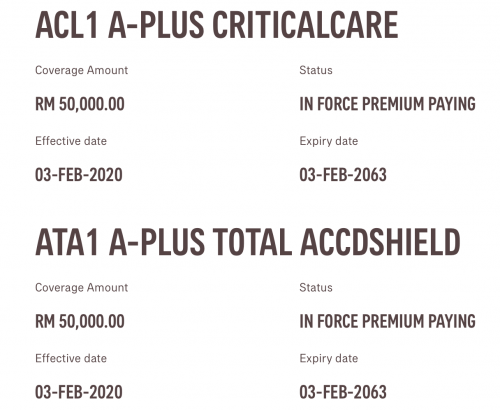

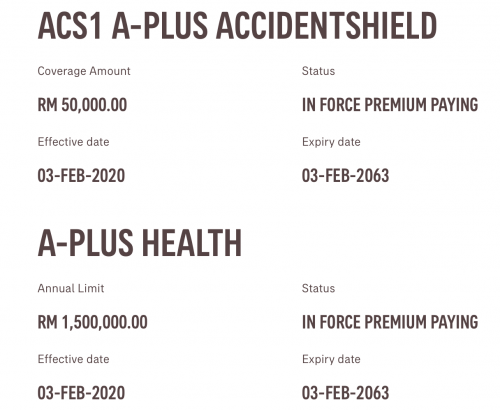

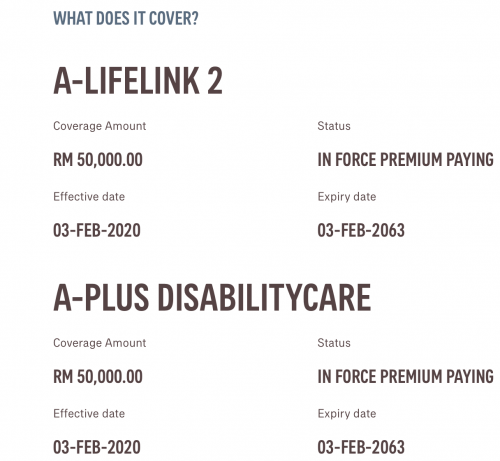

Coverage Amount: RM50k

Annual limit: RM1.5 mil

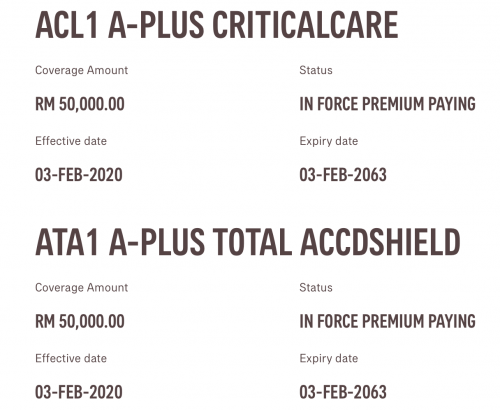

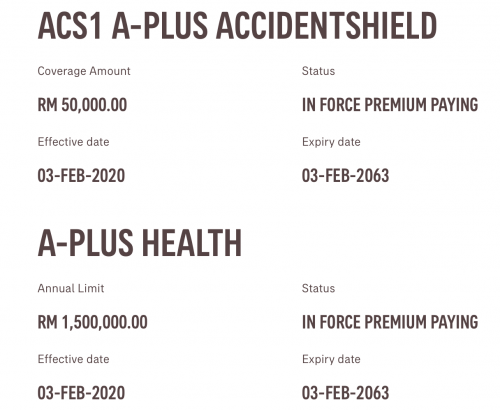

A-lifelink 2 with A-PLUS DISABILITYCARE, ACL1 A-PLUS CRITICALCARE, ATA1 A-PLUS TOTAL ACCDSHIELD, ACS1 A-PLUS ACCIDENTSHIELD, A-PLUS HEALTH, ECI1 A-PLUS EARLY CRITICALCARE, MCC1 A-PLUS MULTI CRITICALCARE, AHE1 A-PLUS HOSPINCOMEEXTRA.

|

|

|

|

|

|

starvinder

|

Jul 20 2020, 01:03 PM Jul 20 2020, 01:03 PM

|

New Member

|

QUOTE(MUM @ Jul 20 2020, 12:46 PM) mind telling more about this? Coverage Amount: RM50k RM50 000? It's just written as coverage amount for A-LifeLink 2 as RM50,000 |

|

|

|

|

|

starvinder

|

Jul 20 2020, 01:28 PM Jul 20 2020, 01:28 PM

|

New Member

|

QUOTE(lifebalance @ Jul 20 2020, 01:09 PM) When it's written as such, it means the Death/Disability Sum Assured is RM50,000, you will need to look at the policy detail to find out what are the coverage for the other riders that you've mentioned. So based on the screenshot i've taken from my AIA profile shows coverage as RM50,000 Initially, i wanted just health insurance but the agent kept persuading me to get more and more. So i gave in. For a single 28 year old who doesn't drink or smoke, I feel kinda cheated now seeing my other friends paying less than RM2k yearly premium. However, I'm thinking of cancelling my plan when it expires and look for a cheaper plan    |

|

|

|

|

|

starvinder

|

Jul 20 2020, 01:43 PM Jul 20 2020, 01:43 PM

|

New Member

|

QUOTE(lifebalance @ Jul 20 2020, 01:31 PM) Not many insurance can accept her age now as she's 70, moreover she may be subjected to a medical check up due to her age, premium around her age starts from 6k - 9k annually. Looks like an all-rounder plan, if you don't need those extra bells and whistle and a simple medical plan, can just remove the additional riders. Again, your friends and your own risk management may differ, don't just follow "because my friend is paying lower so I must follow them". Instead, get a plan that is tailored to you. Appreciate your inpu  I'll probably sit with my agent and discuss on removing some of these riders for now. Maybe add on back once im older. |

|

|

|

|

|

starvinder

|

Jul 20 2020, 03:58 PM Jul 20 2020, 03:58 PM

|

New Member

|

QUOTE(yklooi @ Jul 20 2020, 03:20 PM) if you need to do that, may i suggest you "forget" about this agent,...for by the look of it, does he/she really studied and evaluated your needs before suggesting a plan with that cost? or does he/she emphasized on the cost first (his need of cost target over your needs) before suggesting a plan to you? Initially the agent came up with a plan that cost RM7k yearly. I almost fainted cause all i asked for was basic plan with medical coverage. After explaining further on my needs he came back with the current plan im on. I still find this expensive, will have a discussion with him on removing some of the riders. Not sure if the age of the agent played a part since he is quite new to the industry and probably money driven  |

|

|

|

|

Jul 20 2020, 12:42 PM

Jul 20 2020, 12:42 PM

Quote

Quote

0.1313sec

0.1313sec

0.62

0.62

7 queries

7 queries

GZIP Disabled

GZIP Disabled