QUOTE(Cyclopes @ Jan 3 2021, 10:15 PM)

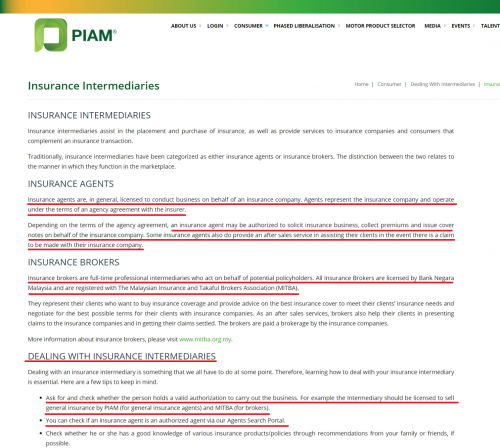

Insurance is generally a risk transfer instrument. Good that you have transfered the mortgage risk via MLTT. What about your loss of income if you are not able to work due to illness or accident?

very good question which i had struggle before dude. basically it is about the same. That is the reason protection need to be manage well whenever u buy an insurance.

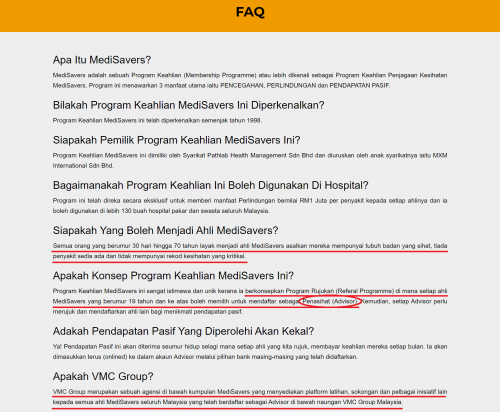

Cant denied that the medisaver program does not really provide so call waiver to the insurance , which u need to pay continuously till u die.

but if you study detail.... the protection is consider good enought compare to the market which none of the insurance company able to come out with such benefit of protections.

Ops, sorry , to anwer your question , therefore you need to managed well buy extra protection to protect your the rest of ur life in case anything happened to you.

from here , you may ask, then buy extra definately pay extra ?

Well , cant denied it is

you wan to make it free, pls work hard

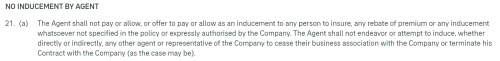

Then lastly i wanna remind thouse policy holder have the waiver option, it not come for free... it is just a easy option to make u feel relief in case anything happened to you. if u see clearly ur policy , it has the charges , that is first thing.

Second thing , you need to think about your protection. To me , i always focus on protections.

let say , touch wood, accidently i can not work for soemtime or illness i got it , then my policy still get waive and probably i got money claimed back from 36 illness or maybe total disability and etc (wow how nice).

Now the question come to you , how much your protection really help you ? [old policy ? or new ? if new maybe still substain a while]

Does the protection allow to cover you when u have problem with other illness or maybe the one of 36 illess you had claimed ?? what if not enought ?? you going to fork our ur money again ?

Think twice , thing nvr come free

No products is perfect , is depend on how u think and what choice do you make.

i feel this product can relief me from paying extra premium , which it can save my money but not putting into investmentlink which i really thinks is not a smart choice for me , and some tell me buy medical card from investment link can get back money [at this point, you really need to study deeply you really can get back money or not , or you need to top up to substain your existing policy ?

This post has been edited by jacky1678: Jan 4 2021, 10:32 PM

Jan 4 2021, 08:37 PM

Jan 4 2021, 08:37 PM

Quote

Quote

0.1372sec

0.1372sec

0.35

0.35

7 queries

7 queries

GZIP Disabled

GZIP Disabled