QUOTE(GE-DavidK @ Jun 18 2020, 02:08 PM)

As you mentioned, insurance is for protection, not investment. Life insurance is a form of protection as well, so there is no need to reduce the life insurance portion.

There are some benefits to have some form of life insurance:

1. Life insurance money will not be frozen and will be passed to your beneficiaries for use immediately.

2. Using small periodical payments to exchange for large payout.

3. Considering you are just age 35, life insurance is to make sure that your family can maintain the same standard of living (daily expenses, children's education fund, parents' expenses, etc) if you were to pass away tomorrow.

3. Rule of thumb is to have life insurance coverage 10 times your annual income.

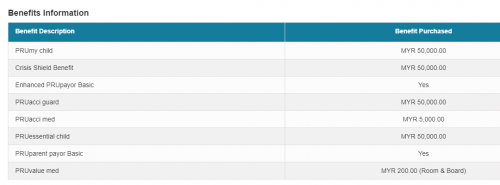

Looking at your policies in medical card as well as GETC (without looking at the sum assured), it looks like you are covered quite well in terms of medical insurance as well as critical illness.

I see a lot of online life insurance covered up to 500k only. How to buy 10 times of annual income? Does it mean buy multiple life insurance?There are some benefits to have some form of life insurance:

1. Life insurance money will not be frozen and will be passed to your beneficiaries for use immediately.

2. Using small periodical payments to exchange for large payout.

3. Considering you are just age 35, life insurance is to make sure that your family can maintain the same standard of living (daily expenses, children's education fund, parents' expenses, etc) if you were to pass away tomorrow.

3. Rule of thumb is to have life insurance coverage 10 times your annual income.

Looking at your policies in medical card as well as GETC (without looking at the sum assured), it looks like you are covered quite well in terms of medical insurance as well as critical illness.

Jun 19 2020, 11:58 PM

Jun 19 2020, 11:58 PM

Quote

Quote

0.1380sec

0.1380sec

0.30

0.30

7 queries

7 queries

GZIP Disabled

GZIP Disabled