QUOTE(jacky1678 @ Jan 17 2021, 12:06 AM)

under loanpac Sir. refer to your pm for more info , hope it asnwer u .

Hey Jacky,

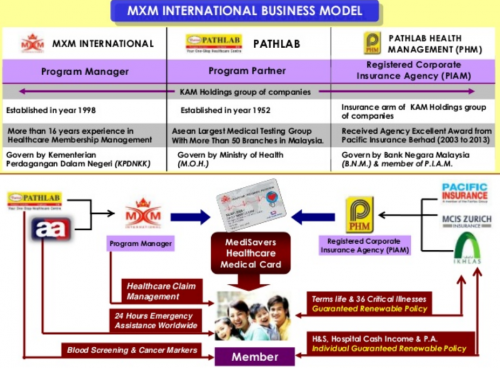

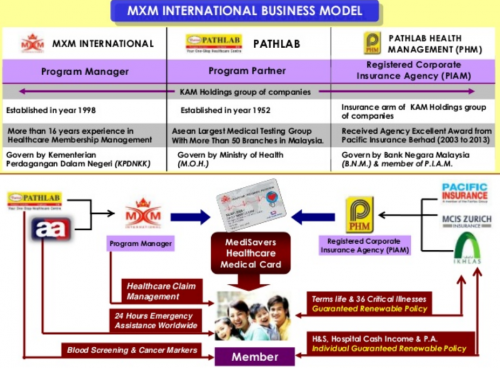

Based on your info given, the license holder is under Pathlab Health Management Sdn Bhd (PHM) which is the corporate license holder for Lonpac & MPI General.

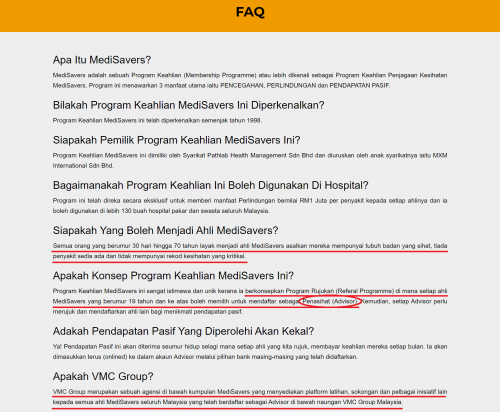

However, the program is "outsourced/managed" to MXM and runs it like a MLM scheme instead of the normal insurance structure.

I'm getting a pattern here whereby, what you've shown me is that.

A (License Holder) ---> B (MXM - 3rd party)

- A says to B - Hey I got this product, help me market it/refer me cases, B runs a MLM structure, but to stay legal, B refers to case back to A for any signing.

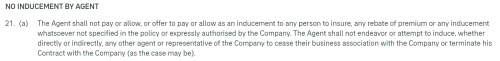

- However in return, A pays an incentive to B for giving them the business.

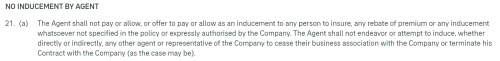

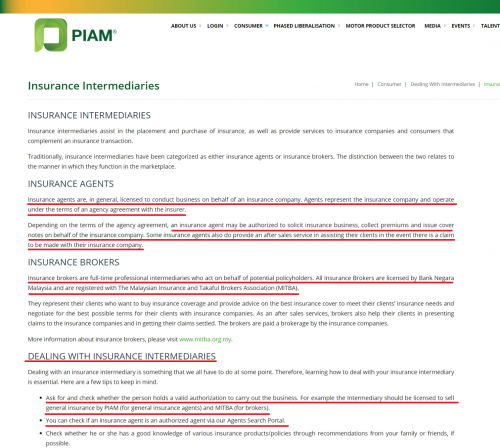

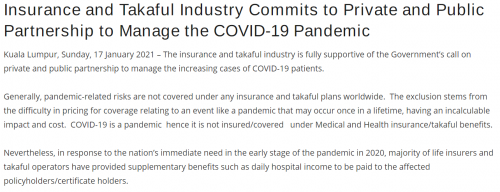

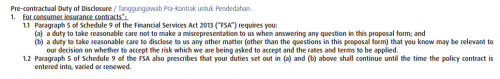

However, I am not sure to what extent the above regulation works as this is plucked from an insurance agreement contract under Life Insurance, I'm not sure if this is applicable to PIAM. But then again, since they are running as a corporate license holder, may not be applicable? Maybe an expert in this field can advise.

- B calls themselves "Advisor" - is this even legal to call yourself that if you're just a referee and you're not licensed under LIAM/PIAM?

» Click to show Spoiler - click again to hide... «

- PHM doesn't run recruitment for agents, instead, their agents are the "referees" who joins under MXM to bring in the business.

- In this context, I'm sure the referees has cross some lines to introduce the insurance plan as part of soliciting without a license.

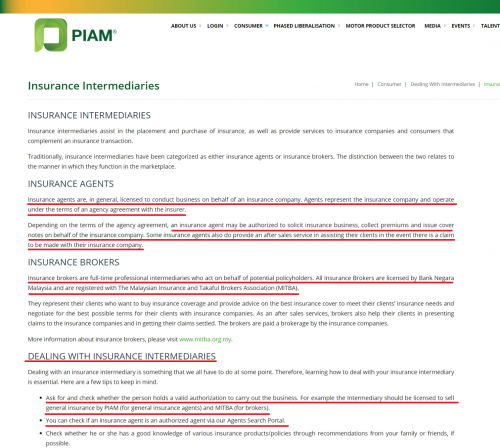

- Based on my findings, PHM is not a Insurance Broker as per

http://www.mitba.org.my/EN/about.

Overall :-

I feel that there is something wrong / abuse in the system for this to get by without noticed by BNM for so many years..

Threads going back 10 years ago -

https://forum.lowyat.net/topic/1146592/all» Click to show Spoiler - click again to hide... «

QUOTE

I went and did a google search, and found more info at mxm.com.my.

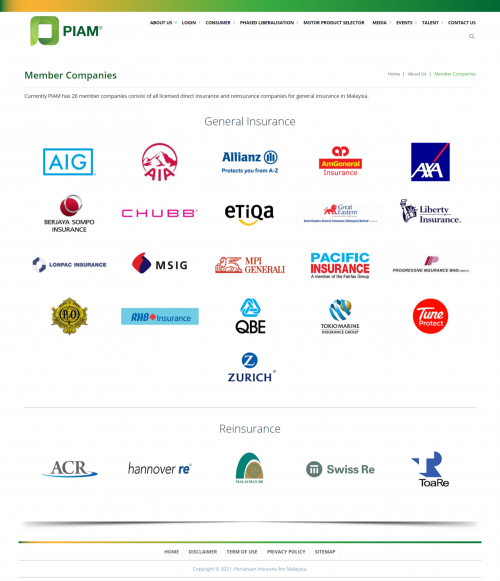

1. MXM is not the registered agent of Pasific Insurance or MCIS Zurich. PATHLAB Healthcare management is. According to the About Us Section, its an associate company of PATHLAB (Even then, no clarification on what associate means, other than its part of Kam Holdings conglomerate).

2. So, does that mean you sign up with MXM, who then signs you up with PATHLAB, who then signs you up with Pasific and MCIS Zurich? Double the agent wor..

3. Who is your servicing agent then? MXM? PATHLAB? Who do you call to confirm your claim? One thing I noticed on the medical card conditions is that your claim is subject to reasonable and customary charge. Does that mean that if the insurance, or MXM or pathlab decides thats its not reasonable, you have to pay?

4. Introduce people get RM30? Since when insurance operates as an MLM?

5. There is a picture of a membership card prominently displayed on the first page of the membership details which shows that the emergency contact is a person with a handphone number somemore. If whoever is helping me can't contact this person, is there another person they can call. Why doesn't the medical card come from Pasific insurance then?

5. Coveted Agency award is for PATHLAB, not MXM.

6. Not even a member of PIAM? LIAM? Which law do you follow then? Akta Jualan Langsung (AJL) or Akta Insurans?

7. So you get benefit of term (CI, Death, PA) + medical card. Why don't you buy directly then. Many insurance company that do Life will sell you all those.

QUOTE

That's the thing. How could you be reselling insurance. You want to sell insurance, you get accredited, you get registered, choose a principal and then sell. Reselling muddies the water, especially considering agent commitments to the client, and insurer's commitment to the client, in terms of who should indemnify and take over liability.

Seriously tempted to check with PIAM if this is legal. Imagine running an insurance like a MLM.

Insurance company = Cost

Agent of Insurance company = Cost + Commission

Reseller of Agent of Insurance Company = Cost + Comission + Reseller Profit (Buildings ain't Cheap)

Agent of Reseller of Agent of Insurance Company = Cost + Comission + Reseller Profit + Reseller Agent Commission

Water Filter are soo yesterday...

QUOTE

1. To sell insurance, you must be an agent, or license by BNM to do so. Its the law. Again, if you are not a registered agent, you shouldn't even be able to talk to a prospect.

2. Why tie up with MXM then? Just go and buy direct from agent or principal, again, for what reason must I join MXM. I sell Pru policies, but I don't ask them to join Pru as members.

3. You think hospital would accept this answer when you are being admitted?

4. Who do you think pays the Rm30? The company? Please lah, the poor sod who you introduced pays your that Rm30. That Rm30 more than getting it from agent or principal.

5. So where's the medical card from Pasific then? Why give MXM branded card? Your relative can provide guarantee letter to the hospital?

6. All agents need to register with LIAM if they sell life and PIAM if they sell general. Or MTA if they sell takaful. Again, as agent selling insurance you are under the purview of LIAM, PIAM and BNM. Not AJL. MXM cannot avoid that.

7. What saving? Dude, you seriously need to talk to a proper agent. Some GI will accumulate cash value, even term would accumulate cash value over time. Trust the otai's here when they say this is not worth your money. There is no win-win situation here. You only win if you get insured from the proper party.

However, there was no longer follow up by mfikri77 after that.

If the above can be abused, any company can simply set up a MLM company, ride under a company/agent who has an insurance license. Get their friends/customers to refer cases and give them an incentive and get them to keep asking more ppl to refer and soon enough, the MLM pyramid scheme comes out. (Now look back at MXM, isn't that what it is?) - Food for thought.

This post has been edited by lifebalance: Jan 18 2021, 09:31 AM

Jan 14 2021, 11:08 PM

Jan 14 2021, 11:08 PM

Quote

Quote

0.1604sec

0.1604sec

0.56

0.56

7 queries

7 queries

GZIP Disabled

GZIP Disabled