QUOTE(afif737 @ May 4 2020, 03:23 AM)

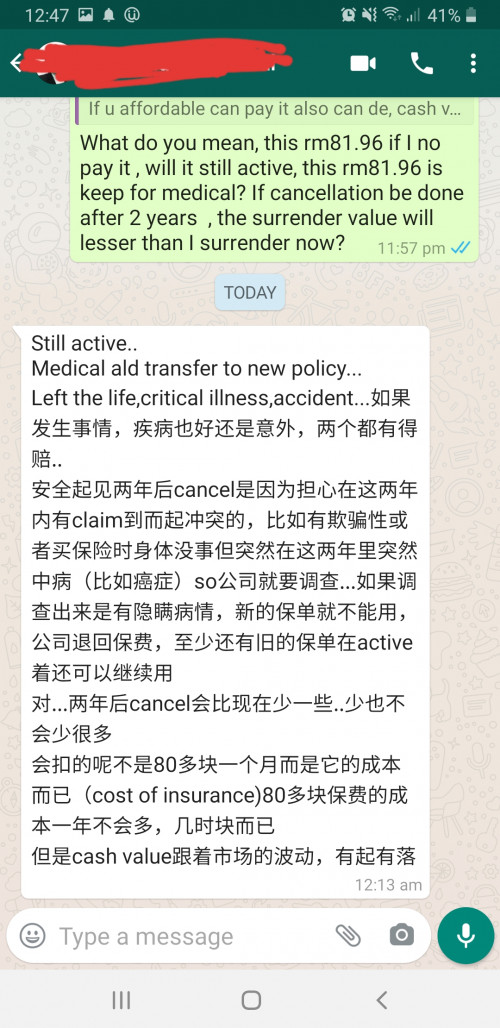

Thank you for your reply. The bolded part, it's quite difficult to say because if we lose our licence for example bcoz of a critical illness like diabetes, we won't be able to fly but we can still work elsewhere. but since we fall back to our spm bcoz we lost our licence,its gonna be hard to find a job. So an agent explained to me, in that case the insurance company will not pay up because we can still work elsewhere.

Hi. You've never heard of loss of licence because it is only offered by airlines. So as far as i know, no insurance company offers it. But some agents try to sell their product using this term which i think is wrong. I was young and ignorant when i got the policy 9 years ago. A few associations outside Malaysia do offer loss of licence. This is why I'm only looking for a medical card and life insurance.

There was a friend who told me that his life insurance coverage is RM1 mil+ and he's only paying like RM2000+ a year for it. I forgot to ask him from which company and i honestly don't know anything else about it other than those figures. Is it plausible to have that kind of coverage at that price?

They are restrictions based on nature of work due to the inherent risk of the job, that certain plans are offered with higher premium or declined but there would be specific policies that cater to certain industries. Hi. You've never heard of loss of licence because it is only offered by airlines. So as far as i know, no insurance company offers it. But some agents try to sell their product using this term which i think is wrong. I was young and ignorant when i got the policy 9 years ago. A few associations outside Malaysia do offer loss of licence. This is why I'm only looking for a medical card and life insurance.

There was a friend who told me that his life insurance coverage is RM1 mil+ and he's only paying like RM2000+ a year for it. I forgot to ask him from which company and i honestly don't know anything else about it other than those figures. Is it plausible to have that kind of coverage at that price?

There are various options to keep a premium affordable for high coverage.

May 4 2020, 05:43 AM

May 4 2020, 05:43 AM

Quote

Quote

0.3110sec

0.3110sec

0.72

0.72

7 queries

7 queries

GZIP Disabled

GZIP Disabled