QUOTE(MiKE7LIM @ May 1 2020, 08:09 PM)

» Click to show Spoiler - click again to hide... «

QUOTE(Chyan @ May 1 2020, 09:44 PM)

» Click to show Spoiler - click again to hide... «

Insurance Talk V6!, Everything about Insurance

|

|

May 1 2020, 11:06 PM May 1 2020, 11:06 PM

Show posts by this member only | IPv6 | Post

#341

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(MiKE7LIM @ May 1 2020, 08:09 PM) » Click to show Spoiler - click again to hide... « QUOTE(Chyan @ May 1 2020, 09:44 PM) » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

May 2 2020, 12:12 AM May 2 2020, 12:12 AM

Show posts by this member only | IPv6 | Post

#342

|

Junior Member

182 posts Joined: Apr 2020 |

AIA Medical Insurance A-Plus Health (Deductible) Eligibility Malaysian and Permanent Resident of Malaysia # of Panel Hospitals 82 Maximum age of entry 70 Maximum age of renewal 99 Guaranteed Renewal - Yes Co-Insurance - No Deductibles Apply - Yes Can anyone advise the pro and cons if taking this AIA insurance. Thanks |

|

|

May 2 2020, 10:50 AM May 2 2020, 10:50 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(kazekage_09 @ Apr 29 2020, 12:25 PM) Hi all. The COI varies from different companies depending on the medical card benefits, the best way to compare is to look into the COI table provided by the insurance company.Can I know whether the COI is same or not between standalone and ILP in same company? I heard that COI of standalone is higher than ILP. Let say for example for 30 years old male non smoker for 500k term life compared to 500k life ILP plain plan with no other riders. The premium for sure will be different but I eager to know their COI is same or not each year. And whether it also same if compared between online products and tru agents. Thanks! QUOTE(db07mufan @ Apr 30 2020, 10:14 PM) anyone with Great Eastern here, I have a 10 year old medical plan which i would like to cancel. My agent is no longer in the industry so am wondering who i can deal with for this You can walk in to GE or give them a call to find out how you can surrender during the MCOQUOTE(farizmalek @ May 1 2020, 11:59 AM) Same as above QUOTE(MiKE7LIM @ May 1 2020, 08:09 PM) RM250 monthly Hi, the plan looks okayBenefits Payout 1 Life/TPD-100K 2 Critical Illness-150K 3 Early Critical Illness-100K 4 Diabetes Recovery-20K 5 Cancer Recovery-35K Hospitalization & Surgical (Med Card 6 Room-150 daily 7 Annual Limit-850K 8 Lifetime Limit-Unlimited Others Benefits 9 Waiver-Yes (in the event diagnose with CI, premium will be waive but still continue to enjoy the benefits) 10 Savings/Cash Value-Yes Hi , above plan for single male - 30 years old should be ok right QUOTE(Chyan @ May 1 2020, 09:44 PM) Hi all, HiI'm currently 28. Class 1 job. Non-smoker. I only have MP Generali health insurance from my employer. I searched around and sieved through what I found interesting and ended up with these two. 1. AIA A-Plus Health 2. Allianz Medisafe I wonder can I get a good enough ILP for below RM180? So far from my understanding, standalone packages tend to be more expensive along the years that is why I'm leaning towards ILP. I have not engaged with an agent yet. Thought of getting some opinion in Lyn first. ILP plan may look cheaper because of the investment return over the long term compared to a stand-alone but is not necessarily cheaper. Based on the above mentioned age, you can get it within RM180 but the term of coverage may be shorter |

|

|

May 2 2020, 10:51 AM May 2 2020, 10:51 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(farizmalek @ May 2 2020, 12:12 AM) AIA Medical Insurance A-Plus Health (Deductible) Plans from AIA are good so far, the coverage are quite comprehensive although cost of insurance maybe on a higher side.Eligibility Malaysian and Permanent Resident of Malaysia # of Panel Hospitals 82 Maximum age of entry 70 Maximum age of renewal 99 Guaranteed Renewal - Yes Co-Insurance - No Deductibles Apply - Yes Can anyone advise the pro and cons if taking this AIA insurance. Thanks What will be your main concern ? |

|

|

May 2 2020, 12:20 PM May 2 2020, 12:20 PM

Show posts by this member only | IPv6 | Post

#345

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(farizmalek @ May 2 2020, 12:12 AM) » Click to show Spoiler - click again to hide... « |

|

|

May 2 2020, 03:42 PM May 2 2020, 03:42 PM

Show posts by this member only | IPv6 | Post

#346

|

Junior Member

182 posts Joined: Apr 2020 |

QUOTE(lifebalance @ May 2 2020, 10:51 AM) Plans from AIA are good so far, the coverage are quite comprehensive although cost of insurance maybe on a higher side. I am looking to change my wife and dotter medical insurance. Their are still healty. Me cannot already. WHat is deductible?What will be your main concern ? |

|

|

|

|

|

May 2 2020, 03:44 PM May 2 2020, 03:44 PM

Show posts by this member only | IPv6 | Post

#347

|

Junior Member

182 posts Joined: Apr 2020 |

QUOTE(lifebalance @ May 2 2020, 10:51 AM) Plans from AIA are good so far, the coverage are quite comprehensive although cost of insurance maybe on a higher side. and my concern is whether this will be a good medical card compare to others and any hidden disadvantages that I should know about. ThanksWhat will be your main concern ? |

|

|

May 2 2020, 03:45 PM May 2 2020, 03:45 PM

Show posts by this member only | IPv6 | Post

#348

|

Junior Member

182 posts Joined: Apr 2020 |

|

|

|

May 2 2020, 03:47 PM May 2 2020, 03:47 PM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(farizmalek @ May 2 2020, 03:42 PM) I am looking to change my wife and dotter medical insurance. Their are still healty. Me cannot already. WHat is deductible? A deductible is a fixed cost that you share with the insurance company in the event of a claim, depending on the amount of deductible that you opted, you need to pay that amount first and the balance is paid by the insurance company.QUOTE(farizmalek @ May 2 2020, 03:44 PM) and my concern is whether this will be a good medical card compare to others and any hidden disadvantages that I should know about. Thanks Major disadvantage I don’t think so with the newer medical cards, though they have different benefits offered for outpatient.My advise is for you scout around if you would like to know the pros and cons or seek a independent financial advisor that does not side with any insurance company to give you the best solution. |

|

|

May 2 2020, 04:59 PM May 2 2020, 04:59 PM

Show posts by this member only | IPv6 | Post

#350

|

Junior Member

182 posts Joined: Apr 2020 |

QUOTE(lifebalance @ May 2 2020, 03:47 PM) A deductible is a fixed cost that you share with the insurance company in the event of a claim, depending on the amount of deductible that you opted, you need to pay that amount first and the balance is paid by the insurance company. alright thank you TuanMajor disadvantage I don’t think so with the newer medical cards, though they have different benefits offered for outpatient. My advise is for you scout around if you would like to know the pros and cons or seek a independent financial advisor that does not side with any insurance company to give you the best solution. |

|

|

May 2 2020, 09:29 PM May 2 2020, 09:29 PM

|

Junior Member

103 posts Joined: Nov 2014 |

Hi,

I'm 32yo. Airline pilot. Looking for a good insurance plan. Leaning towards AIA. Medical card and maybe life insurance. I used to have one with AIA 9 years ago. The sale pitch by the agent was it was a 'Loss of licence' policy. But actually there's no such thing. It says on my policy booklet, the plan is : AIA Assurance Account. If i'm not mistaken it is under 'occupational' policy or something like that I really don't remember. It was also an ILP. I cancelled it years ago. An agent tried to sell me the same policy, but i'm a bit wiser now, so i asked to show where it says 'loss of licence', well it doesn't. I don't think it is right to sell something when it is not what you say it is, even when it is similar. My company does cover me for permanent loss of licence, hospitalization and also death. But the amounts are not that high. So thinking of additional insurance. Okay so now for me personally I don't mix insurance with investment. Can anyone suggest any policy that i can read up on? Medical card and life insurance. Preferably AIA. And also is it true when people say you should get either a life insurance OR an MLTA but not both? Thank you in advance. This post has been edited by afif737: May 2 2020, 09:31 PM |

|

|

May 3 2020, 12:37 AM May 3 2020, 12:37 AM

|

Junior Member

123 posts Joined: Dec 2019 |

QUOTE(afif737 @ May 2 2020, 09:29 PM) Hi, Medical card with ILP generally comes with life insurance and critical illness coverage. Loss of license means provide coverage for pilots alone. For medical card/life insurance nowadays, any permanent disability or critical illness regardless of your occupation will be covered as well. I'm 32yo. Airline pilot. Looking for a good insurance plan. Leaning towards AIA. Medical card and maybe life insurance. I used to have one with AIA 9 years ago. The sale pitch by the agent was it was a 'Loss of licence' policy. But actually there's no such thing. It says on my policy booklet, the plan is : AIA Assurance Account. If i'm not mistaken it is under 'occupational' policy or something like that I really don't remember. It was also an ILP. I cancelled it years ago. An agent tried to sell me the same policy, but i'm a bit wiser now, so i asked to show where it says 'loss of licence', well it doesn't. I don't think it is right to sell something when it is not what you say it is, even when it is similar. My company does cover me for permanent loss of licence, hospitalization and also death. But the amounts are not that high. So thinking of additional insurance. Okay so now for me personally I don't mix insurance with investment. Can anyone suggest any policy that i can read up on? Medical card and life insurance. Preferably AIA. And also is it true when people say you should get either a life insurance OR an MLTA but not both? Thank you in advance. On whether mixing insurance with investment in ILP, you can do so by maximising the insurance coverage but the sustainability of the policy will be short. The investment/cash value is used to pay for the rising insurance charges in the future. If you are planning to get insurance for long term (i.e. coverage until age 80), you are still better off getting an ILP instead of term insurance/stand alone because ILP will be cheaper than term insurance. MLTA is a type of mortgage life insurance which is a type of insurance to protect against the house loan you signed up for. Whereas for life insurance it is used to provide peace of mind and reduce financial loss or hardship faced by your family if you passed away. In a person's lifetime, it is common to have multiple life insurances running at the same time. Different people have different needs and how much they want to leave behind for their family. So, how much life insurance you need is dependent on you. |

|

|

May 3 2020, 10:17 AM May 3 2020, 10:17 AM

Show posts by this member only | IPv6 | Post

#353

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(farizmalek @ May 2 2020, 03:45 PM) hi fariz, if you are comparing COI, cheaper ones are Prudential, GE and HLA. For AIA, Allianz and Manulife, the COI is slightly higher but of course the benefits differs too.QUOTE(afif737 @ May 2 2020, 09:29 PM) » Click to show Spoiler - click again to hide... « as of life insurance, it will be more on risk management planning based on your current lifestyle and needs. (MLTA is actually life insurance termed as MLTA) |

|

|

|

|

|

May 3 2020, 10:30 AM May 3 2020, 10:30 AM

Show posts by this member only | IPv6 | Post

#354

|

Junior Member

182 posts Joined: Apr 2020 |

QUOTE(ckdenion @ May 3 2020, 10:17 AM) hi fariz, if you are comparing COI, cheaper ones are Prudential, GE and HLA. For AIA, Allianz and Manulife, the COI is slightly higher but of course the benefits differs too. thank you banghi afif, i'd never heard of 'loss of license' policy. for AIA latest medical card, you can actually find it on google. as of life insurance, it will be more on risk management planning based on your current lifestyle and needs. (MLTA is actually life insurance termed as MLTA) |

|

|

May 4 2020, 03:23 AM May 4 2020, 03:23 AM

|

Junior Member

103 posts Joined: Nov 2014 |

QUOTE(GE-DavidK @ May 3 2020, 12:37 AM) Medical card with ILP generally comes with life insurance and critical illness coverage. Loss of license means provide coverage for pilots alone. For medical card/life insurance nowadays, any permanent disability or critical illness regardless of your occupation will be covered as well. Thank you for your reply. The bolded part, it's quite difficult to say because if we lose our licence for example bcoz of a critical illness like diabetes, we won't be able to fly but we can still work elsewhere. but since we fall back to our spm bcoz we lost our licence,its gonna be hard to find a job. So an agent explained to me, in that case the insurance company will not pay up because we can still work elsewhere.On whether mixing insurance with investment in ILP, you can do so by maximising the insurance coverage but the sustainability of the policy will be short. The investment/cash value is used to pay for the rising insurance charges in the future. If you are planning to get insurance for long term (i.e. coverage until age 80), you are still better off getting an ILP instead of term insurance/stand alone because ILP will be cheaper than term insurance. MLTA is a type of mortgage life insurance which is a type of insurance to protect against the house loan you signed up for. Whereas for life insurance it is used to provide peace of mind and reduce financial loss or hardship faced by your family if you passed away. In a person's lifetime, it is common to have multiple life insurances running at the same time. Different people have different needs and how much they want to leave behind for their family. So, how much life insurance you need is dependent on you. QUOTE(ckdenion @ May 3 2020, 10:17 AM) hi fariz, if you are comparing COI, cheaper ones are Prudential, GE and HLA. For AIA, Allianz and Manulife, the COI is slightly higher but of course the benefits differs too. Hi. You've never heard of loss of licence because it is only offered by airlines. So as far as i know, no insurance company offers it. But some agents try to sell their product using this term which i think is wrong. I was young and ignorant when i got the policy 9 years ago. A few associations outside Malaysia do offer loss of licence. This is why I'm only looking for a medical card and life insurance.hi afif, i'd never heard of 'loss of license' policy. for AIA latest medical card, you can actually find it on google. as of life insurance, it will be more on risk management planning based on your current lifestyle and needs. (MLTA is actually life insurance termed as MLTA) There was a friend who told me that his life insurance coverage is RM1 mil+ and he's only paying like RM2000+ a year for it. I forgot to ask him from which company and i honestly don't know anything else about it other than those figures. Is it plausible to have that kind of coverage at that price? |

|

|

May 4 2020, 05:33 AM May 4 2020, 05:33 AM

Show posts by this member only | IPv6 | Post

#356

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(farizmalek @ May 2 2020, 12:12 AM) AIA Medical Insurance A-Plus Health (Deductible) Do read up on the Health Wallet and how Vitality can add value to your AIA Medical Plan.Eligibility Malaysian and Permanent Resident of Malaysia # of Panel Hospitals 82 Maximum age of entry 70 Maximum age of renewal 99 Guaranteed Renewal - Yes Co-Insurance - No Deductibles Apply - Yes Can anyone advise the pro and cons if taking this AIA insurance. Thanks This post has been edited by Cyclopes: May 4 2020, 06:06 AM |

|

|

May 4 2020, 05:43 AM May 4 2020, 05:43 AM

Show posts by this member only | IPv6 | Post

#357

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(afif737 @ May 4 2020, 03:23 AM) Thank you for your reply. The bolded part, it's quite difficult to say because if we lose our licence for example bcoz of a critical illness like diabetes, we won't be able to fly but we can still work elsewhere. but since we fall back to our spm bcoz we lost our licence,its gonna be hard to find a job. So an agent explained to me, in that case the insurance company will not pay up because we can still work elsewhere. They are restrictions based on nature of work due to the inherent risk of the job, that certain plans are offered with higher premium or declined but there would be specific policies that cater to certain industries. Hi. You've never heard of loss of licence because it is only offered by airlines. So as far as i know, no insurance company offers it. But some agents try to sell their product using this term which i think is wrong. I was young and ignorant when i got the policy 9 years ago. A few associations outside Malaysia do offer loss of licence. This is why I'm only looking for a medical card and life insurance. There was a friend who told me that his life insurance coverage is RM1 mil+ and he's only paying like RM2000+ a year for it. I forgot to ask him from which company and i honestly don't know anything else about it other than those figures. Is it plausible to have that kind of coverage at that price? There are various options to keep a premium affordable for high coverage. |

|

|

May 4 2020, 06:54 AM May 4 2020, 06:54 AM

Show posts by this member only | IPv6 | Post

#358

|

Junior Member

182 posts Joined: Apr 2020 |

|

|

|

May 4 2020, 07:11 AM May 4 2020, 07:11 AM

Show posts by this member only | IPv6 | Post

#359

|

Junior Member

182 posts Joined: Apr 2020 |

https://www.aia.com.my/content/dam/my/en/do...rochure_1st.pdf

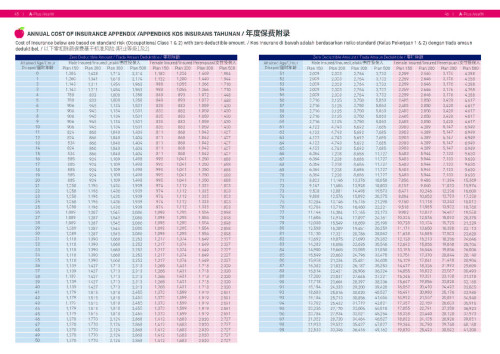

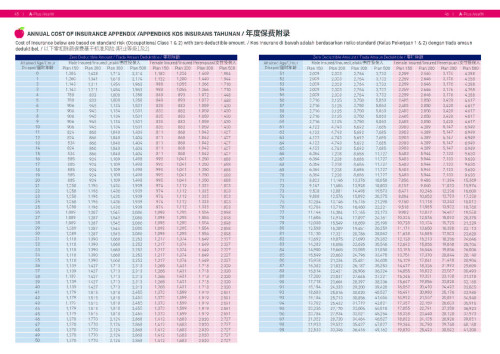

Is this insurance ok? one of the Q&A in the AIA website:- 06: WILL MY COST OF INSURANCE INCREASE AS I GET OLDER? As the Cost of Insurance for A-Plus Health is deducted depending on your attained age, it will increase as your age increases. Is this mean that every year the premium will be increased as per the table below...  |

|

|

May 4 2020, 07:12 AM May 4 2020, 07:12 AM

Show posts by this member only | IPv6 | Post

#360

|

Junior Member

182 posts Joined: Apr 2020 |

QUOTE(farizmalek @ May 4 2020, 07:11 AM) https://www.aia.com.my/content/dam/my/en/do...rochure_1st.pdf Thank you and appreciate for any advise...Is this insurance ok? one of the Q&A in the AIA website:- 06: WILL MY COST OF INSURANCE INCREASE AS I GET OLDER? As the Cost of Insurance for A-Plus Health is deducted depending on your attained age, it will increase as your age increases. Is this mean that every year the premium will be increased as per the table below...  |

|

Topic ClosedOptions

|

| Change to: |  0.0235sec 0.0235sec

0.14 0.14

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 3rd December 2025 - 05:29 AM |