QUOTE(farizmalek @ Apr 24 2020, 05:33 AM)

» Click to show Spoiler - click again to hide... «

Insurance Talk V6!, Everything about Insurance

|

|

Apr 24 2020, 09:55 AM Apr 24 2020, 09:55 AM

Show posts by this member only | IPv6 | Post

#281

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

QUOTE(farizmalek @ Apr 24 2020, 05:33 AM) » Click to show Spoiler - click again to hide... « |

|

|

|

|

|

Apr 24 2020, 10:05 AM Apr 24 2020, 10:05 AM

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(taiping... @ Apr 23 2020, 06:12 PM) Pls excuse me if I’m ignorant I don't have a crystal ball, but very likely what you save for 25 years ( from age 30 to age 55) will likely not be enough to buy you a new medical policy from age 55 onwards that will sustain for another 25 years. Example: firstly, I’m covered by my company both life and medical. By the time I’m 55, there will b an amount that I’ve saved up for insurance. I then use this amount to purchase insurance at the age of 55 (let’s say) Secondly, if I were to buy insurance at 30years old or 55 years old, the premium would roughly be the same? If not how much difference is the premium? The money saved for 30 to55 years old, could b use to purchase insurance at 55 years old The premium will not be the same at age 30 and age 55. No crystal ball either to know what the medical cost inflation will be 25 years from today. |

|

|

Apr 24 2020, 10:09 AM Apr 24 2020, 10:09 AM

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(farizmalek @ Apr 24 2020, 05:33 AM) Thank you for your feedback. Yes, the medical insurance each covered for self, wife and my dotter. In short, I believe your family has good coverage currently for medical. You may want to relook on life insurance for yourself and estate planning/wasiat.The purpose of my posting is whether our current medical insurance is sufficient. We bought it in 2014 and that was one of the best at that time. Now i am 44 and to change to a new and better one will be expensive. Beside that o have already have illness although not that serious. As a back-up, my wife is Pegawai Kerajaan and I have GL for government hospital (From my wife). Plus my sister (adik) is a specialist in UITM Hospital, Selayang (not hospital selayang). Plus without the GL from my wife, i am still covered for life for free from the government because I already donated blood more than 50 times to National Blood Center. In term of life saving, as a seaman before and also working overseas, currently I have cash: RM3,223,000 in my KWSP and ASNB. All my properties, land and cars were fully paid (No loans) and no credit card debt or personal loans. I am still working. My question is that, do i need to upgrade/change my medical insurance and also to get a life insurance from my condition above. |

|

|

Apr 24 2020, 02:11 PM Apr 24 2020, 02:11 PM

|

Senior Member

1,309 posts Joined: Nov 2008 |

QUOTE(taiping... @ Apr 23 2020, 06:12 PM) Pls excuse me if I’m ignorant Yes, most of us are covered by our employee benefits throughout the tenure of our employment. Example: firstly, I’m covered by my company both life and medical. By the time I’m 55, there will b an amount that I’ve saved up for insurance. I then use this amount to purchase insurance at the age of 55 (let’s say) Secondly, if I were to buy insurance at 30years old or 55 years old, the premium would roughly be the same? If not how much difference is the premium? The money saved for 30 to55 years old, could b use to purchase insurance at 55 years old By the time you're 55, yes, you would have saved up an amount for lots of various purposes, insurance can be one of your purposes. But money is actually the secondary factor in buying personal insurance. First, we have to ensure that we are in reasonable health condition to be "insurable". Buying now at 30 vs buying later at 55. The premium will ROUGHLY be the same, CONSIDERING in 25 years from now, there is no improvement in product, no inflation, no improvement in coverage, and no change in your health condition. If all these conditions are met, then yes, your statement is correct. |

|

|

Apr 24 2020, 02:22 PM Apr 24 2020, 02:22 PM

Show posts by this member only | IPv6 | Post

#285

|

Senior Member

2,230 posts Joined: Jan 2006 From: K. L. |

QUOTE(farizmalek @ Apr 24 2020, 05:33 AM) Thank you for your feedback. Yes, the medical insurance each covered for self, wife and my dotter. Sounds good for you.The purpose of my posting is whether our current medical insurance is sufficient. We bought it in 2014 and that was one of the best at that time. Now i am 44 and to change to a new and better one will be expensive. Beside that o have already have illness although not that serious. As a back-up, my wife is Pegawai Kerajaan and I have GL for government hospital (From my wife). Plus my sister (adik) is a specialist in UITM Hospital, Selayang (not hospital selayang). Plus without the GL from my wife, i am still covered for life for free from the government because I already donated blood more than 50 times to National Blood Center. In term of life saving, as a seaman before and also working overseas, currently I have cash: RM3,223,000 in my KWSP and ASNB. All my properties, land and cars were fully paid (No loans) and no credit card debt or personal loans. I am still working. My question is that, do i need to upgrade/change my medical insurance and also to get a life insurance from my condition above. Will suggest you look into critical illness coverage. Also wealth & legacy planing. |

|

|

Apr 24 2020, 05:51 PM Apr 24 2020, 05:51 PM

Show posts by this member only | IPv6 | Post

#286

|

Junior Member

182 posts Joined: Apr 2020 |

|

|

|

|

|

|

Apr 24 2020, 05:51 PM Apr 24 2020, 05:51 PM

Show posts by this member only | IPv6 | Post

#287

|

Junior Member

182 posts Joined: Apr 2020 |

|

|

|

Apr 24 2020, 07:09 PM Apr 24 2020, 07:09 PM

|

Probation

30 posts Joined: Mar 2020 |

|

|

|

Apr 24 2020, 07:12 PM Apr 24 2020, 07:12 PM

|

Probation

30 posts Joined: Mar 2020 |

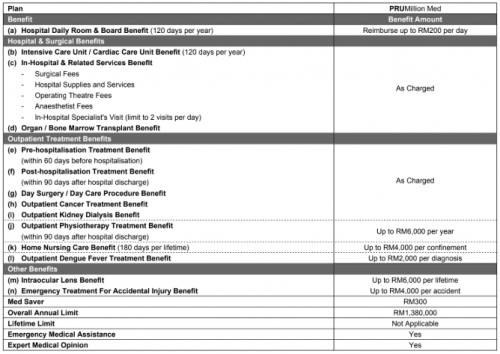

SA (Death / TPD) for the above plan is RM50k

|

|

|

Apr 24 2020, 08:12 PM Apr 24 2020, 08:12 PM

|

Junior Member

123 posts Joined: Dec 2019 |

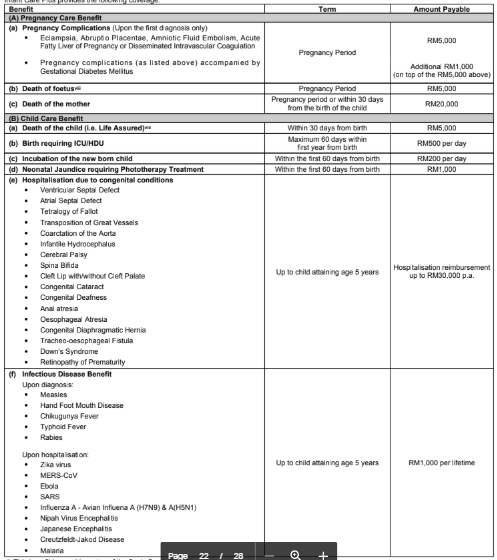

QUOTE(RAL @ Apr 24 2020, 07:09 PM)   Hi guys, what is your feedback about the above child plan to cover the baby in the womb. This one is from Prudential (Pru_my_child) & will cost around 201rm per month. Suggestions please.. You can consider similar plans from Great Eastern's SmartProtect Junior as well. |

|

|

Apr 25 2020, 02:43 AM Apr 25 2020, 02:43 AM

Show posts by this member only | IPv6 | Post

#291

|

Junior Member

109 posts Joined: Feb 2015 |

May I know is there any medical insurance where the insurance charges (not just premium) are fixed for the rest of your life?

|

|

|

Apr 25 2020, 08:04 AM Apr 25 2020, 08:04 AM

Show posts by this member only | IPv6 | Post

#292

|

Junior Member

474 posts Joined: Mar 2011 From: Kuala Lumpur |

QUOTE(smallikanbilis @ Apr 25 2020, 02:43 AM) May I know is there any medical insurance where the insurance charges (not just premium) are fixed for the rest of your life? Good morning.As it currently stands, no medical plan with fixed insurance cost. There are fixed band for age groups that will increase as you get older. This post has been edited by Cyclopes: Apr 25 2020, 08:08 AM |

|

|

Apr 25 2020, 09:07 AM Apr 25 2020, 09:07 AM

Show posts by this member only | IPv6 | Post

#293

|

Junior Member

109 posts Joined: Feb 2015 |

QUOTE(Cyclopes @ Apr 25 2020, 08:04 AM) Good morning. As it currently stands, no medical plan with fixed insurance cost. There are fixed band for age groups that will increase as you get older. Thank you. I was looking for a way to hedge against the rising medical costs but seems like it is not possible. |

|

|

|

|

|

Apr 25 2020, 09:17 AM Apr 25 2020, 09:17 AM

|

Senior Member

8,188 posts Joined: Apr 2013 |

|

|

|

Apr 25 2020, 09:24 AM Apr 25 2020, 09:24 AM

Show posts by this member only | IPv6 | Post

#295

|

Senior Member

2,866 posts Joined: Sep 2008 From: Wangsa Maju, KL |

|

|

|

Apr 25 2020, 10:28 AM Apr 25 2020, 10:28 AM

|

All Stars

10,162 posts Joined: Nov 2014 |

QUOTE(taiping... @ Apr 23 2020, 06:12 PM) Pls excuse me if I’m ignorant The premium you have saved won't be much considering you will be paying much more once you get older, whatever you have assume to "save" during the 25 period from 30 to 55 years old may be marginal against being diagnosed with any illnesses in between.Example: firstly, I’m covered by my company both life and medical. By the time I’m 55, there will b an amount that I’ve saved up for insurance. I then use this amount to purchase insurance at the age of 55 (let’s say) Secondly, if I were to buy insurance at 30years old or 55 years old, the premium would roughly be the same? If not how much difference is the premium? The money saved for 30 to55 years old, could b use to purchase insurance at 55 years old The insurance cost difference yearly of a 30 year old and 55 year old is probably about RM1000? Again, Insurance is managing your own risk. If you think the next 25 years, nothing will happen to you. Then so be it. QUOTE(farizmalek @ Apr 23 2020, 02:08 PM) QUOTE(farizmalek @ Apr 24 2020, 05:33 AM) Thank you for your feedback. Yes, the medical insurance each covered for self, wife and my dotter. Hi Fariz, from your more elaborated explanation, your medical coverage will be sufficient for now, since you are able to get coverage from Government especially your wife is a government servant.The purpose of my posting is whether our current medical insurance is sufficient. We bought it in 2014 and that was one of the best at that time. Now i am 44 and to change to a new and better one will be expensive. Beside that o have already have illness although not that serious. As a back-up, my wife is Pegawai Kerajaan and I have GL for government hospital (From my wife). Plus my sister (adik) is a specialist in UITM Hospital, Selayang (not hospital selayang). Plus without the GL from my wife, i am still covered for life for free from the government because I already donated blood more than 50 times to National Blood Center. In term of life saving, as a seaman before and also working overseas, currently I have cash: RM3,223,000 in my KWSP and ASNB. All my properties, land and cars were fully paid (No loans) and no credit card debt or personal loans. I am still working. My question is that, do i need to upgrade/change my medical insurance and also to get a life insurance from my condition above. With the age of 44 now and a sum of money in KWSP and ASNB, it will continue to snowball for you to a bigger sum in the future to cover your retirement and medical expenses (should any illnesses arise). You can consider to look into building a legacy for your family should anything happen to you earlier. QUOTE(smallikanbilis @ Apr 25 2020, 02:43 AM) May I know is there any medical insurance where the insurance charges (not just premium) are fixed for the rest of your life? There is no such thing unfortunately as medical expenses is a big variable cost to the insurance company.It's like telling a wan tan mee seller to fix their price at RM5 in 2020 until year 2100 for the same portion. Would you think it's logical ? |

|

|

Apr 25 2020, 02:44 PM Apr 25 2020, 02:44 PM

Show posts by this member only | IPv6 | Post

#297

|

Junior Member

109 posts Joined: Feb 2015 |

QUOTE(yklooi @ Apr 25 2020, 09:17 AM) Hmmm I have always wondered why some agents ask us to buy medical insurance early to protect against escalating medical fees. Seems like there is no way to get a product that features fixed cost of insurance, guaranteed renewal, and no portfolio withdrawal clause |

|

|

Apr 25 2020, 03:23 PM Apr 25 2020, 03:23 PM

|

Senior Member

8,188 posts Joined: Apr 2013 |

QUOTE(smallikanbilis @ Apr 25 2020, 02:44 PM) Hmmm I have always wondered why some agents ask us to buy medical insurance early to protect against escalating medical fees. Seems like there is no way to get a product that features fixed cost of insurance, guaranteed renewal, and no portfolio withdrawal clause I think buying when older may cost more due to loadings of pre existing illness, family history and could be subjected to lengthy in depth medical examination too....they cannot provides you with the current fixed premium for a lengthy period due to the yearly rises of medical cost....as below provides some insight of the % amount of rises per year. Medical Inflation https://infocus.wief.org/medical-inflation/ |

|

|

Apr 25 2020, 04:19 PM Apr 25 2020, 04:19 PM

Show posts by this member only | IPv6 | Post

#299

|

Senior Member

2,230 posts Joined: Jan 2006 From: K. L. |

QUOTE(smallikanbilis @ Apr 25 2020, 02:44 PM) Hmmm I have always wondered why some agents ask us to buy medical insurance early to protect against escalating medical fees. Seems like there is no way to get a product that features fixed cost of insurance, guaranteed renewal, and no portfolio withdrawal clause Start early protection mainly to cover against risk of illness.For medical fees yes you can have affordable premium during young age. With the inflation increase you still be able to pay lower premium when age grow compare to those new join. Because system calculation for risk of age / illness are not same from time to time. ILP medical good to start young as well. You may get some quote to compare. Check the same sum assured and protection for young and old age. |

|

|

Apr 25 2020, 05:14 PM Apr 25 2020, 05:14 PM

|

Junior Member

123 posts Joined: Dec 2019 |

QUOTE(smallikanbilis @ Apr 25 2020, 02:44 PM) Hmmm I have always wondered why some agents ask us to buy medical insurance early to protect against escalating medical fees. Seems like there is no way to get a product that features fixed cost of insurance, guaranteed renewal, and no portfolio withdrawal clause There is a plan from Great Eastern which features fixed/guaranteed cost of insurance which is SmartProtect Sure. It is a type of life insurance + critical illness policy but it's not the medical insurance you are looking for though. |

|

Topic ClosedOptions

|

| Change to: |  0.0198sec 0.0198sec

0.49 0.49

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 2nd December 2025 - 03:03 PM |