QUOTE(driftkids @ Jul 31 2020, 04:08 PM)

Hi, would like to ask sifus here about recommendations for investment link policy for life/total permanent disability/ci

Age 32 non smoker

1.waiver in case of having CI/TPD

2.annual limit may be 1m++

3.lifetime unlimited

4. Cover till min 80

5. Life/ci/tpd payout 300k

6. Single room 300

Better to take deductible 1k for reduce monthly? And roughly how much premium will increase over time?

Budget around annual premium of 3k

Thank you.

Taking an ILP now will lock in the premium that you need to contribute that is recommended to sustain until certain age i.e your case, you want until 80 years old. However should there be any medical repricing over the years by the insurance company, they may recommend you to increase your premium payable in order to maintain the same original sustainability (80 years), otherwise you may be advised by the insurance company that your term would have been shortened / reduced ((say dropped to until 75 years) due to the increase in cost of insurance if you refuse to top up the difference recommended by the insurance company.Age 32 non smoker

1.waiver in case of having CI/TPD

2.annual limit may be 1m++

3.lifetime unlimited

4. Cover till min 80

5. Life/ci/tpd payout 300k

6. Single room 300

Better to take deductible 1k for reduce monthly? And roughly how much premium will increase over time?

Budget around annual premium of 3k

Thank you.

Now, moving back to your main inquiry, having deductible will definitely reduce your cost of insurance incurred for your hospital & surgical benefit (which a lot of people would call it the "Medical Card").

However most of the famous companies nowadays will allocate up to 300 as a deductible instead of 1,000, some other options are 5,000 - 100,000 deductible.

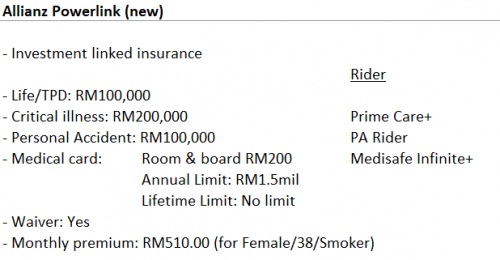

Based on what you are requesting, it's kind of impossible to get the said benefit for 3,000 yearly. You may need to increase your budget or reduce the benefits / terms of the policy i.e 70 years instead of 80.

This post has been edited by lifebalance: Jul 31 2020, 04:18 PM

Jul 31 2020, 04:14 PM

Jul 31 2020, 04:14 PM

Quote

Quote

0.2092sec

0.2092sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled