QUOTE(gsem984 @ Jan 19 2020, 09:30 PM)

i attended a dinner organised by this so called iFast agent. people there got newbie like me and some existing clients to it. those already joined kept telling me how much they earn like 6 to 10% a year by simply just dump the money to iFast and let the agents there manage their fund.

the agent kept assuring me how transparent and how flexible their fund management is.

i don't believe easy money in this world. but 6% to 10% annually is really very good. much better than FD.

i wonder anyone here also a client to iFast and can share with me your experience?

thanks

Hi gsem984

I invest in funds at iFast and PMO (Public Mutual).

I can't confirm if that agent you're telling us about is a scammer or not. But I advise you to not fully 100% depend on any agent and do your own research about the funds. And it's not recommended to let them manage your iFast & bank account.

Anyway, I would like to share my experience.

For PMO, although I have an agent, he doesn't do anything & reluctant to help do anything, and so I have to manage my own funds. But hey, at least I am able to manage my funds via their online system without relying on my lazy agent.

For iFast, my agent (advisor) marketed it to me as a fully online system. However, it's actually not. For us clients, all we can do is view funds, and deposit money into our iFast account to be used by our agent to invest in funds. We can't manage our own funds and need to rely on the agent to do it. So better get an agent who will cooperate with you, if not, you sure vomit blood.

Usually I'll do some research, and then I'll contact my agent, and tell him which fund I would like to invest in. He'll give feedback regarding that fund. If I wish to proceed, then I'll need to deposit cash into my iFast account. And then my agent will follow-up, and that's it.

Anyway, the only reason why I prefer to invest in iFast funds compared to PMO is because I found that iFast funds are doing way better.

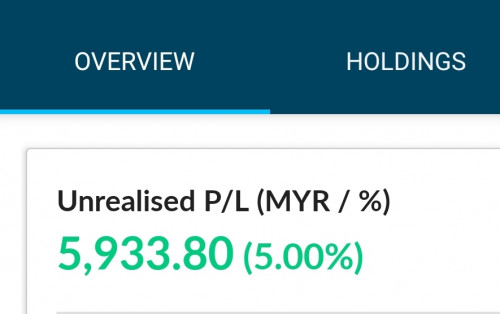

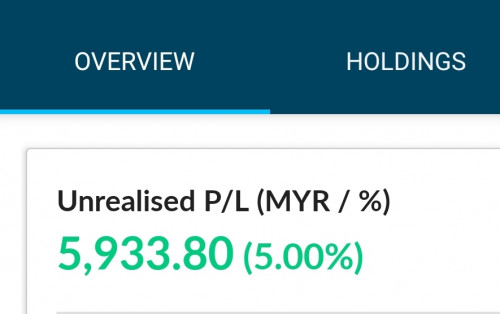

I started investing at iFast in Oct 2019. Attached is the screenshot of "Unrealised P/L".

This post has been edited by LemonSeed.Tea: Jan 23 2020, 03:33 AM

This post has been edited by LemonSeed.Tea: Jan 23 2020, 03:33 AM

Jan 19 2020, 09:30 PM, updated 6y ago

Jan 19 2020, 09:30 PM, updated 6y ago

Quote

Quote

0.0247sec

0.0247sec

0.81

0.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled