Outline ·

[ Standard ] ·

Linear+

Banking Privilege$aver by Standard Chartered, up to 4.75%, Seems like so few people talk about it

|

Hobbez

|

Aug 25 2020, 01:07 PM Aug 25 2020, 01:07 PM

|

|

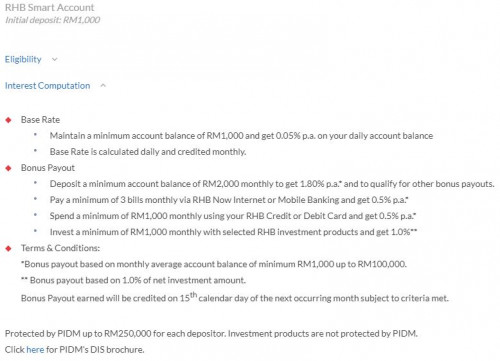

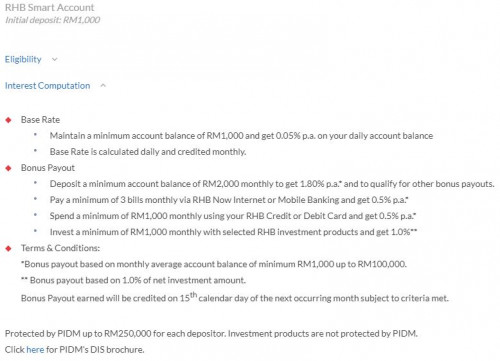

QUOTE(GrumpyNooby @ Aug 18 2020, 02:39 PM) RHB Smart Account interest rate has been revised to 2.85% pa effective 13/7/2020  How does this compare with StanChart? It looks much better if their base rate is currently 2.85% while StanChart is going to be 1.5% within a few days from now. StanChart rate only looks good if you invest in one of their Insurance/Unit Trust products. This post has been edited by Hobbez: Aug 25 2020, 01:08 PM |

|

|

|

|

|

Hobbez

|

Aug 25 2020, 02:38 PM Aug 25 2020, 02:38 PM

|

|

QUOTE(GrumpyNooby @ Aug 25 2020, 01:14 PM) It's just 2.6% (2 conditions for SC PSA) vs 2.85% (3 conditions for RHB Smart Account). No investment/insurance to be considered for both. I thought the SC is 3.5% due to 1.5% for the base PSA plus 2% extra for taking their Bancassurance? |

|

|

|

|

|

Hobbez

|

Aug 25 2020, 03:20 PM Aug 25 2020, 03:20 PM

|

|

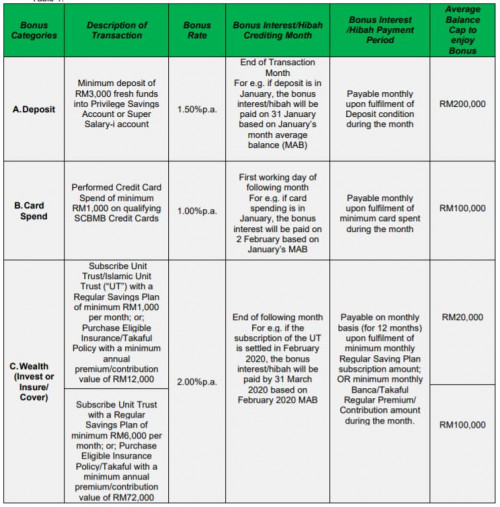

QUOTE(GrumpyNooby @ Aug 25 2020, 02:45 PM) Ya this is what I meant. With RM3000 every mth in, the interest is 1.5%. And then with Bancassurance can get additional 2%. |

|

|

|

|

|

Hobbez

|

Apr 24 2021, 01:24 PM Apr 24 2021, 01:24 PM

|

|

QUOTE(cucikaki @ Apr 21 2021, 07:41 PM) I change to rhb in january, but it lasted for 1 week only. I transfer rm50k to my account via SCB, and can see the money instantly, but the money went ‘completely gone’ from my account next day. It took them 4 working days to rectify the error. CS is unable to reach. Need call the ‘lost card’ centre and they keep saying they only lost card cant do anything. Other number if call like 9 years no one pick up. Once issue settle, they say due to new account la what ever bullshit they give. I’ll stick with my SCB, better service. Superior customer service experience Local vs Foreign. Of course lah, foreign standard is better than Malaysia standard 95% of the time.... |

|

|

|

|

|

Hobbez

|

Apr 24 2021, 01:27 PM Apr 24 2021, 01:27 PM

|

|

Hong Leong having promotion 3.6% interest.

1.6% to FD and 2% cashback to CC.

It seems similar to such conditional yield programs...

6 mths and 50k limitation. They give you a CC and you just need to spend RM200+ a month.

It might work if your expenses are a must every month....

This post has been edited by Hobbez: Apr 24 2021, 01:28 PM

|

|

|

|

|

|

Hobbez

|

Apr 24 2021, 02:41 PM Apr 24 2021, 02:41 PM

|

|

QUOTE(!@#$%^ @ Apr 24 2021, 02:07 PM) I was offered this by a HLB promoter within the bank. Maybe you have to walk in to a branch to find out. |

|

|

|

|

|

Hobbez

|

Aug 1 2021, 04:35 PM Aug 1 2021, 04:35 PM

|

|

QUOTE(Cookie101 @ Aug 1 2021, 11:28 AM) It seems scb just paid interest based on previous tnc. Not complaining  What rate is it now? Seems much lower now. Might as well you take your money and put into any reasonable FD is much better........ |

|

|

|

|

|

Hobbez

|

Aug 1 2021, 07:17 PM Aug 1 2021, 07:17 PM

|

|

QUOTE(Cookie101 @ Aug 1 2021, 05:01 PM) I’m ok with parking there for 4.75% 😌 Even if 4.3 still ok. Can you give a breakdown of your interest? I am only getting for the RM3000 credit and the Debit card usage and even then, it doesn't seem to add up. Much lower than what I expected. |

|

|

|

|

Aug 25 2020, 01:07 PM

Aug 25 2020, 01:07 PM

Quote

Quote

0.8548sec

0.8548sec

0.32

0.32

7 queries

7 queries

GZIP Disabled

GZIP Disabled