HPP Holdings Bhd, which is involved in the printing, production, and sales and marketing of paper-based packaging, as well as trading and production of rigid boxes, is seeking a listing on the ACE Market of Bursa Malaysia to raise funds for capital expenditure and expansion, to repay borrowings and for working capital.

According to its draft prospectus seen on the Securities Commission Malaysia's website, its initial public offering (IPO) entails the issuance of 88.67 million new shares, representing 22.83% of the company's enlarged issued share capital.

It also involves an offer for sale of 20 million existing shares, representing 5.15% of its enlarged issued share capital, by way of private placement to selected bumiputera investors.

Of the public issue of 88.67 million, 19.42 million shares will be available for application by the Malaysian public, 30 million shares for its eligible directors, employees and other business associates and 39.25 million shares by way of private placement to selected investors and bumiputera investors.

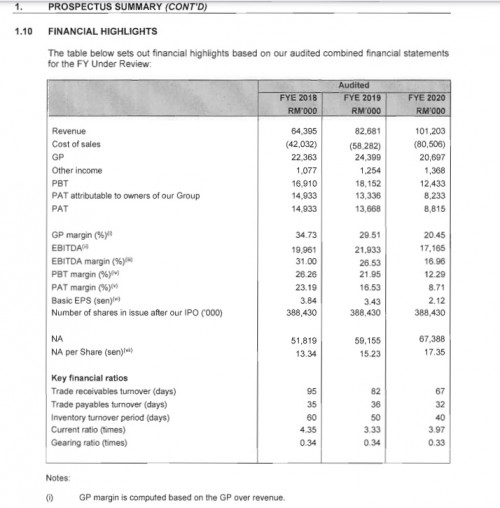

For the financial year ended May 31, 2019, HPP Holdings posted a 28.4% increase in revenue to RM82.68 million from RM64.4 million in the previous year. The group's revenue is mainly derived from printing and production of corrugated packaging, accounting for 36.23% of total revenue for FY19, and non-corrugated packaging 39.98%, while trading of rigid boxes contributed 18.25%.

Its revenue is mainly derived from its customers in Malaysia, constituting 94.36%. It also exports to Singapore, Thailand, Myanmar, the US, Germany and Australia.

https://www.theedgemarkets.com/article/hpp-...capex-expansion

This post has been edited by nexona88: Dec 16 2020, 03:35 PM

HPP Holdings Bhd (0228), Ace Market

Jan 5 2020, 04:04 PM, updated 5y ago

Jan 5 2020, 04:04 PM, updated 5y ago

Quote

Quote

0.0231sec

0.0231sec

1.81

1.81

6 queries

6 queries

GZIP Disabled

GZIP Disabled