even opus touch support boost now i wonder when FSM will support e-wallet

Opus Touch, Self-Service UT Platform

Opus Touch, Self-Service UT Platform

|

|

Mar 1 2020, 11:32 PM Mar 1 2020, 11:32 PM

Return to original view | Post

#1

|

Senior Member

2,106 posts Joined: Jul 2018 |

even opus touch support boost now i wonder when FSM will support e-wallet

|

|

|

|

|

|

Mar 6 2020, 05:38 PM Mar 6 2020, 05:38 PM

Return to original view | Post

#2

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(xeon1989 @ Mar 5 2020, 09:03 PM) QUOTE(abcn1n @ Mar 5 2020, 09:29 PM) I think for investment compliance, your funding of investment account, must be coming from your own bank accountbut for the case of BOOST > Opus Touch, I aint sure if they validate that |

|

|

Mar 6 2020, 05:52 PM Mar 6 2020, 05:52 PM

Return to original view | Post

#3

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(GrumpyNooby @ Mar 6 2020, 05:40 PM) Same phone number as in Boost. They assume that the Boost account you used to make payment should be using same NRIC as per your Opus account. QUOTE(tan_aniki @ Mar 6 2020, 05:42 PM) In that case better dont try fishy thing of paying opus touch through other BOOST, or else the money as far I known will be hold and trigger refund process which take at least one business day |

|

|

Mar 12 2020, 10:34 AM Mar 12 2020, 10:34 AM

Return to original view | Post

#4

|

Senior Member

2,106 posts Joined: Jul 2018 |

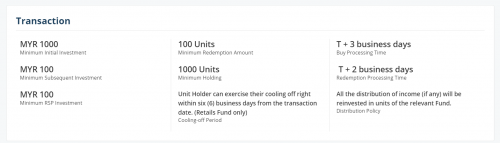

QUOTE(BacktoBasics @ Mar 11 2020, 10:55 AM) How as it? you got your redemption T+2?I remember previously on FSM Opus Income Plus Redemption is T+1 too but now changed to T+2 if I am not wrong. https://www.fundsupermart.com.my/fsmone/fun...ncome-Plus-Fund  |

|

|

Mar 17 2020, 10:01 AM Mar 17 2020, 10:01 AM

Return to original view | Post

#5

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 17 2020, 02:53 PM Mar 17 2020, 02:53 PM

Return to original view | Post

#6

|

Senior Member

2,106 posts Joined: Jul 2018 |

wah the market so scary now even FI funds also can lose few percent, better put boost money to money market for safe

|

|

|

|

|

|

Mar 17 2020, 02:59 PM Mar 17 2020, 02:59 PM

Return to original view | Post

#7

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 19 2020, 02:05 PM Mar 19 2020, 02:05 PM

Return to original view | Post

#8

|

Senior Member

2,106 posts Joined: Jul 2018 |

FI funds drop a lot people are selling bonds holdings?

This post has been edited by tadashi987: Mar 19 2020, 02:05 PM |

|

|

Mar 20 2020, 09:02 AM Mar 20 2020, 09:02 AM

Return to original view | Post

#9

|

Senior Member

2,106 posts Joined: Jul 2018 |

woah dropped 3% in a week, gg

|

|

|

Mar 26 2020, 02:09 PM Mar 26 2020, 02:09 PM

Return to original view | Post

#10

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Mar 31 2020, 03:05 PM Mar 31 2020, 03:05 PM

Return to original view | Post

#11

|

Senior Member

2,106 posts Joined: Jul 2018 |

Anyone here aware that if I sell SIPF and IPF together at same day and same time, it will be seperate payment ?

also, SIPF payment will be later than IPF? as I have received the payment for IPF but SIPF. |

|

|

Apr 12 2020, 03:12 AM Apr 12 2020, 03:12 AM

Return to original view | Post

#12

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Apr 17 2020, 09:26 AM Apr 17 2020, 09:26 AM

Return to original view | Post

#13

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(GrumpyNooby @ Apr 16 2020, 07:24 PM) QUOTE(tan_aniki @ Apr 16 2020, 08:13 PM) if want to get more profit must dump more in but anyway this is not a high risk investment wah u parking more than 95k in FI funds and with this rise my calculation was more than 20% pa rate |

|

|

|

|

|

Apr 17 2020, 10:14 AM Apr 17 2020, 10:14 AM

Return to original view | Post

#14

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(cucikaki @ Apr 17 2020, 10:02 AM) I suffered so bad from my 10k place early march, but slowly has recovered. My heart also stopped during mid march when it start to drop like crazy. Current at 1.47% loss. Luckily i didnt decide to cut loss like what other people did last time dont worry FI funds shoudn't be having big downfall, march downfall is global recession, keep DCA you will soon back on track Today up the highest after everyone read ur statement ahahah |

|

|

Apr 27 2020, 09:09 PM Apr 27 2020, 09:09 PM

Return to original view | Post

#15

|

Senior Member

2,106 posts Joined: Jul 2018 |

Not sure why everytime getting into the Account Module or Account details is very slow, can take more than 10 seconds

|

|

|

Apr 28 2020, 11:29 AM Apr 28 2020, 11:29 AM

Return to original view | Post

#16

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Apr 29 2020, 02:32 PM Apr 29 2020, 02:32 PM

Return to original view | Post

#17

|

Senior Member

2,106 posts Joined: Jul 2018 |

so so far SIPF or IPF performance better hehe

|

|

|

Apr 29 2020, 03:36 PM Apr 29 2020, 03:36 PM

Return to original view | Post

#18

|

Senior Member

2,106 posts Joined: Jul 2018 |

|

|

|

Apr 29 2020, 08:31 PM Apr 29 2020, 08:31 PM

Return to original view | Post

#19

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(frostbyte13 @ Apr 29 2020, 07:05 PM) Hi fellow Sifus. Newbie here. I use Boost a lot so one of the reasons why I am here is to look for bond funds I can maximise with Boost returns. Alternatively, I am also curious if Opus AM funds are so far performing based on your personal experiences & also whether the timing into the bond market is still considered a good window. Very recently got some cash & already DCA into StashAway so need a new basket. TQTQ in advance Cant say Opus Fixed income fund is the best performing but so far it is ok. there is no good timing to enter the bond market since bond is fixed income, not equities with great volatility that go up and down most of the time, bond fund tend to go up slowlyThis post has been edited by tadashi987: Apr 29 2020, 08:31 PM |

|

|

Apr 29 2020, 08:51 PM Apr 29 2020, 08:51 PM

Return to original view | Post

#20

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(GrumpyNooby @ Apr 29 2020, 08:34 PM) Isn't bond sensitive to interest rate movement? not too sure but i think they are interrelated to an extent. Not sure that's why the reason bond return rate is increasing lately compare to few years back then since interest rate cutThe underlying debt papers are sensitive to credit rating and credit default swap. Both is the measure of default risk. |

| Change to: |  0.0260sec 0.0260sec

0.58 0.58

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 09:31 PM |