QUOTE(MNet @ Jan 4 2020, 10:54 PM)

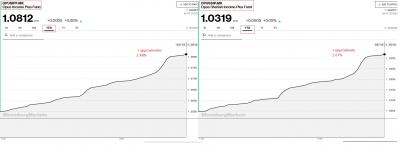

Its 0% for bond fund as u can see at here

https://www.fundsupermart.com.my/fsmone/fun...ncome-Plus-Fund

Opus touch sales charge are... Read post 6 & 7https://www.fundsupermart.com.my/fsmone/fun...ncome-Plus-Fund

Opus can use Boost which gives out "points"

Opus does not has platform fees unlike the place in that link for that Opus Income Plus Fund

This post has been edited by T231H: Jan 5 2020, 08:18 AM

Jan 5 2020, 01:18 AM

Jan 5 2020, 01:18 AM

Quote

Quote

0.0695sec

0.0695sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled