Total return of OPUS INCOME PLUS FUND for the period from 28 Sep 2020 to 22 Dec 2020 is (0.2700) %.

Seems like pathetic return.

Opus Touch, Self-Service UT Platform

|

|

Dec 26 2020, 05:23 PM Dec 26 2020, 05:23 PM

Return to original view | IPv6 | Post

#541

|

All Stars

12,387 posts Joined: Feb 2020 |

Total return of OPUS SHARIAH INCOME PLUS FUND for the period from 28 Sep 2020 to 22 Dec 2020 is (0.3800) %.

Total return of OPUS INCOME PLUS FUND for the period from 28 Sep 2020 to 22 Dec 2020 is (0.2700) %. Seems like pathetic return. |

|

|

|

|

|

Dec 29 2020, 06:44 AM Dec 29 2020, 06:44 AM

Return to original view | Post

#542

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 30 2020, 02:27 PM Dec 30 2020, 02:27 PM

Return to original view | Post

#543

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Dec 30 2020, 11:08 PM Dec 30 2020, 11:08 PM

Return to original view | IPv6 | Post

#544

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 1 2021, 04:50 PM Jan 1 2021, 04:50 PM

Return to original view | IPv6 | Post

#545

|

All Stars

12,387 posts Joined: Feb 2020 |

Details: https://www.opusasset.com/opusgoes100/ This post has been edited by GrumpyNooby: Jan 1 2021, 04:54 PM |

|

|

Jan 6 2021, 01:48 PM Jan 6 2021, 01:48 PM

Return to original view | Post

#546

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jan 7 2021, 12:24 PM Jan 7 2021, 12:24 PM

Return to original view | Post

#547

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 13 2021, 03:37 PM Jan 13 2021, 03:37 PM

Return to original view | Post

#548

|

All Stars

12,387 posts Joined: Feb 2020 |

Full redemption on SIPF on Monday.

Yesterday around 7pm receive the proceed in CIMB. |

|

|

Jan 13 2021, 03:39 PM Jan 13 2021, 03:39 PM

Return to original view | Post

#549

|

All Stars

12,387 posts Joined: Feb 2020 |

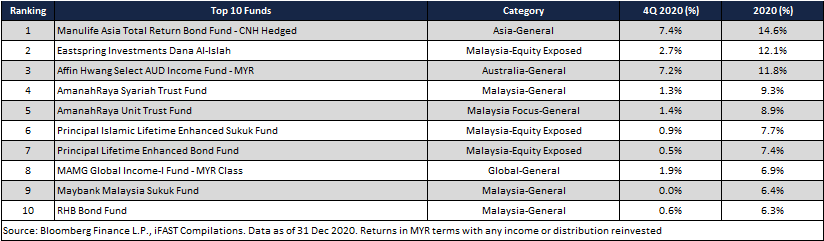

QUOTE(ironman16 @ Jan 13 2021, 03:38 PM) Amanahraya ... top 4 fixed income fund https://www.fsmone.com.my/funds/research/ar...ncome?src=funds This post has been edited by GrumpyNooby: Jan 13 2021, 03:40 PM |

|

|

Jan 18 2021, 08:10 PM Jan 18 2021, 08:10 PM

Return to original view | IPv6 | Post

#550

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 18 2021, 08:12 PM Jan 18 2021, 08:12 PM

Return to original view | IPv6 | Post

#551

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Jan 20 2021, 06:23 PM Jan 20 2021, 06:23 PM

Return to original view | IPv6 | Post

#552

|

All Stars

12,387 posts Joined: Feb 2020 |

Bank Negara extends flexibility for banks to use MGS, MGII

KUALA LUMPUR: Bank Negara Malaysia has extended the flexibility for banking institutions to use MGS and MGII to meet the Statutory Reserve Requirement (SRR) until Dec 31,2022. In a statement issued on Wednesday it said this flexibility for them to use the Malaysian Government Securities and Malaysian Government Investment Issues -- previously announced on May 5 last year – is currently applicable until May 31, 2021. The SRR ratio remains unchanged at 2%. https://www.thestar.com.my/business/busines...to-use-mgs-mgii |

|

|

Jan 21 2021, 11:51 AM Jan 21 2021, 11:51 AM

Return to original view | Post

#553

|

All Stars

12,387 posts Joined: Feb 2020 |

Malaysia continues to see strong foreign bond buying in December, says MARC KUALA LUMPUR (Jan 21): Malaysia’s bond market continued to see net positive foreign inflows in December for the eighth consecutive month, despite Fitch's downgrade of Malaysia’s sovereign credit rating amid the Covid-19 pandemic, said Malaysian Rating Corp Bhd (MARC). MARC said that with net foreign inflows coming in at RM3.6 billion (November: RM2.5 billion), total foreign holdings rose to RM223.0 billion, the highest since November 2016. “This took the total foreign share of outstanding local bonds to 13.9% (November: 13.6%),” it said. It added the Malaysian Government Securities (MGS) and Government Investment Issues (GII) were the primary drivers of December’s net foreign inflows. Foreign holdings of MGS rose by RM2.4 billion to RM177.3 billion, which is equivalent to 41.1% of total outstanding MGS. Meanwhile, foreign holdings of GII increased by RM1.4 billion to RM24.8 billion, representing 6.6% of total outstanding GII. https://www.theedgemarkets.com/article/mala...ember-says-marc no6 liked this post

|

|

|

|

|

|

Jan 29 2021, 10:21 AM Jan 29 2021, 10:21 AM

Return to original view | IPv6 | Post

#554

|

All Stars

12,387 posts Joined: Feb 2020 |

Moody’s maintains Malaysia’s rating

PETALING JAYA: Moody’s Investors Service’s move to affirm Malaysia’s A3 rating is testimony to the government’s strong fiscal discipline and robust medium-term growth prospects amid the Covid-19 pandemic, Tengku Datuk Seri Zafrul Tengku Abdul Aziz says. The Finance Minister said yesterday the rating agency acknowledged Malaysia’s economic prospects due to the earnest containment measures, including four comprehensive economic stimulus packages valued at RM305bil, or about 20% of gross domestic product (GDP). “It also demonstrates Moody’s confidence in Malaysia amidst unprecedented credit rating adjustments globally, with Credit Rating Agencies (CRAs) taking more than 220 negative rating actions since the onset of the pandemic, ” he said in a statement. The International Monetary Fund (IMF), he said, estimated the global economy contracted by 3.5% in 2020, while facing an estimated cost of US$22 trillion from 2020 to 2025. As for Malaysia, Tengku Zafrul said these four economic stimulus packages announced throughout 2020 are expected to have contributed up to four percentage points to GDP and on track with a projected growth target of 6.5% to 7.5% in 2021. https://www.thestar.com.my/business/busines...alaysias-rating |

|

|

Jan 30 2021, 05:12 PM Jan 30 2021, 05:12 PM

Return to original view | IPv6 | Post

#555

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(!@#$%^ @ Jan 30 2021, 05:00 PM) Wondering if Grab is going to venture into wealth management/financial service products, which fund house will they partner with? Boost x Opus Asset Management Versa x Affin Hwang Asset Management TnG e-wallet x Principal Asset Management Grab x ??? This post has been edited by GrumpyNooby: Jan 30 2021, 05:12 PM |

|

|

Jan 31 2021, 06:18 PM Jan 31 2021, 06:18 PM

Return to original view | IPv6 | Post

#556

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(alandhw @ Jan 31 2021, 06:15 PM) TnG x Principal Asset ManagementQUOTE(GrumpyNooby @ Jan 13 2021, 01:11 PM) TNG Digital receives approval to directly distribute capital market products Versa: https://versa.com.my/KUALA LUMPUR: Touch 'n Go Group's (TNG) subsidiary TNG Digital Sdn Bhd has been granted conditional approval to operate as a recognised market operator (RMO) by the Securities Commission. It said in a statement that the conditional approval will enable it to directly distribute capital market products, including money market unit trust funds, through the Touch 'n Go eWallet platform without having to be directed to third-party applications. TNG group CEO Effendy Shahul Hamid said the RMO status will allow it to bring a string of innovative digital offerings to its users. The group aims to disrupt the status quo and will be launching a financially inclusive investment product in the first quarter of the year, allowing users to access basic investment services for as low as RM10. “We feel that this offering will add significant value to our large payments and transportation user base and continue our evolution into financial services. "We aim to make this an extremely seamless and frictionless offer to Touch ‘n Go eWallet users. With the approvals behind us, we will now focus on ensuring the user experience is best-in-class as we move towards a launch,” he said. The proposition is a collaboration between TNG and fund management company Principal Asset Management, combining the platform development, technology and data expertise of Touch ‘n Go eWallet and Principal’s expertise in investment strategy and fund management. Using Touch ‘n Go eWallet as a delivery platform also supports the nations digital and cashless agenda; as well as support financial inclusion, it said. https://www.thestar.com.my/business/busines...market-products Discussion thread: https://forum.lowyat.net/topic/4962773/+200#entry99822676 |

|

|

Feb 2 2021, 04:51 PM Feb 2 2021, 04:51 PM

Return to original view | Post

#557

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 19 2021, 07:09 AM Feb 19 2021, 07:09 AM

Return to original view | Post

#558

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 19 2021, 07:46 AM Feb 19 2021, 07:46 AM

Return to original view | Post

#559

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Feb 21 2021, 06:19 PM Feb 21 2021, 06:19 PM

Return to original view | IPv6 | Post

#560

|

All Stars

12,387 posts Joined: Feb 2020 |

Nobody shares about this? Looking to grow your savings? As we welcome this ox-picious new year, we will be rewarding RM8.88 cashback* when you start investing at least RM100 with us! Find out more at https://www.opusasset.com/moomoolahopus2021/ So go on and grab this offer, and grow your wealth for your future. *Terms and conditions apply.  Campaign link: https://www.opusasset.com/moomoolahopus2021...EoWotANxPwHPlyg This post has been edited by GrumpyNooby: Feb 21 2021, 06:19 PM extinct_83 liked this post

|

| Change to: |  0.1560sec 0.1560sec

0.29 0.29

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 9th December 2025 - 02:41 AM |