QUOTE(majorarmstrong @ Sep 30 2020, 04:37 PM)

From Opus portal, they disclosed that they're only managing RM 7 bil + only!

Opus Touch, Self-Service UT Platform

|

|

Sep 30 2020, 04:39 PM Sep 30 2020, 04:39 PM

Return to original view | IPv6 | Post

#381

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Sep 30 2020, 05:40 PM Sep 30 2020, 05:40 PM

Return to original view | IPv6 | Post

#382

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(majorarmstrong @ Sep 30 2020, 05:36 PM) app ka no app ka same same la If app is being marinated properly, buy order can be executed seamlessly via pass-through mechanism to e-wallet app (Boost at the mean time) like FavePay.as long as can buy and sell itu saja for me is buy more than sell as i dont really sell just buying RM500 per week Can save a lot of time and mouse clicks! |

|

|

Sep 30 2020, 09:04 PM Sep 30 2020, 09:04 PM

Return to original view | IPv6 | Post

#383

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV update for 30/9/2020:

IPF: 1.0736 -> 1.0762 (+0.0026) SIPF: 1.0265 -> 1.0282 (+0.0017) This post has been edited by GrumpyNooby: Sep 30 2020, 09:04 PM |

|

|

Oct 1 2020, 07:24 AM Oct 1 2020, 07:24 AM

Return to original view | Post

#384

|

All Stars

12,387 posts Joined: Feb 2020 |

https://www.opusasset.com/opusgoes100/ This post has been edited by GrumpyNooby: Oct 1 2020, 04:56 PM |

|

|

Oct 1 2020, 07:35 AM Oct 1 2020, 07:35 AM

Return to original view | Post

#385

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 09:43 AM Oct 1 2020, 09:43 AM

Return to original view | Post

#386

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 1 2020, 09:40 AM) I think if you don't have either one of the funds or neither both funds in your portfolio, you can invest by just putting RM 100. ironman16 liked this post

|

|

|

|

|

|

Oct 1 2020, 02:42 PM Oct 1 2020, 02:42 PM

Return to original view | Post

#387

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 02:57 PM Oct 1 2020, 02:57 PM

Return to original view | Post

#388

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 1 2020, 04:45 PM Oct 1 2020, 04:45 PM

Return to original view | IPv6 | Post

#389

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 2 2020, 09:38 AM Oct 2 2020, 09:38 AM

Return to original view | Post

#390

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV update for 1/10/2020:

IPF: 1.0762 -> 1.0759 (-0.0003) SIPF: 1.0282 -> 1.0280 (-0.0002) |

|

|

Oct 2 2020, 12:57 PM Oct 2 2020, 12:57 PM

Return to original view | Post

#391

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 3 2020, 11:00 AM Oct 3 2020, 11:00 AM

Return to original view | IPv6 | Post

#392

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 3 2020, 10:21 AM) so, conclude its between bond fund and money market fund???? The weightage of the assets allocation matterssorry, i no quite understand this SSTPLR compare to Income Plus Fund.....last time ask CS what is the different between this two (SSTPLR vs IPF), only mention is bond fund and no further explanation... ironman16 liked this post

|

|

|

Oct 3 2020, 12:18 PM Oct 3 2020, 12:18 PM

Return to original view | IPv6 | Post

#393

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(ironman16 @ Oct 3 2020, 12:14 PM) Yes, of course.Read the fund prospectus or PHS. ironman16 liked this post

|

|

|

|

|

|

Oct 5 2020, 09:14 AM Oct 5 2020, 09:14 AM

Return to original view | Post

#394

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV update for 2/10/2020:

IPF: 1.0759 -> 1.0774 (+0.0015) SIPF: 1.0280 -> 1.0300 +0.0020) |

|

|

Oct 5 2020, 09:19 AM Oct 5 2020, 09:19 AM

Return to original view | Post

#395

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 5 2020, 10:01 AM Oct 5 2020, 10:01 AM

Return to original view | Post

#396

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 6 2020, 10:09 AM Oct 6 2020, 10:09 AM

Return to original view | Post

#397

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV update for 5/10/2020:

IPF: 1.0774 -> 1.0778 (+0.0004) SIPF: 1.0300 -> 1.0305 (+0.0005) This post has been edited by GrumpyNooby: Oct 7 2020, 09:09 AM |

|

|

Oct 6 2020, 08:49 PM Oct 6 2020, 08:49 PM

Return to original view | IPv6 | Post

#398

|

All Stars

12,387 posts Joined: Feb 2020 |

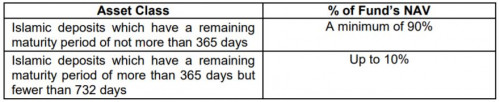

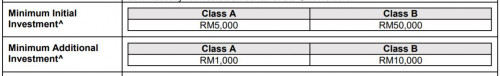

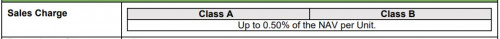

OPUS SHARIAH CASH MANAGEMENT PLUS FUND - CLASS A and OPUS SHARIAH CASH MANAGEMENT PLUS FUND - CLASS B

It's not 0% sales harge and also initial investment is not RM 1000 (like normal unit trust fund). Asset Allocation  Initial & Additional Investment  Sales Charge  Fund link (for Class A): https://www.opusasset.com/products/unit-tru...s-fund-class-a/ Fund link (for Class B): https://www.opusasset.com/products/unit-tru...s-fund-class-b/ PHS link: https://www.opusasset.com/wp-content/upload...v=1601988100091 Prospectus link: https://www.opusasset.com/wp-content/upload...v=1601988100091 |

|

|

Oct 7 2020, 07:05 AM Oct 7 2020, 07:05 AM

Return to original view | Post

#399

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

Oct 7 2020, 09:09 AM Oct 7 2020, 09:09 AM

Return to original view | Post

#400

|

All Stars

12,387 posts Joined: Feb 2020 |

NAV update for 6/10/2020:

IPF: 1.0778 -> 1.0781 (+0.0003) SIPF: 1.0305 -> 1.0305 (no change) |

| Change to: |  0.0670sec 0.0670sec

0.67 0.67

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 11th December 2025 - 11:56 AM |