Investment Forex Version 21, Foreign Exchange Market Discussion

Investment Forex Version 21, Foreign Exchange Market Discussion

|

|

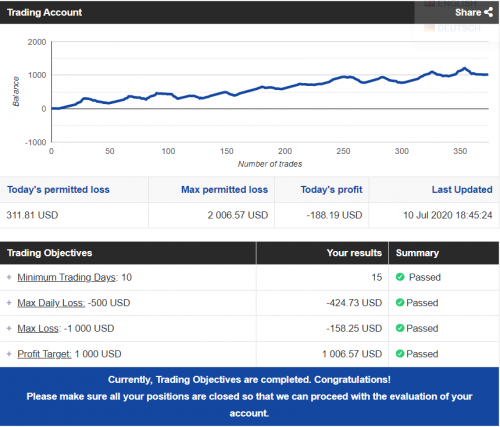

Jul 14 2020, 08:45 AM Jul 14 2020, 08:45 AM

Return to original view | IPv6 | Post

#1

|

Junior Member

115 posts Joined: Aug 2015 |

mrbigggyyy liked this post

|

|

|

|

|

|

Jul 14 2020, 05:51 PM Jul 14 2020, 05:51 PM

Return to original view | IPv6 | Post

#2

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

Jul 3 2022, 09:47 AM Jul 3 2022, 09:47 AM

Return to original view | IPv6 | Post

#3

|

Junior Member

115 posts Joined: Aug 2015 |

yooxie liked this post

|

|

|

Jul 3 2022, 08:49 PM Jul 3 2022, 08:49 PM

Return to original view | IPv6 | Post

#4

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

Jul 4 2022, 08:35 AM Jul 4 2022, 08:35 AM

Return to original view | IPv6 | Post

#5

|

Junior Member

115 posts Joined: Aug 2015 |

QUOTE(dwRK @ Jul 4 2022, 12:17 AM) I have quite a lot of commercial EAs and most of the commercial EAs are applying Martingale and Grid concept or the Martingale+Grid combination.I found that if I am using the default settings, eventually all of them will fail. The easy way to take advantage of these failed systems is just reversing their trades. So I just created a few demo accounts and run these EAs with the more dangerous settings to make them to burst faster. And I am using a trade copier to reverse with some time filtering conditions. My automated trading is just acting like a b-book broker |

|

|

Jul 5 2022, 01:20 AM Jul 5 2022, 01:20 AM

Return to original view | Post

#6

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

|

|

|

Jul 7 2022, 08:54 AM Jul 7 2022, 08:54 AM

Return to original view | IPv6 | Post

#7

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

Jul 8 2022, 05:39 AM Jul 8 2022, 05:39 AM

Return to original view | IPv6 | Post

#8

|

Junior Member

115 posts Joined: Aug 2015 |

QUOTE(dwRK @ Jul 7 2022, 09:48 AM) sure... as per namesake its is trend following on 15 min timeframe... using... cci mfi vwap sma macd sar linearregression rsi*2 kdj and stoch*2 indicators... some are redundant but its only testing so why not... hahaha... from above i created 12 conditions, but any 9 will trigger entry... this will be hard to program into my bot.... so i probably need to group them into mandatory(AND) + optional(OR) triggers... this will have a hit in the results... only have one exit trigger, no partial profit, no stoploss, no dca... on ranging periods, lots of small hits and misses... still figuring out how to reduce this... most of the big drawdown is because of this... anyways will code this out and see how it does live testing... Wishing you very much success with this strategy! |

|

|

Jul 14 2022, 06:47 PM Jul 14 2022, 06:47 PM

Return to original view | IPv6 | Post

#9

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

Jul 31 2022, 09:29 AM Jul 31 2022, 09:29 AM

Return to original view | IPv6 | Post

#10

|

Junior Member

115 posts Joined: Aug 2015 |

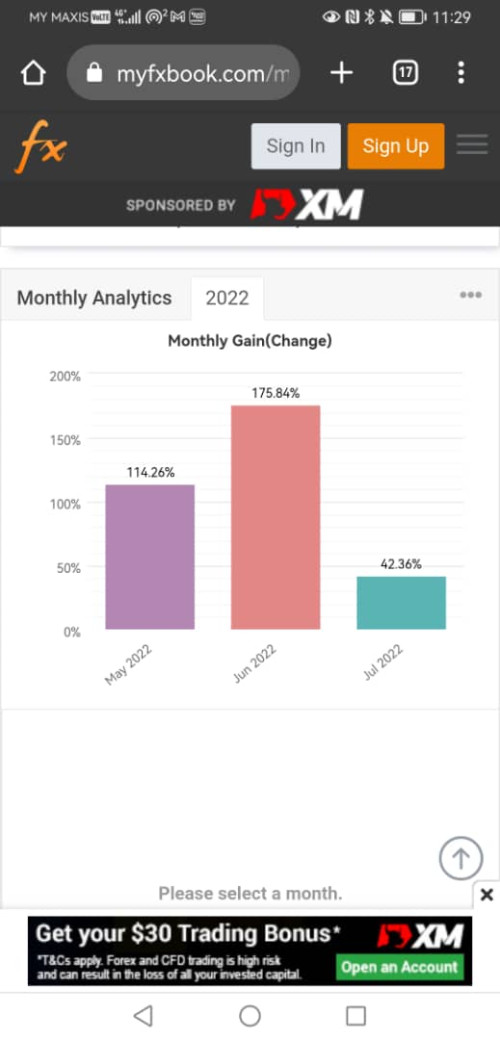

QUOTE(Macau @ Jul 4 2022, 08:35 AM) I have quite a lot of commercial EAs and most of the commercial EAs are applying Martingale and Grid concept or the Martingale+Grid combination. I found that if I am using the default settings, eventually all of them will fail. The easy way to take advantage of these failed systems is just reversing their trades. So I just created a few demo accounts and run these EAs with the more dangerous settings to make them to burst faster. And I am using a trade copier to reverse with some time filtering conditions. My automated trading is just acting like a b-book broker  Another positive month for this b-book trading concept. Although the results is promising however based the last 3-month's observation, the system is still having some "weaknesses" need to fine tune. 1) The DD is high By using a small account of 1.5k to trade against many demo accounts can easily experience big DD. Losing EAs also occasionally have winning days; during this period of time, this b-book account is going to have high DD. 2) The total number of trades is crazy high. For the last 3 months of trading, I have been seeing the total open positions was more than 130 positions at one time. 3) The equity swing is VERY wild. By using this concept, we are more often to see floating gain rather than floating loss because these commercial EAs will have floating losses most of the time when running; and when we reverse their trades, we will see floating gain. But there was time, they were able to fight back the floating loss, so I have experienced many times the floating gain just disappeared quickly. This kind of 见財化水 situations have happened at least 4 times. Psychological wise this is not easy to deal with. kevler liked this post

|

|

|

Aug 3 2022, 08:12 AM Aug 3 2022, 08:12 AM

Return to original view | IPv6 | Post

#11

|

Junior Member

115 posts Joined: Aug 2015 |

QUOTE(dwRK @ Aug 2 2022, 08:44 AM) v1 coded per my post few wks ago made 8% in 8 hrs... very wild... tweak it a bit and overnight lost back 4%... lol... abandon v2 i try new trend start method... 100% losers... v3 i thought 15m tf too long... went to 5m and tweak buying early... 80% losers... ok got progress v4 abandon trending... try bollinger band... 80% winners, but no profit as 20% losers > 80% winners... lol... v5 fixed a bug in v4... i thot good liao... turns out the bug is causing the 80% winners... hahaha ... v18 and going... learned so much about the bot man... so exhausted... but feel am at the cusp of success... hopefully next month can go for live testing... probably need 2 bots... one for pumping/trending, one for ranging/counter-trend... so to manage the cutloss/dca properly... bot does about 150 trades a day with 20 open positions max... average trade duration 2 hrs... i feel for bot trading, scalping maybe be better than position play... maybe will set up a position trading for comparison... In my opinion, these few months is the best time to do forward testing because market movement is so wild. If we are able to sail through during this tough period, then we have high chance to continue to survive in future. 一起加油!! |

|

|

Aug 25 2022, 09:27 AM Aug 25 2022, 09:27 AM

Return to original view | IPv6 | Post

#12

|

Junior Member

115 posts Joined: Aug 2015 |

|

|

|

Aug 25 2022, 07:24 PM Aug 25 2022, 07:24 PM

Return to original view | IPv6 | Post

#13

|

Junior Member

115 posts Joined: Aug 2015 |

|

| Change to: |  0.0675sec 0.0675sec

0.35 0.35

7 queries 7 queries

GZIP Disabled GZIP Disabled

Time is now: 16th December 2025 - 02:36 PM |