Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

mroys@lyn

|

Nov 29 2019, 02:14 PM Nov 29 2019, 02:14 PM

|

|

QUOTE(LoNeLyKiRa @ Nov 29 2019, 01:58 PM) anyone here selling asm units? you should try the bundle with variable price units. may be more profitable than getting from lyn, if the VP is performing. Imbang 1 gave 4.25% right? |

|

|

|

|

|

mroys@lyn

|

Dec 31 2019, 07:32 AM Dec 31 2019, 07:32 AM

|

|

QUOTE(alexanderclz @ Dec 30 2019, 07:20 PM) what if after transferring the units, u refuse to give the cash? it's the risk to the seller. get a lawyer to prepare an agreement if involved large transaction. |

|

|

|

|

|

mroys@lyn

|

Jul 8 2020, 10:33 AM Jul 8 2020, 10:33 AM

|

|

asnb funds look attractive now after yesterday opr cut

|

|

|

|

|

|

mroys@lyn

|

Aug 10 2020, 11:59 AM Aug 10 2020, 11:59 AM

|

|

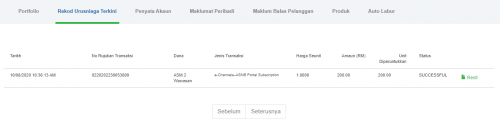

QUOTE(iamoracle @ Aug 10 2020, 10:58 AM) Today a little bit lucky. I managed to fish RM200 from Wawasan.  seriously? or sarcasm... |

|

|

|

|

|

mroys@lyn

|

Aug 10 2020, 02:28 PM Aug 10 2020, 02:28 PM

|

|

QUOTE(iamoracle @ Aug 10 2020, 01:49 PM) I am serious.  *Update* Another RM200.   i see.... in those days, with json, 5k-10k a day was not an issue. |

|

|

|

|

|

mroys@lyn

|

Aug 19 2020, 10:07 AM Aug 19 2020, 10:07 AM

|

|

QUOTE(skty @ Aug 17 2020, 03:08 PM) First time doing this: Let go some of the ASM Units ASM3 190K Transaction fees 1.8% Meet Up at Bank PJ & KL area Only Pls PM don't reply here (sorry as I copy the template of someone previous post) meet up at bank, i think cash transaction  This post has been edited by mroys@lyn: Aug 19 2020, 10:08 AM This post has been edited by mroys@lyn: Aug 19 2020, 10:08 AM |

|

|

|

|

|

mroys@lyn

|

Aug 19 2020, 10:45 AM Aug 19 2020, 10:45 AM

|

|

QUOTE(skty @ Aug 19 2020, 10:12 AM) just called ASNB yesterday to check how's the transfer to 3rd party procedure works. apparently any agent (bank) or ASNB branch also can. do you mean buyer pay to you? or to the bank/asnb? |

|

|

|

|

|

mroys@lyn

|

Aug 19 2020, 11:04 AM Aug 19 2020, 11:04 AM

|

|

QUOTE(skty @ Aug 19 2020, 10:58 AM) buyer sure need to pay to me lor as I am the one selling.  what I asked is the transaction of transferring the ASM3 unit can be done at bank and also ASNB branch. ic, so buyer have to pay you first before you give instruction to the bank/asnb to transfer the units to the buyer. |

|

|

|

|

|

mroys@lyn

|

Aug 19 2020, 11:11 AM Aug 19 2020, 11:11 AM

|

|

QUOTE(skty @ Aug 19 2020, 11:09 AM) yes. there is a form to fill up to initiate the transfer ok, then it's safe. at least got b&w contract. |

|

|

|

|

|

mroys@lyn

|

Aug 26 2020, 09:55 AM Aug 26 2020, 09:55 AM

|

|

saw 4.5%, very happy  QUOTE(lucifah @ Aug 26 2020, 08:37 AM) 4.0% is very optimistic realistically, u should expect 3.5 - 3.75% see this, potong stim  so low meh? |

|

|

|

|

|

mroys@lyn

|

Aug 26 2020, 10:53 AM Aug 26 2020, 10:53 AM

|

|

i'm ok with 4%

|

|

|

|

|

|

mroys@lyn

|

Sep 1 2020, 12:22 PM Sep 1 2020, 12:22 PM

|

|

Wouldn't SSPN is more attractive than ASM and easier to get? SSPN 2019 dividends are 4%+1%(loyalty, tnc).

This post has been edited by mroys@lyn: Sep 1 2020, 12:41 PM

|

|

|

|

|

|

mroys@lyn

|

Sep 1 2020, 12:39 PM Sep 1 2020, 12:39 PM

|

|

QUOTE(lucifah @ Sep 1 2020, 12:32 PM) and dun forget the tax relief at whatever tax bracket u r in for example, a 24% tax bracket got most of LYN forummers (RM 20k monthly salary) oh ya, forgot about that. ASM is more for long/medium term. similar to PRS, SSPN tax relief is only for certain period of time unless extended by gov in the budget announcement. |

|

|

|

|

|

mroys@lyn

|

Sep 1 2020, 04:59 PM Sep 1 2020, 04:59 PM

|

|

QUOTE(beLIEve @ Sep 1 2020, 04:37 PM) that for people with children only right? or ownself also can? anyway, too late for me now. dividends are but tax relieve is not for ownself. a bit off topic now. |

|

|

|

|

|

mroys@lyn

|

Sep 24 2020, 09:04 AM Sep 24 2020, 09:04 AM

|

|

QUOTE(lucifah @ Sep 24 2020, 08:31 AM) and we always have people say IF ASMX DIVIDEND FALLS UNDER X.X% I MAU WITHRDAW MY FUND LIAO that claim never materializes i guess true, many were complaining when 6% dividends declared few year ago  |

|

|

|

|

|

mroys@lyn

|

Oct 2 2020, 08:14 AM Oct 2 2020, 08:14 AM

|

|

QUOTE(yklooi @ Oct 1 2020, 08:38 AM) at this 4% rate, I would add into sspn first for the tax relief n the ease of "able to get units".... But then hopefully can still get 4% next year for sspn.... Same as hopefully 4% too for tis happy n satisfied to have fund. Since I am above 55, I target kwsp first n my spouse near 50 also priorities kwsp over other govt guaranteed stuffs for our 1st rm60k. agree, at 4% sspn seem a better option (4%+1% loyalty, tax relieve) and less hassle (no need to fish). |

|

|

|

|

|

mroys@lyn

|

Oct 4 2020, 01:39 PM Oct 4 2020, 01:39 PM

|

|

QUOTE(CSW1990 @ Oct 2 2020, 10:14 AM) agreed. SSPN won’t give 4% this year. Most of the time SSPN won’t go higher than ASM When ASM go higher than 6% people happy, but do they know FD at that time was >4% also? Equity return at those good time could easily go 15%+? Don’t just look at the number, should compare the return with the risk level among others investment tools in the same period it's higher if considered tax relieve. |

|

|

|

|

|

mroys@lyn

|

Feb 11 2021, 02:50 PM Feb 11 2021, 02:50 PM

|

|

QUOTE(Afterburner1.0 @ Feb 11 2021, 10:59 AM) As fellow non bumi here, who just started to fish for ASM .... how much have u all got for all the senior fisherman here? anyone with total ASMs (1,2,3) of rm50K? rm100K? >100k during captcha-era |

|

|

|

|

|

mroys@lyn

|

Feb 11 2021, 08:20 PM Feb 11 2021, 08:20 PM

|

|

QUOTE(mroys@lyn @ Feb 11 2021, 02:50 PM) from the recent posts, they talked about hundreds units but last time we talked about thousands in one strike. |

|

|

|

|

|

mroys@lyn

|

Mar 10 2021, 06:29 PM Mar 10 2021, 06:29 PM

|

|

any insider news on upcoming asmx dividends?

|

|

|

|

|

Nov 29 2019, 02:14 PM

Nov 29 2019, 02:14 PM

Quote

Quote

0.0381sec

0.0381sec

0.80

0.80

7 queries

7 queries

GZIP Disabled

GZIP Disabled