Outline ·

[ Standard ] ·

Linear+

Ultimate Discussions of ASNB Fixed Price UT, Magical UT only in Malaysia

|

dasecret

|

Jan 16 2020, 06:19 PM Jan 16 2020, 06:19 PM

|

|

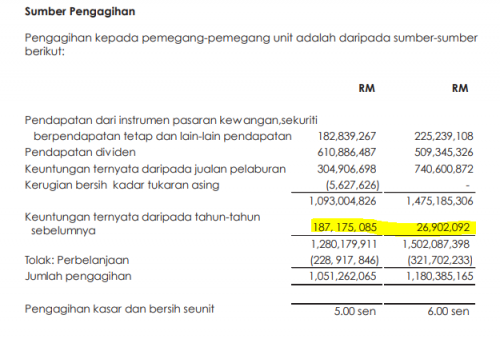

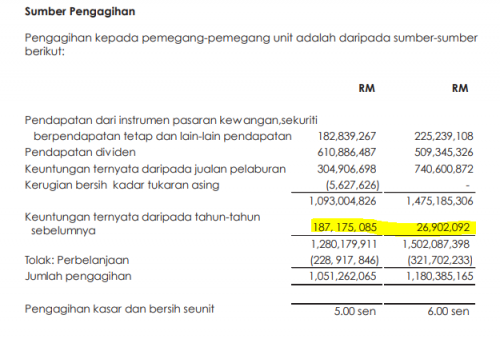

Wow, I've been away so long that this ultra popular thread in finance has moved to kopitiam. Not sure if kopitiam users are interested in this, but saw this in ASW annual report and thought I'd share facts to confirm previous suspicion In the past many forumers speculated that some years dividends are propped up by previous year reserves. This is shown in the annual report  It's based on realised profits. Ultimately, we do not know how much unrealised profits/losses is there in the investments, now they took out even the stock composition % of market value of portfolio. Year on year there are impairments made on the investments, again, we don't know what is it on. As a bean counter, I don't like what I can't see  |

|

|

|

|

|

dasecret

|

Jan 17 2020, 11:02 PM Jan 17 2020, 11:02 PM

|

|

QUOTE(wild_card_my @ Jan 16 2020, 06:44 PM) The most important thing that you cannot see is the outstanding units in the market. As a fixed-unit-price fund, you do not now know what the actual NAV/unit, because despite knowing the NAV, you do not know what the outstanding units in the market. So when you pay RM1/unit, could you be overpaying (the atual NAV/unit is less than RM1/unit) or underpaying (the inverse of the previous statement) I think you meant we don’t know what is the net asset value per unit. The outstanding units is disclosed and it’s traded at rm1.00 per unit. Just that what is the value of the underlying investments per unit that we do not know The financial statements don’t have balance sheet and yet auditor can issue audit report on it. I can never get over this Malaysia Boleh arrangement |

|

|

|

|

Jan 16 2020, 06:19 PM

Jan 16 2020, 06:19 PM

Quote

Quote

0.0387sec

0.0387sec

0.44

0.44

7 queries

7 queries

GZIP Disabled

GZIP Disabled