QUOTE(tsutsugami86 @ Jan 14 2021, 06:36 PM)

Yes but since I'm not a Muslim, I don't know how they deal it.And I cannot remember if I did tell my race/religion during account registration.

Wahed Invest Malaysia, Good, Ok2, Bad?

|

|

Jan 14 2021, 06:38 PM Jan 14 2021, 06:38 PM

Show posts by this member only | IPv6 | Post

#2181

|

All Stars

12,387 posts Joined: Feb 2020 |

|

|

|

|

|

|

Jan 14 2021, 06:42 PM Jan 14 2021, 06:42 PM

Show posts by this member only | IPv6 | Post

#2182

|

Junior Member

524 posts Joined: May 2019 |

QUOTE(GrumpyNooby @ Jan 14 2021, 06:38 PM) Yes but since I'm not a Muslim, I don't know how they deal it. I also not a Muslim and not yet invest full calender month, so I didn't received this email. And I cannot remember if I did tell my race/religion during account registration. Next time maybe Bursa also do this. |

|

|

Jan 14 2021, 06:43 PM Jan 14 2021, 06:43 PM

Show posts by this member only | IPv6 | Post

#2183

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(tsutsugami86 @ Jan 14 2021, 06:42 PM) I also not a Muslim and not yet invest full calender month, so I didn't received this email. Your account needs to meet the criteria set by Wahed before zakat contribution is being deducted from your active portfolio.Next time maybe Bursa also do this. This post has been edited by GrumpyNooby: Jan 14 2021, 09:45 PM |

|

|

Jan 15 2021, 01:33 AM Jan 15 2021, 01:33 AM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(GrumpyNooby @ Jan 14 2021, 06:38 PM) Yes but since I'm not a Muslim, I don't know how they deal it. IINM 2.5% of the whole portfolio are being calculated as Zakat per calendar yearAnd I cannot remember if I did tell my race/religion during account registration. So if it’s RM100k, RM2500 will goes to Zakat which I wonder why Wahed does it when they can actually separate the portfolio gains into their own internal consolidated gains account to be paid Zakat from there which is why I only park a very small amount as I knew that they gonna start doing this Islamic tax to all their portfolios as part ethical investing mantra for ESG principles |

|

|

Jan 15 2021, 09:51 AM Jan 15 2021, 09:51 AM

|

Junior Member

279 posts Joined: Sep 2006 |

QUOTE(xander83 @ Jan 15 2021, 01:33 AM) IINM 2.5% of the whole portfolio are being calculated as Zakat per calendar year 2.5% of the whole portfolio? meaning if you gain 2.5% that whole year means you got nothing?So if it’s RM100k, RM2500 will goes to Zakat which I wonder why Wahed does it when they can actually separate the portfolio gains into their own internal consolidated gains account to be paid Zakat from there which is why I only park a very small amount as I knew that they gonna start doing this Islamic tax to all their portfolios as part ethical investing mantra for ESG principles |

|

|

Jan 15 2021, 11:09 AM Jan 15 2021, 11:09 AM

|

All Stars

15,856 posts Joined: Nov 2007 From: Zion |

I do not qualify to pay zakat as I am not a muslim. You may ignore the content of this email. read people. read. yuiopoiuy, sinisterair, and 1 other liked this post

|

|

|

|

|

|

Jan 15 2021, 02:53 PM Jan 15 2021, 02:53 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(man @ Jan 15 2021, 09:51 AM) Yes which is why Islamic Sukuk/Bond is preferred than Islamic Equities for those investments which you have to pay Zakat Anyway better read transaction when any deductions is being transacted man liked this post

|

|

|

Jan 15 2021, 11:40 PM Jan 15 2021, 11:40 PM

|

Junior Member

689 posts Joined: Mar 2020 |

Referred 2 person to sign up Wahed but they mentioned nowhere to put referral code. Weird. sinisterair liked this post

|

|

|

Jan 16 2021, 07:03 PM Jan 16 2021, 07:03 PM

Show posts by this member only | IPv6 | Post

#2189

|

Junior Member

175 posts Joined: Nov 2020 |

i want to invest in wahed, but im afraid im not able to get full benefit because of the exclusion of non-shariah stocks. is there any important non-shariah company that i will be missing ? i know Square (NYSE: SQ) is one example of high quality stock that Wahed will not invest in. Acidix liked this post

|

|

|

Jan 16 2021, 07:09 PM Jan 16 2021, 07:09 PM

Show posts by this member only | IPv6 | Post

#2190

|

All Stars

12,387 posts Joined: Feb 2020 |

QUOTE(halotaikor. @ Jan 16 2021, 07:03 PM) i want to invest in wahed, but im afraid im not able to get full benefit because of the exclusion of non-shariah stocks. Go look into ETF factsheet of HLAL to understand its stocks selection/inclusion.is there any important non-shariah company that i will be missing ? i know Square (NYSE: SQ) is one example of high quality stock that Wahed will not invest in. |

|

|

Jan 17 2021, 12:59 AM Jan 17 2021, 12:59 AM

|

Junior Member

689 posts Joined: Mar 2020 |

QUOTE(halotaikor. @ Jan 16 2021, 07:03 PM) i want to invest in wahed, but im afraid im not able to get full benefit because of the exclusion of non-shariah stocks. Buy individual stocks thenis there any important non-shariah company that i will be missing ? i know Square (NYSE: SQ) is one example of high quality stock that Wahed will not invest in. |

|

|

Jan 17 2021, 09:22 AM Jan 17 2021, 09:22 AM

|

Junior Member

569 posts Joined: Aug 2020 |

QUOTE(halotaikor. @ Jan 16 2021, 07:03 PM) i want to invest in wahed, but im afraid im not able to get full benefit because of the exclusion of non-shariah stocks. for me its ok as long as shariah compplianceis there any important non-shariah company that i will be missing ? i know Square (NYSE: SQ) is one example of high quality stock that Wahed will not invest in. |

|

|

Jan 17 2021, 12:58 PM Jan 17 2021, 12:58 PM

|

Junior Member

213 posts Joined: Nov 2005 From: Batu Pahat, Johor |

QUOTE(stormseeker92 @ Jan 16 2021, 12:40 AM) i accidently found the link and add my friends code. now, i can't find the link in my wife's app. very weird. svchia78 liked this post

|

|

|

|

|

|

Jan 17 2021, 02:13 PM Jan 17 2021, 02:13 PM

Show posts by this member only | IPv6 | Post

#2194

|

Junior Member

69 posts Joined: Oct 2015 |

QUOTE(halotaikor. @ Jan 16 2021, 07:03 PM) i want to invest in wahed, but im afraid im not able to get full benefit because of the exclusion of non-shariah stocks. Yes, shariah investment universe is smaller due to the shariah screening.is there any important non-shariah company that i will be missing ? i know Square (NYSE: SQ) is one example of high quality stock that Wahed will not invest in. |

|

|

Jan 17 2021, 06:31 PM Jan 17 2021, 06:31 PM

|

Senior Member

1,974 posts Joined: Dec 2011 |

Not sure if this is related to Wahed 2.0. I deposited 1k on Friday morning and by Saturday morning it is invested as shown in the app and not in cash form. Previously, it will take up to 4 days to be invested. 🤔

|

|

|

Jan 20 2021, 04:34 PM Jan 20 2021, 04:34 PM

Show posts by this member only | IPv6 | Post

#2196

|

All Stars

12,387 posts Joined: Feb 2020 |

App update is available for Android

//Our most important update yet! Wahed V2.0 is officially live, which means brand new features for you! Open multiple portfolios all within one beautifully designed dashboard Brand new graph to make monitoring your performance a lot easier Set targets for your life goals and keep track of your progress Get smart deposit suggestions based on your own personal journey Customize your accounts with nicknames and icons Other small improvements that we’re excited about |

|

|

Jan 20 2021, 08:50 PM Jan 20 2021, 08:50 PM

Show posts by this member only | IPv6 | Post

#2197

|

||||||||||||||||

All Stars

12,387 posts Joined: Feb 2020 |

Market Review: 11 - 15 January 2021

Funds used by Wahed Invest were mixed last week. US markets closed lower after posting record highs the week prior. Investors were worried that lockdowns could extend further, with slow vaccine distributions and new coronavirus strains being detected. Meanwhile, President-elect Joe Biden announced a USD1.9 trillion fiscal stimulus plan to counter the economic impact from COVID-19. KLCI also closed lower after market sentiment was affected by fresh concerns about US-China trade tension, with the Trump administration blacklisting Xiaomi and a host of other Chinese firms. Additionally, new MCO restrictions were announced and a surprise state of emergency was declared by Yang di-Pertuan Agong. Market Outlook: 18 - 22 January 2021 US markets will be closed on Monday in recognition of Martin Luther King Day. For the rest of the week, market direction is expected to be dictated by earnings releases from major financial institutions. Inauguration Day 2021 will be on Wednesday, signalling the start of Joe Biden’s four-year presidency term. The incoming president will inherit a tough stance on Chinese business, and initial expectations are low that he will reverse course. Meanwhile, the local market is expected to be range bound, as investors stay cautious amid increasing COVID-19 cases and ahead of Bank Negara Malaysia overnight policy rate (OPR) announcement on Wednesday. A possibility of a rate cut should not be ruled out. Pressing Points: Strong Long-Term Catalysts To Offset Near-Term Worries For 2021, all funds except GOLD closed higher in terms of total return, with HLAL +2.8%, MMID +3.5%, RHB IBF +0.4%. GOLD declined -0.8%.

The equity markets took a breather last week, with investors focusing on near-term effects of the continued lockdowns and slower-than-expected rollout of COVID-19 vaccines. Nevertheless, historic monetary and fiscal stimulus is a positive catalyst for stocks, which will also benefit once the delays from vaccine distribution are addressed. The economic and monetary backdrops in 2021 provide a platform for a modest uptrend in the capital markets. Even so, investors would be better placed to successfully navigate a shifting investment landscape by having exposure in a properly diversified portfolio. |

||||||||||||||||

|

|

Jan 20 2021, 09:09 PM Jan 20 2021, 09:09 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

QUOTE(ipohps3 @ Jan 17 2021, 06:31 PM) Not sure if this is related to Wahed 2.0. I deposited 1k on Friday morning and by Saturday morning it is invested as shown in the app and not in cash form. Previously, it will take up to 4 days to be invested. 🤔 Must be they improved hey back end platform with their brokerNot sure which broker they as it will be good to invest straight without the FX conversion |

|

|

Jan 27 2021, 07:37 PM Jan 27 2021, 07:37 PM

Show posts by this member only | IPv6 | Post

#2199

|

All Stars

12,387 posts Joined: Feb 2020 |

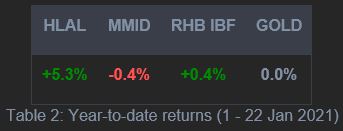

Market Review: 18 - 22 January 2021

Funds used by Wahed Invest were mixed last week. US markets closed higher as investors continue to balance positive news such as the USD1.9 trillion fiscal stimulus program from the Biden administration with near-term challenges which are the worsening COVID-19 news and the slower-than-expected vaccine rollout. KLCI dipped below the 1600 level last week due to weaker buying momentum. Market sentiment was not helped by signs of increasing cases of COVID-19 nationwide Market Outlook: 25 - 29 January 2021 US markets are poised to take direction from company earnings this week, with 23% of the S&P 500 releasing results. As has been the case prior to the inauguration of the Biden government, the drivers for market performance going forward are still the pace of vaccinations and the size of additional fiscal stimulus. For the Malaysian market, trading is expected to remain cautious during this shortened trading week due to Thaipusam holiday. Last week, the overnight policy rate (OPR) was maintained at 1.75% by Bank Negara Malaysia while the government unveiled PERMAI, the fifth stimulus package worth RM15 billion to combat COVID-19. However, the positive COVID-19 cases continue to climb, leading market participants to worry about a prolonged Movement Control Order (MCO), possibly exerting further weakness in the local bourse. Pressing Points: Periods Of Consolidation Are Typical Amid Elevated Expectations For 2021, all funds except MMID closed higher in terms of total return, with HLAL +5.3%, RHB IBF +0.4% and GOLD +0.0%. MMID declined -0.4%.  After a strong performance in 2020, the fresh highs achieved by the US equity markets seem like a weekly occurrence. However, we believe markets have priced in a healthy improvement in fundamentals for the longer term. This possibly leaves the door open for short-term periods of consolidation as investors shift the priority back to the pandemic and the progress of the new administration. Even so, consolidation is a healthy attribute for the markets as it allows the improving earnings and economic data to catch up with stock prices. Such market corrections are common even during the early stages of the market cycle. We remain positive on the long-term market outlook, and view potential pullbacks as something that can benefit long-term investors that consistently invest within their risk tolerance. |

|

|

Jan 27 2021, 09:30 PM Jan 27 2021, 09:30 PM

|

Senior Member

6,427 posts Joined: Jan 2003 From: Autobiography!!! |

Anyone buying this week?

Waiting for correction to buy in again 😂 |

| Change to: |  0.0393sec 0.0393sec

0.43 0.43

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 8th December 2025 - 01:30 AM |