Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

premier239

|

Oct 25 2021, 12:59 PM Oct 25 2021, 12:59 PM

|

Getting Started

|

sorry, didnt follow closely last time,

i opened TSG months ago, then i saw you guys talking about IBKR removed the monthly inactivity fees right?

then most of you delinking TSG and use IBKR directly, other than the monthly inactivity fees, fractional shares, IBKR got any other advantages?

|

|

|

|

|

|

premier239

|

Dec 20 2021, 08:03 PM Dec 20 2021, 08:03 PM

|

Getting Started

|

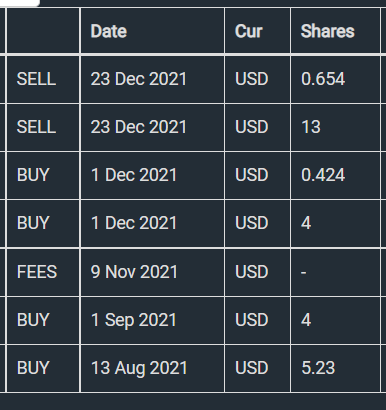

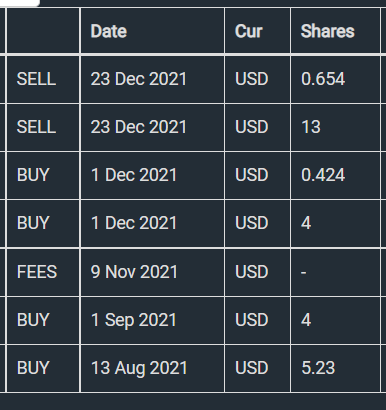

if I buy fractional share, for example 0.5 + 0.5 Tesla, when I want to sell later, will the system q to sell 1 Tesla share, or it will q me to sell 0.5 + 0.5 to someone want 0.5

|

|

|

|

|

|

premier239

|

Dec 24 2021, 04:14 PM Dec 24 2021, 04:14 PM

|

Getting Started

|

QUOTE(Davidtcf @ Dec 24 2021, 10:49 AM) I have transferred many times to my IBKR using Ziet's latest method. Maybank MY > Wise (conversion from MYR to USD happens here) > IBKR (last step your money will only arrive next day). Can bypass steps via SG CIMB bank. Wise there will ask the reason of transfer also as per required by Malaysian law. Happy to see my investments at IBKR growing.. much better than Bursa.  last time, we use [MY bank acc - cimb sg - ibkr sgd - convert to usd]now we can directly register usd ach at wise, then [MY bank acc - top up usd in wise - ibkr usd] ? This post has been edited by premier239: Dec 24 2021, 04:15 PM |

|

|

|

|

|

premier239

|

Feb 9 2022, 11:40 AM Feb 9 2022, 11:40 AM

|

Getting Started

|

do u guys have experience buy/sell fractional shares?

are they liquid enough?

my concern is to buy big share like google, as 1 share is almost $3k

say to q buy for 0.1/fractional share of this type of "popular" stock, hows the experience?

also, to make it "liquid", better is to accumulate them till it become 1 share unit right?

then i can q at non-fractional listing?

This post has been edited by premier239: Feb 9 2022, 11:42 AM

|

|

|

|

|

|

premier239

|

Feb 9 2022, 12:37 PM Feb 9 2022, 12:37 PM

|

Getting Started

|

QUOTE(tadashi987 @ Feb 9 2022, 12:27 PM) bought and sell MASTERCARD fractional shares before, everything's smooth, it is just that full unit shares are relatively easier to sell/buy, almost immediate, fractional share takes longer than usual like maybe up to 10 minutes, but it is ok IMO bought ETF fractional shares also, but so far never sell-off before do you remember your mastercard fractional share is in what unit? like 0.1? 0.5? or? |

|

|

|

|

|

premier239

|

Feb 9 2022, 03:46 PM Feb 9 2022, 03:46 PM

|

Getting Started

|

QUOTE(tadashi987 @ Feb 9 2022, 01:25 PM)  I were purchasing with a fixed amount of USD, so I got odd units didnt know it can get fractional till 3 decimal places.. liquidity seems like not an issue for popular stocks thanks for this This post has been edited by premier239: Feb 9 2022, 03:52 PM |

|

|

|

|

|

premier239

|

Feb 9 2022, 03:48 PM Feb 9 2022, 03:48 PM

|

Getting Started

|

QUOTE(Davidtcf @ Feb 9 2022, 02:28 PM) wait for Google to split in July 2022 if wanna buy it cheap. It will split 20 meaning 3k/20 = 150USD per stock. easier to buy and sell whole stocks.. I wouldn't buy fractional also due to this. that day luckily no buy yet, almost buy 0.1  i was betting it to up before split n continue to up after split, thats y thinking to buy 0.1, so post-split also gt 2 units |

|

|

|

|

|

premier239

|

Mar 10 2023, 09:08 AM Mar 10 2023, 09:08 AM

|

Getting Started

|

woah so mean direct send via wise (MYR)?

the rate will use wise rate or ibkr rate

|

|

|

|

|

|

premier239

|

Apr 7 2023, 02:57 PM Apr 7 2023, 02:57 PM

|

Getting Started

|

https://www.interactivebrokers.com/en/prici...sions-bonds.phpfor US T-bill on IBKR lets say, T-bill, rate 4.5%, expire in 3-month the pricing is 100/ (1 + (4.5%/12*3)) = $98.89 purchase min $1000 face value, with min $5 fees, so it is 988.9 +5 = $993.88 is my calculation correct? This post has been edited by premier239: Apr 7 2023, 02:59 PM

|

|

|

|

|

|

premier239

|

Oct 20 2023, 10:53 PM Oct 20 2023, 10:53 PM

|

Getting Started

|

ibkr real time option data is $32.75 monthly?

am i looking it right?

|

|

|

|

|

|

premier239

|

May 28 2024, 10:06 AM May 28 2024, 10:06 AM

|

Getting Started

|

are we allowed to buy US govt bond on IBKR?

if yes, will the interest received upon maturity hit by 30% tax?

|

|

|

|

|

Oct 25 2021, 12:59 PM

Oct 25 2021, 12:59 PM

Quote

Quote

0.0296sec

0.0296sec

0.43

0.43

7 queries

7 queries

GZIP Disabled

GZIP Disabled