Several months only and you start to complain already?

Maybe you are a trader... you might like to dabble into automotive, airlines, commodities. High volatilities might work for you better.

I choose to dabble into luxury goods after realizing that both S&P 500 and Nasdaq 100 do not have exposure to these industries. The USA doesn't have a rich and deep aesthetic culture like the European continent, so that's why I have some exposure over in the European side.

If you select a true luxury goods company like Hermes, Brunello Cucinelli, and Ferrari, which controls the supply chain from production to end-customer sales, you are literally the sole supplier, and the supply becomes highly inelastic, and if you make nice products, you get the maximum pricing power possible by extracting every single cent out of customer's pockets.

Under supply is key: Take Hermes as an example, the iconic Birkin and Kelly bags are only supplied at 20% of market demand. The latest Ferrari supercar F80 sells for 3.1 million Euro a piece, 800 units in total only, all sold out. That should bring 3 billion USD for your company already...

Sales tactics matter too. Hermes make money by an old trick called bundling... You gotta buy a canoe, gold spoon, or some other stupid things before you even get to queue for a Kelly's or a Birkin. And when it's your turn, you might not get the color you want.

Ferrari makes money by customizing cars for the UHNWI. That's how you sell a typical Ferrari for 400 thousand Euro. Then you gotta pay for maintenance, spare parts...

You won't go to some roadside unauthorized car service center to fix your Ferrari, you have to go back to the factory for original, authentic parts... The stickiness of the business is clearly evident here...

Buying a Ferrari is a fool's of spending money, while we investors sit back and collect the charges.

» Click to show Spoiler - click again to hide... «

A true luxury goods brand do not need a lot of advertisement, and you should not be able to buy the goods even if you have lots of money, you gotta create the aura of the rich. The sponsorship from LV, Gucci and the ease of owning a LV, Gucci bag make them second-class luxury goods company. You want first-class business, gotta be patient...

That's why the PE ratio of RMS, BC and RACE are about 40 times, LVMH can only fetch half of that figure... Kering/Gucci falls to third class already...

But one risk remains with European luxury goods stocks. Unlike in American companies where most of them are open to professionals from outside the family (e.g. JP Morgan), the European founder family can either make (in Hermes case) or break (in Gucci's case) the enterprise. Understanding the founder family is equally important too. But I will leave it to another post to elaborate lah haha Too much to fit into this one post.

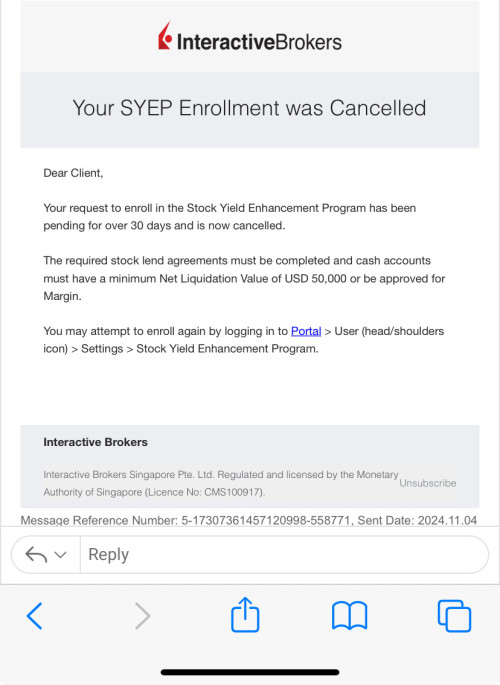

You can deposit any amount to IBKR in many currencies. If you have SGD bank account in SG, can fund your account in SGD also vis FAST then convert to USD via IBKR's internal FX conversion feature. But that's not necessary until you need to start buying US shares/ETFs, for instance.

Oct 20 2024, 06:52 PM

Oct 20 2024, 06:52 PM

Quote

Quote

0.0242sec

0.0242sec

0.42

0.42

7 queries

7 queries

GZIP Disabled

GZIP Disabled