QUOTE(lookie @ Jul 25 2024, 04:10 PM)

Hi, so did you manage to find a solution to this problem? I've been using tiger sg and very happy with their mmf features but looking to diversify using another trading app. Reading this about IBKR is quite a letdown, tbh.

No solution for now. Hopefully they'll reduce the minimum back to $1 because it is a ridiculous rule. If a rich man received a $9,999 dividend, IBKR shouldn't say he can't put that into money market simply because of the $10,000 minimum.

Another problem with IBKR is they have a 60 or 90 day hold on any newly deposited cash. Last year I deposited SGD100 for testing purposes. After that I tried withdraw it back into an SG bank and the system doesn't allow because of the hold. Hotel California - you can check in any time but you cannot leave...

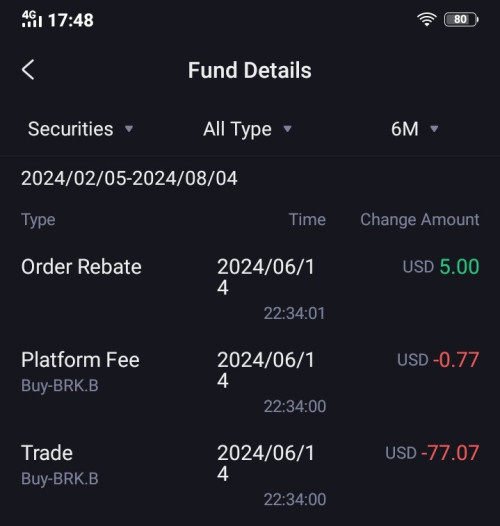

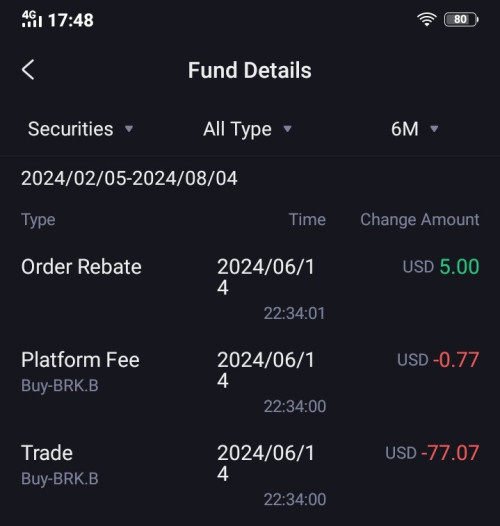

Despite the flaws, IBKR's low $0.35 brokerage (US market) is fantastic for high frequency traders. If you trade options, some will say IBKR is better than other brokers. I use IBKR for access to London's VUAA/VUSD and will continue to use IBKR. However for US and SG stocks, Tiger and Moomoo is perfectly fine. Tiger gives so many cash coupons but I rarely trade. Some of the coupons won't expire until 2026. The other day I bought $77 of fractional shares, paid $0.77 in brokerage fees and received $5 cash back! Screenshot below - it is unbelievable. In nearly two years, I suspect I've received more cash backs than brokerage fees.

Feb 22 2023, 12:01 PM

Feb 22 2023, 12:01 PM

Quote

Quote

0.0259sec

0.0259sec

0.24

0.24

7 queries

7 queries

GZIP Disabled

GZIP Disabled