Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Avangelice

|

Oct 23 2023, 10:03 AM Oct 23 2023, 10:03 AM

|

|

QUOTE(Ramjade @ Oct 23 2023, 09:58 AM) Nah for you. Wise is not the cheapest route if you are doing large amount and doing it for long time. Also US stuff got 30% dividend tax yo. Keep in mind. To avoid 30% dividend tax by Ireland based etf. It will cut your dividend tax to 15% Which one did you invest in? I'm thinking of parking my son's savings under voo. |

|

|

|

|

|

Avangelice

|

Oct 23 2023, 10:15 AM Oct 23 2023, 10:15 AM

|

|

QUOTE(Ramjade @ Oct 23 2023, 10:10 AM) I said many times in many places. If you want highest return, go with QQQ. Their return have always been more than S&P500 butord volatile. If you cannot stand volatility, then stick with S&P500. Ireland version of QQQ https://www.reddit.com/r/singaporefi/commen...lent/?rdt=63973US etf if you want to do options. Ireland version if you don't want options and save 15% on dividend tax. CSPX (non fractional shares) or VUAA (lower price and support fractional shares) Once you get 100 shares in US, you can easily do options to get back your 30% tax and more. Not everyone wants to do options. Thank you bro. My first time venturing out of Malaysia for my money. You have taught alot. Thanks |

|

|

|

|

|

Avangelice

|

Oct 23 2023, 04:38 PM Oct 23 2023, 04:38 PM

|

|

I did abit of research and wonder if someone can advise me whether I should invest in my son's study fund in

Vusa vs VWRA

Vusa is 100% in US

Where as Vwra is more global

Dividend yeild wise Vwra wins but Vusa has better performance

|

|

|

|

|

|

Avangelice

|

Oct 23 2023, 05:04 PM Oct 23 2023, 05:04 PM

|

|

QUOTE(abcn1n @ Oct 23 2023, 05:01 PM) My 2 cents, why don't you just split and invest in 2 funds. That's what I would do if face with this dilemma That's double exposure no? Both tracks s&p but Vwra has more exposure to Europe and EM. (60% still in S&P) |

|

|

|

|

|

Avangelice

|

Oct 23 2023, 05:15 PM Oct 23 2023, 05:15 PM

|

|

QUOTE(lamode @ Oct 23 2023, 05:09 PM) i am not sure u troll or not. his already clearly stated split not double down. if you invest $100 in VUSA, ur exposure is $100 in US. if you invest $50 in VUSA + $50 in VWRA, then ur exposure is $50 + $30 = $80 in US. of course you can further customize allocation, dont have to be $50 in each. btw FWRA has cheaper expense ratio than VWRA. Sorry I'm so new to etf. Coming from a person who parked all his money stupidly in myr for the past 8 years and made a lost. So excuse the stupid questions as I'm using unit trust principles in etf. |

|

|

|

|

|

Avangelice

|

Oct 23 2023, 05:39 PM Oct 23 2023, 05:39 PM

|

|

QUOTE(Ramjade @ Oct 23 2023, 05:30 PM) Bro you didn't pay attention in xuzen class? He already talk about this last time. I repeat what he said. Come I take you back to history around 7 years back for his class. All global funds will have 40-60% exposure to the US. Out of that exposure at least 20% will be make up of FAANG stocks. So why waste money buying global or US stocks. Focus on FAANG. That's why I buy TA global tech over what global fund. You want exposure to other world buy specific unit trust like India, or china focus. His words. Not mine words. Not 100% like that but more or less. Same thing. Only difference is 1. Unit trust fees is ridiculous at 1.5-1.8p.a% Vs etf at 0.07%p.a 2. ETF is actively traded like a stock but passively managed while unit trust price is delayed. 3. You won't beat the market or underperformed it. You will get market return. Shit your right. He never liked broad index funds. Thank you ram |

|

|

|

|

|

Avangelice

|

Oct 23 2023, 07:50 PM Oct 23 2023, 07:50 PM

|

|

QUOTE(Hoshiyuu @ Oct 23 2023, 05:27 PM) I mean... what is your investment horizon? If your son needs the fund in 3 year, keep it out of the market and put it in some safer places. The only situation I can see myself putting my child's study fund in a 100% stock portfolio, however diversified, is that I am going to be having the kid soon and they won't need it in 15-20 years, with a backup plan in case hit by sequence of return risk... even VWRA, the arguably safest, most diversified total stock market etf has a ~25% max drawdown within 10 years. It's easy to ask an A or B question and get an answer, but it's also important to find out if you are asking the right question to begin with. QUOTE(TOS @ Oct 23 2023, 06:53 PM) Indeed, if Avangelice knows exactly when he needs the money, US T-bills/notes/bonds will do the work. No need to bother with price going up or down. Just hold till maturity based on today's rate, you can get about 5% p.a. risk-free from USD side, about 3.5% p.a. from SGD side and 3.8-4% p.a. from MYR side. You just need to forecast the future expenses, and discount based on the rates above. You get the present value now, and thus you know how much to buy. My boy is reaching three years of age coming January 2024 and I feel uncomfortable being heavy in Malaysia with my stock and epf plus asnb (non Muslims) so the horizon is 18 years from now. Bonds. Now that's something I haven't delved into yet |

|

|

|

|

|

Avangelice

|

Oct 24 2023, 08:59 AM Oct 24 2023, 08:59 AM

|

|

Good morning everyone, my funds went through last night and I was checking out recurring fund purchase but I discovered there's three different types of VUSA etf namely ebf, lse & AEB

A quick look shows all three are trading in different currencies. I don't think I wish to trade in Euro but in USD as there's cost incurred? Myr > usd > eur?

Which Vusa are you guys trading in? There's VUSD

|

|

|

|

|

|

Avangelice

|

Oct 24 2023, 09:24 AM Oct 24 2023, 09:24 AM

|

|

QUOTE(Ramjade @ Oct 24 2023, 09:22 AM) Buy the lse one. There's always cost. Is whether you want to give your banker/banks free money or you want to save the money so you have more to invest overtime. I posed I think few post before this on getting the best foreign exchange. Lastly I don't do ETF But choose any one whether it is cspx (most popular and longer established s&p500)or vusa as long as it's Ireland based to get 15% savings on your dividend tax. Vusa lse it is then. Thank you Edit correction Did a little research on cspx and found out it reinvest dividends. This suits my needs for what I intend to do with the money which is my son's studies. So much to learn and discover This post has been edited by Avangelice: Oct 24 2023, 09:29 AM |

|

|

|

|

|

Avangelice

|

Dec 8 2023, 09:50 AM Dec 8 2023, 09:50 AM

|

|

QUOTE(Medufsaid @ Dec 8 2023, 09:35 AM) good news, CSPX has fractional shares support now Just when I just bought 5 units of vuaa when I couldn't afford one cspx. Dammit |

|

|

|

|

|

Avangelice

|

May 6 2024, 10:19 AM May 6 2024, 10:19 AM

|

|

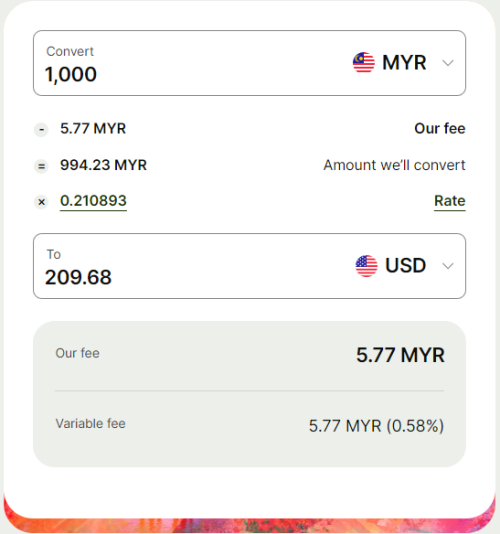

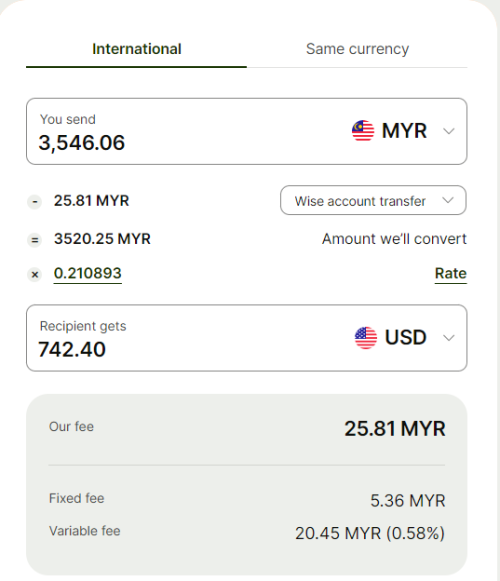

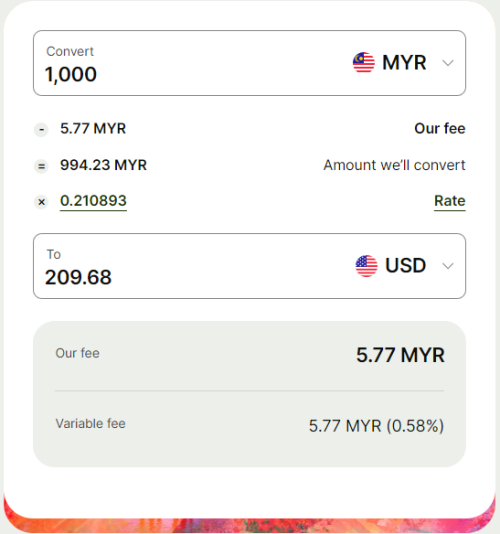

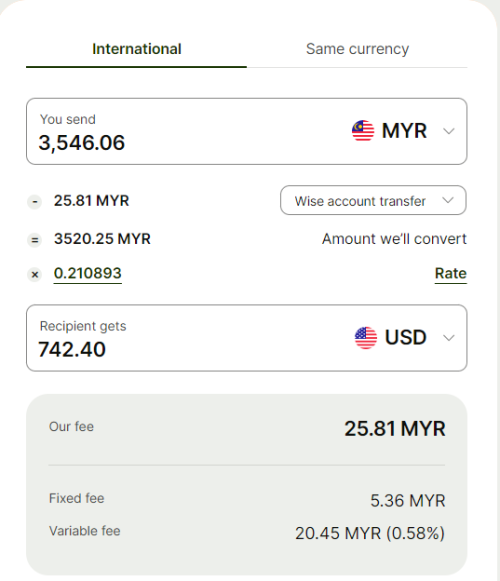

Hi guys, what's the current cheapest way to fund usd into ikbr? Wise has gotten way expensive now

Edit

Never mind, it was answered from the previous page. Tq

This post has been edited by Avangelice: May 6 2024, 10:20 AM

|

|

|

|

|

|

Avangelice

|

May 6 2024, 01:22 PM May 6 2024, 01:22 PM

|

|

QUOTE(Medufsaid @ May 6 2024, 01:14 PM) Avangelice wise is expensive, but credit where credit's due, it has gotten cheaper.  just make sure you convert into your USD balance, then send that out. don't send out MYR to IBRK as you'll have convenience (fixed) fees of RM5.36 added on https://wise.com/my/pricing/send-money?sour...etCcy=USD&tab=0 Thanks ill compare the process when I have the time. 1) cimb my > money match > cimb sg > ikbr sgd> ikbr usd (does this even make sense when I convert X 2? 2) wise myr > wise usd > ikbr |

|

|

|

|

|

Avangelice

|

May 16 2024, 10:43 AM May 16 2024, 10:43 AM

|

|

Just did the

CIMB my to money match to cimb sg to ikbr sgd then convert to ikbr usd.

There's a learning curve but doing this allows you learn how to withdraw in the future

Wah cheaper than Wise because of their stupid transfer fees

|

|

|

|

|

Oct 23 2023, 10:03 AM

Oct 23 2023, 10:03 AM

Quote

Quote

0.0533sec

0.0533sec

0.50

0.50

7 queries

7 queries

GZIP Disabled

GZIP Disabled