QUOTE(Medufsaid @ Dec 30 2024, 10:00 AM)

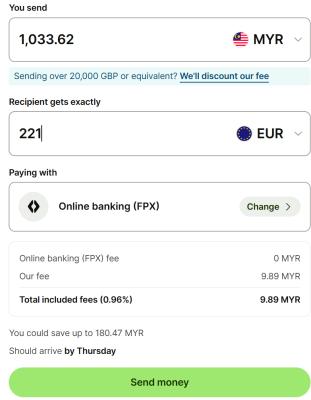

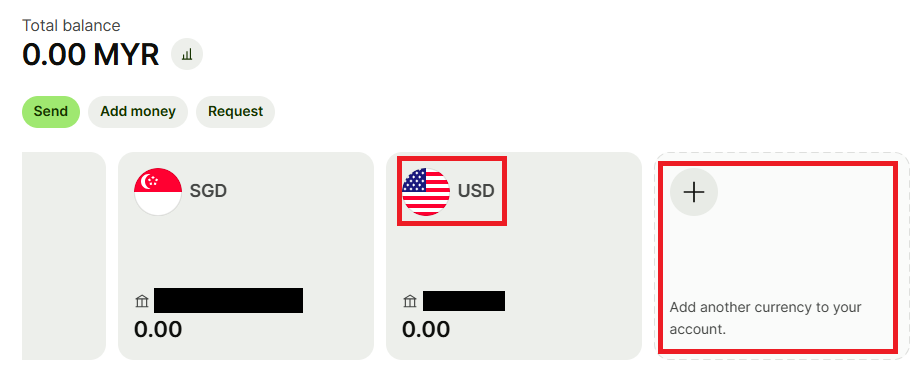

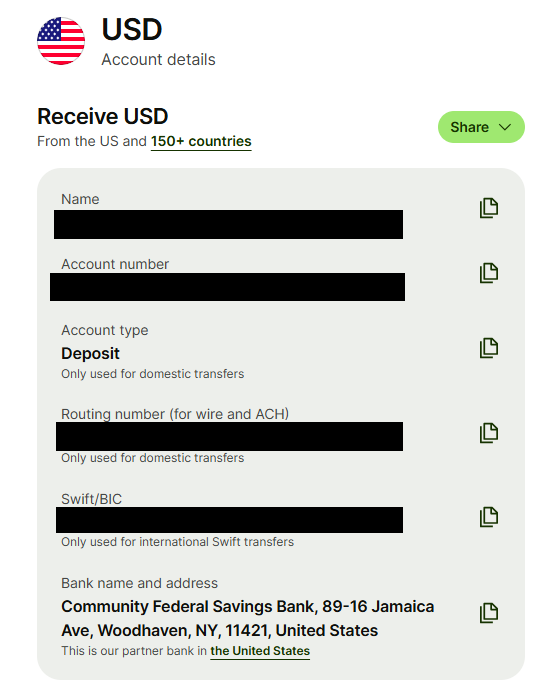

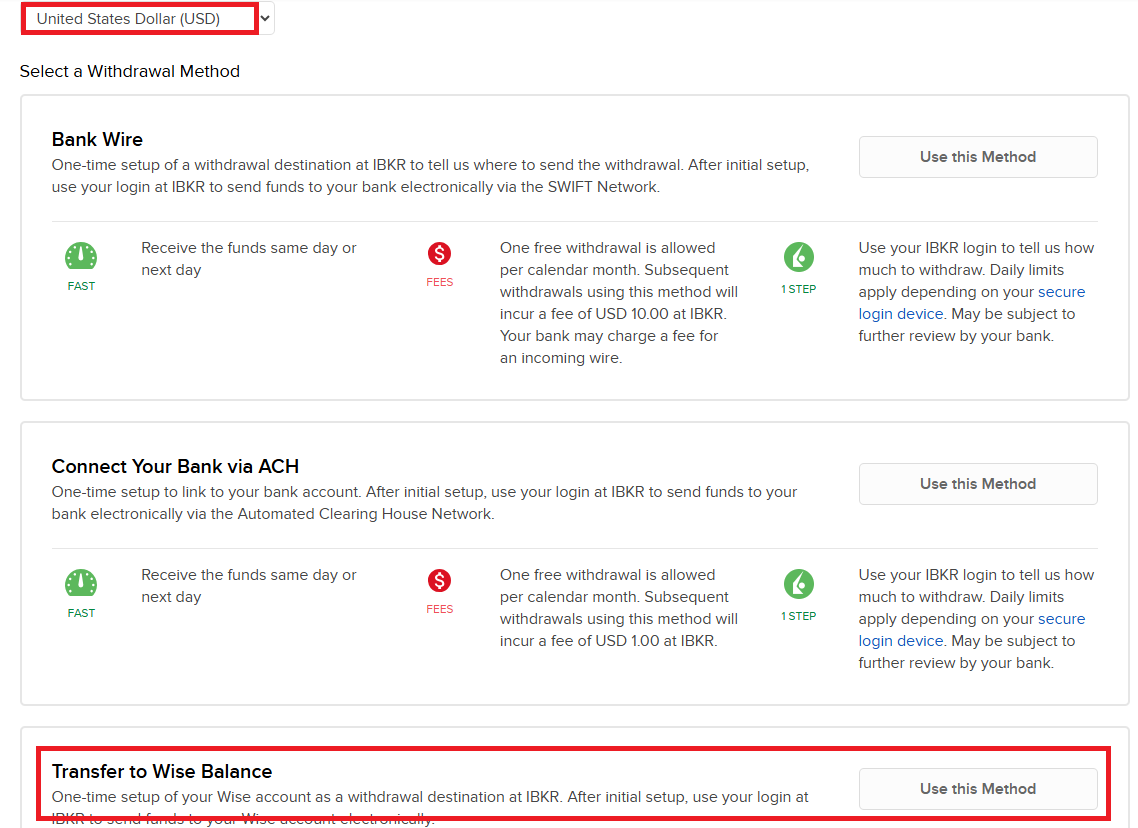

my method is convert to EUR, send to IBKR as

EUR. and use IBKR internal conversion to convert to USD for a fee of 0.03%

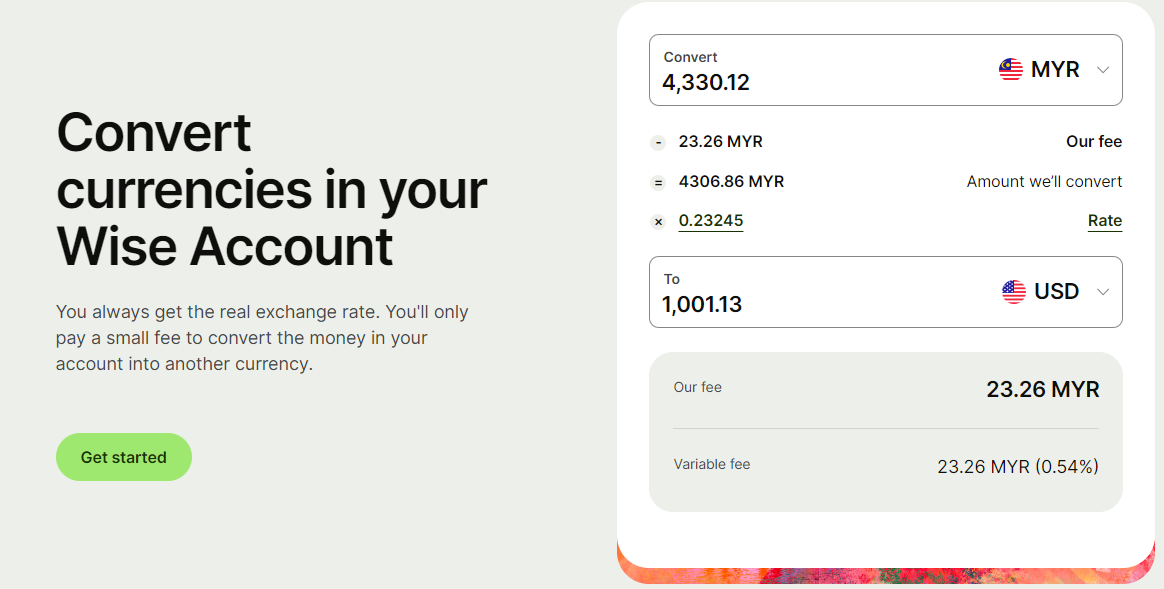

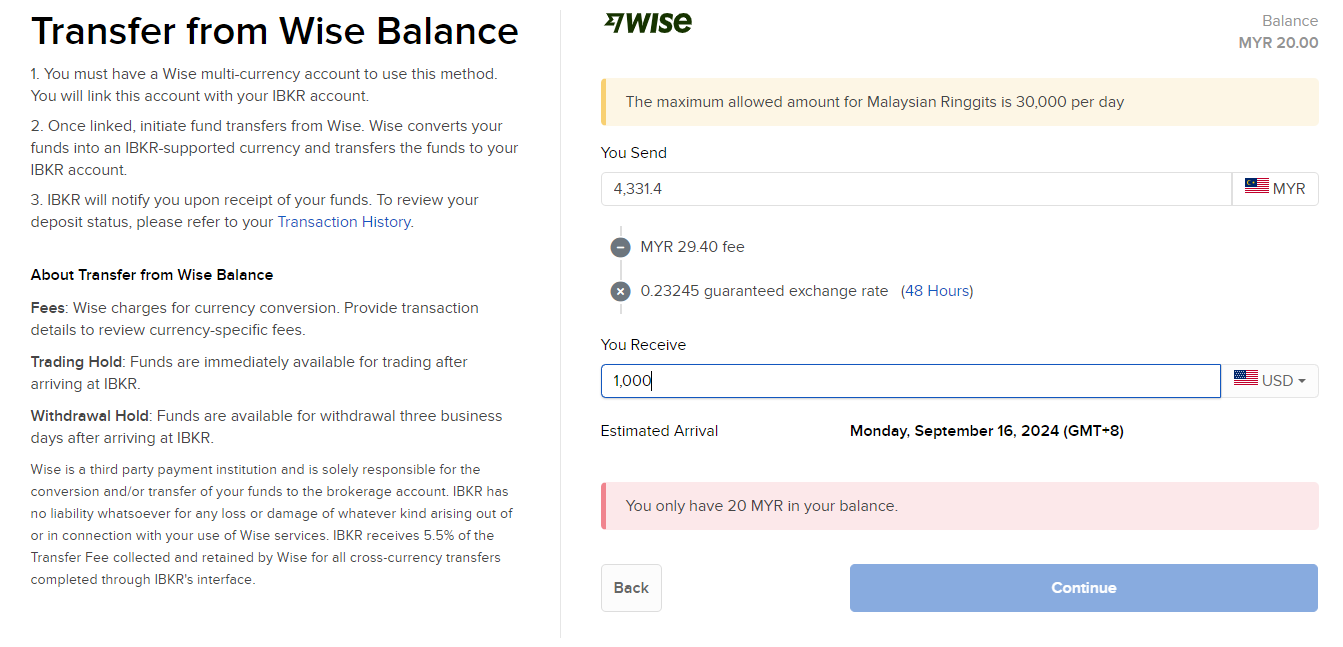

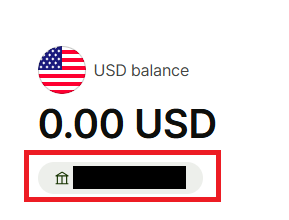

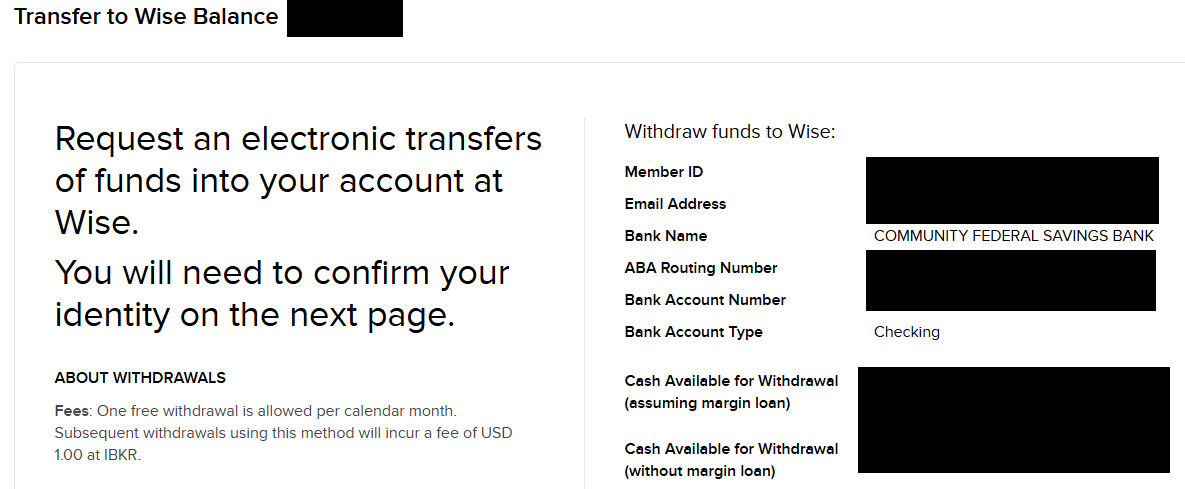

MYR will be converted to USD within Wise, not IBKR. that's how the USD1.13 fee to enter IBKR comes about

Eh, I did a different way than you and Duckies mentioned but not sure if it's cheaper or more expensive.

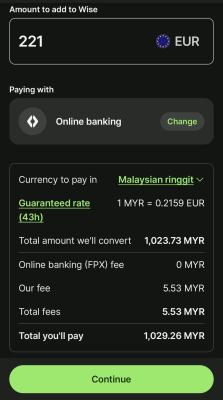

Cause converting MYR to EUR in wise already has charges about ~10 MYR. Then transfer to IBKR should be FOC. Then in IBKR EUR to USD will be charged 0.03% again?

I tried this way, topup MYR in Wise and then transfer to IBKR as USD. The fees is about ~10 MYR also for Wise transfer. Then after that should be no more additional charges?

But when I bought 2 units of VUAA it has USD 1.7 as commission not sure why but could it be from the left over Swiss Franc (CHF) conversion cause I think the MYR -> USD I transferred is not enough.

Dec 30 2024, 10:31 AM

Dec 30 2024, 10:31 AM

Quote

Quote

0.0195sec

0.0195sec

0.20

0.20

6 queries

6 queries

GZIP Disabled

GZIP Disabled