QUOTE(gashout @ Nov 12 2024, 05:34 PM)

Thanks a lot. That's a good point.

Buy t bill, there's transaction fee for it I suppose?

I'm keen to have cash ready in case there is a sudden opportunity, can I sell my t bills and still earn the interest for that particular days/weeks/mths or am I better off leaving it in my account?

Yes, transaction fee is 5 USD minimum:

https://www.interactivebrokers.com/en/prici...nds.php?re=amerFor comparison, buying some 500 USD worth of stocks on IBKR usually cost about 0.3 USD = 0.06%

To achieve 0.06% commission fee as a percentage of your purchase amount, with a 5 USD commissions, you gotta buy 9000 USD minimum worth of T-bills (remember T-bills trade with a minimum denomination of 1000 USD, and increments of 1k USD).

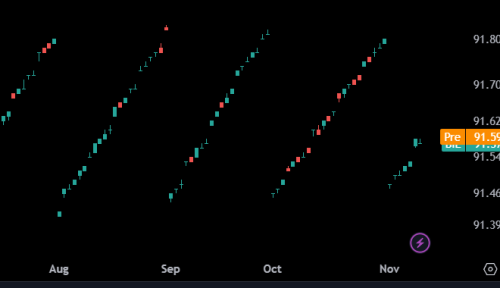

So, if you don't have minimum 10k USD cash, it's a lot cheaper to gain exposure via BIL ETF or SGOV ETF. These T-bills ETFs give you 1-2 month USD risk-free interest rate exposure by buying various US T-bills with 1-3 months of duration. The effective duration is 1-2 months.

With ETFs, now I can purchase T-bills at the same commission level as a US stock on IBKR, even with fractional shares if I want to although I don't recommend that since the ETF price is very low at close to 100 USD a unit.

--------------------------------

To address your question on opportunity. Yes, that's the purpose why I park huge sum of USD in US T-bills ETF as well. You can sell 23 hours and 50 minutes for each trading day (barring trading holiday the next day if you are in Asian hours trying to trade in US Overnight session, as the trades are supposed to cleared the next day following US time). If you spot a crash, you can always sell and get cash instantly even without margin account. The USD can then be used to purchase say VOO or QQQM etc.

There is one caveat, you cannot withdraw the cash or buy stocks/bonds/ETF or anything denominated in other currency on the same day you sell your BIL or SGOV ETF units. The selling trade settles at T+1, so you can only withdraw the cash the next day. They also don't want to bear any overnight FX risk, so they will only allow FX conversion once the selling trade is settled (which means you will have real USD in your account by then, T+1).

They do allow same currency purchase, like sell BIL ETF and buy VOO/QQQM or other US stocks which I stated above. This "contra" trade is allowed, provided the settlement period is the same, i.e., in this case, T+1.

Now, if you have margin account however, the restrictions above do not apply. If you sell BIL and say buy Nestle stocks (SIX: NESN) on SIX in Switzerland the same day, you are effectively shorting USD.CHF overnight forwards, i.e., borrowing CHF from IBKR (or some other market participants) with any outstanding cash/stocks as collateral for one day to buy NESN, and repay back at T+1 with USD proceeds from selling your stake in BIL/SGOV the day before. IBKR will charge interest on the overnight loan I believe, but sifus here can give you more color on this topic.

Relevant info from Reddit:

https://www.reddit.com/r/interactivebrokers...ant_settlement/This post has been edited by TOS: Nov 13 2024, 12:36 AM

Nov 11 2024, 08:04 PM

Nov 11 2024, 08:04 PM

Quote

Quote

0.0289sec

0.0289sec

0.44

0.44

6 queries

6 queries

GZIP Disabled

GZIP Disabled