QUOTE(Ziet Inv @ Jan 2 2021, 12:10 PM)

Hi Everyone,

Not sure if someone brought this up, but thought I should mention about IBKR's Brexit Account Migration here.

TLDR: Effective 1st January 2021, IBKR shifted from UK to Ireland, no longer protected by SIPC and UK compensation (c.500k USD insurance), now protected by Ireland Compensation Scheme (c.20k euro).

IBKR Brexit Account Migration official FAQReddit discussion: IBKR Brexit Account MigrationWhat are your thoughts on this?

As suspected this is only for EU citizens. Clarified with TSG Global and they will remain "affiliated" with IBUK for non EU citizens.

Reply from TSG:

» Click to show Spoiler - click again to hide... «

As you are not a EU citizen this will not affect you as your account will stay with IB UK and will keep on having the same regulations as you have had as off today.

QUOTE(jas029 @ Jan 4 2021, 03:42 PM)

yes agree..

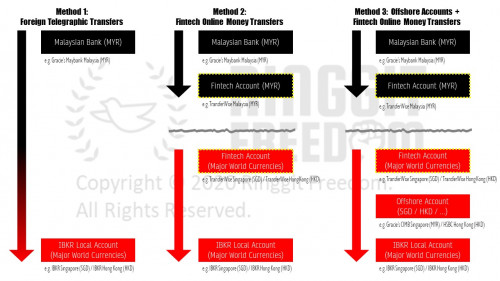

but im just saying it's 'possible' to withdraw directly.. that doesn't mean i encourage or insinuate others to do it.. just a mere clarification that it's possible if one choose to do so..

personally, i will also avoid withdraw directly to stay clear of the exorbitant fees and absurd exchange rates spread..

but despite that, withdraw directly to MYR remain as one of the option.. and i bet there are indeed people using it as a less hassle way (for which one is willing to exchange that for the higher fees + expensive rates) to repatriate money back.. so does that mean those who opted for this option is wrong? in essence, everyone is different.. there are no right or wrong for this.. it's all personal preference

Yup! Fair point for people to be aware of options and choose one that suits them.

QUOTE(yuiopoiuy @ Jan 4 2021, 07:20 PM)

Oh i see. Thanks for the help. I had actually asked them regarding the minimum deposit and they said it was actually 1k until 31 dec, after that only will be 2.5k. I managed to fund it before 31 dec, but till date i havent receive confirmation from tsg so i was a bit worried.

Ah yes, if you already got the exception clarified then it's usually OK. You already got TSG login details? If got then should be fine. I don't remember them sending me any email after that regarding my account approval status (the rest were just support proactive checking if I have issues, or webinar invitation)

Dec 26 2020, 12:29 PM

Dec 26 2020, 12:29 PM

Quote

Quote

0.3620sec

0.3620sec

0.99

0.99

7 queries

7 queries

GZIP Disabled

GZIP Disabled