Outline ·

[ Standard ] ·

Linear+

Interactive Brokers (IBKR), IBKR users, welcome!

|

Medufsaid

|

May 6 2024, 01:32 PM May 6 2024, 01:32 PM

|

|

QUOTE(Avangelice @ May 6 2024, 01:22 PM) (does this even make sense when I convert X 2? that time it make sense as - wise charges 0.6%

- money match charges 0.4% for SGD. and IBKR charges U$2 per U$100k converted (if use recurring investment, IBKR provides free service to change SGD->USD)

now it should still be cheaper, but gap narrower

This post has been edited by Medufsaid: May 6 2024, 02:06 PM |

|

|

|

|

|

SUSTOS

|

May 8 2024, 02:07 PM May 8 2024, 02:07 PM

|

|

Poor Deutsche is Europe's "sickman" bank... https://www.ft.com/content/68eef4b8-961d-4b...48-780acc659f3fQUOTE Deutsche Bank’s asset manager DWS inflated the amount of money it won from clients by billions of euros through an accounting approach that it failed to disclose for years, and which fed into executive bonus calculations.

Quarterly results for the Frankfurt-listed company, in which Deutsche Bank holds an 80 per cent stake, last month showed for the first time how it included so-called advisory mandates in its overall assets under management and annual flows.

Advisory mandates are a low-margin business, where an asset manager gives a client its view on matters such as asset allocation but the client makes its own independent investment decisions, and are distinct from higher-margin “assets under management”, where the company makes investment decisions on the client’s behalf.

DWS did not expressly disclose that its assets under management also included assets managed by third parties until late 2022 — months after former chief executive Asoka Wöhrmann was ousted — and that changes in the market valuation of advisory assets were counted in its flows. Even then, the practice was only referenced in a footnote.

The size of DWS’s advisory assets has grown disproportionally in recent years, according to the new disclosures and people familiar with historic data.

Three people with direct knowledge of DWS’s internal discussions told the Financial Times that the asset manager started to place significant emphasis on the acquisition of new advisory mandates when Wöhrmann took the helm in late 2018, months after the company floated.

Since its IPO, bonuses for executives and other staff have been directly linked to net flows.

DWS’s pay policy tasked executives with lifting net inflows as a percentage of assets under management by 3 to 5 per cent a year as one of four targets in their long-term incentive plans. In 2021 — the first year for which data is available — DWS management achieved 150 per cent of their inflow target.

DWS told the Financial Times that “advisory asset inflows, and in particular the inclusion of market movements when calculating them, have not had a material impact on executive compensation in any year.”

It is the second time since its 2018 IPO that DWS has faced questions about disclosure. Last year, DWS paid $19mn to settle charges with the US Securities and Exchange Commission about greenwashing, and an investigation by Frankfurt prosecutors into the allegations is ongoing.

The asset manager last month reported for the first time that advisory mandates made up 3.5 per cent of total assets excluding cash in 2023, up from 3 per cent a year earlier. In the same year, however, the disclosure shows that advisory assets represented 27 per cent of all net inflows excluding cash.

DWS has not disclosed data for advisory inflows for years before 2022.

But FT calculations based on data provided by insiders show that advisory assets accounted for at least a fifth of all DWS non-cash inflows between June 2018 and March 2024 — a breakdown not previously made public.

Advisory assets more than tripled to €29bn in that period, while total assets under management excluding cash rose 36 per cent to €856bn.

According to people familiar with the historic data, advisory assets lifted DWS’s reported net flows in all years since 2018.

In 2020, almost all of the €10.8bn in reported non-cash inflows were linked to advisory assets, the people said. That was mainly due to a multibillion mandate from Siemens which had been erroneously treated as an active multi-asset one, and was reclassified as an advisory mandate in late 2022, they added.

The overall impact on flows was “immaterial” in all other years, the people said.

After DWS restated the data for 2023, a €4.4bn inflow into the asset manager’s high-margin flagship “active multi-asset” strategy became a €1.7bn outflow when stripping out an advisory mandate for another German blue-chip.

Irene Rossetto, an asset management analyst at Keefe, Bruyette & Woods, told the FT that including changes of the value of advisory assets, including currency effects and market performance, in flows was “uncommon” and “does not appear to be in line with industry practice”.

DWS told the FT that despite changes to the definitions of net flows and assets under management in its financial reports, its internal definitions had “been consistent since prior to the initial public offering”, adding that “our annual reports and financial disclosure were always accurate”.

The group said that changes in disclosure since late 2022 were intended to “provide more transparency into the nature of our AUM and flows”.

Wöhrmann declined to comment through a lawyer. Deutsche Bank declined to comment. This post has been edited by TOS: May 8 2024, 02:07 PM |

|

|

|

|

|

GregPG01

|

May 9 2024, 08:35 PM May 9 2024, 08:35 PM

|

|

Having a difficult time trying to understand the statement for dividends.

Anyone know how long before IBKR deposits the dividend to our cash balance after payment date ?

Thanks.

|

|

|

|

|

|

damien5119

|

May 10 2024, 12:29 AM May 10 2024, 12:29 AM

|

Getting Started

|

hi qq, currently using FSM for monthly DCA into some ETF's

Just opened a IB account.

Looks like Wise fees are high , would it make sense to keep using FSM for the purpose of DCA?

If i were to ever abandon FSM , i can just transfer the securities to IB right for a small fee?

|

|

|

|

|

|

Medufsaid

|

May 10 2024, 12:34 AM May 10 2024, 12:34 AM

|

|

damien5119 how much do you DCA? is it RM1 in fees up until RM1,250? and how much is the fees when they convert from RM to USD? 0.4%?

|

|

|

|

|

|

damien5119

|

May 10 2024, 12:40 AM May 10 2024, 12:40 AM

|

Getting Started

|

QUOTE(Medufsaid @ May 10 2024, 12:34 AM) damien5119 how much do you DCA? is it RM1 in fees up until RM1,250? and how much is the fees when they convert from RM to USD? 0.4%? i saw in this thread the fees are like 0.65% for wise? |

|

|

|

|

|

Medufsaid

|

May 10 2024, 12:41 AM May 10 2024, 12:41 AM

|

|

damien5119 i'm asking about FSM conversion.

normally for IBKR, we transfer using remittance companies to CIMB SG, then send it over to IBKR. check the past few pages

|

|

|

|

|

|

damien5119

|

May 10 2024, 01:32 AM May 10 2024, 01:32 AM

|

Getting Started

|

QUOTE(Medufsaid @ May 10 2024, 12:41 AM) damien5119 i'm asking about FSM conversion. normally for IBKR, we transfer using remittance companies to CIMB SG, then send it over to IBKR. check the past few pages Yea i saw that, let me do a quick compare tomorrow. Although , remit thru SG is too much work for me. Prefer set and forget, maybe do transfers to top up once in a while if using the IB RSP. |

|

|

|

|

|

Medufsaid

|

May 11 2024, 02:11 PM May 11 2024, 02:11 PM

|

|

for those who use ACH to send USD to IBKR, take note QUOTE(Medufsaid @ May 11 2024, 02:10 PM) |

|

|

|

|

|

Ramjade

|

May 11 2024, 04:06 PM May 11 2024, 04:06 PM

|

|

QUOTE(damien5119 @ May 10 2024, 01:32 AM) Yea i saw that, let me do a quick compare tomorrow. Although , remit thru SG is too much work for me. Prefer set and forget, maybe do transfers to top up once in a while if using the IB RSP. You want to save on cost or you want convenience? It's not too much work. It's just few clicks. Not asking you to go queue at banks and wait your turn. All can be done while you are in the train or getting stuck in traffic. Is whether you want to give yourself excuse not to do something. I have been manually transferring money into IBKR via sg banks for years. I give you an example. Last time people give me all sort of excuses cannot open sg bank account. I decided to safeguard my future purchasing power, so I took a train down to Singapore, spend one whole day there just to open account and come back. It's all about giving excuses or taking action. Excuses get you no where. QUOTE(damien5119 @ May 10 2024, 12:29 AM) hi qq, currently using FSM for monthly DCA into some ETF's Just opened a IB account. Looks like Wise fees are high , would it make sense to keep using FSM for the purpose of DCA? If i were to ever abandon FSM , i can just transfer the securities to IB right for a small fee? You can transfer. You need to contact IBKR to initiate the transfer. Fsm function for me is only buy PRS or invest my EPF money. lol. My FSM SG contains zero money and not use at all. This post has been edited by Ramjade: May 11 2024, 05:18 PM |

|

|

|

|

|

Singh_Kalan

|

May 11 2024, 10:53 PM May 11 2024, 10:53 PM

|

|

QUOTE(damien5119 @ May 10 2024, 12:29 AM) hi qq, currently using FSM for monthly DCA into some ETF's Just opened a IB account. Looks like Wise fees are high , would it make sense to keep using FSM for the purpose of DCA? If i were to ever abandon FSM , i can just transfer the securities to IB right for a small fee? FSMOne RSP buy in fees is so low, its almost the same as IBKR. Ya the cost is higher when you want to sell, but its just a one time cost. Plus FSMOne have autosweep that pay u interest. |

|

|

|

|

|

Medufsaid

|

May 12 2024, 01:02 PM May 12 2024, 01:02 PM

|

|

One time cost assuming you sell to withdraw and use.

If it's sell to buy other stocks (or buy an ETF with lower expanse fee), you'll lose out further

|

|

|

|

|

|

Ramjade

|

May 12 2024, 07:38 PM May 12 2024, 07:38 PM

|

|

QUOTE(Singh_Kalan @ May 11 2024, 10:53 PM) FSMOne RSP buy in fees is so low, its almost the same as IBKR. Ya the cost is higher when you want to sell, but its just a one time cost. Plus FSMOne have autosweep that pay u interest. Not sure how is their exchange rate. I know IBKR give the best exchange rate. |

|

|

|

|

|

Ramjade

|

May 12 2024, 08:25 PM May 12 2024, 08:25 PM

|

|

QUOTE(melondance @ May 12 2024, 07:46 PM) Now that Wise increased their transfer fee for ACH (USD local to USD international), if FSMOne do let us access LSE ETF (to avoid paying 30% WHT), it wouldn't make much sense to use IBKR anymore... Furthermore, after doing currency conversion MYR > USD > MYR, it seems like Wise only a tiny bit cheaper than FSMOne. Just use the old school way. Malaysian banks -> moneymatch or Sunway money -> SG banks -> IBKR -> convert currency inside IBKR at real time market rate. |

|

|

|

|

|

Medufsaid

|

May 12 2024, 08:55 PM May 12 2024, 08:55 PM

|

|

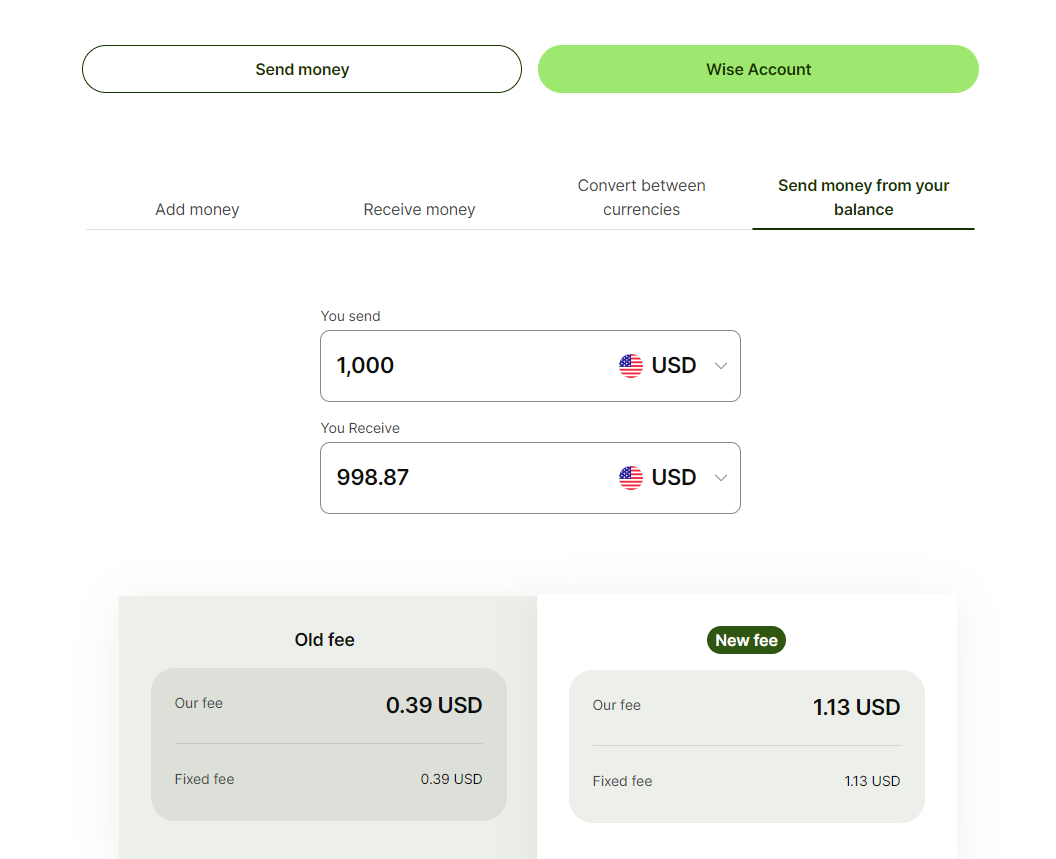

good thing Ramjade moved the reply here. melondance actually the new Wise rates is cheaper if you moved bigger amounts of USD into IBKR - variable rate dropped from 0.6% to 0.5%

- the fixed rate increased from $0.39 to $1.13

so if the amount u moved is small, you'll feel the pinch from the fixed rate. but if you increase, it'll be cushioned by the 0.1% discount |

|

|

|

|

|

Takudan

|

May 13 2024, 12:01 PM May 13 2024, 12:01 PM

|

|

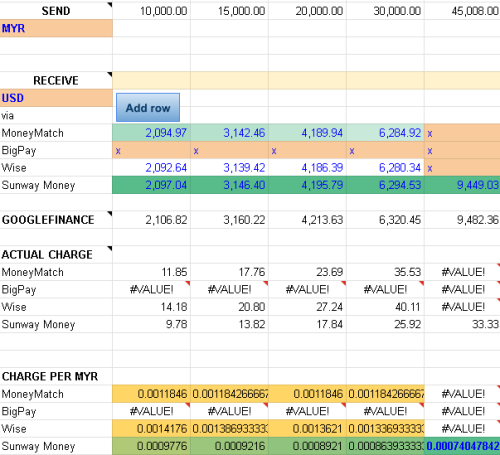

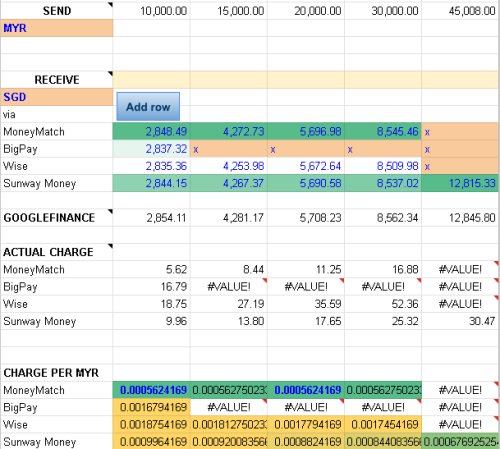

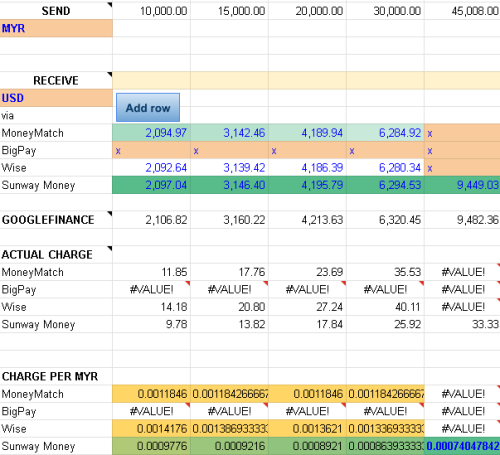

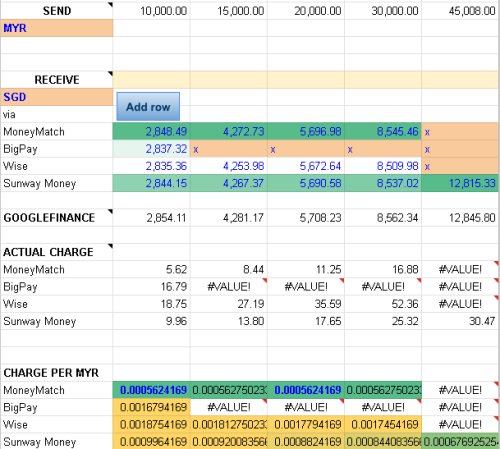

QUOTE(Medufsaid @ May 12 2024, 08:55 PM) good thing Ramjade moved the reply here. melondance actually the new Wise rates is cheaper if you moved bigger amounts of USD into IBKR

- variable rate dropped from 0.6% to 0.5%

- the fixed rate increased from $0.39 to $1.13

so if the amount u moved is small, you'll feel the pinch from the fixed rate. but if you increase, it'll be cushioned by the 0.1% discount Comparison this morning... to USD  to SGD  long story short, Wise loses by miles and MoneyMatch is the best for SGD for today's working day. Note: I checked using FPX rate on Wise, instead of Wise balance (that is a few bucks cheaper). I'm still holding some money from my travels so I can't do a full 20k transfer Note: the column 45008 is only meant for Sunway Money where they offer more favourable rate at 45k and above (with RM8 fee) Also for comparison, I checked rates last Saturday (sheets labelled 20240511): https://docs.google.com/spreadsheets/d/1DF1...#gid=1635374305It's really annoying for me to do during office hours... but looking at these rates, oklah just delay my work a bit  This post has been edited by Takudan: May 13 2024, 12:02 PM This post has been edited by Takudan: May 13 2024, 12:02 PM |

|

|

|

|

|

Medufsaid

|

May 13 2024, 12:03 PM May 13 2024, 12:03 PM

|

|

Takudan wow you are back. i thought you abandoned the excel  --edit-- someone asked me if moneymatch USD remittance was good a while ago. slightly disappointed to realise it's identical to wise (same as your finding) This post has been edited by Medufsaid: May 13 2024, 12:05 PM

|

|

|

|

|

|

bokbokchai

|

May 13 2024, 01:55 PM May 13 2024, 01:55 PM

|

|

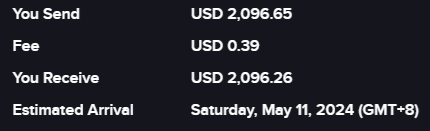

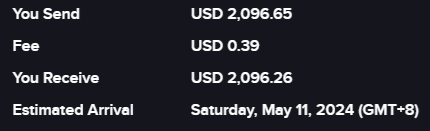

one of the reason why i wanna use sunway money or moneymatch for funding usd into ibkr.. but unsure whther can transfer into wise usd or sgd account balance then move into ibkr. i do noted that IBKR still charge fee for transferring usd but it was very affordable like less than 1 usd pic show i converted myr to usd into USD in wise then transfer to IBKR via wise and charges me the fee for the USD transfer.  This post has been edited by bokbokchai: May 13 2024, 01:59 PM This post has been edited by bokbokchai: May 13 2024, 01:59 PM |

|

|

|

|

|

SUSTOS

|

May 13 2024, 03:34 PM May 13 2024, 03:34 PM

|

|

|

|

|

|

|

|

Takudan

|

May 13 2024, 08:59 PM May 13 2024, 08:59 PM

|

|

QUOTE(Medufsaid @ May 13 2024, 12:03 PM) Takudan wow you are back. i thought you abandoned the excel  --edit-- someone asked me if moneymatch USD remittance was good a while ago. slightly disappointed to realise it's identical to wise (same as your finding) Eh I never abandoned it  just that the Forex thread went dead, I also didn't see the need to bump... QUOTE(bokbokchai @ May 13 2024, 01:55 PM) one of the reason why i wanna use sunway money or moneymatch for funding usd into ibkr.. but unsure whther can transfer into wise usd or sgd account balance then move into ibkr. i do noted that IBKR still charge fee for transferring usd but it was very affordable like less than 1 usd pic show i converted myr to usd into USD in wise then transfer to IBKR via wise and charges me the fee for the USD transfer.  Ah I never got to try direct USD funding from Wise yet, the only time I did and was successful was my leftover Euros from trip... There was no fee at all, so thanks for the info. I personally continued with the SGD route as I compared the rates SGD vs USD and didn't see much difference ... Don't wanna trigger Wise compliance check because IIRC they mandate that you as sender, must send from an account of the same name -- SunwayMoney/MoneyMatch would be labelled otherwise, so they violate that rule. (Others please CMIIW) |

|

|

|

|

May 6 2024, 01:32 PM

May 6 2024, 01:32 PM

Quote

Quote

0.0222sec

0.0222sec

0.43

0.43

6 queries

6 queries

GZIP Disabled

GZIP Disabled