QUOTE(Lon3Rang3r00 @ Apr 14 2022, 12:00 PM)

I'm very new into investing, I don't have enough experiences to tell whether the market is good or bad now. But I'm sure that it will be OK for me as long as I'm investing now than never invest at all. The recent price fluctuating did take a toll on me, last week I'm jumping on Tesla boat when the price is $1120, happy just for a day then next thing i know it drop to $980 on Monday. Kind of lost myself not sure whether this is the First lesson of investing in the stock market = Be "Mentally Prepared".

Look like the Ukraine war won't stop anytime soon, US seems to intervened now by providing more weapons to Ukraine Military.

my total paper loss in IBKR now is around USD 240 (after deduct x1 free Apple share and free IBKR shares). They are unrealized loss as long you don't sell. I will still continue to DCA.

i'm in worse situation than you coz I started investing on December last year, when things were still rosy before the Fed announced interest rate hike.

if started this year is good.. as all the stocks and ETFs are price lower. So when they start to grow again you will see more profit.

be a long term investor, at least hold 3 years before see real growth.. that time if need to sell some for cash then go ahead. But best is don't sell if don't need the money.

As long you confident on what you're investing in, then continue holding. Read and get updated about the company's financials and news to decide. Only rebalance or sell when you're sure there is a need. A good site to learn about stock evaluation is

https://simplywall.st/ .. search for the company you like there and see if they are overvalued, their financials, health, borrowings, PE ratio etc.

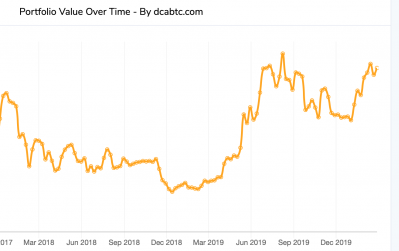

if you think stocks are tough.. wait till you see crypto prices. 24/7 trading and fluctuate even more since it relies on speculation (no fundamentals like stocks)

This post has been edited by Davidtcf: Apr 14 2022, 01:36 PM

This post has been edited by Davidtcf: Apr 14 2022, 01:36 PM

Apr 12 2022, 06:52 AM

Apr 12 2022, 06:52 AM

Quote

Quote

0.0210sec

0.0210sec

0.36

0.36

6 queries

6 queries

GZIP Disabled

GZIP Disabled