FT 080422: https://drive.google.com/file/d/19BH2rewVzy...iew?usp=sharing

Interactive Brokers (IBKR), IBKR users, welcome!

Interactive Brokers (IBKR), IBKR users, welcome!

|

|

Apr 8 2022, 12:24 PM Apr 8 2022, 12:24 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

|

|

|

|

|

|

Apr 8 2022, 12:29 PM Apr 8 2022, 12:29 PM

|

Senior Member

1,195 posts Joined: Feb 2016 |

QUOTE(tadashi987 @ Apr 8 2022, 12:04 PM) i practise keeping an emergency fund for 6 months and monthly DCA from my monthly salary Ya those are necessary, Emergency fund, and better if you have medical insurance to cover your medical bill (It's not a must but it's recommended). Just wondering How much % of your portfolio that you keep with your broker that is in "Cash" form? I might be wrong with the term. like e.g. You have 75% of Portfolio is in ETF, 20% on Index fund and kept 5% of it in cash that's reserved just in case if any stock on discount, you can bought it immediately without the need to transfer from your bank which may take about hours to a day (if it happen to be on the weekend or off their working hour).on top of that, additional source like bonus, dividend, I will keep until there is a attractive entry point |

|

|

Apr 8 2022, 12:33 PM Apr 8 2022, 12:33 PM

|

Senior Member

1,210 posts Joined: Nov 2011 |

QUOTE(Lon3Rang3r00 @ Apr 8 2022, 12:29 PM) Ya those are necessary, Emergency fund, and better if you have medical insurance to cover your medical bill (It's not a must but it's recommended). Just wondering How much % of your portfolio that you keep with your broker that is in "Cash" form? I might be wrong with the term. like e.g. You have 75% of Portfolio is in ETF, 20% on Index fund and kept 5% of it in cash that's reserved just in case if any stock on discount, you can bought it immediately without the need to transfer from your bank which may take about hours to a day (if it happen to be on the weekend or off their working hour). If it helps, I don't keep cash outside of some spending money and emergency fund. So I don't maintain a "cash position" so to say. I don't really time the market and just do regular DCA, but if there's a really good deal and I know I can afford it, I'll buy it with margin with a personal tolerance of up to 1.25x leverage and pay it off with my upcoming income.This post has been edited by Hoshiyuu: Apr 8 2022, 12:34 PM Lon3Rang3r00 liked this post

|

|

|

Apr 8 2022, 12:52 PM Apr 8 2022, 12:52 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(Lon3Rang3r00 @ Apr 8 2022, 11:35 AM) I wonder how many of us waiting for the EPF withdrawal. And also curious what is the recommendation % reserved for Cash in your portfolio? or it's better to invest every penny in stock. I know one investor who keeps like 50% cash. He only buys when things are cheap.Up to you how much you want to keep. If things expensive, why want to overpay for it? But at the same time have to be realistic that some stuff won't be cheap. This post has been edited by Ramjade: Apr 8 2022, 12:53 PM Lon3Rang3r00 liked this post

|

|

|

Apr 8 2022, 12:58 PM Apr 8 2022, 12:58 PM

|

Junior Member

235 posts Joined: Oct 2012 |

For people who had use IBKR and/or Tiger broker, can anyone point out the main pros/cons of IBKR Vs Tiger broker?

As i am currently using Tiger Broker, i am thinking should i move to IBKR (TSG since my deposit is <$100,000) or should i just stay Thanks |

|

|

Apr 8 2022, 01:19 PM Apr 8 2022, 01:19 PM

|

Senior Member

2,106 posts Joined: Jul 2018 |

QUOTE(Lon3Rang3r00 @ Apr 8 2022, 12:29 PM) Ya those are necessary, Emergency fund, and better if you have medical insurance to cover your medical bill (It's not a must but it's recommended). Just wondering How much % of your portfolio that you keep with your broker that is in "Cash" form? I might be wrong with the term. like e.g. You have 75% of Portfolio is in ETF, 20% on Index fund and kept 5% of it in cash that's reserved just in case if any stock on discount, you can bought it immediately without the need to transfer from your bank which may take about hours to a day (if it happen to be on the weekend or off their working hour). if you are referring to "How much % of your portfolio that you keep with your broker"i keep as little as i can, no interest from IBKR, so i dont keep cash with them i dont mind transferring, not like the 2 hours or a day transfer processing will make me lose the opportunity, if it really does, i just let it be Lon3Rang3r00 liked this post

|

|

|

|

|

|

Apr 8 2022, 01:34 PM Apr 8 2022, 01:34 PM

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(puremage111 @ Apr 8 2022, 12:58 PM) For people who had use IBKR and/or Tiger broker, can anyone point out the main pros/cons of IBKR Vs Tiger broker? Just convert to ibkr from tsg.As i am currently using Tiger Broker, i am thinking should i move to IBKR (TSG since my deposit is <$100,000) or should i just stay Thanks Tiger uses ibkr as their backbone. Ibkr commission, Forex rate, margin rate (if you are using margin) way cheaper than tiger. Tiger have free real time data while ibkr needs to pay for it. I think usd4.50/month? This post has been edited by Ramjade: Apr 8 2022, 01:34 PM |

|

|

Apr 8 2022, 02:19 PM Apr 8 2022, 02:19 PM

Show posts by this member only | IPv6 | Post

#5438

|

Junior Member

235 posts Joined: Oct 2012 |

QUOTE(Ramjade @ Apr 8 2022, 02:34 PM) Just convert to ibkr from tsg. Thanks for the input Tiger uses ibkr as their backbone. Ibkr commission, Forex rate, margin rate (if you are using margin) way cheaper than tiger. Tiger have free real time data while ibkr needs to pay for it. I think usd4.50/month? Didn't know that tiger uses ibkr as backbone There's so many brokers available now compare to years ago where people only had a few selection 🥳 |

|

|

Apr 8 2022, 02:23 PM Apr 8 2022, 02:23 PM

|

Junior Member

71 posts Joined: Dec 2021 |

|

|

|

Apr 8 2022, 04:19 PM Apr 8 2022, 04:19 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Apr 8 2022, 12:52 PM) I know one investor who keeps like 50% cash. He only buys when things are cheap. The key to this is how does that investor know "things are cheap" ? Cheap based on his interpretation ? If every investor is able to catch the lowest bottom then we have a lot of rich investors isn't it ? So I am thinking that investor buy when cheap is based on his interpretation and not the lowest bottom logical?Up to you how much you want to keep. If things expensive, why want to overpay for it? But at the same time have to be realistic that some stuff won't be cheap. |

|

|

Apr 8 2022, 07:54 PM Apr 8 2022, 07:54 PM

Show posts by this member only | IPv6 | Post

#5441

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(puremage111 @ Apr 8 2022, 02:19 PM) Thanks for the input I meant just convert your tag into pure ibkr. I did mine like last year. Save on cost.Didn't know that tiger uses ibkr as backbone There's so many brokers available now compare to years ago where people only had a few selection 🥳 QUOTE(sgh @ Apr 8 2022, 04:19 PM) The key to this is how does that investor know "things are cheap" ? Cheap based on his interpretation ? If every investor is able to catch the lowest bottom then we have a lot of rich investors isn't it ? So I am thinking that investor buy when cheap is based on his interpretation and not the lowest bottom logical? If you live through 2008 and march 2020 you will know. People blinding sell and there's no hope left.When your hands shake as you tap the buy/click the buy button. I didn't live through 2008 but I live though everything after that I was prepared in 2020 with my cash. It was spectacular watching market open only kena whack with circuit breaker. People was just relentlessly selling. How I wished for 2008 to happen again. A once a generational wealth transfer opportunity. The recent tech sell off could also be consider one of 5hose opportunities. Good companies were just being sold off relentlessly. Did I pick up some? You bet This post has been edited by Ramjade: Apr 8 2022, 07:54 PM Toku liked this post

|

|

|

Apr 8 2022, 11:25 PM Apr 8 2022, 11:25 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Apr 8 2022, 07:54 PM) If you live through 2008 and march 2020 you will know. People blinding sell and there's no hope left. I started in 2000 so yes I been through 2008. My earlier reply was for the earlier post how that investor know it is cheap? By his interpretation correct?As for your next post topic yes time when everyone exit is when you enter it is only whether one got the nerve to tap the Buy button. |

|

|

Apr 9 2022, 12:10 AM Apr 9 2022, 12:10 AM

Show posts by this member only | IPv6 | Post

#5443

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(sgh @ Apr 8 2022, 11:25 PM) I started in 2000 so yes I been through 2008. My earlier reply was for the earlier post how that investor know it is cheap? By his interpretation correct? https://www.mrtakoescapes.com/love-big-fat-cash-pile/As for your next post topic yes time when everyone exit is when you enter it is only whether one got the nerve to tap the Buy button. He is like Paul low sg who owns a dividend investing blog. Only difference Paul buys everything which pays dividend even crappy stuff. |

|

|

|

|

|

Apr 9 2022, 12:20 PM Apr 9 2022, 12:20 PM

|

Junior Member

692 posts Joined: Nov 2021 |

QUOTE(Ramjade @ Apr 9 2022, 12:10 AM) https://www.mrtakoescapes.com/love-big-fat-cash-pile/ Thanks for sharing. So he also belong to the camp called dividend warriors kind. I think dividend Vs capital gain has been argued for years. For me I go more for dividend why? If I no job the monthly dividend act like salary. If capital gain you need to wait and during waiting period what you eat? The best is a mixture but what should be the ratio is up to individual.He is like Paul low sg who owns a dividend investing blog. Only difference Paul buys everything which pays dividend even crappy stuff. Alot of US has 30%, Irish 15% tax on dividend. Reason why I go for Asian market stocks Dividends and get indirectly exposed to US via mutual fund for which some pay monthly dividend |

|

|

Apr 9 2022, 12:43 PM Apr 9 2022, 12:43 PM

Show posts by this member only | IPv6 | Post

#5445

|

All Stars

24,346 posts Joined: Feb 2011 |

QUOTE(sgh @ Apr 9 2022, 12:20 PM) Thanks for sharing. So he also belong to the camp called dividend warriors kind. I think dividend Vs capital gain has been argued for years. For me I go more for dividend why? If I no job the monthly dividend act like salary. If capital gain you need to wait and during waiting period what you eat? The best is a mixture but what should be the ratio is up to individual. He's US citizen hence no issue with dividends.Alot of US has 30%, Irish 15% tax on dividend. Reason why I go for Asian market stocks Dividends and get indirectly exposed to US via mutual fund for which some pay monthly dividend sgh liked this post

|

|

|

Apr 9 2022, 06:31 PM Apr 9 2022, 06:31 PM

|

Junior Member

453 posts Joined: Jul 2016 |

Hi guys,

Recently I received letter with label "Important Tax Return Document Enclosed". It is now officially one year using IBKR. However this will be the first time I am dealing with tax stuff outside of Malaysia. Please correct my understanding below: - Profits and dividend is subjected to tax in the US market - The profit or dividend will be automatically deducted for tax Do we need to declare the profit or dividend to US gov or MY gov? Is there anything else we should do? Looking forward to have some advise on the above |

|

|

Apr 9 2022, 06:45 PM Apr 9 2022, 06:45 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

QUOTE(potatobanana @ Apr 9 2022, 06:31 PM) Hi guys, Assuming you are MY tax resident:Recently I received letter with label "Important Tax Return Document Enclosed". It is now officially one year using IBKR. However this will be the first time I am dealing with tax stuff outside of Malaysia. Please correct my understanding below: - Profits and dividend is subjected to tax in the US market - The profit or dividend will be automatically deducted for tax Do we need to declare the profit or dividend to US gov or MY gov? Is there anything else we should do? Looking forward to have some advise on the above For US, you should have signed the W-8BEN form (when you open your IB account). So 30% WHT is already automatically deducted by IBKR before the dividend is credited to your IB cash balance. You don't need to declare any capital gains and dividend incomes (whether in the form of stocks or cash) to MY government. This post has been edited by TOS: Apr 9 2022, 07:37 PM potatobanana liked this post

|

|

|

Apr 9 2022, 09:01 PM Apr 9 2022, 09:01 PM

|

Junior Member

453 posts Joined: Jul 2016 |

QUOTE(TOS @ Apr 9 2022, 06:45 PM) Assuming you are MY tax resident: I am residing in Malaysia and also a MY tax resident. For US, you should have signed the W-8BEN form (when you open your IB account). So 30% WHT is already automatically deducted by IBKR before the dividend is credited to your IB cash balance. You don't need to declare any capital gains and dividend incomes (whether in the form of stocks or cash) to MY government. Since the form been signed; which means the form is the only action from us. Happy and glad with the straightforward procedure This post has been edited by potatobanana: Apr 9 2022, 09:05 PM |

|

|

Apr 9 2022, 09:15 PM Apr 9 2022, 09:15 PM

|

Senior Member

8,667 posts Joined: Aug 2019 From: Penang <-> Singapore |

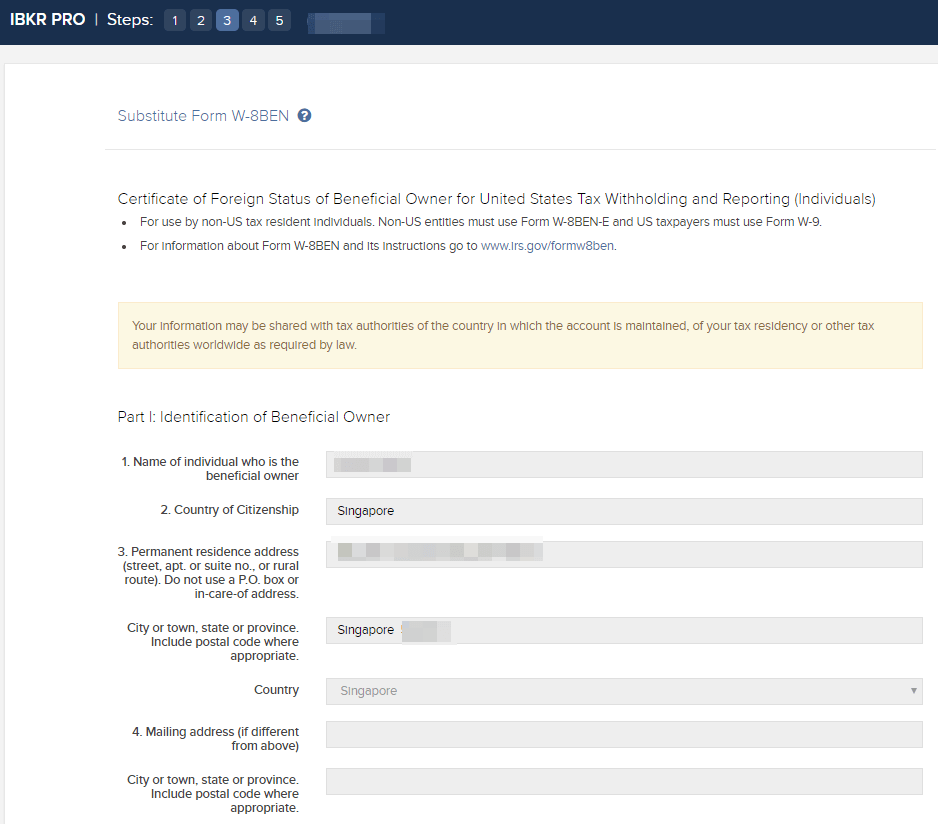

QUOTE(potatobanana @ Apr 9 2022, 09:01 PM) I am residing in Malaysia and also a MY tax resident. Yup, it should look something like step 5 shown in the website (URL link) when you opened your IB account: https://investmentmoats.com/money/easy-step...e-brokers-ibkr/Since the form been signed; which means the form is the only action from us. Happy and glad with the straightforward procedure Here is the screenshot capture from the webpage:  This post has been edited by TOS: Apr 9 2022, 09:19 PM potatobanana liked this post

|

|

|

Apr 9 2022, 09:31 PM Apr 9 2022, 09:31 PM

|

Junior Member

453 posts Joined: Jul 2016 |

QUOTE(TOS @ Apr 9 2022, 09:15 PM) Yup, it should look something like step 5 shown in the website (URL link) when you opened your IB account: https://investmentmoats.com/money/easy-step...e-brokers-ibkr/ I see, it makes more sense now.Here is the screenshot capture from the webpage: The W-8BEN form is signed during account registration. Well that meant there's nothing for us to do for the tax. So, continue trading and investing Many thanks for the info, appreciate it very much TOS liked this post

|

| Change to: |  0.0249sec 0.0249sec

1.69 1.69

6 queries 6 queries

GZIP Disabled GZIP Disabled

Time is now: 7th December 2025 - 03:03 PM |