QUOTE(rEvivEd- @ Apr 19 2022, 08:58 AM)

Hi I’m looking to invest through IBKR for ETFs.

I plan to put 10k into ETF solely.

Do I all in to CSPX? 50/50 it with CSPX + VWRA?

Or is there another combination.

And if I were to DCA after the initial 10k, what’s a good amount monthly?

New to investing please guide / advise.

TIA

I'll just crosspost my answer to this question from

Bogleheads Local Chapter [Malaysia Edisi] QUOTE(Hoshiyuu @ Apr 4 2022, 09:58 AM)

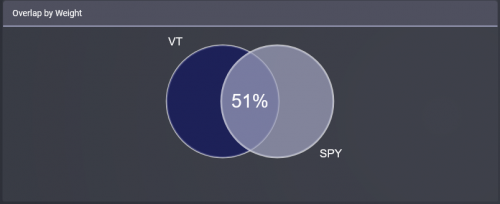

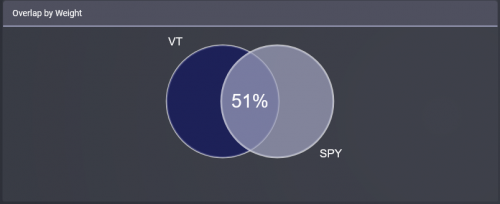

[...]Holding both VUAA & VWRA would be overweighting US and more than half of VWRA holdings by market cap.

While VUAA represents less than ~5% of VWRA holding, market cap wise VUAA represents ~50% of VWRA holdings.

If that is your intention, then all good, if not, be aware that you will have trouble balancing between VUAA & VWRA when only US large/mega caps drop in value.

I'd personally pick one but not both, and if you plan to go with pure VUAA, hold it and hold it well. If it you can manage to hold it for 30 years, then eventually it should all even out.

(VUAA is equivalent to CSPX)

As for DCA amount, I recommend that you keep your total transaction cost (fees and commissions) under 1% or ideally 0.5%.

E.g. If it cost you 1.7USD IBKR commission, 2USD forex fee, then your DCA amount should ideally be no lower than 740USD (~RM3000) or 370USD (~RM1500).

You will find that if you use Wise to send USD directly, your route fees has a minimum of ~0.5%, so keep that in mind.

With these info in mind, it'll still be up to you to decide how much fees is acceptable for you, and what is the balance between tracking the up and downs of the market vs saving fees. (e.g. DCA monthly, quarterly, annually, etc)

Feb 9 2022, 02:26 PM

Feb 9 2022, 02:26 PM

Quote

Quote

0.0356sec

0.0356sec

0.48

0.48

7 queries

7 queries

GZIP Disabled

GZIP Disabled